Original author: Prathik Desai

Translation and compilation: BitpushNews

Just when you think finance has become dull and boring, it always manages to surprise you. Recently, it seems that everyone is reconstructing the financial system in ways few could have predicted, including those from the entertainment and media industries.

Take Jimmy Donaldson (also known as "MrBeast" on YouTube) as an example. He not only has a snack empire, but he also recently acquired a banking app aimed at promoting financial literacy and money management among teenagers and young adults. Why? Perhaps there’s nothing more straightforward than monetizing a subscriber base of 466 million using financial products.

This summer, the CME Group, the largest derivatives exchange in the world, will launch individual stock futures, allowing users to trade futures on more than 50 top U.S. stocks, including Alphabet, NVIDIA, Tesla, and Meta.

These reconstructions show us the changing ways people are participating in finance. And in the past few years, nothing has illustrated this better than the explosion of perpetual contracts (Perpetual Markets).

Perpetual futures (or Perps) are a type of financial derivative contract that allows market participants to speculate on asset prices without an expiration date. Perps also enable people to express their views on assets quickly and cheaply. They are more captivating than traditional markets because they offer instant access and leverage. Unlike traditional markets, they do not require a broker onboarding process, jurisdiction paperwork, and do not follow "traditional" market hours.

Moreover, on-chain perpetual markets allow any asset (whether traditional or crypto) to be traded in a permissionless, highly leveraged manner. This makes speculation interesting, especially when humanity cannot resist gambling on the trajectories of volatile assets outside of traditional trading hours. This allows risks to be priced in real-time.

Think about what happened two weeks ago. When both traditional and crypto markets crashed simultaneously, traders flocked to Hyperliquid, propelling perpetual gold and silver trading into a frenzy. On January 31, Hyperliquid alone accounted for 2% of the global daily trading volume in its silver perpetual contracts market, which had been live for less than a month.

This explains why the perpetual contract trading volume dashboard is increasingly dominating crypto communities and forums. Volume is an absolute figure. It looks large, refreshing every few minutes, making it perfect for leaderboards. But it misses a key nuance: trading volume could reflect a lack of meaningful movement. High volume in a market might be due to depth, but it could also mean that incentives are encouraging higher-frequency activity. This activity is often recursive and carries little significance.

This week, I dove deeper into other metrics of the perpetual trading market. When these metrics are used alongside volume, they add more dimensions and tell a story that is completely different from mere trading volume.

Let's get started.

Several Data Points

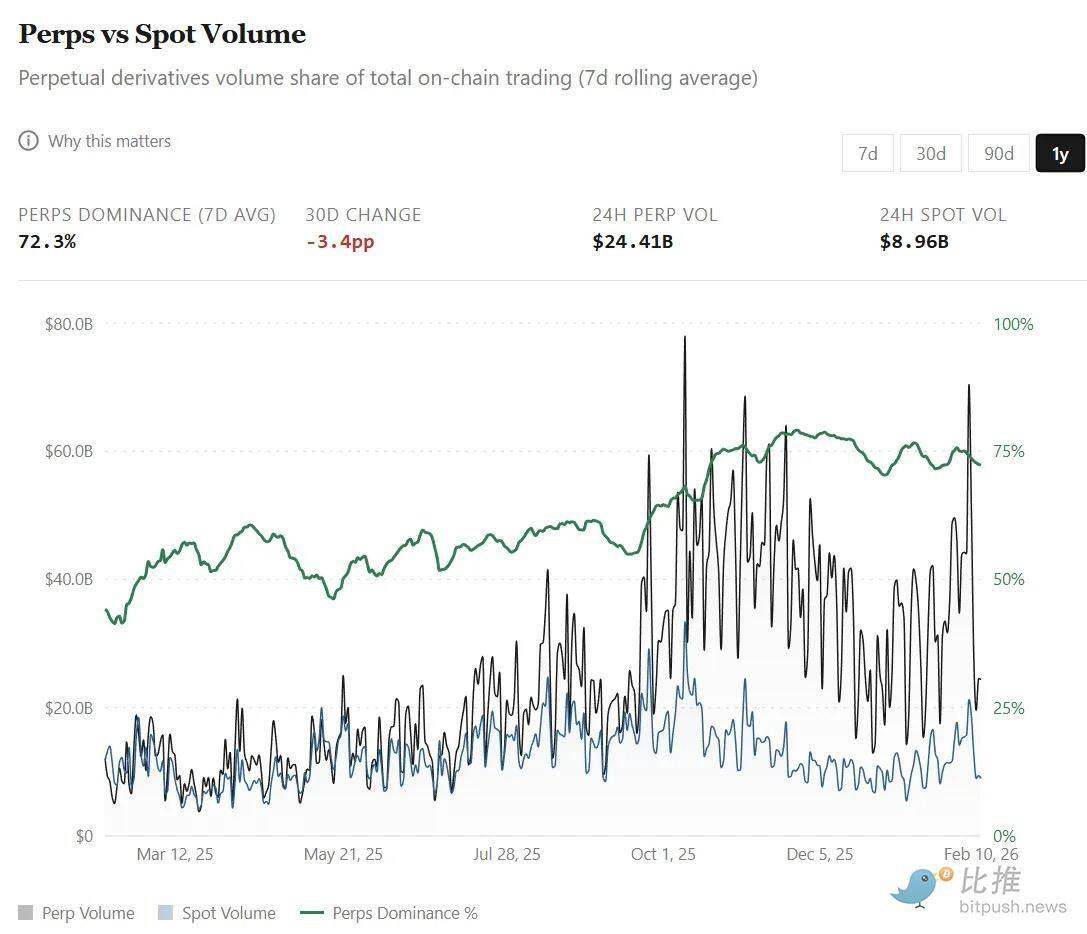

The user-friendly interface of perpetual markets makes it a low-barrier, default interface for expressing views across various markets and global assets. The broad selection of high-leverage derivative trading on a single platform for both traditional and crypto assets has led to perpetual contract trading volume surpassing the spot trading volume of decentralized exchanges. From 44% in February 2025, the share of perpetual contract trading volume has skyrocketed to around 75% today (relative to spot trading volume).

This growth has been particularly pronounced in recent months:

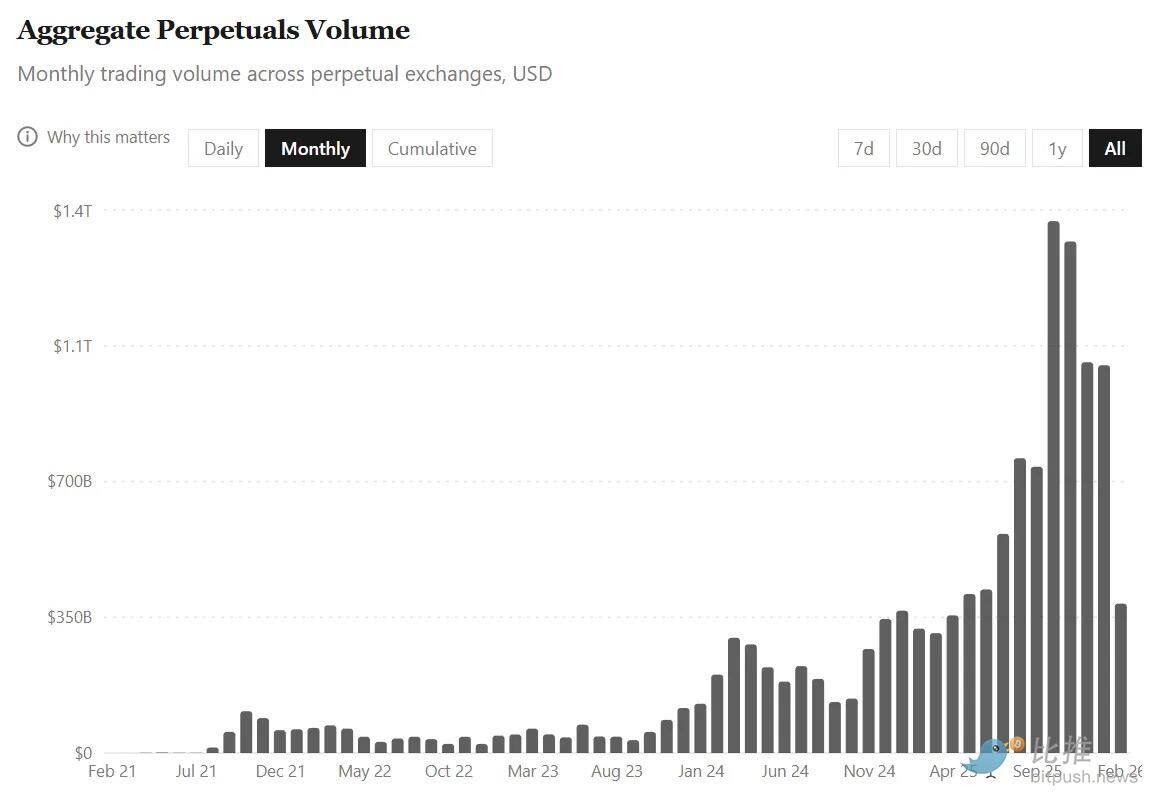

- As of July 31, 2025, the cumulative perpetual trading volume across all platforms reached $6.91 trillion.

- In just the past six months, that volume has doubled to $14 trillion.

All this growth occurred against the backdrop of the total crypto market cap shrinking by nearly 40% from August 1, 2025, to February 9, 2026. This activity suggests that traders are increasingly leaning towards derivative trading, hedging, and short-term positioning, especially when the spot market becomes highly volatile and bearish.

But there’s a catch. In such massive activity, it’s easy to misinterpret volume metrics. Especially since perpetual trading isn’t just about buying and holding assets long-term; it also involves leveraging to repeatedly adjust bet sizes within shorter time frames.

Thus, when market turnover rapidly increases, an unavoidable question springs to mind: does record trading volume reflect more capital inflows, or does it reflect the same capital cycling at a faster pace?

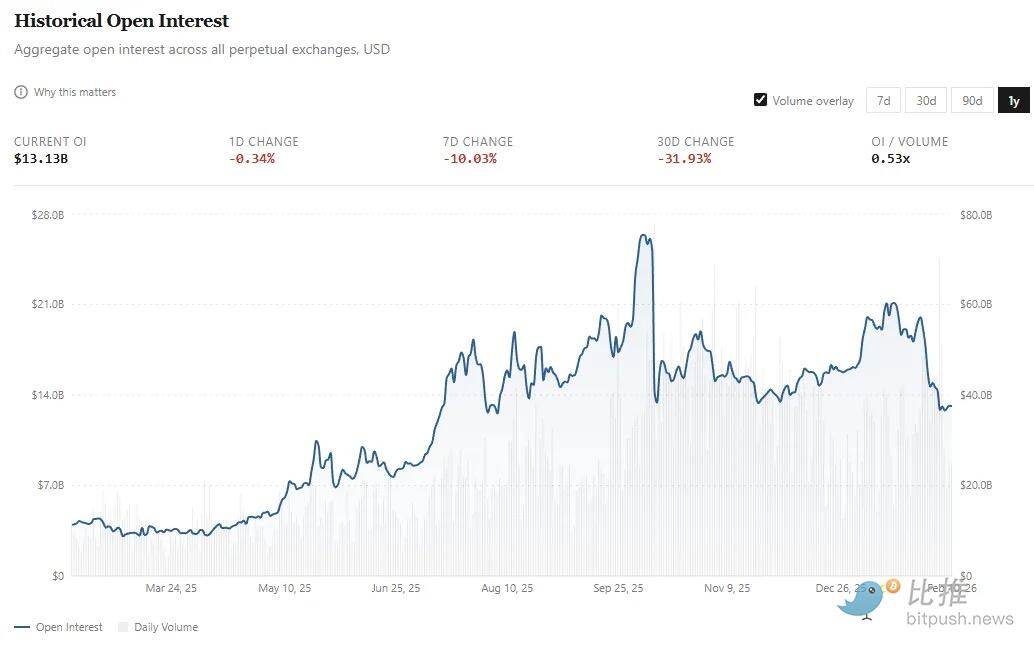

This is where observing Open Interest (OI) comes into play. If trading volume reflects capital flow, then OI measures the outstanding risk exposure. In perpetual exchanges, OI refers to the total dollar value of active and unsettled long and short contracts held by traders.

If perpetual trading gains acceptance in the wider market, we want to see not only greater capital flows but also a proportionally growing open interest.

- Last February, OI averaged about $4 billion;

- now it has more than tripled to about $13 billion. In fact, the average for the entire month of January reached about $18 billion, then fell by about 30% in the first week of February.

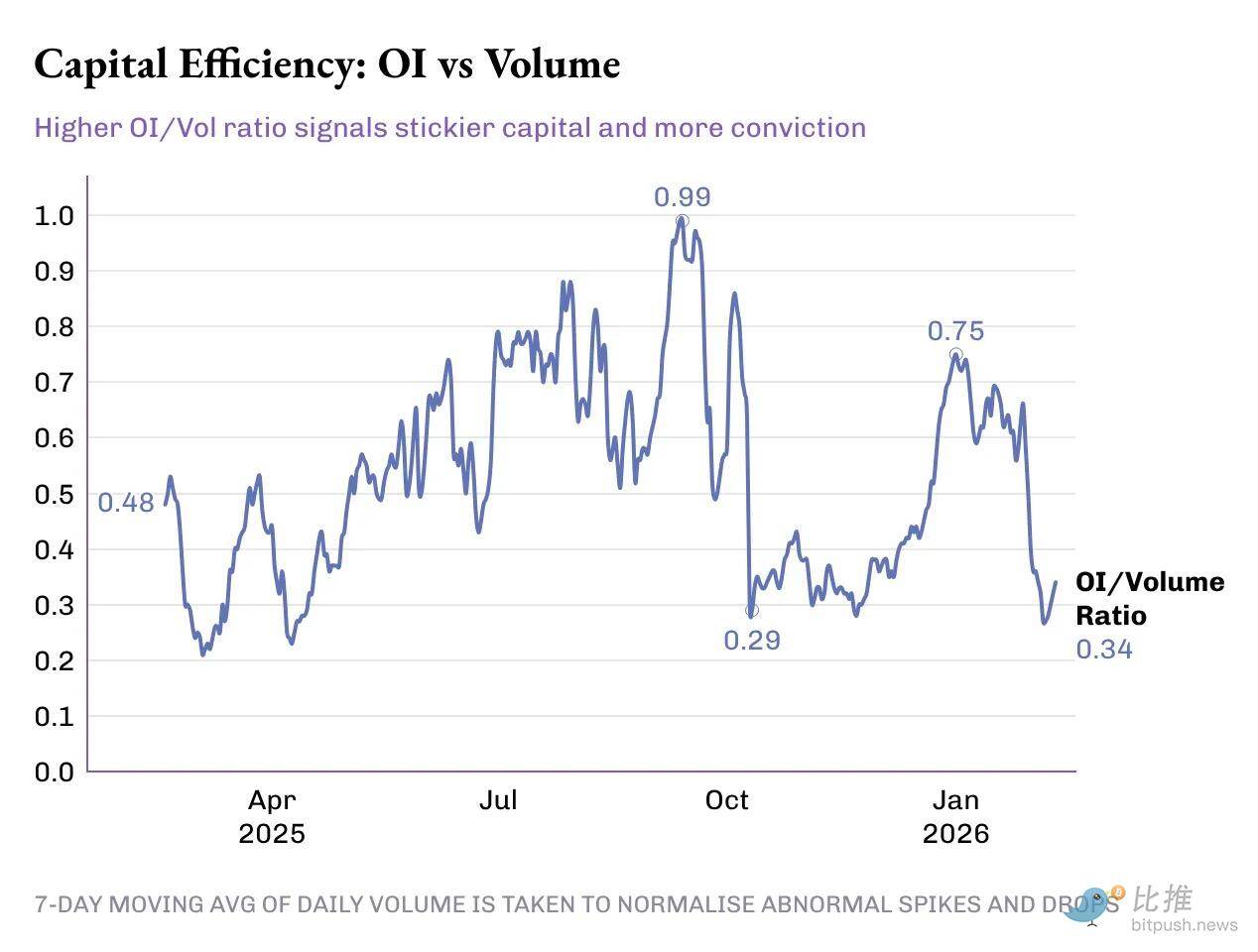

While perpetual trading volume has doubled in the past five months, OI has grown by about 50% (from $13 billion to about $18 billion and then back down to $13 billion). To better understand this, I looked at capital efficiency (i.e., the percentage of OI to daily trading volume) trends over the past year.

The OI/volume ratio jumped 50% from last year’s 0.33x to today’s 0.49x. But this progress hasn’t been smooth; during the 50-basis-point increase in this ratio, it experienced multiple peaks and troughs:

Phase One (February - May 2025): Period of Stagnation. The OI/volume ratio averaged about 0.46x, with an average OI of about $4.8 billion and an average daily trading volume of about $11.5 billion.

Phase Two (June - Mid-October): Leap Phase. The ratio averaged around 0.72x. During this period, average OI rose to $14.8 billion, with a daily average trading volume of $23 billion. This not only marked a historic high in trading volume but also indicated increased risk exposure and greater capital commitments to these derivatives.

Phase Three: Market Reversal. The beginning of this phase coincided with large-scale liquidations on October 10, wiping out over $19 billion in leveraged positions within 24 hours. From mid-October to late December, the OI/volume ratio fell to ~0.38x, primarily driven by growth in trading volume while open interest remained basically stagnant. October, November, and December recorded the highest three months of trading volume in 2025, averaging over $1.2 trillion per month. During the same period, OI averaged about $15 billion, slightly below the averages of the previous three months.

Protocol Level

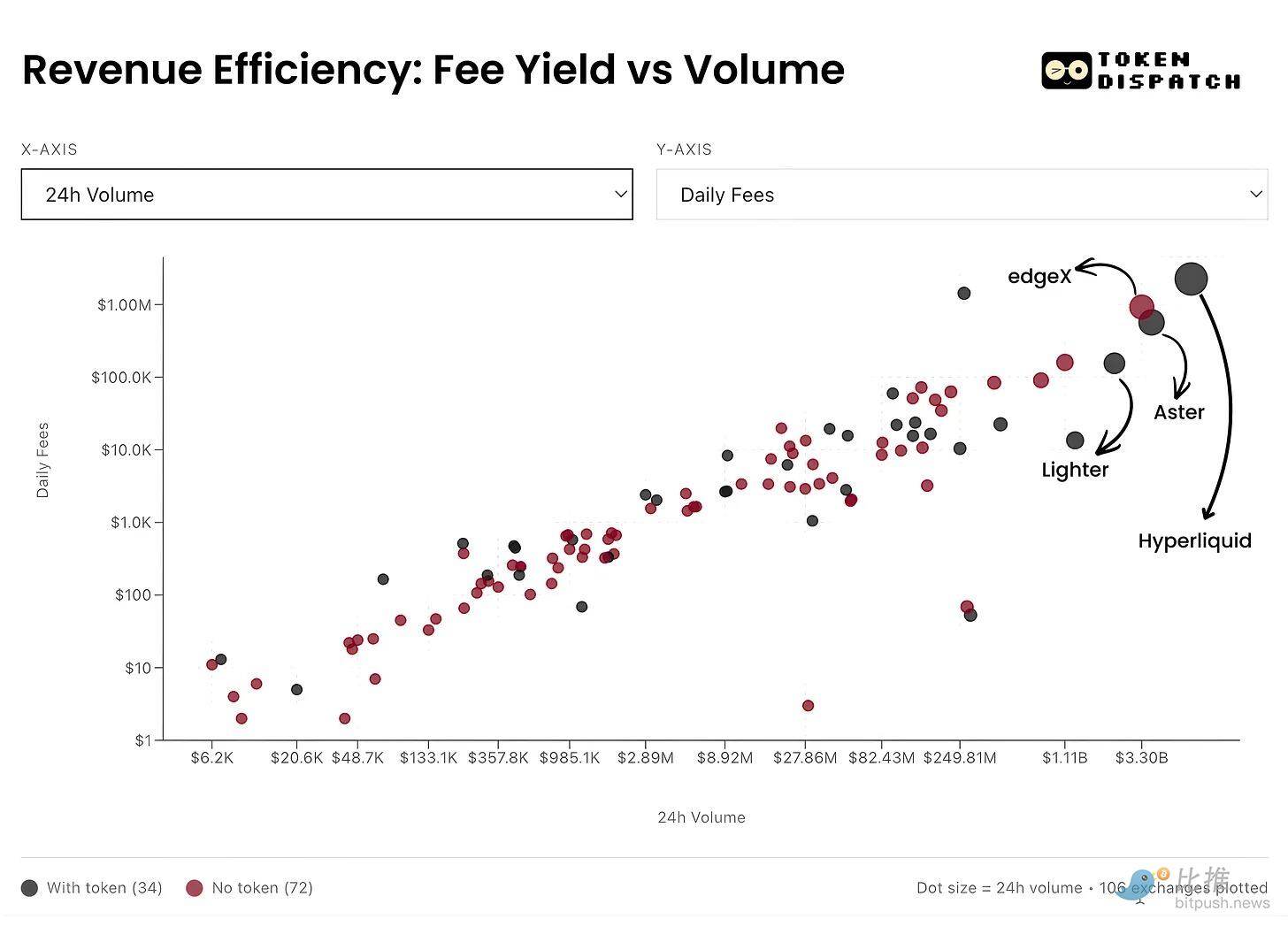

Here, I hope to add more dimensions to the perpetual markets at the protocol level. This helps us understand how efficient perpetual exchanges are at converting trading activity into "sticky capital" and revenue.

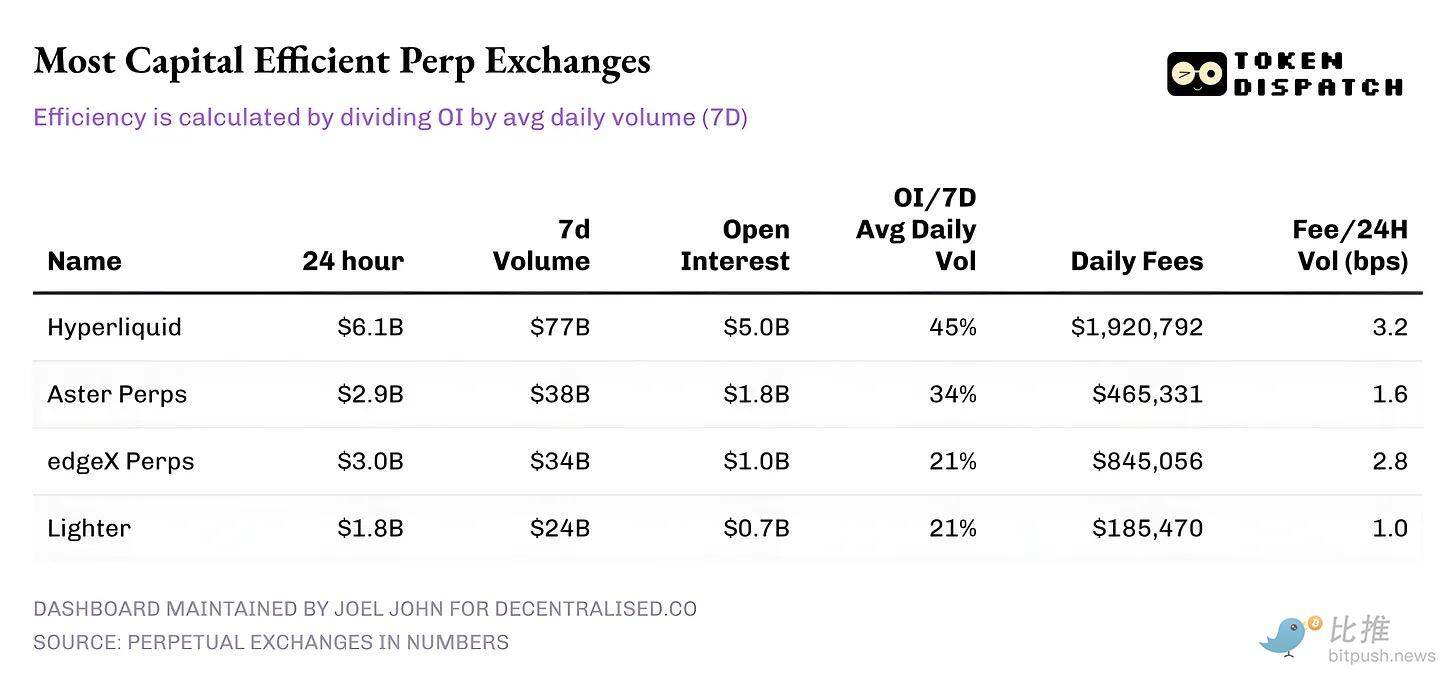

As of February 10, here are the top five perpetual exchanges by 24-hour trading volume performance:

Hyperliquid: Its OI to the 7-day average daily volume ratio exceeds 45%, converting a substantial share of trading volume into lasting positions. This implies that for every $10 traded on the platform, $4.5 is invested into active positions. This is important as a high OI rate brings narrower spreads, deeper liquidity, and confidence in scaling trades without slippage.

Hyperliquid's fee revenue reinforces this narrative. Its take rate is about 3.2 basis points, effectively converting the largest share of 24-hour trading volume into fee revenue.

Aster: Currently ranked second, although its trading volume is only about half that of Hyperliquid, it still boasts a decent capital efficiency of 34% (OI/Vol). However, its ability to monetize is noteworthy—due to a lower take rate (about 1.6 bps), Aster clearly prioritizes capital retention on its platform over maximizing fee income.

edgeX and Lighter: Both perform similarly on the capital efficiency ladder, with OI/Vol at 21%. However, edgeX is comparable to Hyperliquid regarding fee monetization, at 2.8 bps.

Conclusion

Remarkably, today’s perpetual contract market is no longer a simple growth story; it demands a nuanced interpretation of multiple metrics. On a macro level, trading volumes have exploded: the cumulative perpetual trading volume growth in six months exceeds the total of the previous four years. But the picture only becomes clear when OI and volume are combined in analysis.

A clearer victory is found in the increase of the OI/volume ratio. This is a direct signal indicating that "patient capital" is willing to trust and bet on the variety of products and markets emerging in perpetual trading exchanges.

In the future, what’s more interesting to watch is how individual players evolve from here and what they choose to optimize. Over time, those exchanges that can optimize "trading conviction" and achieve sustainable monetization will be far more important than those merely relying on rewards and incentives to dominate the trading volume leaderboard.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。