Super Bowl LX unfolded Feb. 9, 2026, at Levi’s Stadium in Santa Clara, California. The Seattle Seahawks overwhelmed the New England Patriots 29-13 in a performance defined by defense and discipline. Seattle sacked quarterback Drake Maye six times and forced three turnovers, turning the contest into a clinic rather than a shootout.

Running back Kenneth Walker III rushed for more than 100 yards and scored twice, earning MVP honors. The Patriots punted on their first eight possessions, and the final total stayed under 42 points — a result that benefited sportsbooks by dampening high-payout parlays and prop bets.

Prediction Markets Rewrite the Playbook

If the on-field action was controlled, the off-field trading was anything but.

Kalshi reported $871 million in trading volume on Super Bowl Sunday alone, surpassing its previous daily record of $543 million. Bloomberg estimated more than $1.2 billion in prediction market trading tied to the event across platforms like Kalshi and Polymarket.

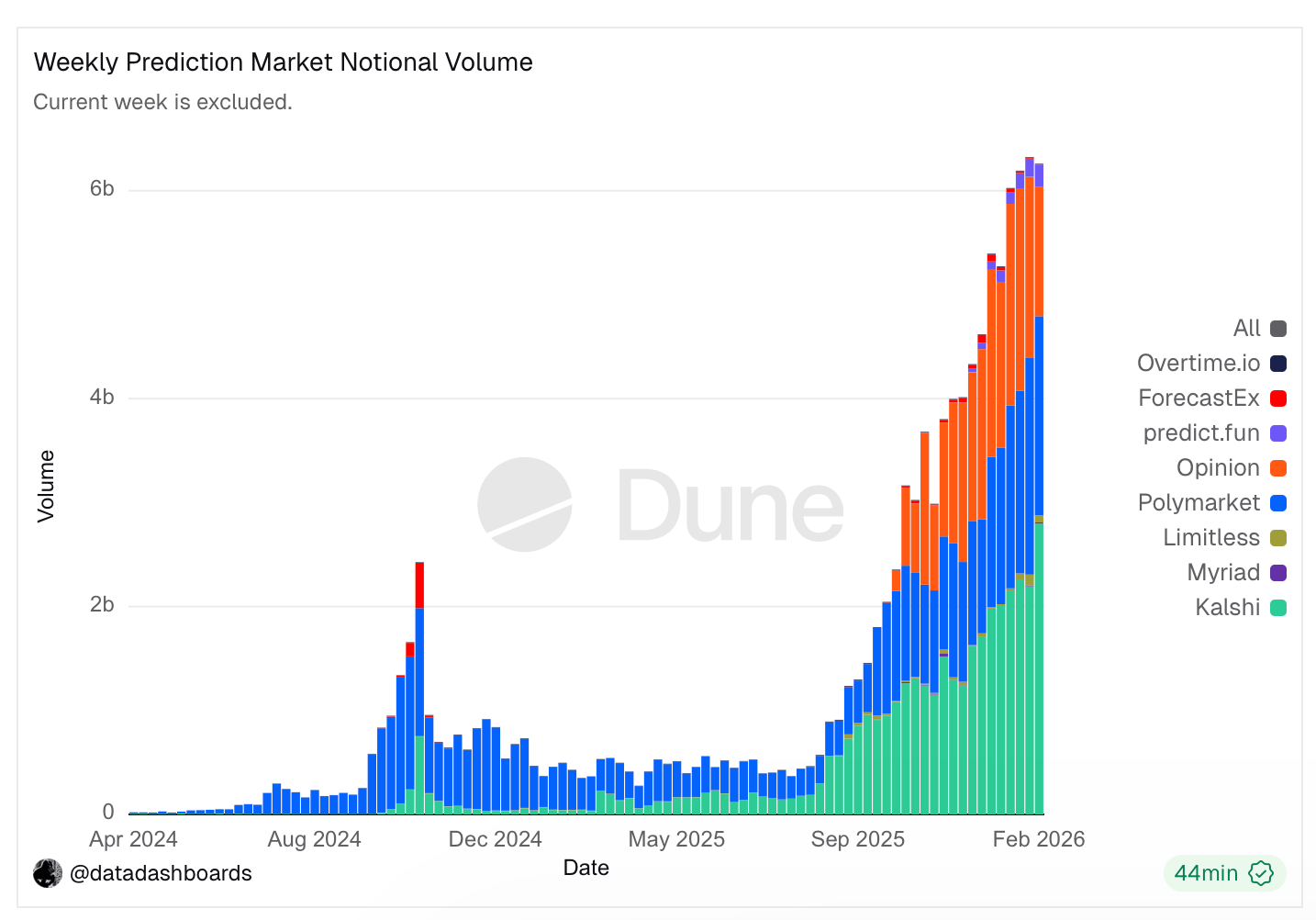

Prediction marketplace notional volume via Dune Analytics.

In the week leading up to kickoff, Kalshi handled $2.79 billion in volume while Polymarket posted $1.92 billion, contributing to roughly $6.3 billion across the broader prediction ecosystem. Contracts extended well beyond the final score, covering halftime performances, commercials, and celebrity appearances — wagers often unavailable through traditional sportsbooks.

Compared with prior years, the acceleration was stark. Kalshi’s Super Bowl volume expanded more than sixfold from the previous event, when activity hovered near $27 million.

Sportsbooks Hold Ground — With Cracks Showing

Traditional operators still command the larger battlefield.

Draftkings reported more than $8 billion in potential payouts tied to Super Bowl LX, including high-risk futures and parlays. The American Gaming Association estimated $1.76 billion in legal wagers nationally, up 27% year over year and a new record.

Headline from the Sports Business Journal on Feb. 10, 2026.

Yet Nevada’s sportsbooks told a different story. The state reported a $133.8 million handle — the lowest since 2016’s $132.5 million — generating $9.9 million in revenue at a 7.4% hold. Industry observers attributed the decline to nationwide betting access, home wagering convenience and a matchup that lacked broad public enthusiasm.

Analysts describe the move toward crypto-native prediction platforms as structural rather than cyclical. Kalshi and Polymarket offer nationwide accessibility, broader event contracts and differing tax treatment compared with state-regulated sportsbooks.

Research cited in the report estimates prediction markets siphon roughly $8 billion annually from sportsbooks, with sports comprising 85% of Kalshi’s volumes. Professional bettors are also drawn to fewer wager limits and deeper liquidity in certain markets.

Still, sportsbooks remain dominant within the approximately $220 billion annual sports betting industry. Legal classification disputes continue, and state regulators challenge whether prediction markets qualify as gambling — a debate that could escalate to higher courts.

Finance Meets the Gridiron

Super Bowl LX demonstrated how sports wagering is increasingly blending with financial market mechanics. Traders discussed arbitrage opportunities and liquidity disparities across platforms in real time, while bettors toggled between apps as easily as flipping channels.

Seattle’s defense may have controlled the Patriots, but the real contest unfolded across trading screens nationwide. Whether prediction markets ultimately complement or meaningfully displace traditional sportsbooks remains unsettled. What is clear is that the modern Super Bowl now doubles as a national experiment in market structure.

- What was the final score of Super Bowl LX?

The Seattle Seahawks defeated the New England Patriots 29-13. - How much did prediction markets trade on Super Bowl LX?

Bloomberg estimated more than $1.2 billion in Super Bowl-related trading across platforms. - How much volume did Kalshi report on game day?

Kalshi reported $871 million in trading on Feb. 9 alone. - What was Nevada’s Super Bowl LX betting handle?

Nevada sportsbooks reported a $133.8 million handle, the lowest since 2016.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。