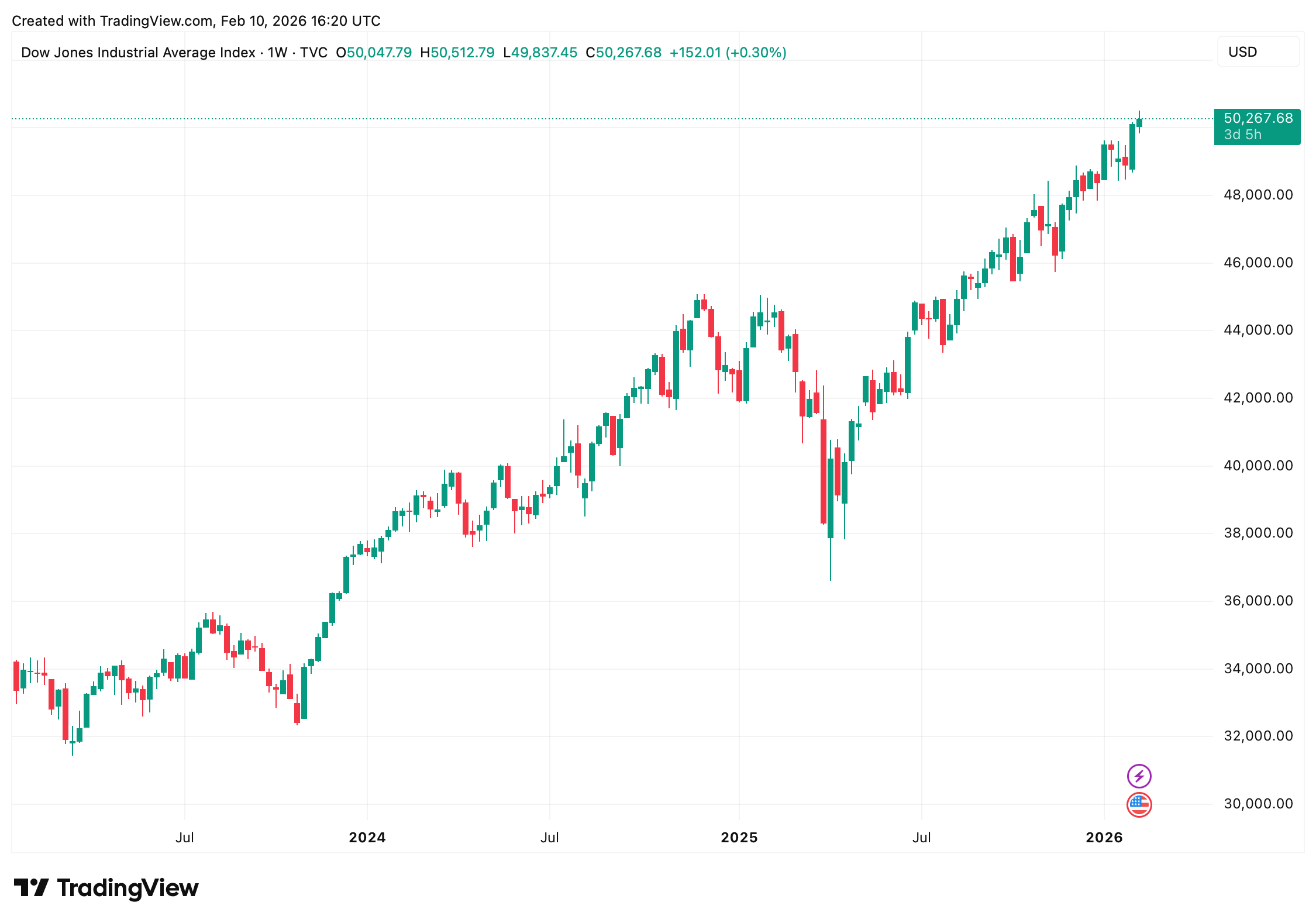

Wall Street opened the session calmly and stayed that way through late morning, with gains spread unevenly across the major benchmarks as traders appeared content to let Monday’s rebound breathe rather than chase it. The Dow Jones Industrial Average led the pack, extending its record-setting run above the 50,000 mark, while the S&P 500 and Nasdaq Composite posted narrower advances.

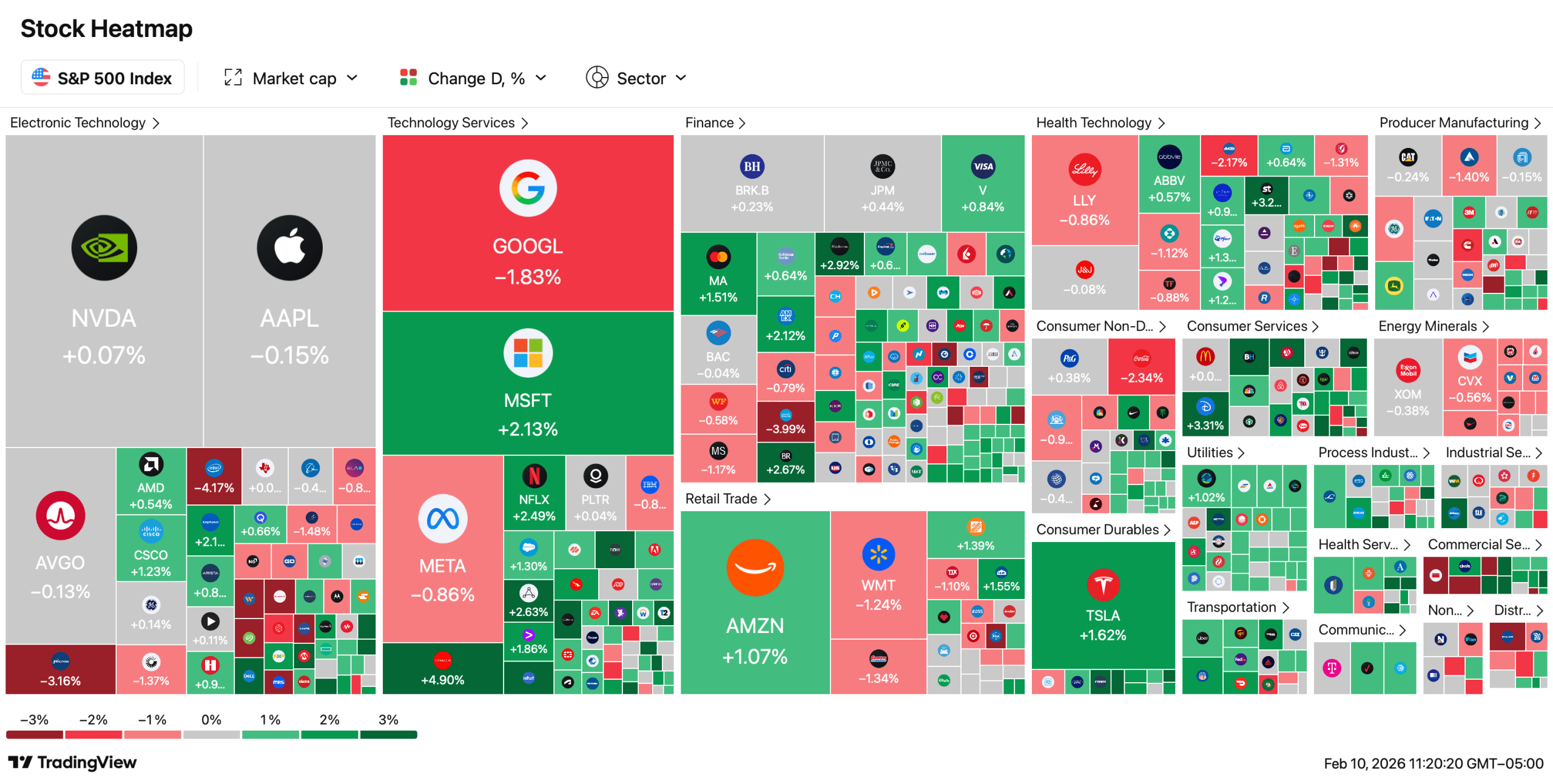

S&P 500 on Feb. 10, 2026.

As of roughly 11:45 a.m. EST, the Dow hovered near 50,300, up about 175 points on the day, while the S&P 500 traded around 6,970 and the Nasdaq Composite sat near 23,246, both edging higher by fractions of a percent. The muted tone suggested a market taking a coffee break rather than making bold bets.

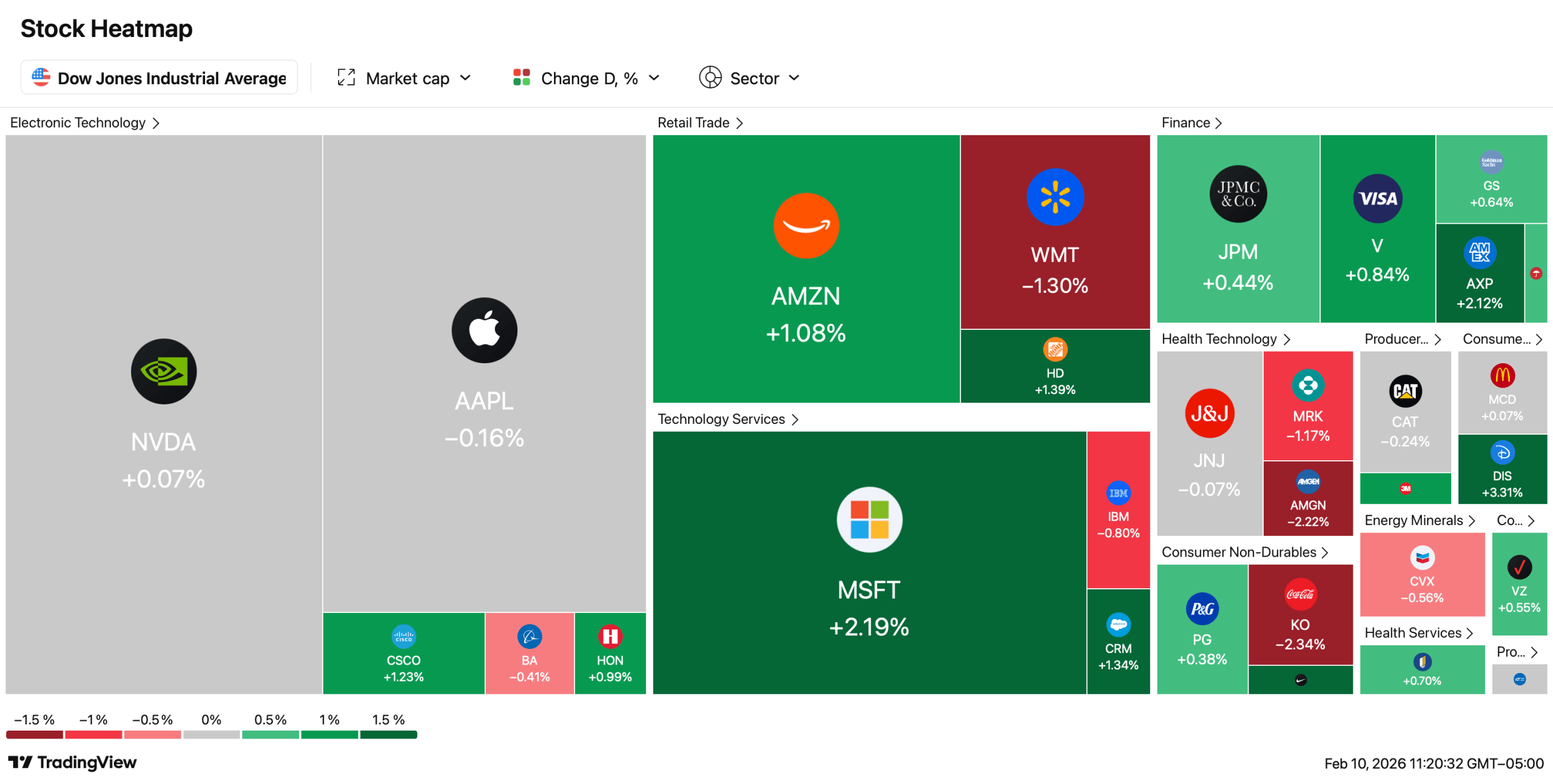

Dow Jones on Feb. 10, 2026.

Economic data helped set the mood. January retail sales came in flat, missing expectations for modest growth and reinforcing the narrative that consumer spending may be cooling. Treasury yields slipped in response, nudging rate-cut expectations higher and offering a gentle tailwind for equities without sparking a full-blown rally.

Sector performance reflected that cautious optimism. Financials and value-leaning names outperformed, while some chipmakers pulled back after recent gains. Software stocks continued to rebound following last week’s volatility, hinting at a rotation rather than a retreat from technology as a whole.

Dow Jones on Feb. 10, 2026.

Earnings remained a stock-by-stock affair. CVS Health climbed after a positive reaction to its results, while Coca-Cola slipped following an earnings miss. Oracle gained ground on continued enthusiasm around artificial intelligence spending, even as Nvidia eased slightly after Monday’s jump. In short, the tape rewarded specifics, not slogans.

Global markets added a supportive backdrop. Asian equities rallied overnight, led by Japan’s Nikkei hitting fresh records, and the dollar weakened modestly. Gold prices held steady as investors weighed policy uncertainty, while risk assets moved with restraint rather than fear. The crypto economy, too, is treading water and consolidating. The price of bitcoin stands at just above the $69,400 mark at 11:45 a.m. EST on Tuesday.

Also read: MrBeast Expands Into Finance With Acquisition of Teen Banking App

Volatility stayed subdued, with the CBOE Volatility Index holding near recent lows. That calm suggests traders are comfortable—for now—parking near record levels ahead of heavier data later in the week rather than heading for the exits.

Looking ahead, attention will turn to upcoming labor and inflation reports, which could quickly change the tone. For mid-day Tuesday, though, U.S. equities appeared content to grind higher, proving that sometimes the market’s most telling move is refusing to panic.

- Are U.S. stock markets still open?

Yes, this report reflects mid-day pricing with trading ongoing. - Which index is leading today?

The Dow Jones Industrial Average is showing the strongest mid-day gains. - What’s influencing markets right now?

Flat retail sales data and shifting rate-cut expectations are shaping sentiment. - Is volatility elevated?

No, volatility remains subdued compared with recent sessions.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。