An employee's erroneous click in front of a computer led to the accidental distribution of Bitcoin worth $44 billion to users, triggering a crisis of trust and regulation in the South Korean cryptocurrency market.

On the evening of February 6, the operational interface of Bithumb, South Korea's second-largest cryptocurrency exchange, experienced an anomaly: a planned reward of 620,000 Korean won for users suddenly turned into 620,000 Bitcoins, totaling a value of $44 billion.

The error was discovered within 20 minutes, and an emergency response was initiated. After 35 minutes, 99.7% of the mistakenly distributed assets were recovered. However, the shockwaves from this incident continue to spread.

Lee Chan-jin, head of the Financial Supervisory Service of South Korea, stated that if the investigation confirms any illegal negligence, Bithumb will face the highest level of sanctions, including fines and suspension of operations.

1. Incident Replay

● On the evening of February 6, 2026, at 7 PM, a fatal input error occurred in Bithumb's internal system. An employee, while distributing promotional rewards, mistakenly set the unit from "Korean won" to "Bitcoin," intending to pay a total of 620,000 Korean won (approximately 3,100 RMB) to 249 users.

● This mistake resulted in the exchange instantly injecting a total of 620,000 Bitcoins into user accounts. Based on the Bitcoin price that evening, the mistakenly distributed assets were valued at 61 trillion Korean won (approximately $44 billion).

● The "windfall" received by users was shocking, with each winner averaging about 2,490 Bitcoins. At the time, with Bitcoin priced at approximately 98 million Korean won, the average amount per person reached about 24.4 billion Korean won.

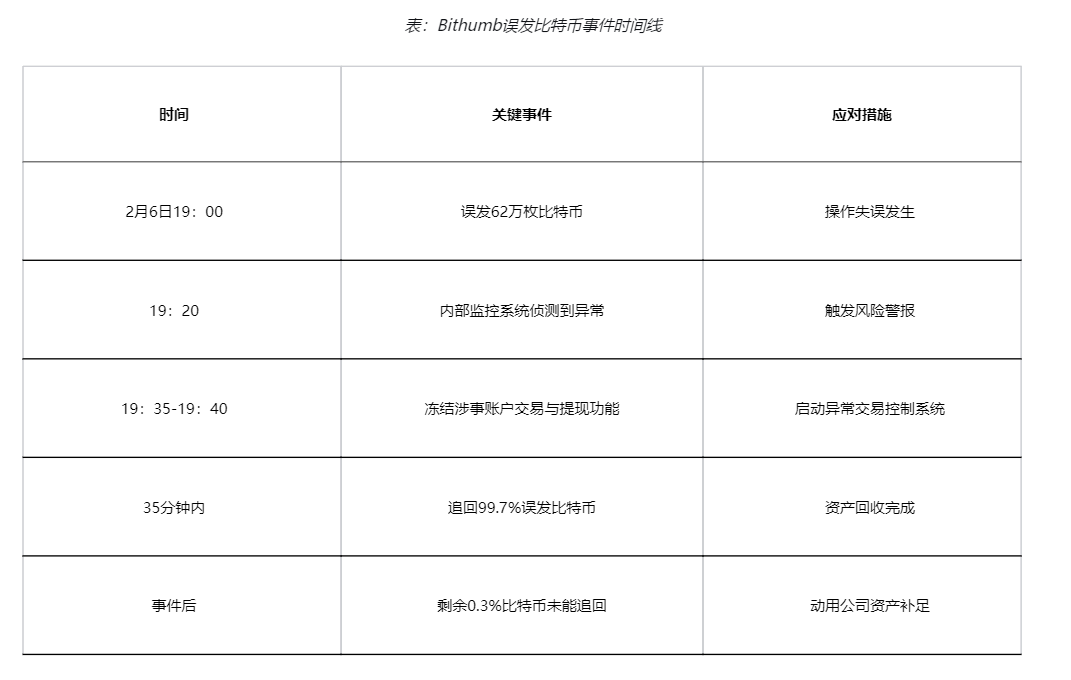

2. Emergency Response

● Upon discovering the anomaly, Bithumb's technical team quickly initiated crisis management procedures. The exchange detected the abnormal large inflow of Bitcoins and triggered a risk alert within 20 minutes.

● Starting at 7:35 PM, the technical team used the abnormal transaction control system to batch freeze the trading rights and withdrawal functions of the involved accounts, completing a full lockdown by 7:40 PM.

● This rapid response allowed the exchange to successfully recover 99.7% of the mistakenly distributed Bitcoins. However, for the 0.3% of assets that could not be recovered in time, Bithumb stated it would use its own assets to fully compensate.

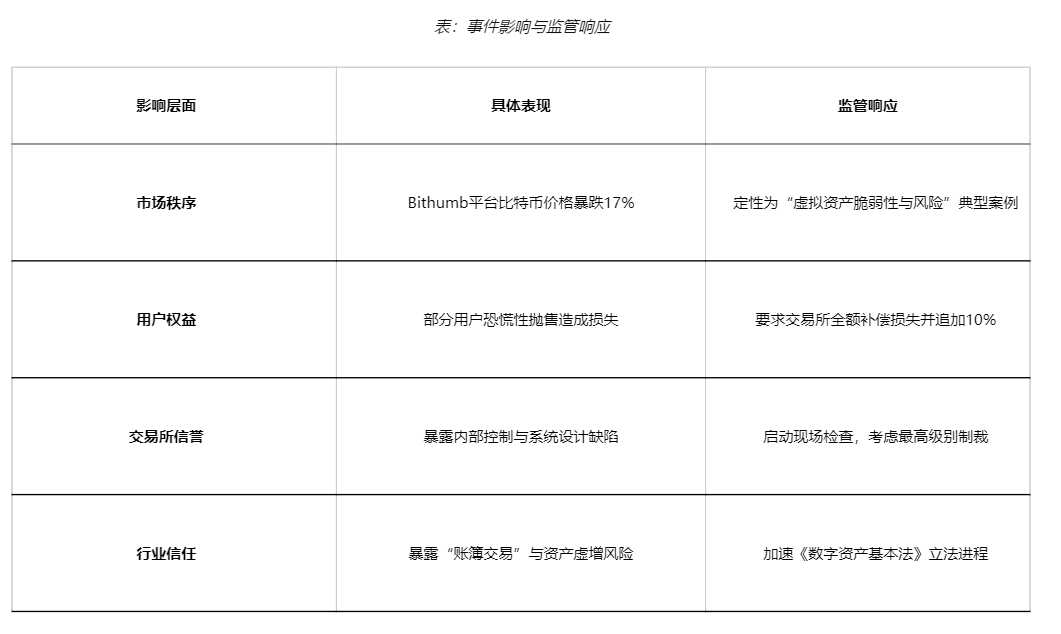

3. Market Impact

● The erroneous distribution had an immediate impact on the Bitcoin trading price on the Bithumb platform. Users who received the "unexpected fortune" reacted quickly, with some immediately selling their Bitcoins and attempting to withdraw.

● This sudden large-scale sell-off caused the price of Bitcoin on the Bithumb platform to plummet 17% in a short time, dropping from 98.29 million Korean won (approximately $67,000) to 81.10 million Korean won (approximately $55,000).

● The exchange was forced to take emergency measures to address the panic selling. Bithumb promised to fully compensate users for their losses incurred during the rapid price drop due to panic selling, and additionally provide 10% extra compensation.

As of 4 PM on February 7, the company initially estimated customer losses to be around 1 billion Korean won.

4. Systemic Vulnerabilities

● Bithumb's "super error" incident revealed deep-seated risks within cryptocurrency exchanges. Lee Chan-jin pointed out that Bithumb actually held only about 42,000 Bitcoins, but the mistakenly distributed 620,000 Bitcoins far exceeded its actual reserves.

● This figure exposed the risks of so-called "bookkeeping transactions"—trading fictitious assets without security guarantees. The exchange's system was designed to recognize the "digits" recorded in the computer ledger as real assets, regardless of actual holdings.

● Bithumb's CEO, Lee Jae-won, admitted that the incident exposed the platform's failure in its two core values of "stability and integrity." From a system design perspective, the change in unit led to a value difference of 100 million times, yet there was no basic verification system to filter such errors.

5. Regulatory Response

● The incident quickly attracted significant attention from South Korean financial regulatory agencies. The Financial Services Commission (FSC) held an emergency meeting, classifying the incident as a typical case of "vulnerabilities and risks in virtual assets." The Financial Supervisory Service (FSS) announced on-site inspections of Bithumb and other exchanges, focusing on internal control systems and asset custody security.

● Lee Chan-jin clearly stated, "This is a serious event that undermines the credibility of cryptocurrency exchanges." He warned that if the investigation confirms any illegal negligence, the highest level of sanctions, including fines and suspension of operations, will be imposed.

● The South Korean National Assembly's Policy Committee quickly responded, scheduling a plenary meeting on February 11 to specifically discuss the incident of Bithumb mistakenly distributing 620,000 Bitcoins.

6. Industry Ripple Effects

The Bithumb incident is not an isolated case. Two months prior, South Korea's largest exchange, Upbit, experienced a hacking incident, resulting in the theft of cryptocurrency worth 44.5 billion Korean won.

● Virtual asset exchanges are facing dual threats from both inside and outside: vulnerable to external hacking attacks and potentially experiencing incredible operational errors internally. These platforms even lack the most basic security measures, such as dual authorization or mutual checks, entrusting everything to the operations of a single employee.

● Lee Chan-jin pointed out that as virtual assets are integrated into the traditional financial system, strengthening regulatory and supervisory frameworks remains an urgent task. He further emphasized that the Bithumb incident exposed the structural limitations of the industry.

● The Financial Supervisory Service plans to focus its inspection capabilities on high-risk events that could lead to consumer harm. The agency will also establish a supervisory framework aimed at preventing cybersecurity risks in the financial sector.

7. Regulatory Upgrade

In direct response to the Bithumb incident, the Financial Supervisory Service of South Korea announced a comprehensive upgrade of regulatory efforts in the cryptocurrency market.

● Key targets for crackdown include price manipulation, abnormal high-frequency trading, and market disorder caused by IT system incidents. The regulatory body emphasized that technical stability has become one of the core elements of financial security.

● At the cryptocurrency market level, the Financial Supervisory Service will focus on behaviors that disrupt trading order, including large traders manipulating prices and artificially creating liquidity tightness. Rapid price increases, intervening in matching mechanisms through API commands, and spreading misleading information via social media are also listed as key areas for rectification.

● The Financial Supervisory Service has also established a dedicated task force responsible for advancing the legislative preparation of the "Basic Law on Digital Assets." This bill is seen as the core framework for South Korea's second phase of cryptocurrency regulation, covering rules for token issuance and listing information disclosure, as well as licensing systems for digital asset service providers.

Discussions regarding the Bithumb incident continue in the meeting room of the National Assembly's Policy Committee. Meanwhile, inspection teams from the Financial Supervisory Service have already entered major exchanges to conduct a comprehensive review of internal control systems.

Lee Chan-jin emphasized in a statement that the problem lies in the system design that allows erroneous inputs, which needs to be carefully considered in the legislative process. He further pointed out that as virtual assets are integrated into the traditional financial system, this incident "may become an opportunity to properly establish the system."

In a virtual asset market with daily trading volumes reaching 20 trillion Korean won, how to build a system that can distinguish between 1 won and 100 million won has become an urgent issue facing South Korean financial regulators.

Join our community to discuss and grow stronger together!

Official Telegram community: https://t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

OKX benefits group: https://aicoin.com/link/chat?cid=l61eM4owQ

Binance benefits group: https://aicoin.com/link/chat?cid=ynr7d1P6Z

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。