Family, the recent market conditions are really so stimulating that it's hard to sleep! It's not the excitement of rising prices, but the brutal impact of falling prices — a comprehensive correction, with precious metals and risk assets diving together, and the crypto market is even more unbearable. BTC has directly erased all the gains from the Trump 2.0 era; who can withstand this!

Last week, BTC was still hovering around 60,000, and then it plummeted by 10,000 points overnight. Waking up felt like the sky had fallen!

ETH isn't doing much better. On-chain demand is weak, and the founder is still reducing holdings. Last week, it briefly fell below the 1,800 mark, with a nearly 30% drop this month. SOL, as a high-beta asset, is still quite active on-chain, but its volatility is frightening, dropping to 67.5 at one point. Who would have thought that standing above 200 seemed like just yesterday!

The total market cap of crypto has evaporated over 600 billion dollars this month, and even the coin hoarding index has re-entered the bottom-buying range after three years, but now it has returned to the regular investment range — to be honest, I have a big question mark in my mind about whether this rebound can last.

Old fans should remember something I said before: "A rebound without volume is just a trick!" Look at the arrows in this chart; when BTC rebounded, the trading volume and open interest did not increase in sync, indicating that the rebound relied entirely on existing funds, with no new money entering the market, making it fundamentally unstable. In contrast, ETH is slightly stronger, having regained the 2,000 mark, and when it first rebounded, the open interest could keep up, which is relatively healthier. However, demand in the US market is still very weak, with the Coinbase BTC premium index consistently negative, indicating that foreign capital is not actively entering the market.

Now let's talk about the macro issues: ETF funds have been experiencing net outflows, geopolitical situations are chaotic, and US monetary policy is uncertain — the newly nominated Federal Reserve chairman is hawkish, and Trump has even stated that if he doesn't cut interest rates as expected, he will withdraw the nomination and sue him! Even if he does take office, the initial phase will likely just be "for show," making immediate easing very difficult. In this environment, cryptocurrencies are always the first to be sold off; after all, when risk aversion rises, everyone first liquidates high-risk assets.

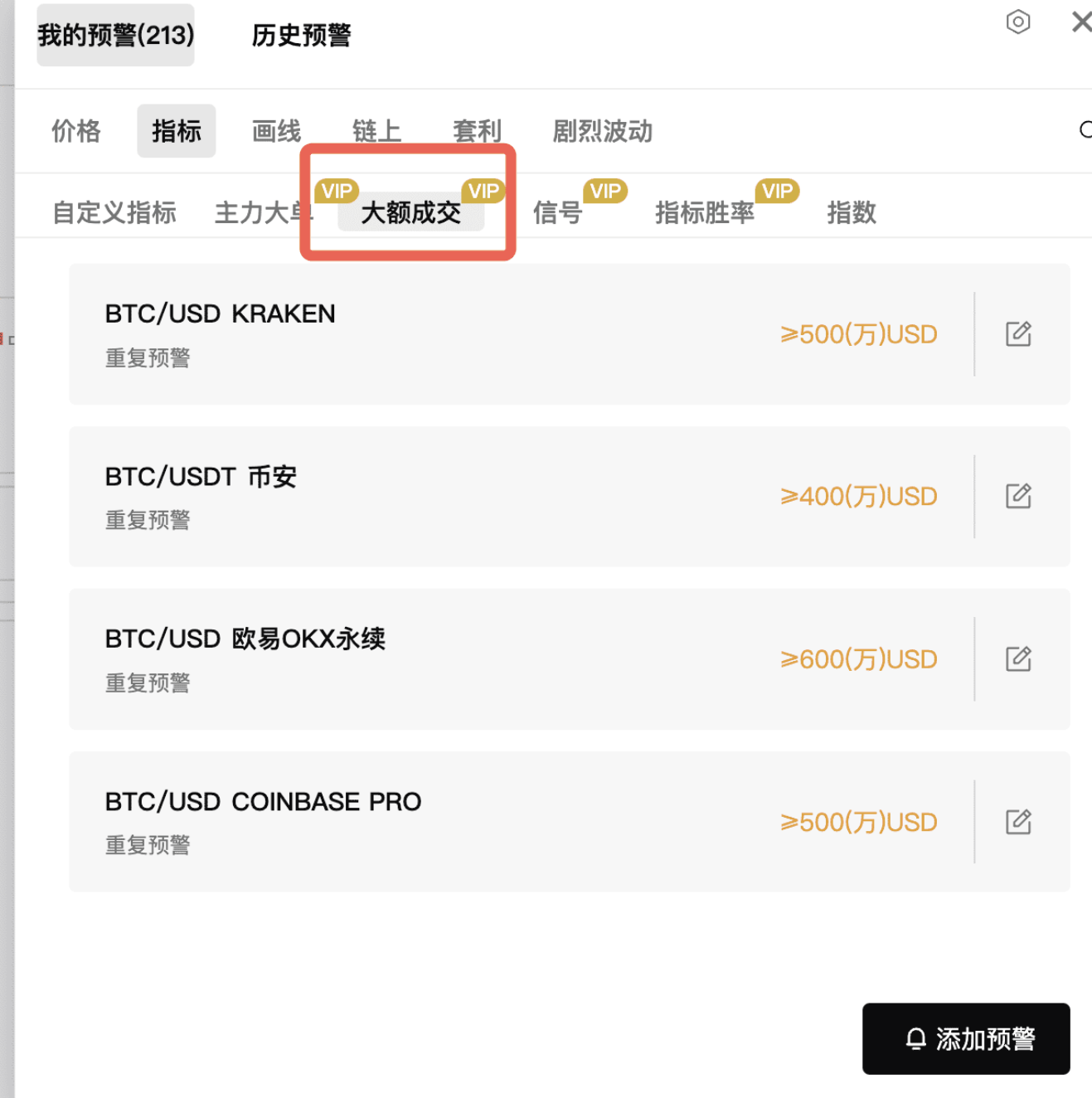

Another detail to note: the bait orders placed by Coinbase are raising the lows while compressing the highs. This could either be a sign of accumulating positions during a consolidation phase or that it hasn't fully dropped yet. Currently, neither Coinbase nor Binance has seen clear large buy orders, so it's crucial to focus on the market price transactions of the main players — based on recent patterns, each drop has been initiated by large US market players on Coinbase or Kraken, followed by the main players on Binance, maintaining a tight rhythm.

VIP members are advised to quickly set up large transaction alerts, whether for market orders or limit orders, so that you receive real-time pop-up notifications when transactions occur. Future products will also optimize push notifications, so you can expect more timely signals.

Ordinary users shouldn't panic either; setting alerts will allow you to grasp the main players' movements in real-time, preventing you from being caught off guard.

Back to the core question: where is the bottom for BTC? Let me show you the support level; the screenshot was taken in advance, but the support level is very effective — the short-term support is at 67,552, just at the peak of the chip distribution, relatively stable.

A stronger support level below is at 57,802, which is the 61.8% Fibonacci retracement level. Below this price is a vacuum area for chips, with low consensus and little support strength; if it really drops to this level, caution is warranted. For those trading short-term, it’s important to pay attention to the chip distribution since 2024, and now that leverage is allowed for shorting, operations need to be more cautious.

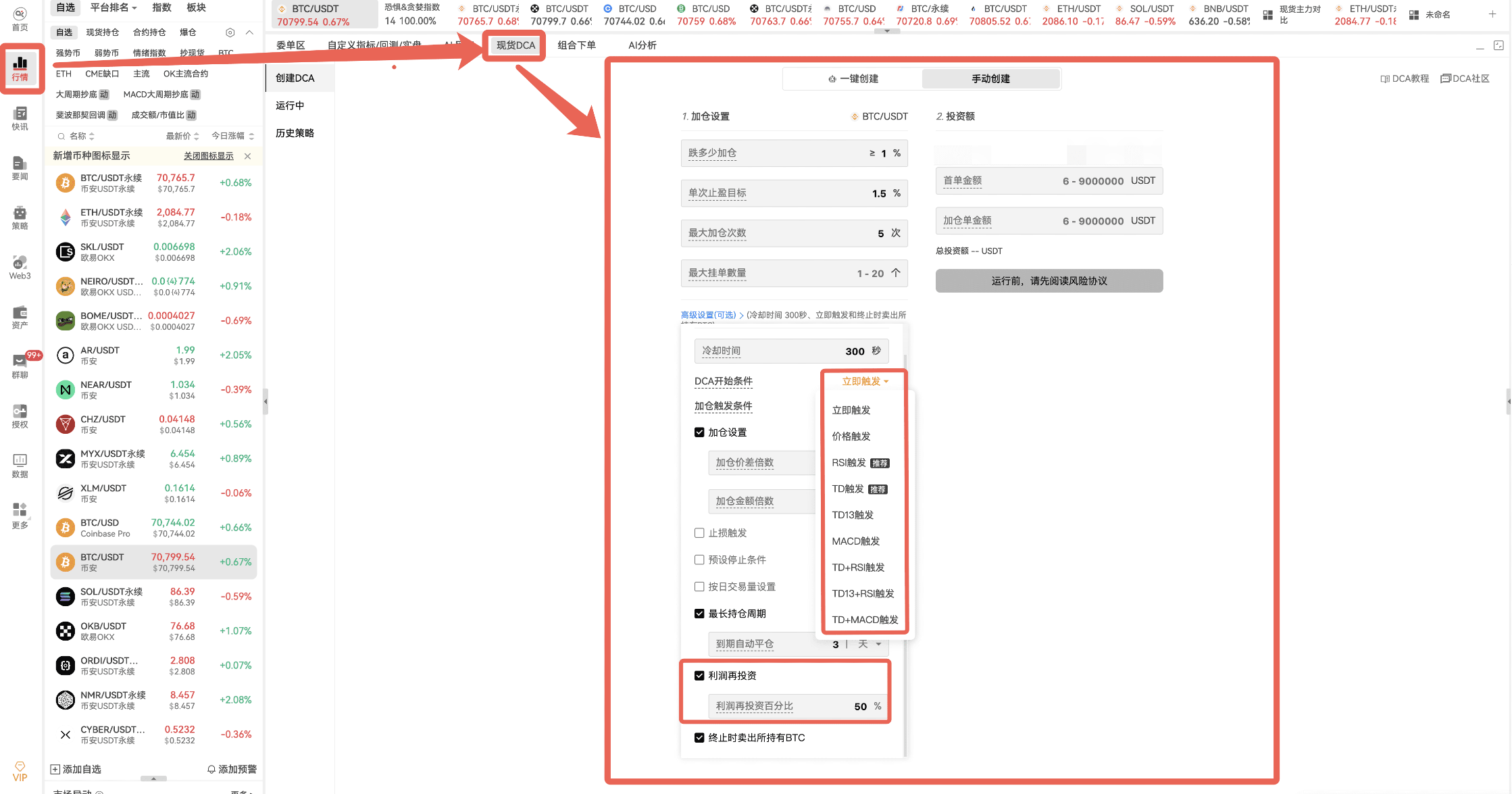

To be honest, guessing the bottom right now is not very meaningful; the more you guess, the more anxious you become. If you want to enter the market but are afraid of being trapped, I strongly recommend trying a spot DCA (dollar-cost averaging) strategy, allowing the program to help you automatically average down. You can even do a "scaled-up capital DCA" — for example, invest 100U for the first order, 150U for the first average down, and 200U for the second average down. This can effectively lower your average holding price, so even if it drops further later, you won't suffer too much loss.

Can we trust this volume-less rebound? Will it drop to 57,802 later? If you have any questions about the DCA strategy or think there are other support levels worth paying attention to, feel free to comment, and we can discuss and analyze together!

No matter how bad the market is, don't panic. Find the right method, patiently wait for opportunities, and you will always find the true bottom!

Join our community to discuss and become stronger together!

Official Telegram community: https://t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

OKX benefits group: https://aicoin.com/link/chat?cid=l61eM4owQ

Binance benefits group: https://aicoin.com/link/chat?cid=ynr7d1P6Z

This article only represents the author's personal views and does not represent the platform's stance or views. This article is for information sharing only and does not constitute any investment advice to anyone.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。