Written by: Yishi

Note: This article was originally published on November 4, 2023, when the BTC price was $34,522, and the text has not been modified. This article does not provide any investment advice and has no stance or judgment on subsequent market trends.

The main text follows.

A storm is brewing. 1284 days ago, I released a video discussing Bitcoin's halving, predicting that the price would rise to $55,000 after the halving.

That day was April 17, 2020, and Bitcoin's closing price was $7,125. A few years have passed, and the halving is about to happen again, specifically at some point in April or May 2024.

This is the fourth halving in Bitcoin's history and the last opportunity for ordinary investors, like a narrow gap in the ancient city wall under the setting sun. When this door closes, the last chance to get on board will also disappear. Xiao Feng's greatest regret was not being able to save Ah Zhu, “I am a Khitan, what great ambitions can I have?” The golden bottle has fallen into the well, and there is no turning back.

My greatest regret is that after nearly a decade of dedicated entrepreneurship, I haven't accumulated enough coins, and the game is about to end; this is also a kind of fate.

How to Define Scarcity

An Arab scholar named Saifedean Ammous wrote a book called "The Bitcoin Standard" in 2018, where he discussed a "stock-to-flow" model, which simply refers to the relationship between stock and annual production.

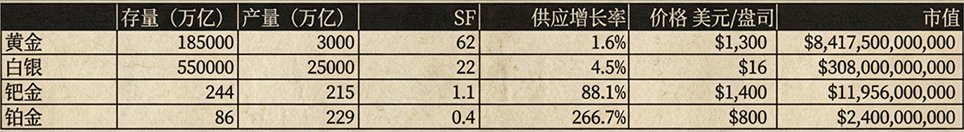

When we talk about stock, we are counting the total quantity of a commodity. Annual production is the total amount of that commodity produced in a year. Dividing the two gives us a ratio called SF.

In the chart, you can see that gold has an SF of 62, and silver has an SF of 22. What does this mean? It means you would need 62 years to produce as much gold as currently exists, 22 years for silver, and 0.4 years for platinum, all indicating that they are particularly scarce.

We start to wonder if these things became currency because of their scarcity. In contrast, platinum and palladium have SF values equal to or less than 1, indicating they are not that scarce.

This is indeed the case; gold retains value better than other metals listed. The goods we use in our daily lives, such as food, phones, computers, and cars, have SF values far less than 1, meaning they have never been scarce. Why? Because as long as there is demand for a product, it can be produced. Once someone wants to hoard it, the price will rise, prompting more businesses to produce it, which will inevitably lead to a price drop.

This is the common sense of supply and demand balance. Therefore, we can easily conclude that the higher the SF of a commodity, the better it can maintain its value and the less it will be diluted.

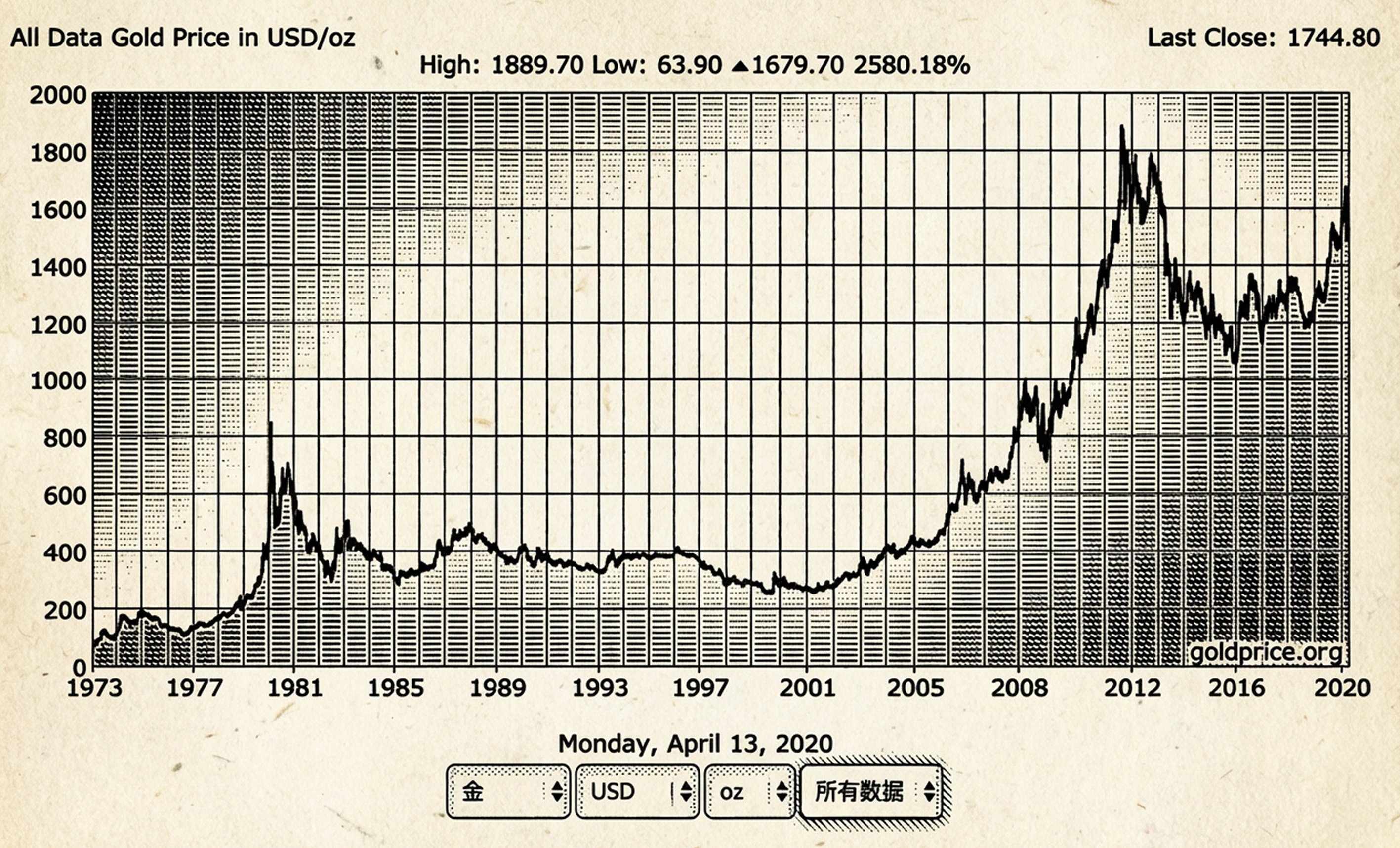

Look at gold; in 1972, it was $46 per ounce, and by 2020, it reached a new high of $1,744 per ounce, a total increase of 37.9 times. So why don't we produce more gold to meet demand? The reason lies in the constraints of mining technology and costs. If it costs more to do something than what you earn in the end, you certainly wouldn't do it.

So, what is Bitcoin's SF value? About 19.5 million Bitcoins have been mined worldwide. However, a research report states that over 1.6 million of these Bitcoins are permanently lost.

Thus, the actual usable Bitcoins are only around 17.9 million. Given Bitcoin's current annual production, its SF is about 54, similar to gold. In a few months, Bitcoin's SF will rise to 108, with an annual inflation rate of only about 0.9%, meaning Bitcoin has become the most scarce asset in human history since gold.

The halving is the underlying reason for changing Bitcoin's supply relationship, not any other factor. And this supply relationship determines the price of the coin. Some people hear about Bitcoin ETFs and get excited, as if once approved, the price will skyrocket. I suggest you don't pay attention to media hype but see the underlying reality.

Whether BlackRock's Bitcoin ETF is approved or not is not important, nor is when it will be approved. What matters is the expectation of "Bitcoin ETF approval," which will gradually build momentum as a bait to boost market confidence, pushing the price above $45K in the future without you even realizing it. You think we are still in a bear market, but in fact, the bear market has quietly ended without your awareness. Moreover, this momentum will continue; it is not like your household water supply.

BlackRock and subsequent approved ETFs are like the Suez Canal (Arabic: قناة السويس), connecting old money and new pools. The scale of these traditional financial risk funds is larger than many can imagine. For them, Bitcoin is not too expensive; it is too cheap, and the market is too small.

The Suez Canal flows majestically, connecting the north-south waterway between Europe and Asia. Since then, ships no longer need to navigate around the Cape of Good Hope at the southern tip of Africa; fleets departing from London or Marseille head to Mumbai, India, returning laden with gold, silk, and spices.

King Darius I of the Persian Empire completed the last section of the Suez Canal around 500 BC. He erected a granite stele in one of the river areas, inscribed with:

I am a Persian, I rose from Persia and conquered Egypt. I commanded the opening of this river, flowing from the Nile in Egypt to the vast sea bordering Persia. Once this river is completed, Egyptian vessels can sail directly to Persia, fulfilling my wishes.

Cool and impressive, this is the charm of the passage.

The approval of Bitcoin ETFs affects not just the present but the next decade. Once the channels for fiat currency are unobstructed, the rest is left to time.

By 2025, we may indeed see Bitcoin surpassing $100K.

Bitcoin is gradually evolving into the land of Manhattan, becoming a social status symbol. People choose Bitcoin not because it transfers faster than other coins, but because it is expensive. It is expensive because it embodies the core consensus of the entire crypto game, serving as a vehicle for value storage and as an object to flaunt in social relations, sought after by all.

Bitcoin showcases your strength, stability, loyalty, and faith; it is your courtyard in the second ring of Beijing, your old Western-style house on Hengshan Road in Shanghai, your villa on the Peak in Hong Kong. Its value is determined by the truly purchasing power-rich upper class, just like Berkshire Hathaway's Class A shares, which can reach $530,000 per share, attracting funds like a magnet, remaining ever-popular, making it difficult for retail investors to buy even one share.

Ten coins can be called a marquis.

The Price Anchoring Game

If a person does not understand how the price of coins is anchored, they have not truly grasped Bitcoin. Let me first talk about land, then return to Bitcoin.

Everyone has played "Monopoly," but I rarely see anyone articulate its essence. You need to understand that the role of the Federal Reserve is similar to the bank in the board game "Monopoly"; its goal is not to win but to provide enough funds to maintain the game's progress.

For the Federal Reserve, the appropriate amount of assets is the quantity that best enables it to fulfill its responsibilities. Monopoly is essentially a game of land speculation, where the core objective is to monopolize resources, and there can only be one winner at the end of the game, while the other players are merely collateral damage. Victory does not come from competition but from monopoly.

Question: Where does the fiscal revenue of a central empire come from?

Answer: It is no different from Monopoly, simply:

- State-owned enterprises

- Publicly owned land

- A monopolized financial system

For a centralized government, this game only concerns itself with two points:

1) How to control the entire society with a top-down bureaucratic system;

2) How to extract commissions through land, taxes, and the financial system to sustain this bureaucratic apparatus.

Countries around the world are similar; the differences between ancient and modern times are not significant. Take the Tang Dynasty as an example: the government implemented a land distribution system, where every male born was allocated 80 acres of public land and an additional 20 acres of permanent private land. When a man reached adulthood, he would cultivate the land and pay taxes, with harvests submitted to the government proportionally. Upon death, the land would be reclaimed. At the same time, the emperor allowed local governments and offices to own operational land and funds. This system eventually collapsed because land increasingly concentrated in the hands of bureaucrats and nobles.

For instance, during the reign of Emperor Gaozong of Tang, a man named Wang Fangyi owned a vast amount of land, approximately several dozen hectares. By the time of Emperor Zhongzong, Princess Taiping owned a significant amount of land spread across fertile areas, which she rented to poor farmers, taking a large portion of the harvest for the nobility, with the government taking another cut. Many people fled to the countryside to escape forced labor. The government first registered the names of these escapees, and later simply mandated that they pay taxes; they either sold their land and houses or transferred them to neighbors, creating a cycle until there was nowhere left to escape.

What happens when the game fails? Start a new round.

Thus, dynastic changes and peasant uprisings occur to redistribute resources. The modern situation is similar; the asset values promoted by East Asian countries are mostly tied to land. This is the game rule set by the government, with houses as the medium. In contrast, the U.S. promotes capital efficiency, so the game played by everyone is the stock market, with the purchasing power represented by the national 401K pension being the reservoir.

These are all different price anchoring games, and there are countless similar copies scattered around the world, such as Rolex, Hermès platinum bags, Yu-Gi-Oh cards, limited edition blind box figures… all of them.

In New York, which is quite developed and has a high building density, there are still over 25,000 parcels of vacant and underutilized land—25,000 parcels (the light-colored areas in the image are vacant land). Some have even proposed imposing a 3.5% tax on these lands, potentially bringing an additional $429.9 million in revenue to the city.

In contrast, Beijing, the city with the highest population concentration in northern China, covers an area of 16,000 square kilometers, but only 2,000 square kilometers are actually developed, with a land development rate of just 12.5%, which is even more stingy than Hong Kong (25%).

If Beijing wanted to provide a large villa for every person, it could easily do so. According to China's planning standards of 10,000 people per square kilometer, if the city were fully developed, it could accommodate 160 million people. Given this, why haven’t these governments opened up construction to provide shelter for the masses?

Because in this game, land is a means of production, and monopolists must maintain its scarcity to keep the game going. What is price anchoring? This is price anchoring. To win, you must understand Bitcoin's position in the crypto game. Bitcoin is like land; the only difference is that it lacks a supreme will, and the operation of the entire system is maintained by algorithms and consensus.

In other words, it is almost unbreakable. The greatest anchor of Bitcoin is the consensus on its total supply of 21 million. We can easily categorize Bitcoin holders as the "coin class" and those without coins as the "no-coin class." With a global population of 8.045 billion, dividing these 21 million coins means each person would get only 0.0026 BTC, which is hardly enough to distribute.

You might question the consensus, claiming it is merely paper-thin, and wonder if you can just walk away and start anew. In fact, countless people have thought the same way in the past, and they have proven it through their actions. The recent wave of Bitcoin forks is akin to starting a private server; today, these forked coins lie dead everywhere, serving as a monument to those once naive thoughts.

If consensus were so easily changed, the wealthy in the world wouldn’t need to cling to Manhattan; they could simply buy a piece of wasteland in Ohio and build a new capital. But do you think that’s realistic? The establishment of a value coordinate system is a long process, and once established, it is unlikely to change for a century.

Who Took Your Coins

Some people clearly see the golden finger to victory yet still exit the game hastily. Hoarding coins seems simple, but for some, it is harder than climbing to the sky. It is a game, and there are levels to it. In the past few cycles, the tried-and-true method for accumulating wealth has been through various altcoin narratives. People may verbally profess their love for Bitcoin, but in practice, they buy altcoins. This plays right into the hands of the manipulators, who collect your chips; you end up with worthless coins while they acquire Bitcoin, and you both part ways calling each other fools.

New public chains, platform tokens, forked coins, MemeCoins, storage, and stable coins… if you count them all, they are all traps. When we evaluate something, we should not look at its performance over a few days or months; during a bull market, many can "outperform Bitcoin." I ask, excluding those KOLs who write little essays to scam money, how many have truly held altcoins for the long term and achieved significant results? Over a year, how many have genuinely outperformed Bitcoin? Just listen to their boasts.

In 2017, the narrative for public chains was to surpass Bitcoin; by 2021, it shifted to surpassing Ethereum… In the primary market, it’s a zero-sum game, while in the secondary market, stories are spun to lure retail investors. In this market, aside from Bitcoin, there are no truly decentralized crypto assets. Buying any altcoin means participating in an unequal game.

Web3 teams, especially anonymous ones issuing tokens, are severely anti-human. When you can fork a project and tweak the front end to gain massive profits, no one will work long-term. What is the original intention? The original intention is to make quick money.

Tokens corrode the mindset of a startup team. Traditional internet startup teams work passionately for several years, going through Series A, B, and C funding rounds, cashing out some money each round to improve their lives, which is understandable. In the crypto space, the rhythm changes to: start trading and mining today, list tomorrow, and dump the project the day after, leaving it to the community. Expecting to find a team that genuinely works within this environment is as difficult as fishing gold out of a cesspool.

Thus, I say this game is unequal. To win, you must be strategic. Strategy is unrelated to short-term gains or losses, macroeconomics, or even the size of the pot. A successful strategy depends on whether you make the right choices. Every time you decide to buy coins, you should repeatedly ask yourself:

- Should I participate in this game?

- How much should I bet?

- Is my entry point the best?

- Can I force my opponent to fold?

If you can make better decisions than your opponent, then your strategy is viable. Even if you can’t win the biggest pot, as long as you persist, your chances of winning will accumulate, ultimately leading to success. However, in my limited experience, it seems there is only one mathematically expected strategy: accumulate coins in batches during a bear market and sell at the peak during a bull market. Altcoins excel at making you believe they are as durable as Bitcoin, with narratives and lies intertwining until you genuinely believe it, obediently trading your Bitcoin for other tokens that will be worthless in the long run.

In the past year, the exchange rate between Ethereum and Bitcoin has been the perfect trap, with every red line hiding a pile of corpses. I have no doubt that one day a bull market will return, and Ethereum will rise again, but if you are choosing an asset over a ten-year period, you have only one choice in the entire crypto market: Bitcoin. As long as the crypto market continues to thrive, Bitcoin will not wither. If Bitcoin is ultimately disproven, then the entire crypto market will cease to exist.

Understanding the Bottom Line

To hold onto Bitcoin, you must clearly understand the quality of the assets in your hands. There are two mainstream viewpoints:

1) Bitcoin is a safe-haven asset, rising first during times of war and turmoil.

2) The government protects retail investors (as individuals).

Both are entirely wrong.

Bitcoin remains a risk asset to this day and will maintain this identity for a long time. In 2020 and 2021, government money printing injected massive liquidity, leading to a global asset bull market, and its speculative nature aligned with the flood of fiat liquidity.

The government's goal has never been to protect retail investors but to ensure that everyone mines enough before being reclaimed by the system, contributing sufficient tax revenue and providing necessary labor value. The government is not a "person"; it is a machine that maintains its operation through monopolizing resources within its jurisdiction.

The most important component of this machine is fiat currency. In 1260, Kublai Khan began issuing paper money. They used the bark of mulberry trees to make the paper. They extracted a very thin layer of white inner bark from between the wood and the rough outer bark of the mulberry tree. This inner bark was processed into a material similar to what we now call paper, except that it was black in color. Once the paper was made, they would cut it into various sizes. Each piece of paper represented the solemnity of real gold and silver. Why? Because officials would sign their names on these pieces of paper and affix their seals.

Once ready, the high-ranking officials appointed by the Khan would take their jade seals, dip them in bright red cinnabar, and then press them onto the paper. When that crimson seal appeared, the paper transformed into currency of real gold and silver. Anyone who dared to counterfeit such paper money would face the death penalty. The backing of paper money is the authority of the state. However, the authority of the state has a fatal weakness: it is not bound.

Question: Who constrains the paper money issuance mechanism?

Answer: No one.

Once currency enters the credit standard, issuance relies entirely on the central bank's self-discipline, and even the debt ceiling can be adjusted at will. In my view, the term "ceiling" can also be removed; since it can be adjusted at will, what is the point of calling it a ceiling?

The complex theories and models woven by economists are merely to persuade us to believe that the central bank's issuance of paper money is subject to self-imposed constraints. But if you take a look at the Federal Reserve's balance sheet, you will find that since the era of credit standards began, the so-called constraints are actually just empty words.

When material scarcity occurs, issuing paper money becomes the primary means of alleviating contradictions. I remember when I was a child, a steamed bun cost only 25 cents, but now in Shenzhen, you need to pay three yuan or even more. The currency has depreciated by 12 times. Since we have become accustomed to the price of buns increasing by 12 times, what is there to accept if the currency depreciates another 12 times in the future?

We have gradually become accustomed to the way we pay bills and receive salaries now, accustomed to the numbers on bank balances and credit card statements. It is only when the system collapses that we begin to think about the real value represented by these numbers. In short, government money printing is borrowing time from all cash holders, hoping that future social productivity can repay this debt; whether it can be done is not a concern for the current government.

Bitcoin, on the other hand, plays the role of an anti-inflationary talisman. Its essence is a rug pull against fiat currency. The long night is coming; from this night onward, you will keep watch until death. Devote your life and honor to the night watchman; tonight is like this, and every night will be so.

Remember, hold onto the Bitcoin in your hands.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。