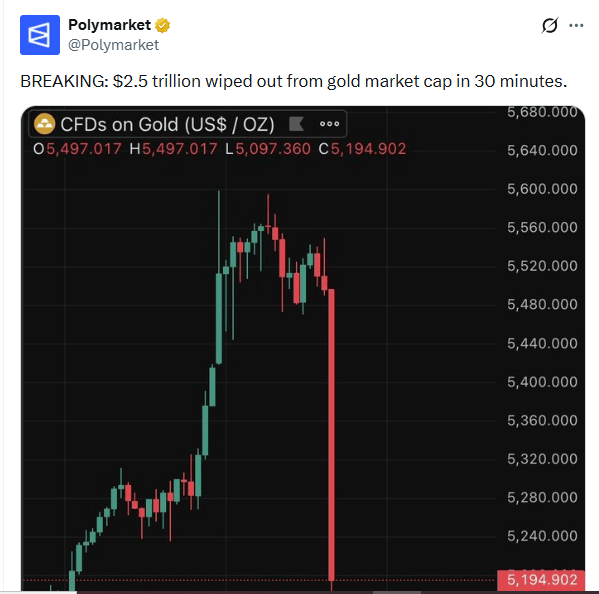

After an almost uninterrupted surge to an all-time high of $5,594.82 per ounce Jan. 29, gold finally buckled. The precious metal plunged 10%—losing nearly $500 in value later that day—halting a remarkable rally that defied even the industry’s highest expectations. This reversal, occurring in just a few hours, wiped trillions of dollars in market value from an asset that had recently reinforced its status as the ultimate safe haven.

While many analysts attributed the “flash crash” to a massive wave of profit-taking and shifting geopolitical tides, some critics warn that gold has entered a bubble. Cathie Wood, CEO of Ark Invest, voiced this concern on X shortly before the drop.

“While parabolic moves often take asset prices higher than most investors would think possible, these out-of-the-world spikes tend to occur at the end of a cycle,” Wood wrote. “In our view, the bubble today is not in AI, but in gold. An upturn in the dollar could pop that bubble, a la 1980 to 2000 when the gold price dropped more than 60%.”

Following her comments, gold tumbled to $5,109.62 per ounce.

Despite this retreat, gold remains up nearly 30% so far in 2026. Conversely, bitcoin, often touted as “digital gold,” has headed in the opposite direction. As reported by Bitcoin.com News, the cryptocurrency briefly tumbled below $82,000 Jan. 30 amid escalating tensions in the Middle East. This decline suggests bitcoin will finish January in the red, highlighting a significant decoupling between the two assets.

Read more: Bitcoin Slumps to $83K Amid Nasdaq’s AI-Driven Free-Fall

However, bitcoin proponents argue that monthly or yearly snapshots provide an incomplete picture. Dessislava Ianeva, an analyst at Nexo Dispatch, suggests a longer horizon reveals bitcoin’s continued dominance. Since 2022, bitcoin is up approximately 92%, compared to gold’s 20% while its market capitalization is still only about 10% of gold’s, suggesting massive structural catch-up potential.

Historically, bitcoin and gold both trended higher during periods of uncertainty. However, 2025 saw a shift where bitcoin’s price action became increasingly tethered to the political landscape—specifically the actions of President Donald Trump. From social media posts regarding a “strategic bitcoin reserve” to tariff announcements, Trump’s rhetoric had a direct, measurable impact on the crypto market.

However, for Ianeva, the current divergence is cyclical rather than structural. She notes that capital has rotated toward the “familiar hedge” of gold as trade tensions intensify, supported by persistent central bank buying.

“While gold may dominate during acute uncertainty,” Ianeva explained, “ bitcoin’s distinct supply dynamics and expanding institutional adoption suggest its long-term investment case remains intact.”

Jonatan Randin, senior market analyst at PrimeXBT, views gold’s rally as a hedge against both geopolitical risk and currency debasement. While the dollar hit four-year lows, central banks accumulated gold at a record pace. Randin acknowledged that bitcoin has recently behaved more like a risk asset than a safe haven, showing a high correlation with equities.

“ Bitcoin has the downside characteristics of a risk asset—it sells off during geopolitical stress—but it isn’t capturing the same upside driving equities right now,” Randin concluded. “ Gold is bought on the safe-haven narrative; stocks are bought on AI hype. Bitcoin is caught somewhere in between.”

- Why did gold plunge after hitting record highs? Analysts cite profit‑taking and geopolitical tensions as key drivers of the sudden 10% drop.

- Is gold in a bubble? Cathie Wood and other critics warn that parabolic price spikes signal bubble‑like behavior.

- How is bitcoin performing compared to gold? Bitcoin fell below $82K, highlighting a short‑term decoupling, though long‑term gains still outpace gold.

- What does this mean for investors? Capital is rotating toward gold as a safe haven, while bitcoin remains a risk asset with long‑term potential.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。