Disclosure: This article contains affiliate links. If you click a link and make a purchase or sign up for a service, Bitcoin.com may receive a commission. Our editorial content is independent and based on objective analysis.

The top crypto exchanges of January 2026 are entering the new year with confidence. Trading activity remains elevated following year-end strength, liquidity across major pairs is holding firm, and platforms are rolling out upgrades designed to capture early-cycle demand.

Institutional participation continues to build. In the U.S., Europe, and Asia, clearer regulatory frameworks and expanding compliance pathways are supporting broader adoption. As a result, capital flows remain steady as investors position themselves for the year ahead.

At the same time, exchanges such as Binance, Coinbase, Bybit, and Bitget are leading the market’s early momentum. They combine deep liquidity, transparent security standards, and advanced tools that support both retail traders and institutional users.

This guide compares the top crypto exchanges by fees, security, innovation, and global reach, helping traders identify the platforms best positioned as 2026 gets underway.

The Top 15 Crypto Exchanges of January 2026

Here’s a quick overview of the top crypto exchanges 2026 ranked by performance.

| Rank | Exchange | Notable Strengths |

|---|---|---|

| 1 | Binance | ~40% spot share; $698.3B July volume; BNB ATH $1,100+; launched Crypto-as-a-Service; 275M+ users |

| 2 | Bitget | $2.08T Q1 volume; Universal Exchange (UEX) launch; 120M+ users; 440M BGB moved to Morph Foundation |

| 3 | Coinbase | Closed $2.9B Deribit deal; Mag7+ Crypto Index futures; 110M+ users; JPMorgan integration; $12K NY crypto-aid pilot |

| 4 | KuCoin | 41M+ users; $2B Trust Project; MiCA license bid; AAA CER rating; KCS monthly burns |

| 5 | WhiteBIT | $2.7T annual volume; WBT token ATH $65.30; Juventus partnership; new Portfolio Margin product |

| 6 | Kraken | $411.6M Q2 revenue; Ink Layer-2 live; NinjaTrader acquisition; SEC lawsuit dismissed; $15B valuation target |

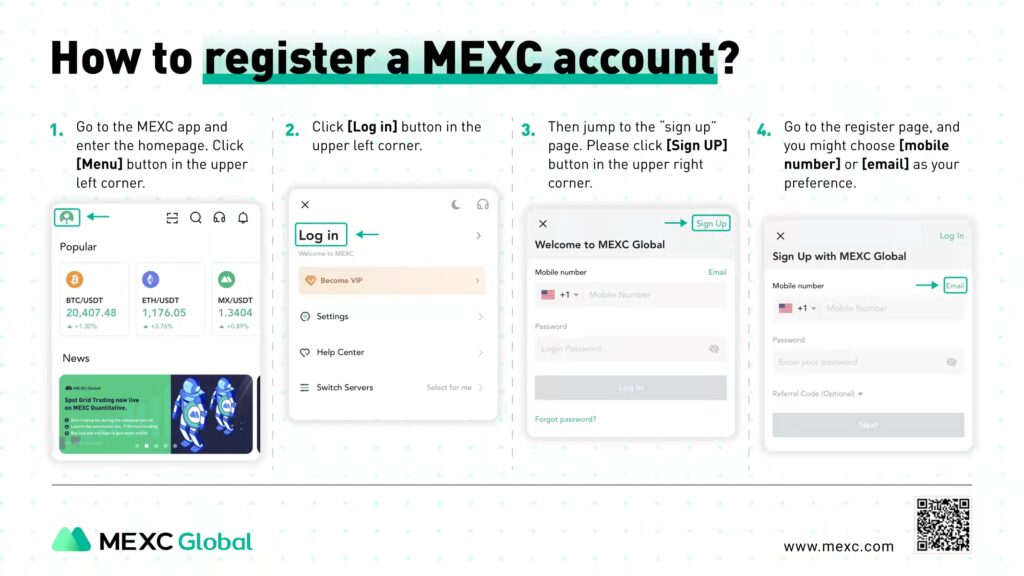

| 7 | MEXC | 9.6% Q2 market share; $150B July volume; 580 Q2 listings; AI/infrastructure tokens up 35,000%+ |

| 8 | LBank | 930+ tokens; ~3.1% spot share; $5B avg daily volume; memecoin EDGE platform; IPO exploration |

| 9 | BitMart | 12M+ users; 120% spot growth; launched BitMart DEX; 3rd-gen engine 2ms latency; AI/fiat tools |

| 10 | BTCC | $957B Q2 volume; 10M+ users; NBA star Jaren Jackson Jr. ambassador; 143% reserve ratio |

| 11 | Bybit | MNT integration; cmETH listing via EigenLayer; Mantle roadmap; ETH/ SOL liquidity leader |

| 12 | Uphold | 10M+ users; 300+ assets; 100%+ reserves updated every 30s; Uphold Vault assisted self-custody; USD Interest up to 4.9% APY |

| 13 | ChangeNOW | 1,400+ assets; 110+ chains; instant non-custodial swaps; fixed-rate option; B2B APIs & white-label solutions |

| 14 | Swapuz | 3,000+ assets; multi-channel non-custodial system; fixed & floating swaps; affiliate program with BTC rewards |

| 15 | BYDFi | MoonX dual-engine ( CEX+ DEX); Newcastle United partnership; social trading & bots; active in Asia & LATAM |

Exchange-by-Exchange Breakdown

1. Binance – Best for Liquidity & Institutional Expansion

Binance remains the number one centralized exchange by trading volume. It consistently holds close to 40 percent of global market share. In July 2025, Binance processed $698.3 billion in spot volume – the latest data from CoinGecko – and it maintained that dominance into Q4 2025. With more than 275 million registered users worldwide, the exchange delivers unmatched liquidity across spot, futures, staking, lending, and token launches.

Momentum continues to build. BNB reached a new all-time high above $1,200 in October 2025, driven by network growth, DeFi integrations, and rising institutional demand. In addition, governments are engaging directly. For example, Kazakhstan launched the Alem Crypto Fund in October, naming Binance Kazakhstan as its custodian and making an initial BNB purchase.

Institutional expansion is now a central priority. On September 29, Binance introduced Crypto-as-a-Service (CaaS) – a white-label solution that allows banks and brokerages to integrate crypto trading under their own brands. The service relies on Binance’s liquidity, custody, and compliance infrastructure. Meanwhile, the company’s venture arm, now rebranded as YZi Labs, manages a $10 billion portfolio spanning Web3, AI, and biotech investments.

Takeaway: Binance combines market dominance with deep institutional strategy. Its liquidity, ecosystem token strength, and new CaaS model confirm why it remains the largest – and most forward-looking – exchange in 2026.

2. Bitget – Best for Copy Trading & Universal Exchange Innovation

Bitget’s growth in 2025 was extraordinary. In the first quarter alone, the exchange processed $2.08 trillion in trading volume, achieved 159 percent quarter-over-quarter spot growth, and surpassed 120 million users worldwide. In Q2, Bitget also completed a 30 million BGB token burn (~$138 million) to reinforce its deflationary model.

A major structural shift came in September 2025 with the launch of Universal Exchange (UEX). This framework unifies crypto, tokenized stocks, ETFs, forex, and real-world assets under a single account. As a result, it reduces fragmentation across asset classes and provides traders with seamless multi-market access.

To strengthen BGB’s role, Bitget transferred 440 million BGB tokens to the Morph Foundation. Half were burned immediately, and the other half were locked to fund future ecosystem growth. As a result, BGB now serves as the gas and governance token for the Morph chain, extending its utility beyond trading.

At its 7th anniversary in September, Bitget unveiled its UEX branding alongside the “Gear Up to 7” campaign, highlighting its next-generation vision. In addition, the exchange continues to expand its Launchpool listings – including projects such as Falcon Finance – to boost user engagement and rewards.

Takeaway: Bitget combines a powerful copy-trading engine with an ambitious infrastructure roadmap. Its Universal Exchange model, BGB utility upgrade, and strong ecosystem partnerships position it as one of the most forward-thinking exchanges in 2026.

3. Coinbase – Best U.S. On-Ramp & Institutional Bridge

Coinbase cemented its position as the leading U.S. exchange in August 2025 after completing its $2.9 billion acquisition of Deribit. The deal transformed Coinbase into a full-spectrum trading platform, covering spot, futures, perpetuals, and options under one roof. Deribit’s July volume reached $185 billion, with open interest near $60 billion. As a result, Coinbase gained instant depth in global derivatives markets.

In addition, the exchange is expanding beyond pure trading. In 2025, Coinbase launched the Mag7 + Crypto Equity Index futures, a hybrid product that blends exposure to major tech stocks – the “Magnificent 7” – with crypto ETFs and Coinbase’s own shares. This move marks a strategic shift toward multi-asset derivatives and tighter TradFi– crypto integration.

Institutional adoption remains central to Coinbase’s growth. A Coinbase / EY-Parthenon survey of 352 global investors found that 75% planned to increase their crypto allocations in 2025. Moreover, 59% intend to allocate more than 5% of their total assets to digital investments.

Partnerships are also expanding. Coinbase and JPMorgan Chase introduced new connectivity that lets customers link bank accounts directly to Coinbase wallets. Clients can buy crypto with credit cards and, eventually, convert reward points into tokens – a clear step toward everyday utility.

Coinbase is also experimenting with public initiatives. In early October 2025, the exchange launched a pilot in New York distributing $12,000 in USDC to low-income residents. This program explores how crypto can power direct financial aid.

Takeaway: Coinbase is evolving from a retail trading hub into a global institutional bridge. The Deribit acquisition, multi-asset futures, and banking partnerships – along with its social-impact pilots – make Coinbase one of the most forward-looking exchanges of 2026.

4. KuCoin – Best for Listings, Token Utility & Trust Expansion

KuCoin showed strong momentum through the first half of 2025. The exchange now serves more than 41 million users worldwide and launched the $2 billion “Trust Project” to strengthen compliance, security, and community support. In addition, KuCoin achieved SOC 2 Type II and ISO 27001:2022 certifications. It also earned an AAA rating from CER.live and partnered with BitGo’s Go Network to provide institutional-grade custody with up to $250 million in insurance coverage.

Tokenomics remains a core pillar of KuCoin’s strategy. In September 2025, the exchange executed its 62nd monthly KCS burn, removing 62,386 KCS (~$726 K) from circulation and reinforcing its deflationary model. Moreover, KCS gained new utility through partnerships – most notably with Vietnam’s national blockchain strategy – aligning the token with infrastructure and payment initiatives in a rapidly growing adoption market.

Regulatory expansion is also accelerating. KuCoin submitted a MiCA license application in the EU and launched KuCoin Thailand, a fully regulated local exchange under the Thai SEC. These moves highlight its commitment to operating within compliant frameworks.

At the same time, KuCoin continues to lead in listings and product variety. The platform released 170+ new tokens and 106 futures assets, and its AI-powered trading bots have now surpassed 8.9 million creations. In addition, the exchange introduced xStocks, expanding access to tokenized equities.

Takeaway: KuCoin strikes a balance between innovation and credibility. Its compliance progress, aggressive token-burn program, and strong listing momentum make it a standout choice for traders seeking volume, diversity, and long-term confidence.

5. WhiteBIT – Best for Institutional Tools & Token Momentum

WhiteBIT, consistently ranked as one of Europe’s highest-traffic crypto exchanges, is sharpened its institutional edge in 2025. In late September, it rolled out Portfolio Margin, a new product tailored for institutions – market makers, hedge funds, and prime brokers – enabling crypto-backed loans up to 10× leverage without selling existing holdings. At the Liquidity 2025 summit, WhiteBIT served as a Golden Partner, unveiling a broader suite of institutional services including OTC trading, institutional-grade custody, and Crypto-as-a-Service (CaaS) integration options.

Its native token, WBT, has been a standout. In 2025, WBT posted triple-digit percentage gains, rising from early-year levels to a peak at $65.30, and saw renewed momentum following a partnership with Juventus, where WhiteBIT became the club’s “official exchange” and sleeve sponsor. The collaboration led to a >30% intraday jump in WBT’s price.

In branding and outreach, WhiteBIT strengthened ties with global institutions – hosting an “Institutional Night” at FC Barcelona Museum with LTP and Global Dollar Network, targeting high-value stakeholder engagement. Meanwhile, the exchange touts having processed $2.7 trillion in annual trading volume and commanding a valuation around $38.9 billion in early 2025.

Takeaway: WhiteBIT is pivoting from retail growth to institutional backbone. Its Portfolio Margin, custody solutions, and WBT token strength make it a serious contender for institutions and power users who want both infrastructure and upside.

6. Kraken – Best for Security, Multi-Asset Vision & DeFi Bridge

Kraken continues to strengthen its reputation for security and institutional reliability. At the same time, it’s expanding its multi-asset and on-chain strategy. In Q2 2025, Kraken reported $411.6 million in revenue, an 18 percent year-over-year increase, with total exchange volume reaching $186.8 billion. Earlier in the year, it posted $472 million in Q1 revenue – a 19 percent YoY rise.

A key milestone came in August 2025 when Kraken launched its Layer-2 blockchain, Ink, ahead of schedule. Built on Optimism’s OP Stack, Ink bridges centralized-exchange users directly into DeFi environments. As a result, transactions are faster, cheaper, and seamlessly connected to decentralized apps. Kraken has also improved Ink with new features. Users can now self-withdraw to Ethereum, challenge rollups, and work with a security committee that safeguards disputes.

On the expansion front, Kraken’s strategic acquisition of NinjaTrader (valued near $1.5 billion) extends its reach into futures and traditional markets. In addition, the exchange is pursuing new funding at a valuation between $15 billion and $20 billion. This could help fuel an eventual IPO.

Regulatory progress has also been positive. In early 2025, the U.S. SEC agreed to dismiss a civil lawsuit against Kraken, removing a major legal overhang. Moreover, Kraken secured a MiCA license to offer regulated crypto services across 30 EU states – a significant step for European expansion.

Takeaway: Kraken’s strength remains trust and reliability. In 2026, it is evolving into a multi-asset and DeFi gateway. With the Ink L2 launch and ongoing product expansion, Kraken is becoming a key bridge between CeFi and DeFi for serious traders.

7. MEXC – Best for Altcoin Discovery & Explosive Spot Momentum

MEXC became one of the fastest-rising exchanges in 2025. In the second quarter, its spot market share jumped 2.4 percentage points, climbing from 7.2% to 9.6%. This made it one of the top gainers among major exchanges. In July 2025, MEXC captured 8.6% of the spot market and processed $150.4 billion in trading volume – a 61.8% month-over-month increase. As a result, it briefly rose into the global top two by trading volume.

Listings remain the core of MEXC’s strategy. In Q2, the exchange added 580 new tokens, many achieving triple- or quadruple-digit peak returns. Moreover, July alone brought 255 listings, dominated by AI and infrastructure projects – some returning as much as +35,920%. The platform now offers nearly 2,000 spot pairs and more than 350 derivative pairs. It also maintains an active listing calendar to help traders stay ahead of emerging trends.

Beyond token additions, MEXC is investing heavily in product evolution and ecosystem growth. Its Q2 Ecosystem & Growth Report highlights infrastructure diversification, including ZK technology, restaking, and cross-chain integrations. In addition, the exchange continues to strengthen security reserves and Web3 interoperability.

Takeaway: MEXC is doubling down on what it does best – fast, speculative listings combined with strong spot-market performance. For traders seeking the next breakout altcoin, it remains a go-to platform. However, users should still be mindful of liquidity, slippage, and listing risks.

8. LBank – Best for Token Discovery & Meme Coin Innovation

LBank is ascending fast within the exchange rankings. As of September 2025, it captured ~3.1% of the global 24-hour spot trading market, a sign of its growing footprint in high-velocity trading. In Q2 2025, LBank’s average daily trading volume reached ~$4.98 billion, with 24.5% growth QoQ, reinforcing its strength in memecoin and altcoin listings.

The exchange currently supports over 930 tokens, making it one of the broadest catalogs among mid-tier CEXs. Its Launch IDO/EDGE platform has become a go-to hub for high- volatility memecoin premieres – several listings in EDGE delivered triple-digit to quadruple returns post-launch.

Recent listing updates show active new pairs appearing daily, including PEPE2025/ USDT and WING (Aladdin Booster), highlighting LBank’s priority on meme or high- volatility assets.

In governance & expansion, LBank is reportedly exploring a U.S. IPO and stronger compliance posturing, although nothing has been confirmed officially yet.

Takeaway: LBank is staking its reputation on rapid listings and meme market dominance. If your strategy is early discovery and high risk, high potential returns, LBank should be a key stop – but prioritize risk controls (position sizing, exit strategy) when trading volatile assets.

9. BitMart – Best for Innovation & Hybrid CEX-DEX Strategy

BitMart continues to punch above its weight by combining high throughput, asset discovery, and latest infrastructure – making it standout among mid-tier exchanges in 2025. As of mid-2025, BitMart surpassed 12 million registered users globally, with spot trading volume up over 120% HoH and its 3rd-generation engine processing orders in ~2ms at 80,000 orders/second.

Recently, BitMart launched BitMart DEX, an on-chain trading interface designed to blend the accessibility of centralized platforms with decentralized transparency and security. It aims to reduce fragmentation and bring CEX users into the on-chain world with ease.

BitMart is also actively tweaking futures contracts and leverage settings: in September it announced delistings of multiple perpetual pairs and adjustments to funding intervals and leverage tiers across futures markets. On the listing front, BitMart continues to add new assets: recent additions include UCHAIN (UCN) and OMNILABS AI protocols.

BitMart’s product ecosystem is expanding too: its X Insight AI tool, BM Discovery Zone, copy trading, and fiat on-ramp features continue to evolve, underpinned by its emphasis on tech and discovery.

Takeaway: BitMart is no longer just a fast-growing exchange – it’s building a hybrid future. With CEX speed, a newly launched DEX, aggressive listing growth, and smart product layering, it’s positioning itself as a bridge between centralized and decentralized finance in 2026.

10. BTCC – Historic Exchange Doubling Down on Trust & Growth

BTCC, launched in 2011 and one of the longest-running exchanges in crypto, rewrote its narrative for 2025. In Q2, it reported $957 billion in total trading volume and over 9.1 million users – a strong showing for its 14th anniversary. Recently, BTCC crossed the 10 million user milestone, citing global expansion and a renewed push into Web3.

In September 2025, BTCC named NBA All-Star Jaren Jackson Jr. as its global brand ambassador, launching a $500,000 USDT trading competition with high-profile rewards and community engagement. The partnership is a clear push into mainstream visibility.

Transparency is a major focus. In its September 2025 Proof of Reserves report, BTCC revealed a total reserve ratio of 143%, confirming that it holds more assets than user liabilities – boosting confidence in security and solvency. The reserves cover major assets such as BTC, ETH, USDT, and more, all showing over-collateralization.

The exchange continues listing actively: in July it added 80+ new spot pairs, lifting its catalog to 300+ spot markets and 380+ futures pairs. BTCC also announced plans to triple its global workforce to 3,500 staff over the next six months, marking the next phase of its Web3 infrastructure ambitions.

Takeaway: BTCC is leaning into its heritage with renewed vigor – not relying solely on being “oldest,” but on transparency (143% reserves), a high-impact ambassador strategy, and volume expansion. It’s positioning itself as a legacy player evolving for the future.

11. Bybit – Best for Derivatives, Restaking Innovation & Layer-2 Synergy

Bybit continues to dominate the derivatives market and advanced product innovation. In 2025, it pushed deeper into Web3 infrastructure through bold integrations with Mantle (MNT) and restaking technology. Most notably, Bybit became one of the first exchanges to list cmETH, a Liquid Restaking Token (LRT) built on Mantle’s mETH protocol. This allows users to restake ETH and still retain liquidity.

Through its On-Chain Earn platform, users can stake ETH → mETH → cmETH. They can also join bonus APR events via EigenLayer integration. No external wallet or bridge is required.

In September 2025, Bybit and Mantle released the Mantle × Bybit Roadmap. As a result, MNT’s utility expanded across the Bybit ecosystem. The roadmap now includes over 20 new trading pairs and enables MNT to be used for trading-fee discounts, card payments, VIP perks, and institutional leverage. That same month, Mantle hit a new all-time high near $2.50 – boosted by the listing and rewards campaigns.

In addition, Bybit supported Mantle’s v1.3.1 upgrade in August 2025, showing strong technical alignment and commitment to Layer-2 performance. Meanwhile, the exchange continues to lead in derivatives volume and social trust. It has recovered soundly from past incidents and maintains high uptime and transparent operations.

Takeaway: Bybit is evolving beyond a derivatives powerhouse. It’s becoming a restaking infrastructure hub, with cmETH and Mantle integrations pushing it toward a hybrid DeFi-plus-CeFi future.

12. Uphold – Best for Multi-Asset Access & Assisted Self-Custody

Uphold has built a reputation as a global multi-asset trading platform, serving over 10 million users across 150+ countries. Unlike many crypto-only exchanges, it bridges both digital assets and traditional currencies, with access to 300+ tokens and fiat pairs. Its “Trade Anything to Anything” engine allows seamless swaps between assets without first converting to USD or USDT, while liquidity is sourced from 30+ exchanges to ensure competitive pricing.

The platform is designed to serve both beginners and active traders. Features include take-profit and stop-loss tools, repeat transactions, and limit orders, alongside curated Uphold Baskets for easy diversification. Early token support makes it a destination for users seeking access to new or low- liquidity projects, and UK users can spend directly with the Uphold Card.

What sets Uphold apart is its transparency and security model. It operates a 100%+ reserve system, publishing proof of assets and liabilities refreshed every 30 seconds. In 2025, it introduced Uphold Vault, the first assisted self-custody solution on a major platform, offering direct trading, recovery options, and secure access for supported assets like BTC, XRP, SOLO, and COREUM.

Uphold also recently launched a USD Interest Account, offering up to 4.9% APY on deposits over $1,000 with FDIC insurance up to $2.5 million.

Takeaway: Uphold stands out as a hybrid exchange and wallet solution, offering unmatched transparency, multi-asset access, and unique tools like assisted self-custody and interest-bearing accounts.

13. ChangeNOW – Best for Instant, Non-Custodial Swaps & B2B Infrastructure

ChangeNOW has established itself as a leader in non-custodial trading, offering fast, account-free swaps while keeping users in full control of their funds. Supporting 1,400+ assets across 110+ blockchains, the platform aggregates liquidity from both centralized and decentralized sources to minimize slippage and speed up execution. Most swaps complete in just a few minutes, with options for either floating or fixed rates to avoid price volatility.

In 2025, ChangeNOW expanded its toolkit with new fixed-rate swap flows and upgraded API endpoints, allowing users and partners to directly manage refunds and delayed trades without manual support. On the business side, the company is doubling down on infrastructure, promoting its white-label services, exchange APIs, and widgets as turnkey solutions for wallets, fintechs, and exchanges seeking to integrate crypto swaps.

The team is also positioning for a “CeDeFi” future – combining decentralized principles with added safeguards to make token swaps safer and more accessible for mainstream adoption. Trusted by partners like Bitcoin.com, Exodus, and Trezor, ChangeNOW is more than just a retail swap tool: it is becoming an invisible backbone powering the next generation of crypto integrations.

Takeaway: For users, ChangeNOW remains one of the fastest and simplest ways to swap across chains without giving up custody. For businesses, it’s a growing infrastructure provider offering seamless non-custodial integration.

14. Swapuz – Best for Multi-Channel Non-Custodial Trading

Founded in 2020, Swapuz has grown into one of the most advanced non-custodial exchange platforms, now supporting 3,000+ digital assets across millions of trading pairs. Its hallmark is a multi-channel exchange system that blends decentralized finance protocols with centralized user-experience features. This architecture routes trades automatically through the most efficient pathways, delivering optimal pricing and minimal slippage across supported assets.

Swapuz’s model goes beyond basic swaps. It integrates DeFi protocols with institutional-grade exchange mechanics, allowing traders to retain full custody of their assets and private keys while still accessing advanced features. These include limit orders, stop-loss settings, and portfolio tracking – tools typically found only on centralized venues. The platform also supports fixed and floating rate swaps, giving traders flexibility in how they manage volatility.

Security is a defining strength. Swapuz layers advanced cryptography, smart contract auditing, multi-signature wallets, and real-time monitoring into its infrastructure, ensuring that trades are both private and protected. Enhanced SSL encryption further safeguards transactions, while the non-custodial model removes counterparty risk entirely.

Swapuz also invests in community growth through an affiliate program offering tiered BTC rewards (0.3%–0.7%) based on referral volume and activity. Its hybrid design of speed, privacy, and feature depth positions Swapuz as a pioneer in the next generation of decentralized exchange technology.

Takeaway: Swapuz is not just a swap tool – it’s a multi-channel non-custodial ecosystem offering security, flexibility, and professional-grade tools, making it one of the most innovative DEX platforms in 2026.

15. BYDFi – Best for Social Trading, Dual-Engine Innovation & Brand Reach

BYDFi (rebranded from BitYard) pushed aggressively in 2025 toward a hybrid CEX + DEX model, marrying liquidity with on-chain access. Its MoonX tool, launched in 2025, enables users to trade on-chain meme and trending assets directly from the platform, bridging centralized and decentralized rails.

The platform continues to expand its social & automated trading capabilities: Smart Copy Trading, grid bots, demo accounts, and advanced tools built into MoonX (e.g. “Alpha” signal detection, trend ranking) are central to its offering. BYDFi’s “Dual-Engine Strategy” is now part of its core messaging – combining the speed and depth of a traditional exchange with on-chain discovery and trading.

In August 2025, BYDFi became the Exclusive Official Crypto Exchange Partner of Newcastle United, a move to expand brand awareness globally through sports marketing, and also launched its BYDFI Card. At a match on September 28, the exchange displayed its slogan “BUIDL Your Dream Finance” on LED boards, fueling social engagement and messaging about building vs. hype.

Meanwhile, BYDFi is active on the event circuit – officially sponsoring TOKEN2049 Dubai, and participating in Korea Blockchain Week 2025 (KBW 2025) with a booth and Web3 presentations on its dual engine and MoonX roadmap. The exchange also continues to roll out new listings (e.g. ELDE/ USDT, PFVS/ USDT), and has added “one-click withdrawals” to MoonX addresses for quicker on-chain transitions.

Takeaway: BYDFi is positioning itself not just as a beginner-friendly exchange, but as a next-gen platform that blends CEX performance with DEX transparency and discovery. Its branding plays, product layering, and dual-engine ambition make it one to watch in 2026.

Crypto Exchange Trends to Watch in Early 2026

- Regulatory clarity is strengthening worldwide. In the U.S., implementation of the GENIUS Act and expanded retirement-account access are laying the groundwork for broader participation. At the same time, the EU’s MiCA framework is moving from rollout to execution, while APAC hubs such as Hong Kong, Singapore, and Dubai continue to position themselves as regulated crypto gateways. As a result, compliant trading infrastructure is scaling faster than ever.

- Institutional adoption is deepening. Corporate Bitcoin treasury strategies are expanding across the U.S., Latin America, and the Middle East. In addition, partnerships like Coinbase–JPMorgan and Binance’s Crypto-as-a-Service (CaaS) highlight how traditional finance and crypto platforms are becoming more interconnected as 2026 begins.

- Derivatives remain a key growth engine. Futures, perpetuals, and restaking-linked products are driving a large share of exchange activity. Products such as Bybit’s cmETH and Coinbase’s expanded options offering show how exchanges are blending yield, hedging, and liquidity. Looking ahead, more hybrid instruments combining equities, ETFs, and crypto are expected to emerge.

- Exchange tokens continue to gain relevance. Assets like BNB, BGB, and WBT are playing larger roles within their ecosystems, supporting governance, fee discounts, gas usage, and real-world asset initiatives. In early 2026, strong token utility is becoming a clear competitive advantage for leading platforms.

- Consolidation and expansion are shaping the market. High-profile moves such as Coinbase’s Deribit acquisition, Binance Labs’ transition into YZi Labs, and BTCC’s global workforce expansion signal a new phase of diversification. These trends suggest that exchange rankings will continue to evolve throughout 2026.

- Security and transparency remain non-negotiable. Proof-of-Reserves reporting, assisted self-custody solutions like Uphold Vault, and non-custodial swap platforms such as ChangeNOW and Swapuz are increasingly seen as baseline expectations. As the year progresses, exchanges that prioritize trust and user control are likely to stand out.

Final Thoughts

As 2026 gets underway, leading crypto exchanges are evolving into full-scale financial platforms. Early momentum in the new year points to continued growth in liquidity, compliance, and product innovation. Together, these trends are creating a strong foundation for the months ahead.

At the same time, platforms such as Binance, Coinbase, Bybit, and Bitget remain market leaders. In addition, non-custodial services like ChangeNOW and Swapuz highlight rising demand for privacy, flexibility, and user control alongside speed and convenience.

For new traders, understanding how crypto exchanges work is an essential first step. Our guide on How Does a Crypto Exchange Work? explains the fundamentals clearly. More experienced users, meanwhile, may benefit from exploring advanced tools, multi-chain access, and staking features as platforms expand their offerings.

Ultimately, the top crypto exchanges ranked in 2025 are helping shape the next phase of global crypto adoption. As a result, choosing the right platform at the start of the year can provide confidence and a strategic advantage as the market develops in 2026.

FAQ: Crypto Exchanges in Early 2026

Which exchange has the lowest fees right now?

Several major platforms continue to offer competitive fees. Binance, Bitget, MEXC, and BitMart rank among the lowest across spot and derivatives markets. In particular, MEXC and Bitget are known for frequent fee discounts and promotional campaigns.

Can I trade crypto without KYC in 2026?

Yes, but only in limited cases. Platforms such as MEXC, BYDFi, ChangeNOW, and Swapuz allow certain swaps or capped withdrawals without full identity verification. However, global regulations are tightening. As a result, full KYC is becoming standard across most centralized exchanges.

What’s the safest crypto exchange right now?

Kraken and Coinbase remain strong benchmarks for security, compliance, and custody standards. Meanwhile, Binance has expanded transparency through its Crypto-as-a-Service infrastructure. For users who prefer non-custodial security, ChangeNOW and Swapuz eliminate counterparty risk entirely.

Which exchange is best for beginners?

BYDFi and Uphold are popular with beginners due to their simple interfaces and guided tools. In addition, Bitget and Coinbase offer educational resources and intuitive layouts that help new users get started.

Which exchange is best for trading altcoins?

MEXC, LBank, and KuCoin stand out for their broad token coverage and frequent new listings. BitMart is also competitive, especially for early-stage assets and hybrid CEX- DEX discovery.

What’s the best exchange for futures trading?

Bybit, Binance, and Bitget continue to lead the derivatives market. They offer deep liquidity, advanced order types, and high leverage options. Coinbase has also strengthened its futures and options offering following its Deribit acquisition.

How important is Proof of Reserves when choosing an exchange?

Proof of Reserves is increasingly essential. Platforms such as BTCC, Kraken, and Uphold publish reserve data to demonstrate solvency and transparency. Users should prioritize exchanges that provide independently verifiable reports.

What hidden fees should I watch out for?

Beyond trading fees, it’s important to monitor withdrawal charges, funding rates on perpetual contracts, and maker-taker spreads. In some cases, exchanges may also charge higher fiat on-ramp fees or inactivity penalties.

- What is Bitcoin?

- What are Altcoins?

- What is a Centralized Exchange?

- What is a Decentralized Exchange?

- How does Crypto Exchange Work?

- How to Choose the Best Bitcoin Wallet

- Download the Bitcoin.com Wallet App

Stay Ahead of the Game

- Access to our updated bonus list

- Weekly picks, promos, and expert insights

- Crypto Casino Radar – Track top promos and hidden gems

- iGaming Alpha – Insider deals and exclusive updates

Sign up now to get smarter about where – and how – you bet with crypto.

Business & Partnership Enquiries

For business or partnership inquiries, contact us at affiliates@bitcoin.com. Our team is ready to assist.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。