Author | OAK Research

Compiled by | Odaily Planet Daily (@OdailyChina)

Translator | Dingdang (@XiaMiPP)

Introduction

The tokenization of real-world assets (RWA) is often seen as a multi-trillion dollar opportunity. Perhaps this is true, but at present, it is not the most pressing issue. This is because it obscures a more central question for 2026: once assets are truly migrated onto the chain, who will capture the value?

In 2025, the status of RWA underwent a fundamental change. For a long time, tokenization remained in the experimental project phase; now, it has evolved into a mature, scalable on-chain market. The total value of RWA grew from approximately $3 billion in 2022 to over $35 billion by the end of 2025. This growth comes from both the influx of institutional capital and the ongoing demand for "on-chain yield products backed by compliant assets."

This trend profoundly reshapes the landscape of on-chain finance. An increasing number of projects are beginning to build products around asset custody, issuer control, identity verification, and transfer rules. Secondary liquidity no longer solely depends on technology but increasingly relies on the existence of compliant trading venues, the transferability of assets across different platforms, and the ability to navigate regulatory constraints across different jurisdictions.

Therefore, RWA is not a single, homogeneous asset class. It relies on a complex system composed of multiple layers that are interconnected, from blockchain infrastructure to custody to distribution platforms. All layers are indispensable, but their positions in terms of power and value capture are not the same.

In 2026, understanding RWA is no longer just about "which assets are tokenized and why," but about identifying: where exactly are the control points located within the stack? How does economic value flow and get redistributed among different participants?

This is precisely the question this article seeks to answer.

Overall Structure of the RWA Stack

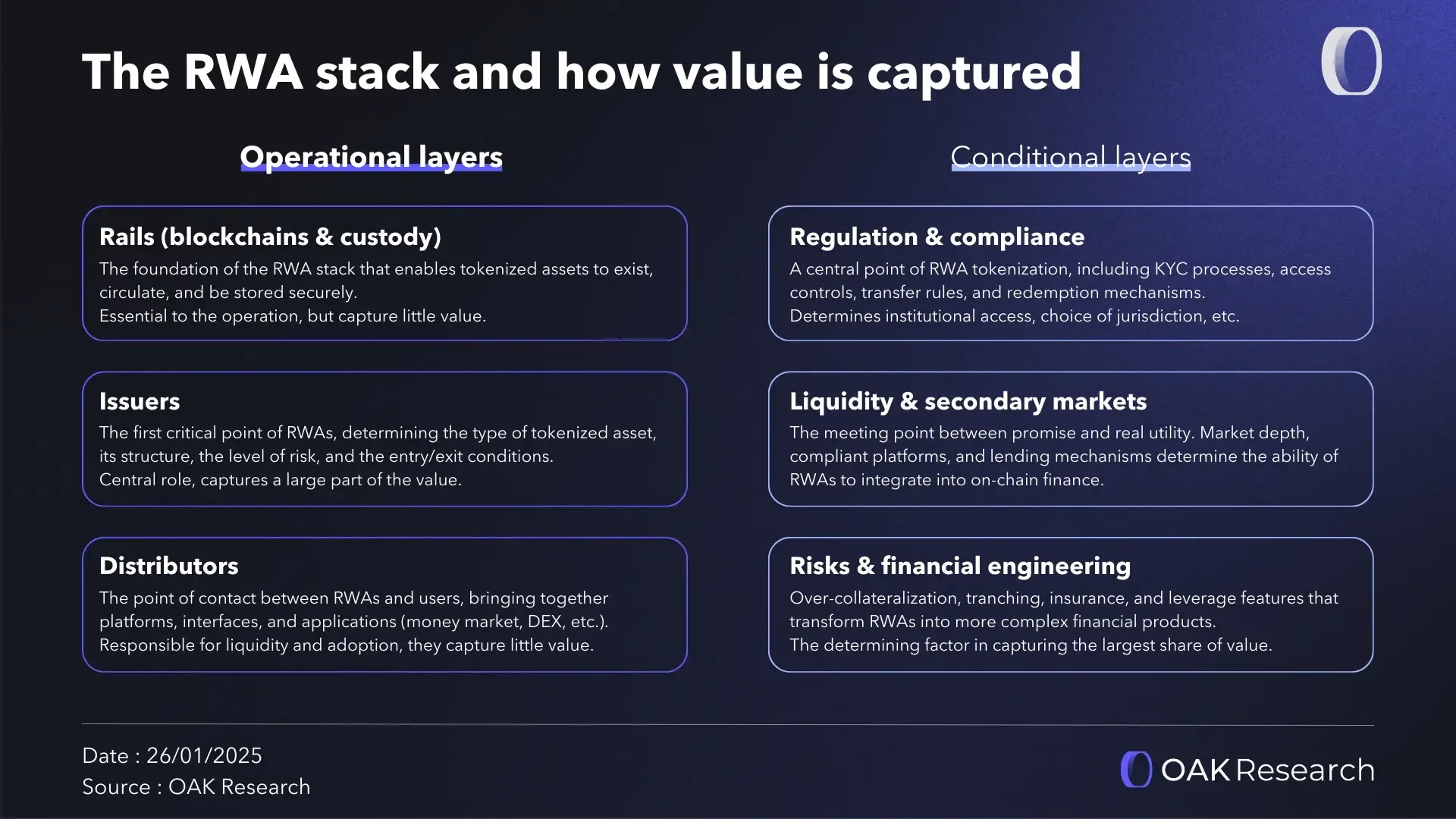

The RWA space is not composed of a single type of participant but is built on a multi-layered stacked system. Each layer plays a distinct and different role in the process of transforming traditional assets into investment tools that can be used on-chain.

All these layers are necessary for the system to operate, but they do not have equal value capture capabilities. Some are clearly identifiable operational participants (such as blockchains, custodians, issuers, etc.), while others are horizontal condition layers that determine whether the former can be deployed smoothly, attract capital, and achieve scalable operations.

Operational Layer

The operational layer consists of the entities directly involved in the issuance, circulation, and access of RWA. They form the daily operational structure of the RWA market, controlling most key points and capturing a significant proportion of the value.

Infrastructure Layer (Blockchain and Custody)

The infrastructure layer constitutes the bottom layer of the RWA stack, including blockchain networks and custody solutions that enable tokenized assets to exist, circulate, and be securely held. This layer is responsible for value transfer, near-instant settlement, and synchronization between the underlying assets and their on-chain representations.

It is indispensable, but as the market matures, it often becomes gradually standardized. Ultimately, value will concentrate on the infrastructure deemed the safest and most robust. The infrastructure layer is a prerequisite for the system's operation, but compared to higher layers in the stack, its value capture capability is relatively limited.

Issuer

The issuer is the first key control point in the RWA stack. They decide which assets can be tokenized, how to structure them, what level of risk to assume, and under what conditions investors can enter or exit.

Whether it is U.S. Treasury bonds, private credit, stocks, or commodities, these products rely on complex offline legal and financial structures that need to be accurately mapped onto the chain. Issuers are not merely "providing assets"; they are actually ensuring the legal and economic consistency of the entire system.

Distribution

The distribution layer includes the platforms, applications, and interfaces through which investors access RWA, such as lending markets, DEXs, etc. It determines which products are visible, usable, and how easy it is to deploy capital.

In practice, the assets that attract the most capital are often not the most complex or sophisticated in structure, but rather the products that are easiest to access and smoothly integrate into user pathways. Distribution directly determines adoption rates, liquidity, and scalability. Whoever controls the entry point controls the flow of capital.

Condition Layer

The condition layer does not correspond to a specific participant but is a set of horizontal standards that determine whether the operational layer can function smoothly, establish trust, and capture value over the long term.

Regulation, Compliance, and Redemption Mechanisms

Regulation is a core component of RWA tokenization. KYC processes, access controls, transfer rules, and redemption mechanisms do not disappear because of the existence of blockchain; rather, they must be more systematically integrated into the products.

This layer determines whether institutional investors can enter, whether the rights attached to tokens are recognized, and whether there is the capability to expand across jurisdictions. Therefore, the choice of jurisdiction itself is a highly strategic decision, as regulatory frameworks differ significantly across jurisdictions.

Liquidity and Secondary Markets

Liquidity is the intersection between the "theoretical promise" of tokenization and its "real-world availability." An asset can have a perfect structure and be fully compliant, but if it cannot be traded, collateralized, or exited conveniently, its actual value remains limited.

The depth of the secondary market, compliant trading platforms, and lending mechanisms determine whether RWA can truly integrate into financial strategies. Only when liquidity is present do other layers truly gain significance.

Odaily Planet Daily Note: Tokenization is highly anticipated, but the current practical issue is that most tokenized assets operate in extremely fragile and illiquid markets. For further reading, see “Large Funds Are Taking It Seriously, RWA's Liquidity Issues Are Highlighted.”

Risk and Financial Engineering

Risk management and structural design are the final links that determine value capture. Over-collateralization, layered structures, insurance, and leverage transform simple assets into complex financial products that meet the needs of different investors.

Historical experience shows that this layer has always been one of the most important sources of value in the financial system. In the RWA space, this layer is still under construction, but it is likely to become the core value creation lever in the long term.

Main Types of Tokenized Assets

After understanding the structure of the RWA stack, we can observe how this logic is specifically reflected in different asset classes. Their maturity and value capture capabilities vary, but each reveals different aspects of tokenization.

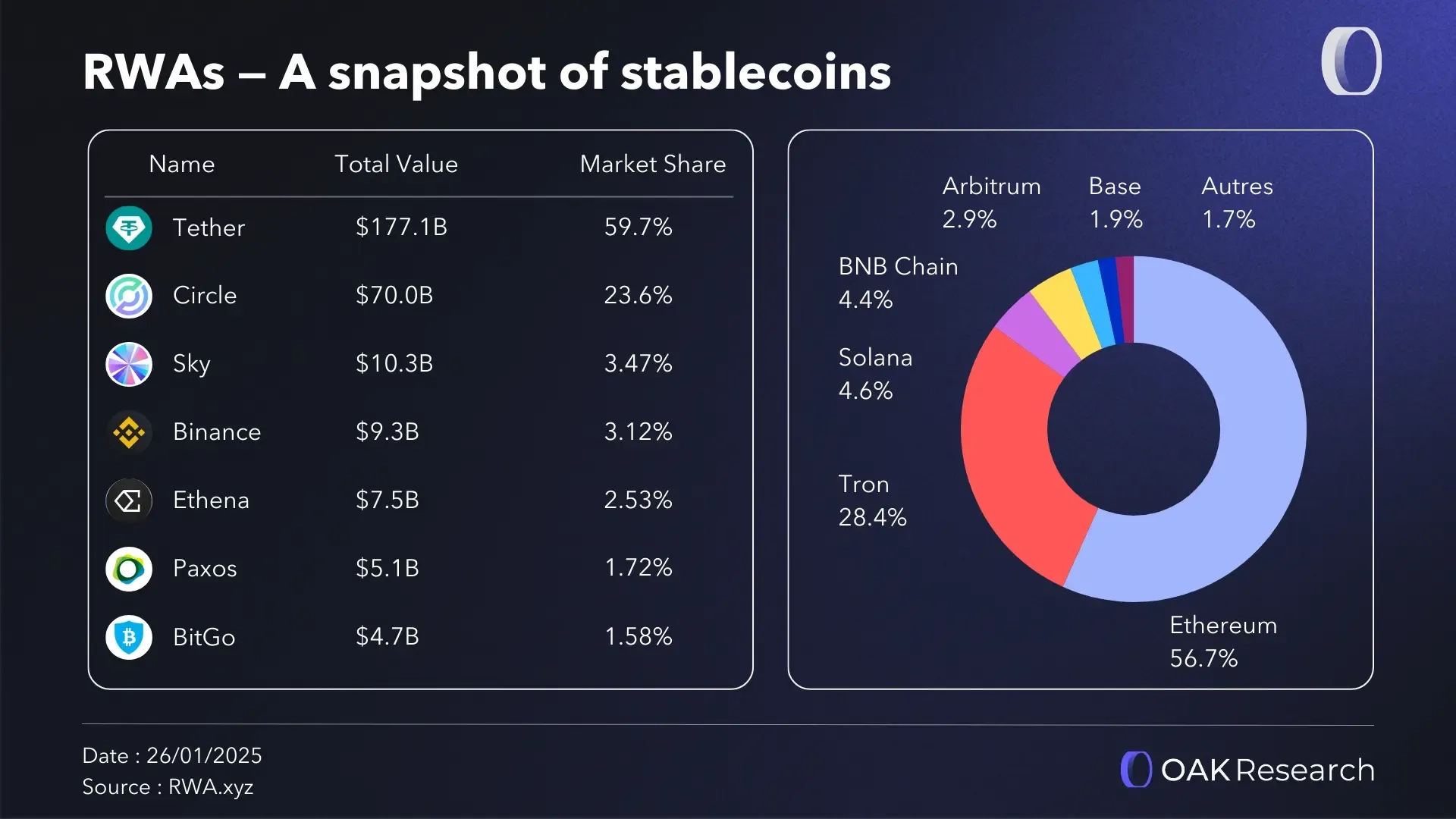

Stablecoins

Stablecoins are the cornerstone of the RWA market. Almost all on-chain capital flows related to real assets use stablecoins as the unit of account, payment medium, and settlement tool.

Initially viewed simply as "digital dollars," stablecoins have undergone profound changes. A large number of stablecoins are now backed by high-quality real assets, especially short-term U.S. Treasury bonds. This structure explains both their stability and why they are increasingly favored by institutional investors, as they see stablecoins as tools that are liquid, predictable, and compliant with operational constraints.

Thus, stablecoins play a dual role in the RWA stack: on one hand, they are the main liquidity channel for capital entering and exiting the ecosystem; on the other hand, they have themselves become one of the largest tokenized cases, with their reserves corresponding to a massive portfolio of tokenized sovereign debt.

In practice, stablecoins are not just products; they are infrastructure. They ensure settlement continuity, market liquidity, and the connection between traditional finance and on-chain finance, thus capturing structural value throughout the entire RWA market.

Focus Case: Ethena (USDe)

Ethena is a decentralized protocol, with its most well-known product being the stablecoin USDe. USDe generates yield through a delta-neutral strategy, with annualized returns ranging from approximately 5% to 15% under different market conditions.

In September 2025, Ethena launched Ethena Whitelabel—a "Stablecoin-as-a-Service" infrastructure that allows any blockchain, application, or wallet to quickly issue stablecoins while significantly reducing technical complexity.

This is a significant innovation as it directly addresses the issue of "stablecoin taxation." Currently, the stablecoin market is dominated by a duopoly of Tether and Circle, which together hold about 95% market share and generate billions in revenue through their collateralized asset scales.

In contrast, the blockchains, protocols, and users that support the operation and distribution of stablecoins can hardly share this portion of value. Ethena aims to solve this value outflow problem through USDe.

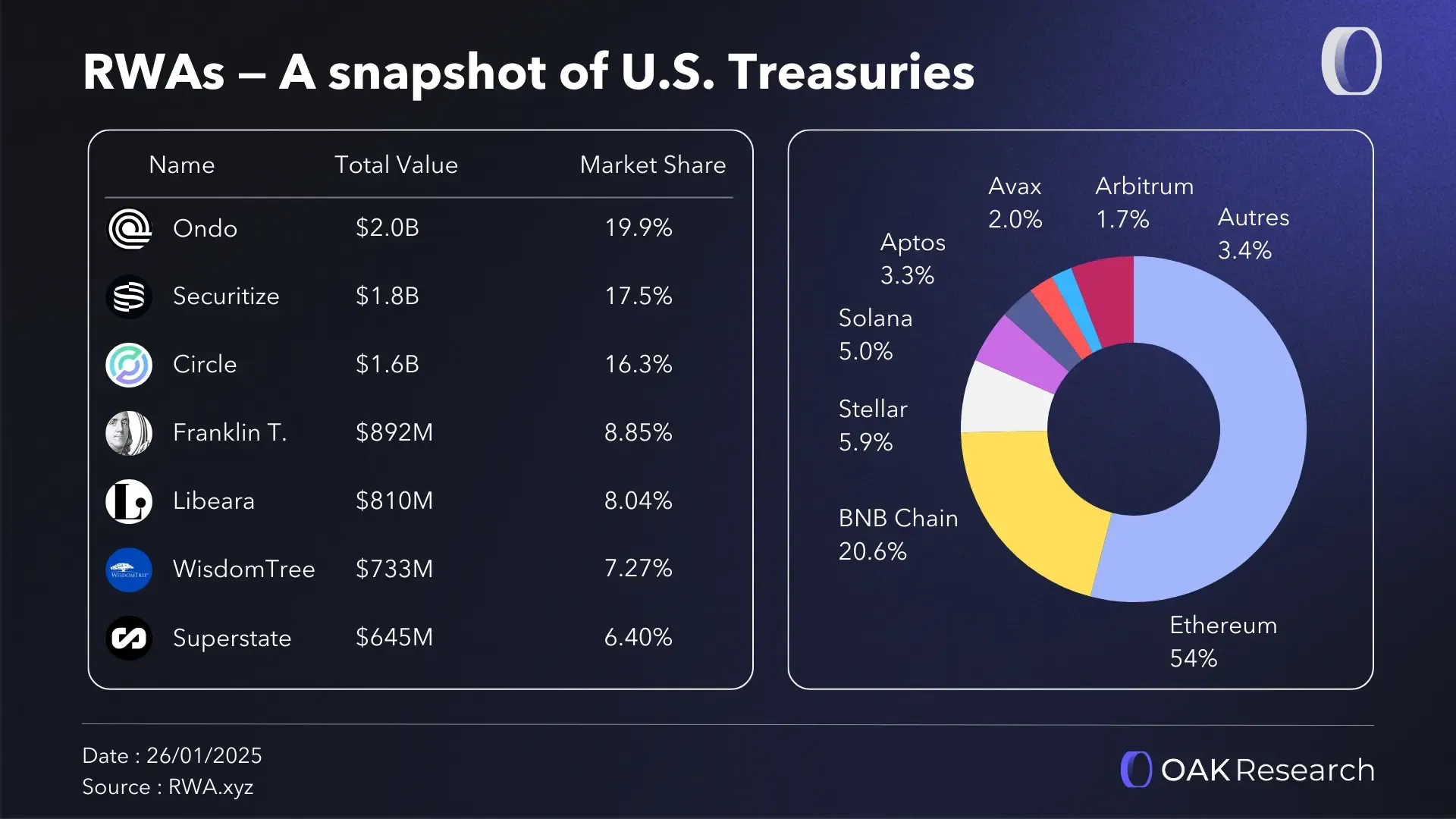

U.S. Treasury Bonds

U.S. Treasury bonds are currently the most mature and dominant sub-market of RWA. By tokenizing the world's safest and most liquid assets, issuers provide investors with continuous access, near-instant settlement, and fragmented ownership.

The primary use of these products is clear: to provide safe, yield-generating, and regulatory-compliant collateral assets within on-chain financial protocols. Tokenized U.S. Treasury bonds allow crypto investors to directly access U.S. sovereign debt yields without relying on traditional financial channels.

Since the Federal Reserve's interest rates exceeded the yields of most stablecoins in 2023, institutional interest in such products has significantly increased. The reliable yields, sustained liquidity, and collateralizable characteristics of tokenized U.S. Treasury bonds have gradually made them an important tool for on-chain capital management.

Some key data indicators:

- Since the beginning of 2023, the total market capitalization of mainstream tokenized U.S. Treasury products has grown from nearly zero to close to $9 billion.

- In 2025 alone, the scale of tokenized U.S. Treasury bonds added $4.4 billion, a year-on-year increase of 85%.

- BlackRock's U.S. Digital Liquidity Fund (BUIDL) dominates this market, followed by Circle's USYC and several Ondo products.

- In terms of on-chain deployment, Ethereum is the primary network for tokenized U.S. Treasury bonds, followed by Arbitrum, Polygon, BNB Chain, and Solana.

- Securitize is currently the most core tokenization service provider, although WisdomTree, Franklin Templeton, and Centrifuge have also seen significant growth in recent years.

This sub-sector clearly demonstrates a trend: value is shifting from purely technical infrastructure to issuers capable of building "structurally simple, clearly compliant, and easily integrable" products.

Focus Case: BUIDL (BlackRock)

BlackRock's U.S. Digital Liquidity Fund (BUIDL) is the first tokenized fund launched by BlackRock. This product brings traditional institutional-grade money market fund strategies on-chain, combining daily yield distribution, multi-chain deployment capabilities, and deep liquidity achieved through partners like Securitize and Circle.

BUIDL is distributed through the U.S. compliant platform Securitize, allowing it to target high-barrier institutional clients with a higher minimum investment, a stable $1 net asset value (NAV), and an on-chain daily dividend experience. The fund leverages cross-chain deployment via Wormhole across multiple blockchain networks, including Ethereum, Solana, Avalanche, Arbitrum, Optimism, Polygon, and Aptos.

Currently, BUIDL's assets under management exceed $2.5 billion. Although the number of holders is extremely limited (only 93 investors), this scale fully reflects institutional recognition and actual commitment to tokenized funds.

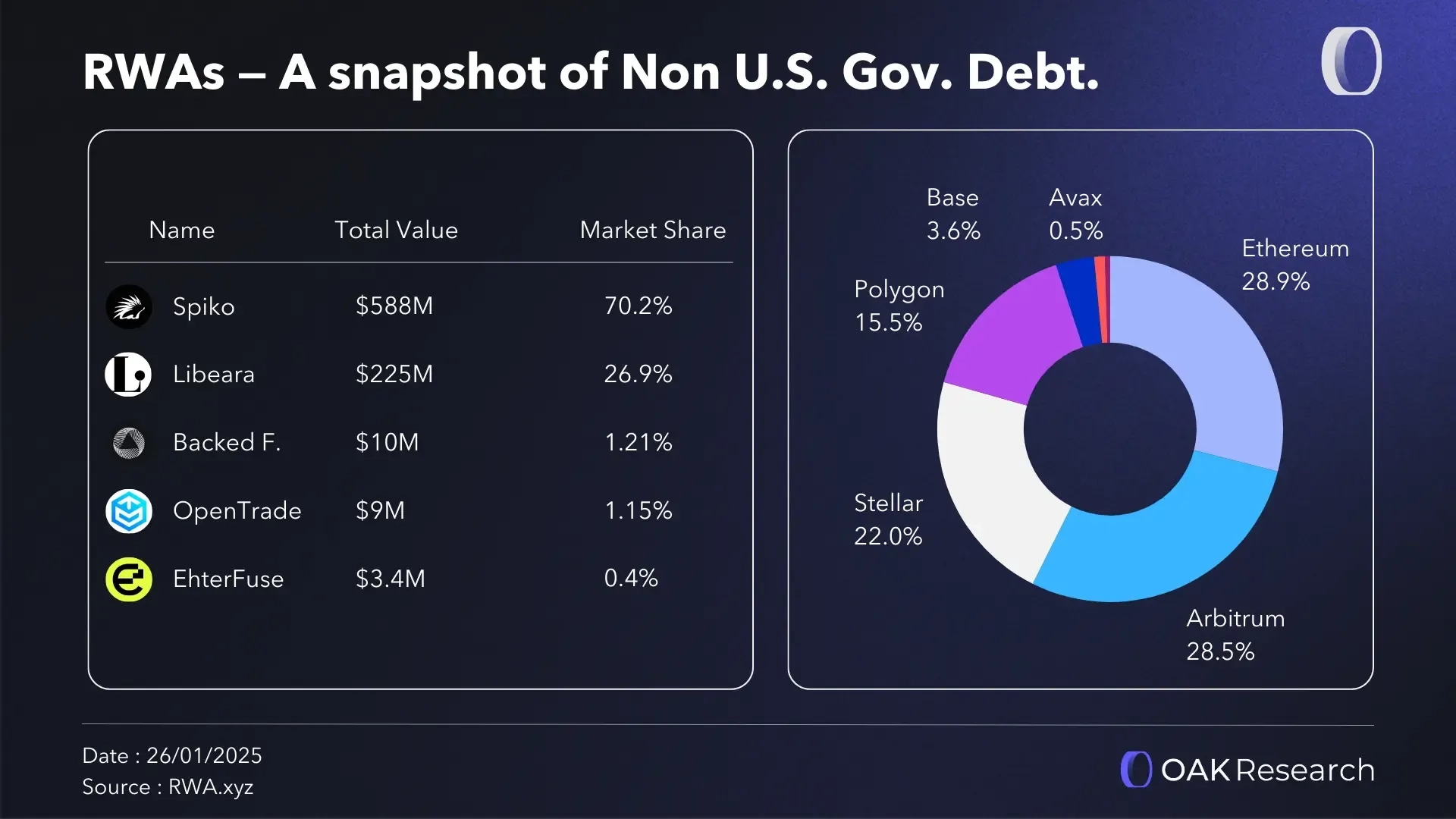

Non-U.S. Sovereign Debt

The tokenization of non-U.S. sovereign debt extends the advantages represented by U.S. Treasury bonds to other public issuers. It significantly reduces the operational complexity of cross-border investments in foreign government bonds while retaining a regulatory framework acceptable to institutions.

In the traditional financial system, purchasing foreign sovereign debt typically involves multiple intermediaries, complex jurisdictional settlement rules, and even longer settlement periods. Tokenization makes these assets more accessible, speeds up settlement, enhances capital efficiency, and still meets the compliance requirements of institutional investors.

Although the scale of this sub-market is still small, it clearly reflects the trend of RWA diversifying geographically. In this field, value capture highly depends on whether issuers have the capability to navigate local regulatory frameworks and whether they can provide easily understandable and usable products to global investors.

Currently, the non-U.S. sovereign RWA market is primarily dominated by issuers from Hong Kong (67% market share) and France (30%), corresponding to the major tokenized funds identified in this category, with ChinaAMC in Asia and Spiko in Europe.

Focus Case: Spiko

Spiko is a French fintech company established in 2023, which has grown to become the largest issuer of euro-denominated tokenized money market funds in Europe. Its products enable companies to allocate funds to funds backed by French, British, and U.S. Treasury bonds.

In January 2026, Spiko announced that it had obtained a MiFID investment management license granted by ACPR and AMF, allowing it to provide services compliantly across the European Union.

Spiko is one of the fastest-growing RWA projects in 2025, with its total value locked (TVL) increasing from $130 million to over $730 million. These assets are distributed across the Spiko Euro Fund ($523 million), Spiko Dollar Fund ($202 million), and the Spiko Pound Fund launched in December.

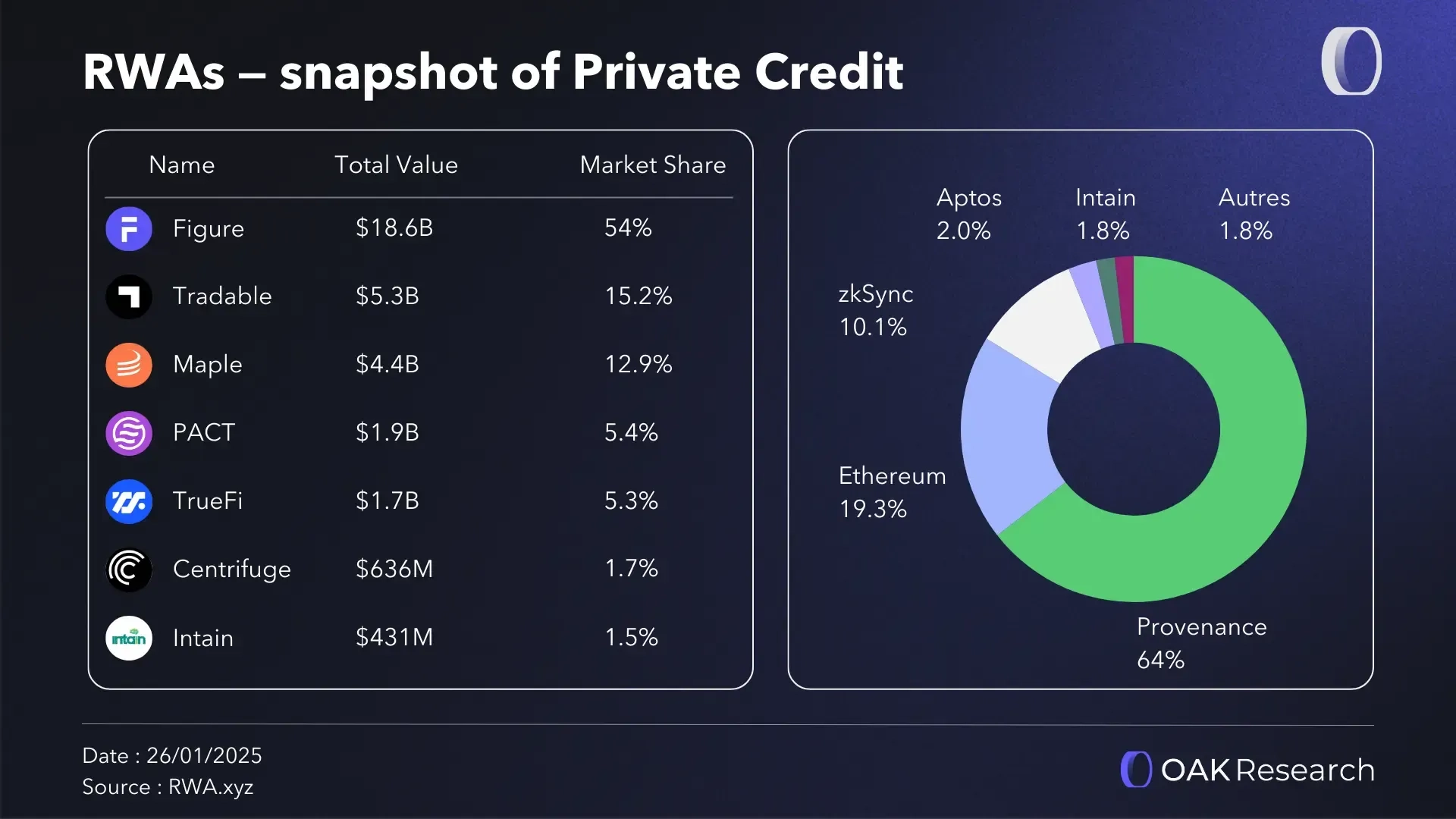

Private Credit

Private credit is one of the asset classes with the greatest potential for tokenization. This field has long been characterized by low liquidity and access limited to professional investors, but due to its clear cash flows and the potential for automated loan monitoring, it is naturally suited for on-chain applications.

Tokenization allows corporate loans, trade financing, and other non-public debt instruments to be broken down into smaller, potentially tradable units, enhancing liquidity for lenders and broadening financing sources for borrowers. Additionally, it enables real-time tracking of collateral, repayment progress, and cash flows.

This section emphasizes a core fact within the RWA stack: value does not only exist in the underlying assets themselves, but in the risk structure design, analysis, and management capabilities. As the market matures, differentiated competition will increasingly depend on risk control capabilities and structural credibility.

Focus Case: Maple Finance

Maple is a clear example of the demand for on-chain financial products supported by private credit. The protocol offers permissioned liquidity pools backed by BTC lending, while also launching permissionless liquidity pools built around syrupUSD through syrupUSDC and syrupUSDT. This allows Maple to serve both KYC-compliant institutional clients and crypto-native users.

In 2025, Maple achieved significant growth. Its assets under management (AUM) exceeded $4.5 billion (+800%), with total borrowing on the institutional side reaching $1.7 billion and protocol revenue approaching $11.7 million (+370%).

A key advantage of Maple is its clear recognition that for RWA products, distribution capability is one of the most critical foundational modules, as discussed earlier. The protocol has expanded integration across multiple new blockchains and key partners, creating concrete and actionable use cases for syrupUSDC and syrupUSDT.

In 2025, Maple deployed its products to Solana through Kamino and Jupiter; to Plasma through Midas; to Arbitrum through Fluid, Euler, and Aave; and recently expanded to Base through Aave.

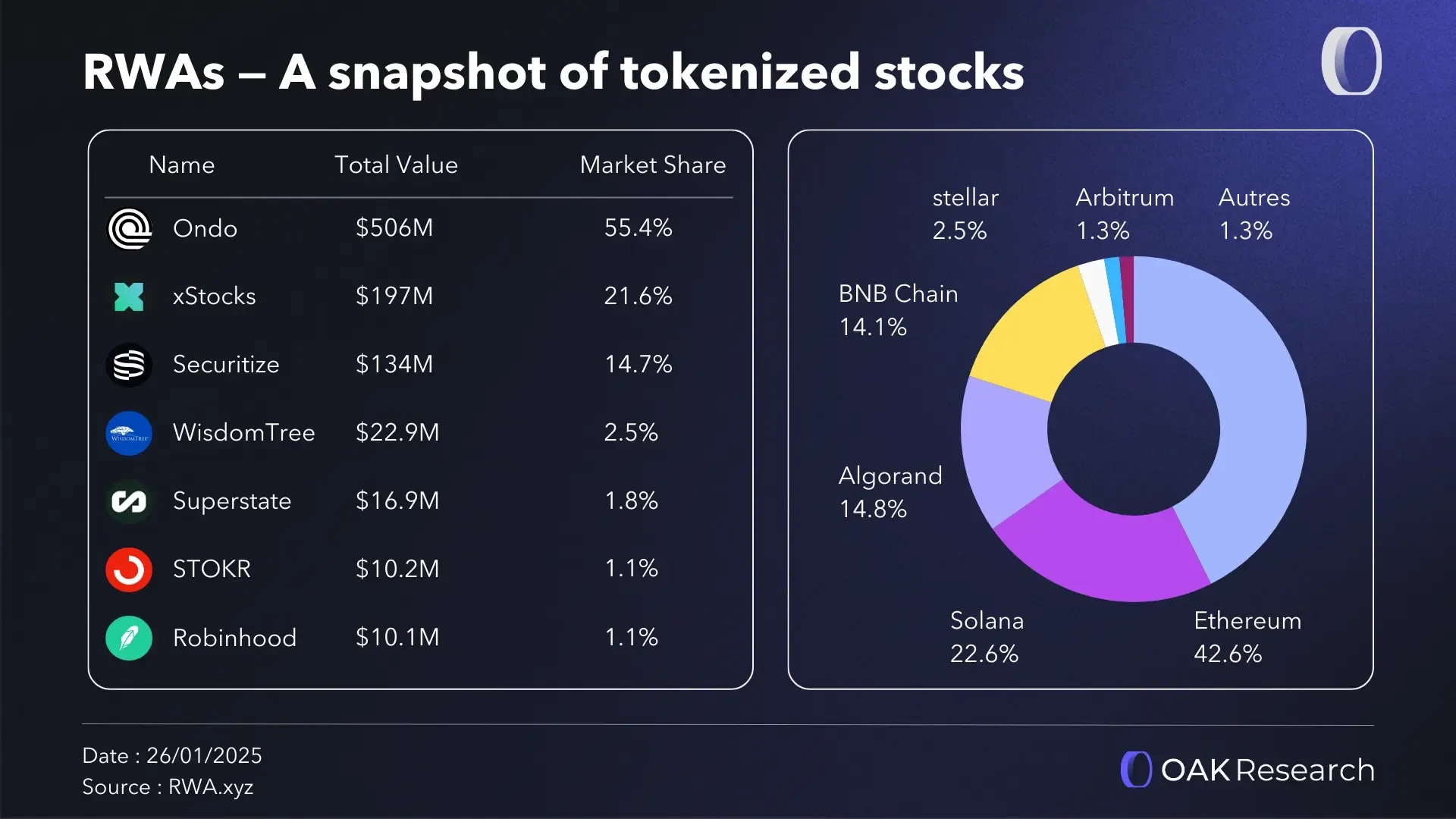

Tokenized Stocks

Tokenized stocks are digital representations of shares in publicly listed or private companies, allowing for continuous trading outside traditional market hours and faster settlement. For publicly traded stocks, these tokens are typically backed by real stocks held in custodial accounts; for private equity, tokenization simplifies the management of equity structures and enables compliant secondary markets.

This sub-field is primarily driven by demand for asset exposure rather than yield generation. It attracts a broader, often retail-oriented user base and highlights the core role of distribution capability and user experience in value capture.

Tokenized stocks indicate that even when the underlying assets are well-known, the focal point of value is not in the assets themselves, but in the ability to organize access, liquidity, and compliance. Currently, most trading activity is still driven by perpetual contract markets, although some projects have begun to integrate the spot ownership of tokenized stocks into the on-chain financial system.

Catalysts in this field have come from announcements related to Robinhood, followed by Backed Finance launching xStocks, and Ondo Global Markets entering the space. The number of holders of tokenized stocks far exceeds that of other tokenized asset classes, surpassing 100,000 holders within a year. This reflects a retail-dominated investor structure that focuses more on asset exposure than yield.

From the perspective of the perpetual contract market, growth is also clearly visible. In Hyperliquid's HIP 3 market, Trade.xyz and Markets, which focus on tokenized stocks, have performed outstandingly, with daily trading volumes exceeding $800 million.

Focus Case: xStocks by Backed Finance

Backed Finance is an infrastructure provider responsible for issuing on-chain representations of traditional financial assets, including stocks, ETFs, and bonds. The company was acquired by Kraken in December 2025 and launched xStocks in June of the same year, offering tokenized stock products backed by real stocks held by Swiss custodial partners.

Currently, xStocks has been integrated into multiple centralized platforms, including Kraken, Gate, Bybit, and Bitget, and supports Ethereum, Solana, and Tron. Over 70 assets have been tokenized through xStocks, with a total assets under management of $215 million and nearly 60,000 holders. This accounts for about 23% of the entire tokenized stock market.

Main Winners of RWA in 2026

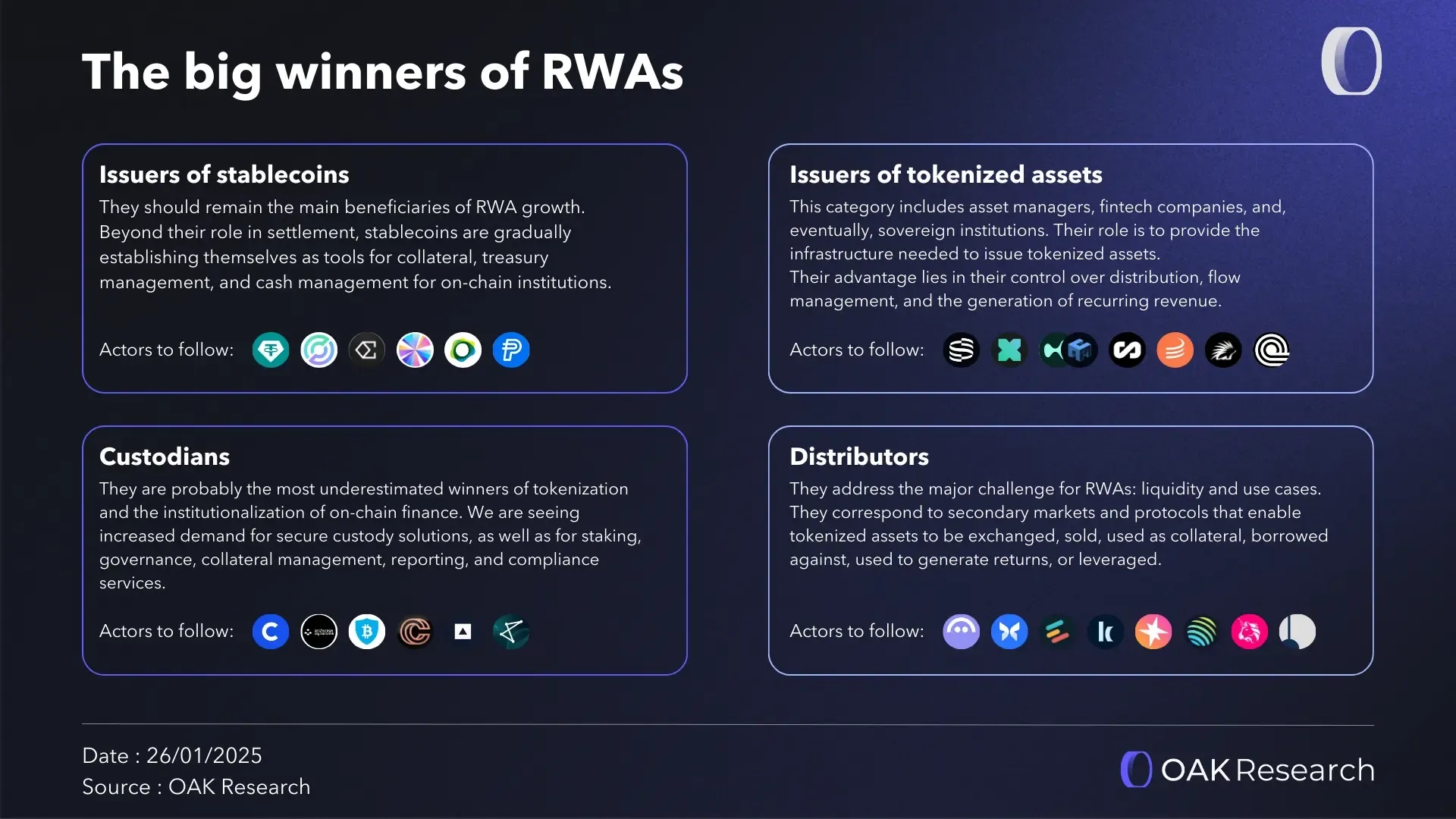

As we enter 2026, the question is no longer whether tokenization will continue to grow, but rather: as the market expands, where will value concentrate? The number of tokenized assets is rapidly increasing, but value capture remains highly uneven, primarily revolving around three types of participants that control issuance, distribution, and trust.

Stablecoin Issuers

Stablecoin issuers are expected to remain the biggest beneficiaries of RWA growth. Even in more challenging market environments, the total supply of stablecoins often mechanically increases with the expansion of payment, trading, and tokenization activities.

Beyond being settlement tools, stablecoins are increasingly used as collateral, capital management tools, and cash management solutions for on-chain institutions. With the increasing clarity of regulations in the U.S. and Europe, this field is expected to continue attracting new entrants while further consolidating the positions of leading players.

Key Participants to Watch: Tether, Circle, Ethena, Sky, Paxos, PayPal

Issuers of Tokenized Financial Assets

Issuers of tokenized financial assets include asset management institutions, fintech companies, and may also include sovereign entities in the future. Their role is to provide the infrastructure necessary for issuing tokenized assets while reducing operational complexity and shortening settlement cycles.

Their core advantages are not primarily reflected in cost reduction, but in distribution control, fund flow management, and sustainable recurring revenue. Those issuers that strategically position themselves early and build credible on-chain strategies are more likely to attract and concentrate liquidity and institutional attention.

Key Participants to Watch: Securitize, xStocks, Unit, Superstate, Maple, Spiko, Ondo

Custodians

Custodians are likely to be the most critical and yet underestimated winners in the institutional-level tokenization process. As institutions increasingly interact with on-chain assets, the demand for secure, compliant custodial solutions with insurance coverage will inevitably rise.

In a tokenized world, custody has long transcended simple asset safekeeping. Custodians now also provide staking, governance, collateral management, reporting, and compliance services. The likelihood of institutions building these capabilities themselves is extremely low, further reinforcing the strategic position of mature custodial service providers.

By 2026, the tokenization process is expected to continue accelerating, but the true winners may not necessarily be the participants with the most tokenized assets. Value will concentrate on those who control key technological layers, manage market access, and can earn trust in scaled operations.

Key Participants to Watch: Coinbase, Anchorage, BitGo, Copper, Fireblocks, Zodia

Distributors

The core challenge faced by any RWA issuer is enabling users to easily enter and exit the market. Many projects have attempted to tokenize private credit, real estate, or alternative investments on-chain, and their common issue often lies in long-standing liquidity shortages.

If investors cannot exit a tokenized asset at any time, they do not truly hold a liquid asset but rather depend on whether another buyer is willing to take over the position. In the absence of sufficient liquidity, tokenization does not solve the core issue of capital accessibility; it merely shifts the problem to other areas. Therefore, market depth and trading continuity are necessary conditions for the sustainable growth of RWA.

This is precisely the role that distributors play. They correspond to secondary markets and various protocols, enabling tokenized assets to be traded, sold, used as collateral, lent, generate yield, or leveraged. Distributors transform static assets into truly usable financial components.

In this category, money market protocols occupy a central position. Protocols like Aave, Morpho, Euler, Spark, and Kamino allow holders of tokenized assets to deploy them in more complex strategies. By facilitating lending, re-collateralization, and capital reuse, these protocols enhance both the individual utility of RWAs and the overall market liquidity.

Some DEXs also play a key role in this process. Platforms like Uniswap, Jupiter, and Fluid drive price discovery and asset circulation, especially in the context of tokenized assets beginning to integrate natively into the DeFi ecosystem.

Finally, there is another category of participants worth mentioning separately. Pendle does not position itself as a traditional secondary market but exists as a layer for yield structuring. By enabling the splitting and trading of future cash flows, Pendle provides more complex tools for optimizing, hedging, or amplifying tokenized asset exposure.

As the RWA market matures, distributors are increasingly emerging as one of the most important control nodes in the entire technology stack. They ultimately determine the degree of asset adoption, liquidity levels, and whether tokenized assets can truly establish themselves as usable financial instruments.

Key Participants to Watch: Aave, Euler, Morpho, Kamino, Jupiter, Uniswap, Spark, Pendle

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。