A new ethereum staking report shows 2025 delivered major technical upgrades and surging institutional adoption, even as ETH prices lagged, setting the stage for structural changes to staking and market dynamics in 2026.

Ethereum’s 2025 was defined by sharp contrasts. According to the Ethereum Staking Insights & Protocol Analysis report by Everstake, the network delivered major protocol upgrades and attracted record institutional participation, yet ETH prices remained largely stagnant. The disconnect highlights how ethereum’s role is evolving faster than market valuations suggest.

Two major upgrades shaped the year. Pectra introduced EIP-7251, raising the maximum effective validator balance from 32 ETH to 2,048 ETH, while Fusaka activated PeerDAS (EIP-7594), a key data-availability upgrade that safely increased Layer 2 blob throughput by up to eight times. Together, these changes improved scalability and validator efficiency, reinforcing Ethereum’s position as a global settlement layer.

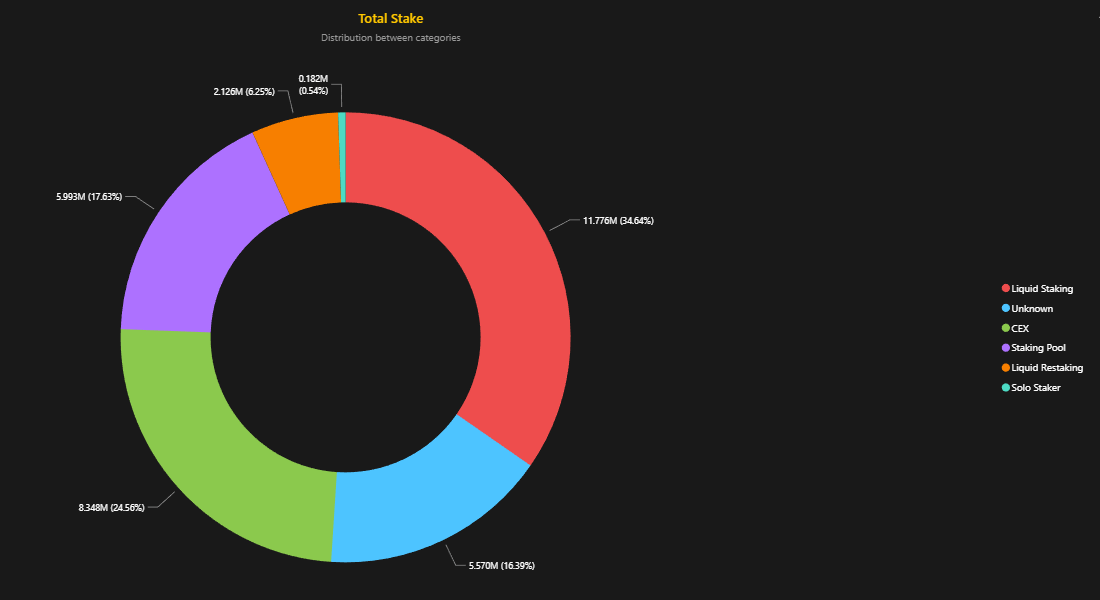

Consolidated validators grew from roughly 2% to more than 11% of total staked ETH in just six months, reflecting a shift toward operational efficiency, particularly among larger and institutional operators. By year-end, total value staked reached about 36.1 million ETH, or 29.3% of total supply, with net growth exceeding 1.8 million ETH.

Source: Everstake

Institutional demand also surged. Digital Asset Treasuries (DATs) accumulated an estimated 6.5–7 million ETH by December, representing around 5.5% of total supply. Many of these entities are staking corporate holdings to generate yield, effectively removing ETH from liquid markets and contributing to a growing supply constraint.

Bohdan Opryshko, Co-Founder and COO of Everstake commented:

In 2025, as infrastructure improved and fees fell, ETH increasingly functioned as working capital, securing networks and generating yield. In 2026, we expect institutions to move beyond passive exposure, treating ETH as a yield-bearing asset where staking becomes a baseline requirement rather than an optional add-on.

Read more: Ethereum Daily Transaction Count Hits Record High While Fees Stay Flat

On the usage side, Ethereum’s Layer 2 ecosystem surpassed 300 transactions per second, while Layer 1 activity still climbed roughly 30% year over year to 1.5–1.6 million daily transactions. Daily active addresses rose to around 450,000–500,000, driven largely by ETF-related wallets and smart accounts rather than retail transfers.

Looking ahead to 2026, the report suggests Ethereum staking is becoming more formalized and aligned with traditional finance standards. While this may attract further institutional capital, it raises fresh questions around decentralization, client diversity, and systemic risk tolerance as Ethereum continues its transformation.

- What defined Ethereum’s performance in 2025?

Ethereum saw major network upgrades and rising institutional staking despite flat ETH prices. - Which upgrades mattered most?

Pectra and Fusaka boosted validator efficiency and Layer 2 scalability across the network. - How strong was institutional adoption?

Institutions staked up to 7 million ETH, tightening supply and reshaping market dynamics. - What does this mean for 2026?

Ethereum staking is becoming more institutional and structured, setting up deeper market shifts.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。