Written by: Arthur Hayes

Translated and Compiled by: BitpushNews

The views expressed in this article are solely those of the author and should not be considered as the basis for investment decisions or as advice or opinions regarding investment trading.

A sound of "Woomph" echoed from the mountain.

Me: Did you hear that?

In the powder snow valley, certain sounds make you stop, listen, and adjust your actions immediately.

The mountain emitted another "Woomph."

My companion: The snow layer is fracturing.

If we pretend nothing is wrong and continue upward, it could cost us our lives. When the mountain speaks, we must listen.

The mountain rumbled with a third "Woomph."

Guide: It seems we can only ski the gentle slope today.

We, the brave powder snow seekers, stopped at a snow-covered intersection at the valley's bottom. The guide took out a snow saw and shovel from his backpack and dug a snow pit about 1.5 meters deep. Everyone gathered around the pit, carefully observing the snow layer structure.

The guide pointed at the snow layers and said: Look at this layer of ice crust, formed by rain before the last snowstorm. After that, due to consecutive sunny days, the snow crystals underwent faceting, creating a weak layer—this situation is quite rare in this mountainous area.

He then conducted a column test to determine how much energy would be needed to trigger a snow layer fracture. He tapped a few times with the shovel, and the snow surface cracked above the ice crust, easily sliding out a block of snow about 80 centimeters high. Everyone gasped: we all know that on a slope of 35 to 40 degrees, the weight of a skier could trigger an avalanche across the entire slope.

Thus, it was decided: we would not challenge any steep slopes today. If the snow layer becomes unstable while ascending in a zigzag pattern, we will immediately retreat to the left—safety is always the priority.

The sound of "Woomph" under the beautiful powder snow sounded a dangerous alarm. And with the weakening of the yen and the collapse of Japanese government bond (JGB) prices, the financial markets also echoed with a "Woomph."

These two events occurring simultaneously in Japan is no coincidence.

Many smarter macro commentators claim that Japan will become the spark that ignites the decaying fiat currency system. I do not believe that the elites entrenched in global power structures will sit idly by as this collapse occurs without attempting to print money to escape the predicament. Therefore, it is crucial to analyze the vulnerabilities that the yen and Japanese government bonds inject into the global market at this juncture. Will the collapse of the yen and the Japanese government bond market trigger some form of monetary expansion from the Bank of Japan (BOJ) or the Federal Reserve?

The answer is yes, and this article will explain the intervention mechanism hinted at last Friday.

Discussion about the Japanese financial market is vital because Bitcoin needs a strong dose of monetary expansion (money printing) to emerge from the shadow of sideways movement.

I will present a theory, although the actual flow of funds in the global monetary system has not fully supported this theory yet. Over time, I will validate this hypothesis by observing changes in specific items on the Federal Reserve's balance sheet.

But most importantly, I will listen for that "Woomph," as the monetary overlords want us to trade based on their manipulations. Therefore, I must remain vigilant, listening to what U.S. Treasury Secretary Bill Bessent and BOJ Governor Kazuo Ueda say, as well as the unspoken messages they convey.

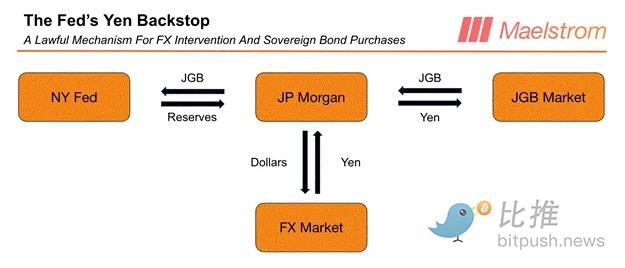

Before explaining how the "money printing button" will be triggered under pressure, let me first use this chart to illustrate how the Federal Reserve will expand its balance sheet through money printing and intervene in the USD/JPY exchange rate and the Japanese government bond market.

Here are the steps for manipulating the foreign exchange and bond markets:

The New York Fed creates a bank reserve liability (i.e., dollars) with primary dealer banks like JPMorgan Chase.

JPMorgan sells dollars and buys yen on behalf of the New York Fed in the foreign exchange market. The yen appreciates against the dollar.

The New York Fed can invest its yen in suitable securities, with Japanese government bonds (JGB) qualifying. The New York Fed instructs JPMorgan to purchase Japanese government bonds for its System Open Market Account (SOMA). The yield on Japanese government bonds decreases.

The "Foreign Currency Denominated Assets" item in the Federal Reserve's balance sheet increases due to the purchased Japanese government bonds, while the bank reserve liability item also increases by the same amount. The New York Fed prints dollars to buy Japanese government bonds, lowering Japan's bond yields. As a result, the New York Fed incorporates the USD/JPY exchange rate risk and Japanese government bond interest rate risk into its balance sheet. If the yen weakens or Japanese government bond yields rise (prices fall), it will lead to floating losses for the Federal Reserve.

Why would the Federal Reserve engage in such manipulation? What compels them to accept this exchange rate and interest rate risk?

Japan has sounded the "Woomph"!

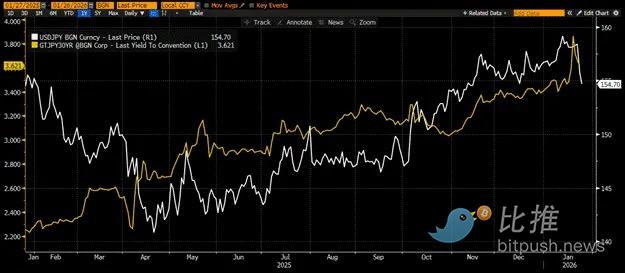

Japanese authorities have lost control over the long end of the government bond yield curve. Specifically, the yen has weakened against the dollar while bond yields are rising. This situation should not occur if investors have confidence in the government's ability to maintain the purchasing power of its fiat currency and stop deficit spending. A weaker yen will bring imported inflation, as Japan is a net importer of energy. High Japanese government bond yields make government debt burdensome. Ultimately, falling bond prices have led to significant floating losses for the BOJ, as it is the largest holder of Japanese government bonds in the market.

Chart Explanation: USDJPY (white), 30-year Japanese government bond yield (gold)

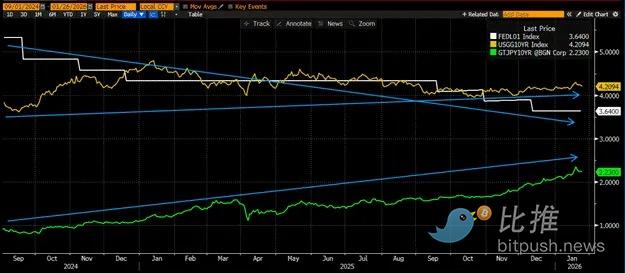

Why does helping Japan align with the interests of President Trump and Treasury Secretary Bessent? "Pax Americana" finances itself in the bond market. Japanese private investors collectively are among the largest holders of these bonds. Japan's overseas debt portfolio totals $2.4 trillion, most of which is invested in U.S. Treasuries. If Japanese companies can earn enough income by purchasing Japanese government bonds, they will sell U.S. Treasuries and repatriate the funds to Japan. Such a large, motivated marginal seller would lead to falling prices/rising yields for U.S. Treasuries.

As the U.S. government is running the largest peacetime deficit in the country's history, the speed of rising financing costs will outpace that of Caroline Ellison (former CEO of Alameda Research and core partner of FTX founder Sam Bankman-Fried) swiping on Tinder after being released from prison. In addition to skyrocketing interest costs, a weakening yen against the dollar would also undermine the competitiveness of U.S. manufacturers in global exports.

Chart Explanation: The Federal Reserve has cut rates by 1.75% since easing began in September 2024 (white line). Unfortunately for Bessent, the 10-year U.S. Treasury yield (yellow line) has risen instead of falling. Partly due to stubborn inflation and partly due to supply issues. As yields on Japanese government bonds (green line) rise for 10 years and beyond, Japanese companies are investing more domestically rather than abroad.

What to do now?

The above explains a flowchart of how the Federal Reserve intervenes.

But what legal justification allows the Federal Reserve to manipulate the yen and the Japanese government bond market?

Readers, please put away your eye rolls. I know Trump does not care about legal inconveniences, nor did any of his predecessors. But sometimes those annoying checks and balances can challenge the implementation of presidential privileges, so let’s assess whether there is a legal framework or recognized practice that permits such behavior.

Bessent can utilize the "Exchange Stabilization Fund" to intervene in the currency market as deemed appropriate to maintain the value of the dollar. The Treasury uses the New York Fed to help manipulate the market because the New York Fed has regulatory responsibilities over major financial institutions headquartered in New York. The involvement of the New York Fed is necessary because the Treasury cannot print money, while the product of Jekyll Island (referring to the Federal Reserve) can.

The next question is: what assets can the New York Fed purchase with its yen? The New York Fed allows itself to buy government debt securities. Holding debt that the government can repay with money it can print at will carries no credit risk. This is the logic that supports the assertion that "holding Japanese government bonds is a high-quality investment."

The Federal Reserve and the Treasury have legal cover. The next step is to look for evidence that confirms the existence of this Federal Reserve/Treasury manipulation of the yen and Japanese government bonds.

The first milestone confirming my theory is last Friday's announcement: the New York Fed inquired about pricing from several Wall Street dealers. The Federal Reserve deliberately and publicly conveyed its intentions so that the market could preemptively react to potential future interventions.

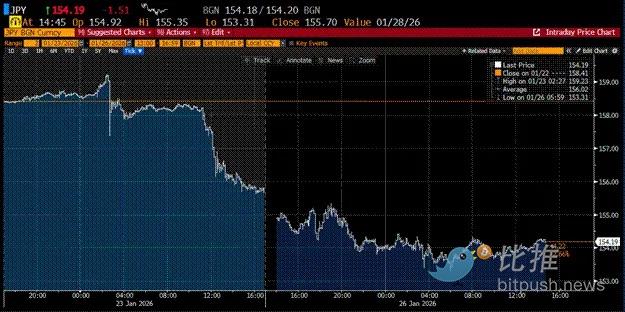

On January 23, 2026 (Friday), the BOJ maintained interest rates, while by all measures, they should have raised rates to defend the exchange rate and bond market. I suspect Ueda called his counterpart across the ocean seeking help, thus initiating discussions on Federal Reserve and Treasury intervention.

The next milestone in the journey is the changes in the Federal Reserve's balance sheet as shown in its weekly H.4.1 report. The item to monitor is "Foreign Currency Denominated Assets." They will not provide an exact detailed breakdown of the assets they hold. We must infer the presence of the Federal Reserve from the price trends of Japanese government bonds. Even if they officially obscure their holdings, I bet that Nick Timaros, the Federal Reserve's mouthpiece at the Wall Street Journal, will receive "whispers" from insiders indicating that the institution is actively purchasing Japanese government bonds.

The Federal Reserve will confirm these purchases because it wants us traders to invest as well. The more investors buy, the less the Federal Reserve needs to buy; and since these plans will expose the Federal Reserve to significant foreign exchange and interest rate risks, the less they buy, the better.

We have established the legal fiction that allows for manipulation and where we can observe evidence of its existence. So what impact will this policy have on the prices of various important financial assets and currencies?

Wonderful Effects

The Federal Reserve's intervention in the yen and Japanese government bond market has resolved many financial challenges for the Trump administration.

Supporting the Yen

This move will boost the yen's exchange rate against the dollar, thereby enhancing the competitiveness of U.S. exports.

Lowering Japanese Bond Yields

The decline in Japanese government bond yields will suppress the tendency of Japanese companies to sell U.S. Treasuries and shift to Japanese bonds. Prime Minister Fumio Kishida can take advantage of this to launch a large-scale stimulus plan, raising funds through bond issuance to appease the public. Ordinary voters clearly find it hard to accept the reality that their country was once subjected to a nuclear strike and is now reduced to a U.S. colony. Prime Minister Kishida can also use this to increase defense spending and procure more U.S.-made weapons of mass destruction.

Releasing Dollar Liquidity

The Federal Reserve can expand its balance sheet by printing money and nonchalantly claim, "This is not quantitative easing." Asset prices will rise accordingly, keeping wealthy political donors in the U.S. satisfied.

Boosting the Euro

If you haven't noticed—Trump and his aides have no fondness for "European paupers." To thoroughly suppress Europe, a strong euro is needed. As the Federal Reserve prints billions to buy yen and Japanese bonds, the dollar will passively weaken against most currencies (especially the euro). A stronger euro will severely impact German and French exports, handing over more global business to U.S. companies.

Strengthening the Renminbi

For the same reasons as the euro, the renminbi will also strengthen against the dollar. If the renminbi appreciates too quickly, exceeding expectations, the People's Bank of China (PBOC) will expand domestic credit to halt the rise of the renminbi. The increase in renminbi credit will help global asset prices. Since the Chinese government and private sector are among the largest holders of U.S. stocks, some of this credit will flow into the U.S. stock market.

The Federal Reserve's intervention is precisely what this decaying fiat currency system needs to survive.

The only issue is that the appreciation of the yen must be gradual. It cannot appreciate too quickly; otherwise, as volatility rises, it will lead to catastrophic losses for investors who borrowed yen to finance purchases of other assets. If the Federal Reserve can stabilize the volatility of the yen, then a slowly appreciating yen will not trigger a financial crisis.

Who cares if our monetary masters benefit from the Federal Reserve's intervention in the yen/Japanese government bond market? What does this mean for the faithful holders of Bitcoin and cryptocurrencies?

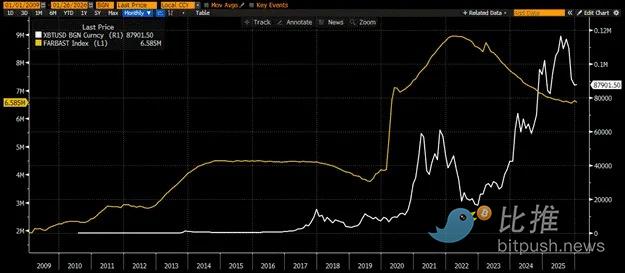

Bitcoin (white line) will rise alongside the expansion of the Federal Reserve's balance sheet (gold line). If you are trading certain altcoin perpetual contracts on a 1-minute chart with 100x leverage, this process may not immediately manifest within your time frame of interest, but the issuance of fiat currency will inevitably mechanically push up the valuation levels of Bitcoin and quality altcoins.

Trading Strategy

A rapid appreciation of the yen typically signals "risk-off," as yen-funded traders will reduce their positions.

Bitcoin falls due to the strengthening yen. I will not increase my risk exposure until it is confirmed that the Federal Reserve is intervening in the yen and Japanese government bond markets through money printing. If the "Foreign Currency Denominated Assets" item on the Federal Reserve's balance sheet shows a week-over-week increase, that will be the time to increase my Bitcoin position. Fortunately, I had closed my long positions in MSTR (U.S. stock) and Metaplanet (Japanese stock 3350) before the yen's volatility. Once my judgment is validated, I will re-enter these leveraged Bitcoin alternative assets.

In the meantime, the Maelstrom fund continues to increase its holdings in Zcash ($ZEC). Our other quality DeFi token positions remain unchanged. Let me reiterate: if the Federal Reserve is indeed manipulating the yen and Japanese bond market through balance sheet expansion, we will increase our positions in the DeFi asset package ($ENA, $ETHFI, $PENDLE, $LDO).

That's all, fellow degens. Today is another powder snow day; it's time to ski until our legs break.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。