The US dollar index fell below the 96 mark, hitting a low of 95.55 during the session, yet Trump stated that "the dollar is performing great," as the market seeks direction amid policy fog. The dollar index continued to decline on January 27, dropping 0.84% that day, closing at 96.219 in the forex market.

It then further dropped to 95.55, the lowest point since mid-February 2022, marking the lowest level in nearly four years. Meanwhile, the euro to dollar exchange rate surpassed the 1.20 mark for the first time since 2021.

1. Market Performance

At the end of the New York forex market on January 27, the dollar faced a comprehensive sell-off. The dollar index continued to decline that day, significantly dropping by the close.

By the end of the New York forex market, 1 euro exchanged for 1.1979 dollars, up from 1.1875 dollars the previous trading day; 1 pound exchanged for 1.3780 dollars, up from 1.3679 dollars the previous trading day.

The performance of major currency pairs against the dollar is as follows:

Currency Pair

Exchange Rate

Change from Previous Day

EUR/USD

1.1979

Up

GBP/USD

1.3780

Up

USD/JPY

152.77

Down

USD/CHF

0.7664

Down

USD/CAD

1.3608

Down

USD/SEK

8.8169

Down

During the Asian trading session, the dollar index briefly rebounded. On January 28, during the Asian trading session, the dollar index rose back to the 96 mark, up 0.26% for the day. This rebound may just be a technical adjustment, as the market remains cautious about the dollar overall.

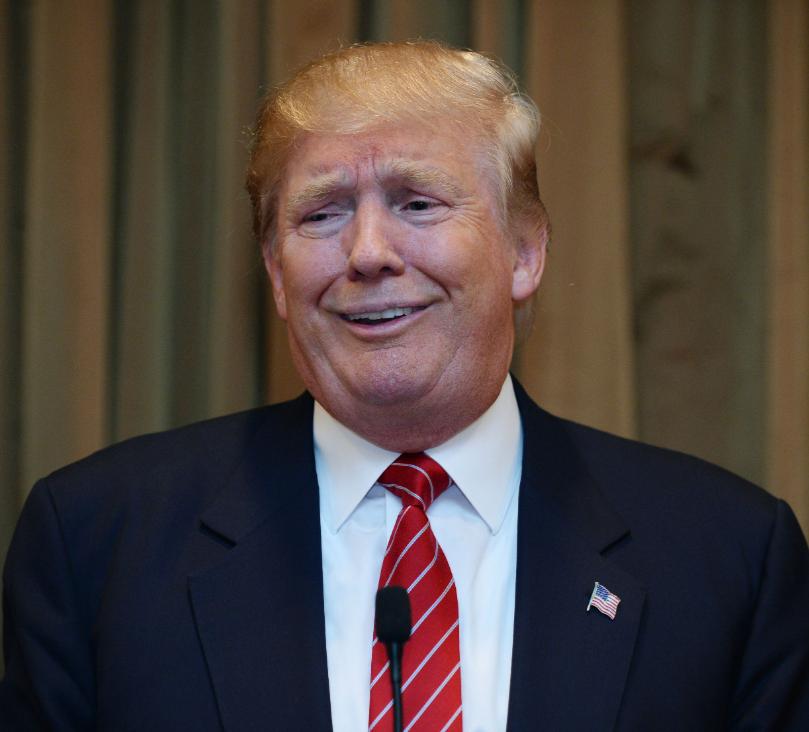

2. Trump's Remarks Add Fuel to the Fire

● On the afternoon of January 27, US President Trump expressed his views on the dollar's performance to the media, directly influencing market sentiment. Trump stated that he does not believe the dollar has fallen excessively and affirmed the current performance of the dollar. His remarks further stimulated a rapid decline in the dollar index.

● Karl Schamotta, Chief Market Strategist at Cambridge Global Payments, pointed out that Trump showed no signs of regret regarding tariff policies, and the US government may face another "shutdown," leading to a significant increase in economic policy uncertainty.

● Market analysis suggests that the Trump administration's preference for a weak dollar and the risk of a federal government shutdown further add to the uncertainty. This unpredictability in policy has become a significant factor suppressing the dollar.

3. Federal Reserve's Independence Questioned

Another focus of the market is the direction of the Federal Reserve's policies and its independence. The Federal Open Market Committee (FOMC) is scheduled to announce its interest rate decision at 03:00 Beijing time on January 29, with the benchmark rate expected to remain at 3.75%.

The market generally expects the Federal Reserve to maintain the federal funds rate in the 3.50%-3.75% range at the FOMC meeting this week.

● Goldman Sachs noted that Governors Waller and Bowman are expected to support keeping rates unchanged, while Governor Mester may be the only dissenter. Goldman’s Chief US Economist predicts that the Federal Reserve will implement two rate cuts by 2025, with the first action occurring in June.

● Trump's intervention in the Federal Reserve's independence mainly occurs through three avenues: nominating a Fed chair who is loyal to him; adjusting the personnel structure of the Federal Reserve Board; intervening in the appointment of regional Fed presidents.

● With the new Fed chair's appointment, 4 of the 7 members of the Federal Reserve Board will be "loyalists," giving Trump greater influence over both the chair and the board.

4. Yen's Strong Rebound Draws Attention

● Against the backdrop of a weakening dollar, the yen has become a focal point in the market. On January 27, 1 dollar exchanged for 152.77 yen, down from 154.18 yen the previous trading day. The dollar to yen rate fell 1% that day, hitting a low of 152.61.

● The market anticipates that the US and Japanese authorities may jointly intervene in the forex market after conducting exchange rate checks on traders. This expectation has stimulated a significant strengthening of the yen against the dollar recently.

● Japanese Prime Minister Sanae Takaichi warned of possible intervention in the forex market, further supporting the yen. The yen has recently rebounded to its strongest level in nearly three years.

● Analysts pointed out that the yen's movement against the dollar "is not a one-time drop, but rather a series of further declines following an initial sharp fall," similar to the trends seen during government intervention periods.

5. Market Outlook and Risks

● Currently, there is a divergence in the market regarding the outlook for the dollar. On one hand, a relatively neutral cyclical environment may provide some support for the dollar; on the other hand, structural factors are exerting downward pressure on the dollar. These structural factors include weakened confidence in US trade and security policies, the politicization of the Federal Reserve, and deteriorating US fiscal credibility.

● The Chief Economist at EY-Parthenon noted that current interest rates are close to neutral, while inflation rates are closer to 3% rather than the long-term target of 2%. He predicts that the Federal Reserve will cumulatively cut rates by 50 basis points by 2026, but actions will not begin until the second half of the year.

● A senior bond portfolio manager at Wilmington Trust believes that the Federal Reserve will not lock in a "pause" stance, and Chair Powell may emphasize policy flexibility. He stated, "This meeting will not have much else besides maintaining rates. The Federal Reserve has entered a phase where it can afford to be patient."

During the Asian trading session, the dollar index struggled to rise back to the 96 mark, but this seems more like a technical rebound after a sharp drop. In the face of a market environment filled with uncertainty, investors need to closely monitor the Federal Reserve's interest rate decision and Powell's press conference on January 29 at 03:00 Beijing time.

Join our community to discuss and grow stronger together!

Official Telegram community: https://t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

OKX benefits group: https://aicoin.com/link/chat?cid=l61eM4owQ

Binance benefits group: https://aicoin.com/link/chat?cid=ynr7d1P6Z

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。