Founded about 14 years ago, Bitgo has built its reputation around institutional-grade security, custody, and transaction infrastructure for cryptocurrencies. The firm oversees approximately $104 billion in assets under management (AUM) and only recently began trading on the NYSE.

It has been a shaky start for Bitgo’s shares, BTGO, which entered the public markets against a backdrop of economic uncertainty, persistent geopolitical tension, and growing speculation that the crypto market may be sliding into a bear cycle. Even with diversified service offerings, publicly traded crypto firms are often linked to bitcoin’s periodic cycles, although the tight connection does not hold in every instance.

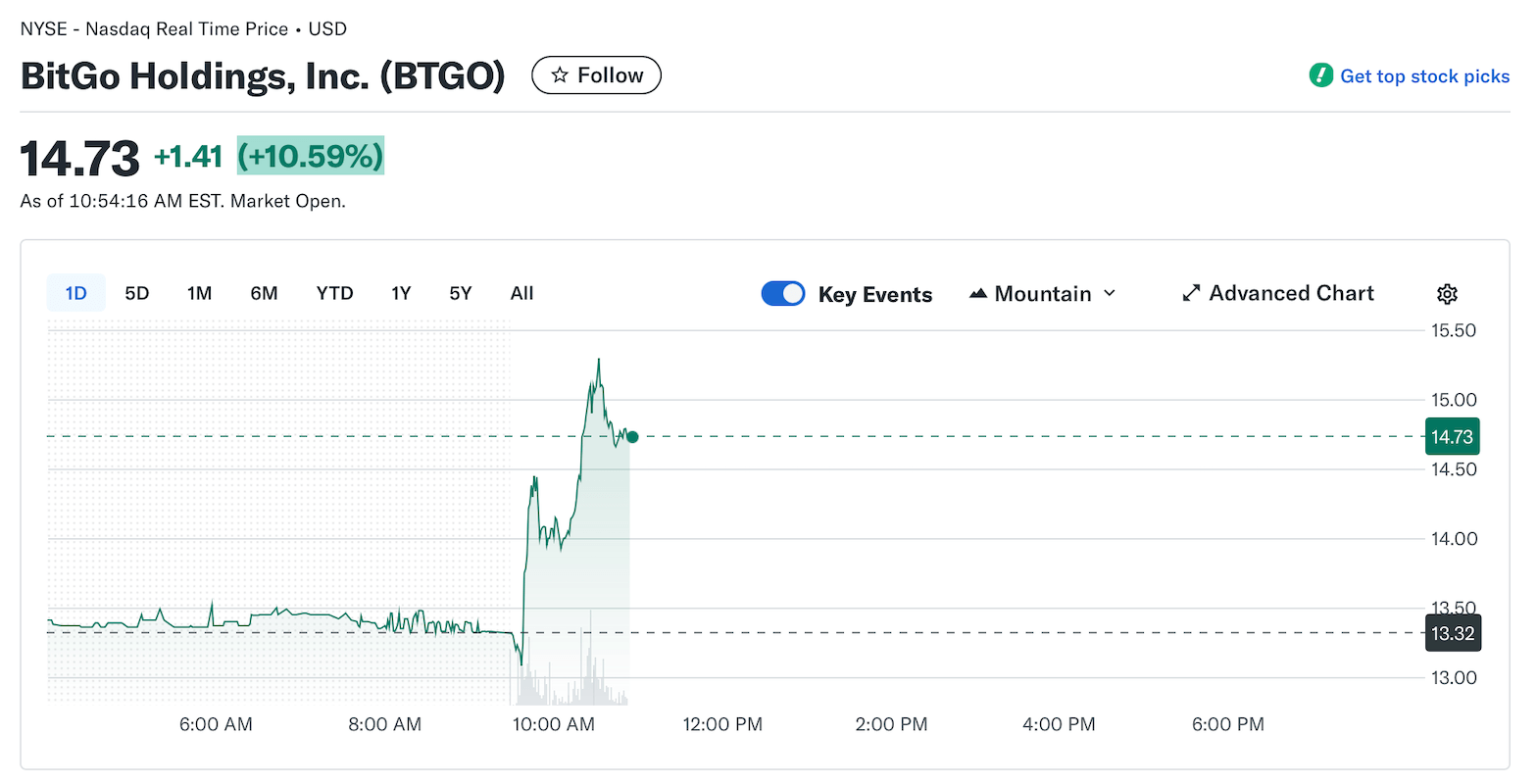

Bitgo shares managed to climb today, erasing some of the losses witnessed yesterday, by 10:54 a.m. Eastern time on Tuesday.

BTGO began trading on the NYSE on Jan. 22, opening at $18 per share before pushing to an intraday high of $23.85. By Monday’s close, Bitgo’s stock was trading 26% below that level at $13.32. Today, BTGO’s latest increase on Tuesday afternoon has lessened that blow. While BTGO operates in a distinct corner of the industry, other recently listed crypto-linked stocks include Circle’s CRCL and Bullish’s BLSH.

Circle raised $1.1 billion through the sale of 34 million shares priced at $31 apiece in an upsized offering, with shares opening at $69. As of today, CRCL is posting a modest gain from that level at $70.90. Crypto exchange Bullish secured $1.1 billion by selling 30 million BLSH shares at $37, opening NYSE trading at $90 per share—more than double its IPO price.

BLSH is now trading at $35.66 per share. Despite the early drawdown, Abra Global CEO and founder Bill Barhydt wrote on X that “Bitgo looks ridiculously undervalued to me right now.” Yahoo Finance’s Simply Wall St echoed a similar view, stating, “On our valuation checks, Bitgo Holdings scores 3 out of 6 for being undervalued, as shown in its valuation score.”

Also read: Tether Unveils USAT Stablecoin for US Institutions Under GENIUS Act Rules

This week, Bitgo CEO Mike Belshe also posted on X, weighing in on the recent siphoning of crypto assets from U.S. government-seized wallets and noting that his firm has specialized expertise in handling such matters compared with outside contractors. “Government procurement often favors “small business” contractors run by former insiders over the companies actually building the industry’s security standards,” Belshe said.

He added:

“We’ve warned for years that prioritizing bid-writing over battle-tested digital asset security experience would lead to this. A $40M hard lesson in why experience matters.”

- Why did Bitgo shares fall after the NYSE debut?

BTGO declined about 18% amid early post-IPO volatility, broader macro uncertainty, and cautious sentiment toward crypto-linked stocks. - When did Bitgo start trading on the New York Stock Exchange?

Bitgo began trading on Jan. 22, opening at $18 per share and briefly touching an intraday high of $23.85. - How much does Bitgo manage in assets under management?

The firm oversees roughly $104 billion in assets under management, primarily tied to institutional crypto custody and security services. - What are analysts and executives saying about BTGO’s valuation?

Some market watchers and executives argue the stock appears undervalued despite the early pullback, citing valuation models and long-term fundamentals.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。