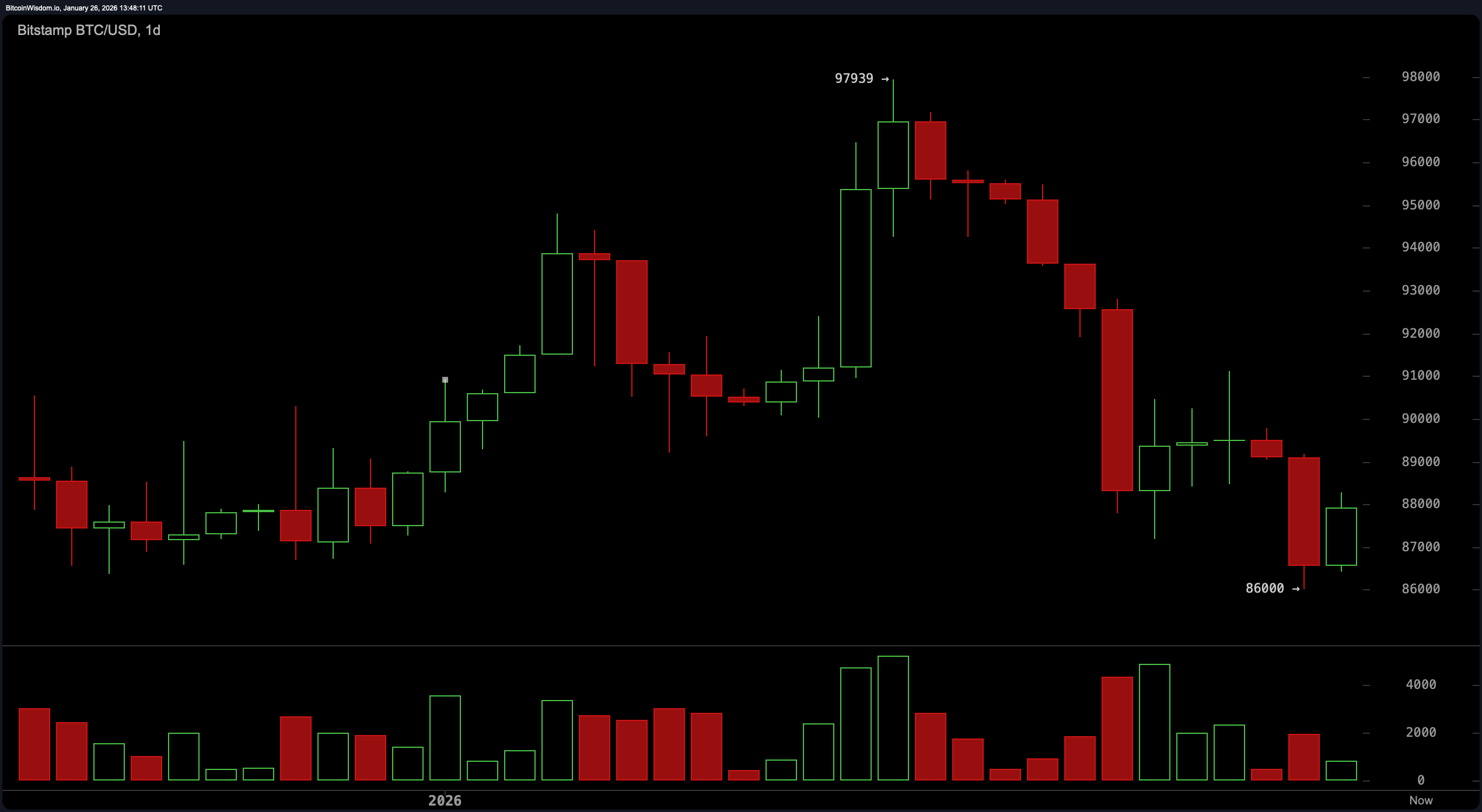

Bitcoin‘s daily chart offers the clearest view of bitcoin’s current mood—and it’s still sulking. After being spurned near the $97,939 level, the asset staged a dramatic descent to around $86,000, propelled by a volume surge that screamed panic selling or, more charitably, automated stop-loss cascades. Around $757 million in liquidations occurred over the last day as 189,853 derivatives traders lost their positions.

A modest recovery followed, but the weak, small-bodied candles suggest that buying appetite is as thin as air at the moment. The structure of lower highs and lower lows remains intact, reinforcing the idea that the bears are still running the show.

BTC/USD 1-day chart via Bitstamp on Jan. 26, 2026.

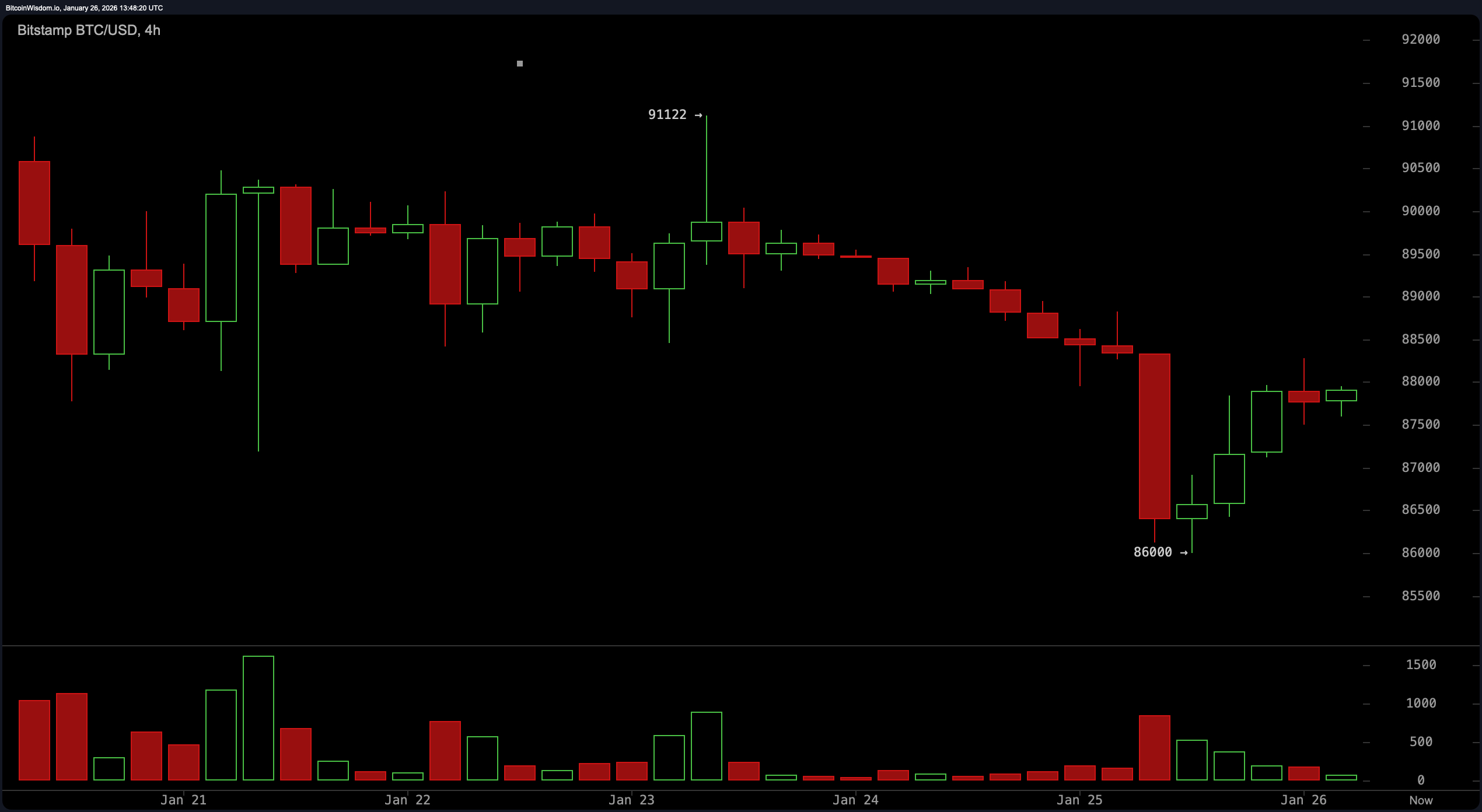

Zooming into the 4-hour chart reveals a textbook breakdown from approximately $89,000 to the aforementioned $86,000 support zone. While some optimistic souls might cheer the slight uptick and higher lows that followed, the resistance around $88,000 to $88,500 has proven to be more stubborn than a crypto maximalist at a fiat party. The dwindling volume during the climb adds insult to injury—this kind of price action reeks of a bear flag or a bearish pennant, both of which typically end in a downward flush.

BTC/USD 4-hour chart via Bitstamp on Jan. 26, 2026.

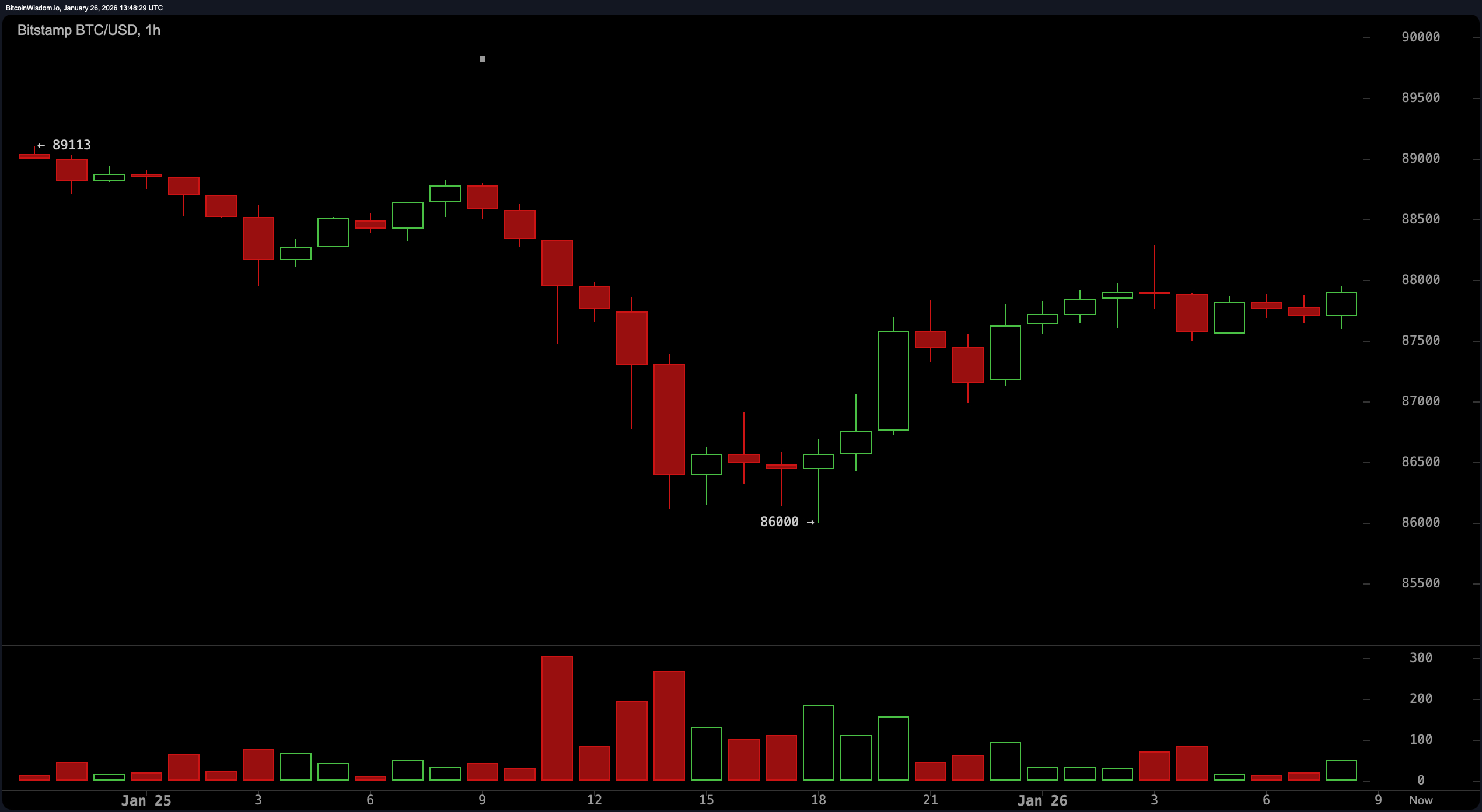

The 1-hour chart doesn’t offer much in the way of redemption either. Bitcoin is yo-yoing between $86,000 and just under $88,000, forming what might eventually become an accumulation zone—but let’s not get ahead of ourselves. Volume is drying up, and without a breakout above $88,500, this movement feels more like a tired retrace than a genuine reversal. Bulls will need to muster some serious strength to push past that resistance level with conviction.

BTC/USD 1-hour chart via Bitstamp on Jan. 26, 2026.

Oscillator readings reinforce the cautious stance. The relative strength index ( RSI) stands at 41, squarely in neutral territory, while the stochastic oscillator also reports a neutral reading of 13. The commodity channel index (CCI) and momentum indicators flash potential upward opportunities, but they’re tempered by the moving average convergence divergence ( MACD) level of -666—an ominous signal that leans decisively in the other direction.

As for moving averages (MAs), there’s no sugarcoating this trend. Every single short-, medium-, and long-term exponential and simple moving average—from the 10-period to the 200-period—are screaming the same refrain: downtrend. With prices trading well below these moving averages, ranging from $89,653 to a distant $104,982, it’s clear that bitcoin has its work cut out for it if it intends to change the narrative anytime soon.

Bull Verdict:

If bitcoin manages to decisively break above the $88,500 resistance with volume to match, the current range-bound structure could shift into a genuine reversal. A reclaim of the $91,000 level would further solidify bullish sentiment and potentially signal that the worst of the pullback is over. For now, bulls are on standby—watching, waiting, and hoping the accumulation phase isn’t just another mirage.

Bear Verdict:

The prevailing structure favors the bears. With every key moving average pointing down and volume drying up on weak upward moves, the momentum is tilted toward continued downside. Unless bitcoin reclaims $91,000 with authority, this looks more like a pause in a broader downtrend than any meaningful recovery.

- What is bitcoin’s current price?

Bitcoin is priced at $87,906 as of January 26, 2026. - Where is bitcoin finding support?

Strong support is holding around the $86,000 level. - What resistance is bitcoin facing now?

Bitcoin is struggling to break above the $88,500 resistance zone. - Is bitcoin in an uptrend or downtrend?

Current chart patterns and moving averages indicate a downtrend.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。