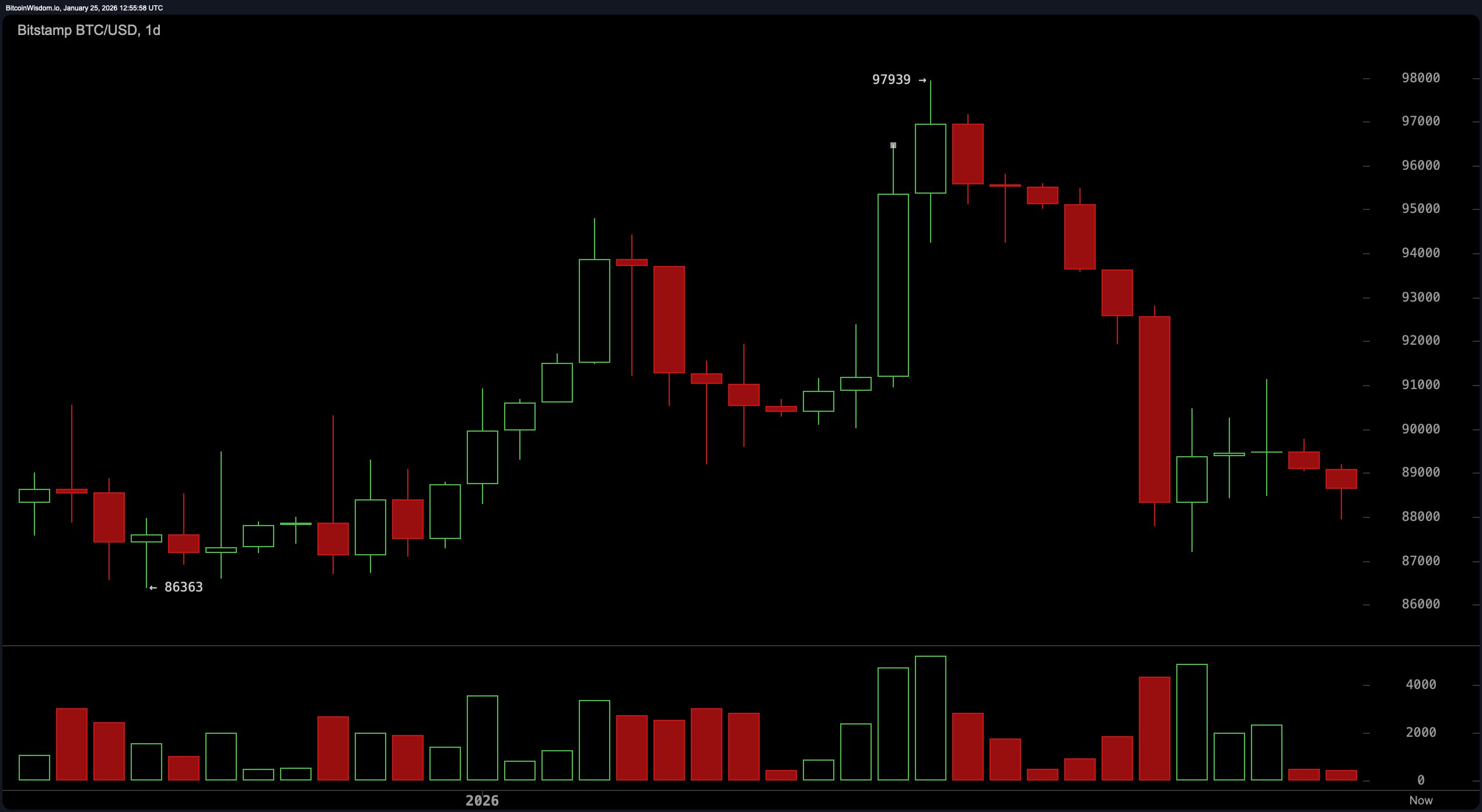

Across the daily chart, the trend has thrown on its bear costume and is stomping through the charts with conviction. Following a failed flirtation with $97,939, bitcoin plunged into a rapid descent, leaving a trail of red candles and panic sellers in its wake.

The current trading region near $88,000 aligns with a key support level, but without a convincing bounce or high- volume reversal, the script is still skewed bearish. Volume surges on the downside imply institutional offloading rather than retail enthusiasm. In short: this isn’t your friendly dip—it’s a structural unraveling.

BTC/USD 1-day chart via Bitstamp on Jan. 25, 2026.

Zooming in to the 4-hour chart, the price action looks like it’s stuck in a sulky sideways shuffle between $87,193 and $89,500. The trend reads as a short-term downtrend disguised as a consolidation—perhaps a bearish flag waving in slow motion. The market is indecisive, with fading volume that suggests buyer apathy and no strong momentum to shift the tides. Should price break above $89,500 with conviction, we might be looking at a short-term relief rally, but any hesitation near this resistance could easily give way to another leg down toward $85,000.

BTC/USD 4-hour chart via Bitstamp on Jan. 25, 2026.

On the 1-hour chart, we’re seeing a glimmer of defiance with a weak bounce from $87,957 nudging toward $88,500. However, the intraday trend is still sinking with lower highs and lingering seller dominance. While there’s an attempt to climb, the volume remains heavily skewed in favor of the bears. Rejection near $88,800 to $89,000 would keep the downtrend intact, whereas a clean break with follow-through could open the door for a quick move up to the $89,700–$90,000 range—assuming bitcoin remembers how to run.

BTC/USD 1-hour chart via Bitstamp on Jan. 25, 2026.

From a technical indicator perspective, the oscillators are a gallery of neutrality with a side of indecision. The relative strength index ( RSI) stands at 41, the Stochastic at 17, and the commodity channel index (CCI) at −102—all signaling a lack of momentum either way. The average directional index (ADX) sits at 25, reinforcing a low-trend strength environment. The Awesome oscillator, firmly in negative territory at −1,417, and momentum at −7,002 show bearish undertones, although the latter suggests a potential for reversal. The moving average convergence divergence ( MACD) level at −351 adds a bearish punctuation mark, contradicting the oscillator’s mixed cues.

As for the moving averages, the scoreboard reads like a red carpet of resistance. All major short- and long-term moving averages—exponential and simple alike—are trailing above the current price, flashing downside bias. The 10-day exponential moving average (EMA) at $90,406 and the 20-day simple moving average (SMA) at $91,900 are miles away from current price action, and even the heavy-hitters like the 200-day SMA at $105,133 aren’t lending support. The entire stack suggests bitcoin is swimming upstream in a market that’s not interested in catching it.

So while the chart may whisper of a bounce, the broader technical narrative is still muttering caution. Whether bitcoin claws its way back into bullish territory or tumbles further into correction depends on its ability to reclaim key levels—and shake off the bearish weight sitting firmly on its back.

Bull Verdict:

If bitcoin can break decisively above $89,000 with volume to match and reclaim the $90,000 level, it could signal the early stages of a recovery rally. A higher low formation near $88,000 would further strengthen the bullish case, potentially turning short-term sentiment from cautious to optimistic.

Bear Verdict:

As long as bitcoin remains pinned below key moving averages and fails to sustain a breakout above the $89,500 mark, bearish momentum remains in control. A break below $87,000 would likely confirm further downside pressure, dragging price action toward $85,000 and possibly lower in the sessions ahead.

- Where is bitcoin trading now?

Bitcoin is currently trading around $88,636, hovering near a key support zone. - Is bitcoin in a bullish or bearish trend?

The trend remains bearish across daily and 4-hour charts, with weak recovery signs. - What price levels should traders watch?

Key support is between $86,000 and $88,000, with resistance at $89,500 to $90,000. - What’s driving bitcoin’s current movement?

Institutional selling pressure and failed resistance retests are fueling bearish momentum.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。