The precious metals’ rally that closed 2025 has continued this year, with gold and silver leading the charge in a global market marred by uncertainty.

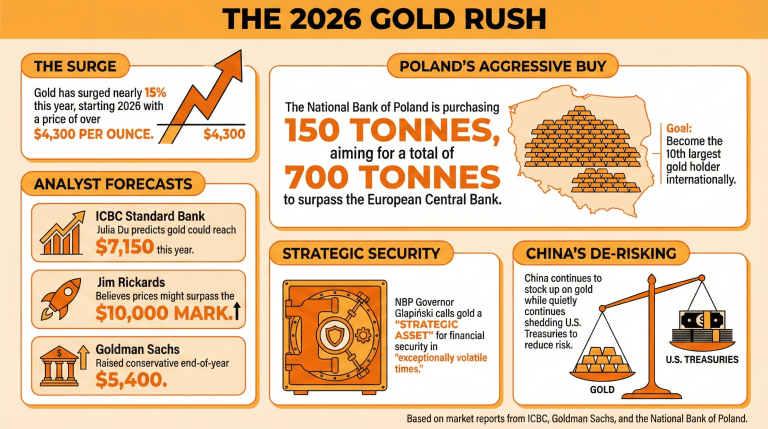

The prime metal has already surged by nearly 15% this year, starting 2026 with a price of over $4,300 per ounce, in a movement considered troubling and an indicator that some countries are pursuing a return to gold as their main reserve.

Analysts agree that gold forecasts are positive in the short and middle term, with ICBC Standard Bank’s Julia Du stressing that it might reach $7,150 per ounce this year. Jim Rickards believes that gold prices might reach and even surpass the $10,000 mark.

Even more conservative predictions are surprisingly bullish, with Goldman Sachs recently raising its end-of-year forecast from $4,900 to $5,400, as investors who purchased gold to diversify and hedge their holdings provide a floor to the price.

Central banks are also following suit, as there are signals that gold demand will remain hot this year. Recently, the National Bank of Poland (NBP) revealed plans to purchase 150 tonnes of gold, aiming to become the 10th largest gold holder internationally.

At the end of this accumulation period, Poland will have 700 tonnes of gold, owning more than the European Central Bank.

NBP governor Adam Glapiński was clear about the purpose of this acquisition, saying that gold was considered a strategic asset for the state’s financial security in “exceptionally volatile times.” He acknowledged that selling was out of the question even if gold prices face a significant correction.

China has also become a perennial gold buyer, as the country seems to be following a de-risking move by stocking up on gold and quietly shedding U.S. treasuries.

Read more: China Continues to Shed US Treasuries, Reaches Lowest Exposure Levels Since 2008

How has the price of gold changed at the beginning of 2026? Gold has surged nearly 15% this year, starting at over $4,300 per ounce, signaling a potential return to gold as a primary reserve for some countries.

What are the forecasts for gold prices this year? Analysts predict positive trends for gold, with estimates ranging from $7,150 by ICBC Standard Bank to potential highs over $10,000 according to Jim Rickards.

What actions are central banks taking regarding gold? The National Bank of Poland plans to purchase 150 tonnes of gold, aiming to enhance its financial security, ultimately holding 700 tonnes and surpassing the European Central Bank.

How is China positioning itself in the gold market? China is increasing its gold reserves while reducing its holdings of U.S. treasuries, aligning with a broader strategy of de-risking in response to global uncertainties.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。