The sell-off showed no signs of slowing. What began as post-holiday caution quickly hardened into full-scale capitulation, with crypto ETFs enduring another punishing session as investors continued to pull risk off the table.

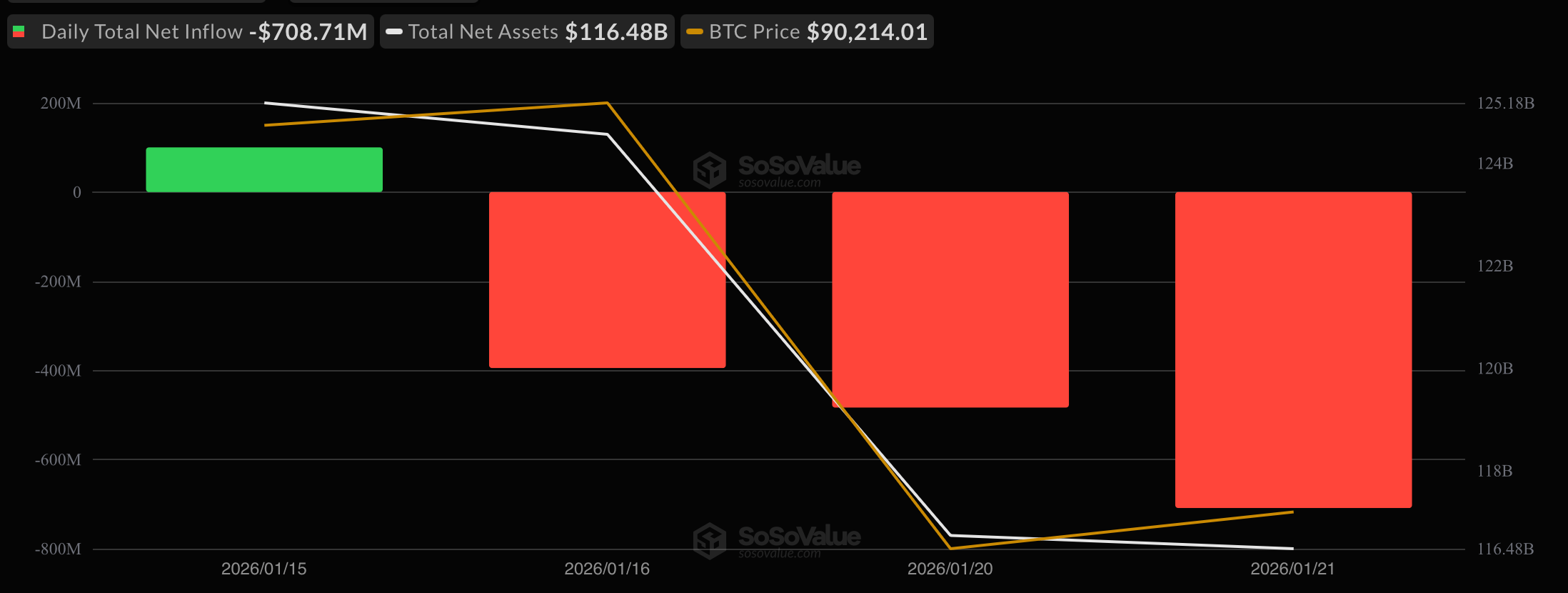

Bitcoin ETFs absorbed the heaviest blow, recording a $708.71 million net outflow as six funds closed firmly in the red. Blackrock’s IBIT and Fidelity’s FBTC accounted for the majority of the damage, shedding $356.64 million and $287.67 million, respectively.

Additional pressure came from ARKB, which lost $29.83 million, followed by Bitwise’s BITB at $25.87 million. Grayscale’s GBTC and Valkyrie’s BRRR rounded out the exits with losses of $11.25 million and $3.80 million. Trading activity remained elevated at $5.51 billion, while net assets slipped further to $116.48 billion.

Three days of successive outflows for Bitcoin ETFs worth $1.58 billion

Ether ETFs followed a similar path, posting a $297.51 million net outflow as red dominated nearly the entire complex. Blackrock’s ETHA led the decline with a $250.27 million exit, dwarfing losses elsewhere.

Fidelity’s FETH saw $30.89 million leave, while Grayscale’s ETHE shed $11.38 million. The lone bright spot was Grayscale’s Ether Mini Trust, which attracted $10.01 million, though it did little to offset broader selling. Additional outflows from TETH and ETHV pushed total volume to $2.20 billion, with assets easing to $18.28 billion.

XRP ETFs managed to swim against the current, posting a $7.16 million net inflow. Bitwise’s XRP led with $5.26 million, supported by smaller additions into Franklin’s XRPZ and Canary’s XRPC. Trading volume reached $29.94 million, keeping net assets steady at $1.39 billion.

Read more: ETF Carnage Returns as Bitcoin, Ether, XRP Suffer Heavy Post-Holiday Exits

Solana ETFs also finished in the green, pulling in $2.92 million. Vaneck’s VSOL, Fidelity’s FSOL, and Grayscale’s GSOL each contributed incremental inflows, lifting total trading volume to $45.68 million and closing assets at $1.10 billion.

Overall, the day reinforced a clear trend. Bitcoin and ether ETFs remain under sustained pressure as investors reduce exposure, while smaller pockets of resilience in XRP and Solana hint at selective positioning rather than broad-based confidence.

- Why did crypto ETF selling intensify midweek?

Investors continued de-risking after the holiday, triggering aggressive exits from bitcoin and ether funds. - How large were Bitcoin and Ether ETF outflows?

Bitcoin ETFs lost about $709 million, while Ether ETFs saw roughly $298 million in net outflows in one session. - Did any crypto ETFs see inflows despite the selloff?

Yes, XRP and Solana ETFs posted modest inflows, signaling selective rather than broad-based buying. - What does this mean for near-term market sentiment?

Persistent ETF outflows point to cautious sentiment, with confidence still concentrated outside BTC and ETH.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。