A calm holiday break did little to prepare investors for the shock that followed. When U.S. markets reopened, crypto exchange-traded funds (ETFs) were met with relentless selling, wiping out gains from the prior week and signaling a sharp shift in short-term sentiment.

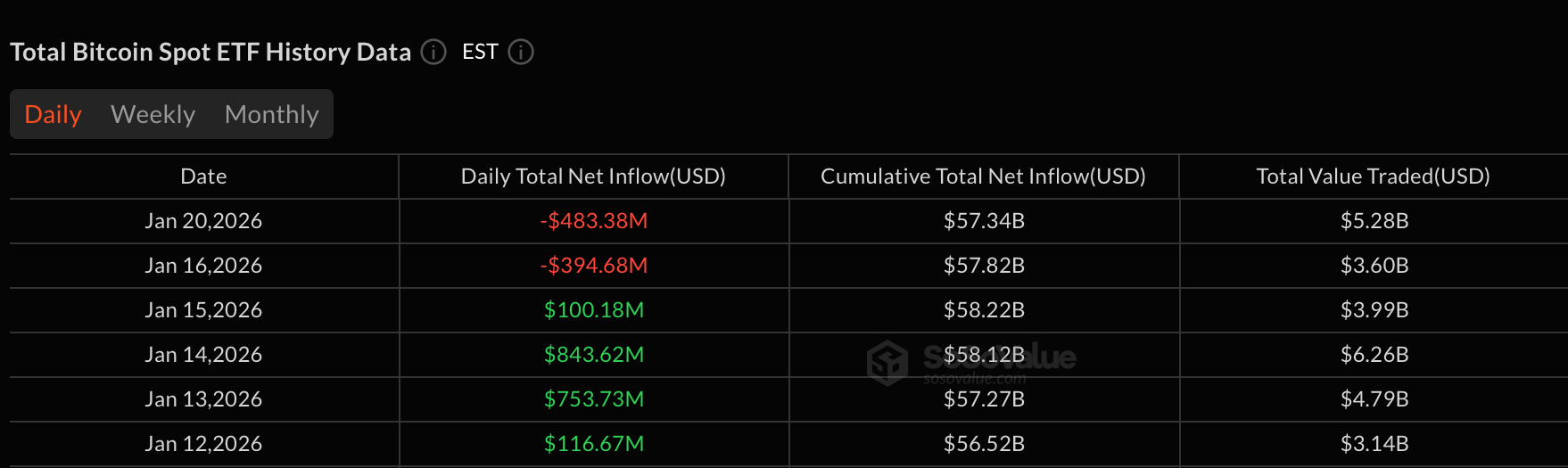

Bitcoin ETFs led the downturn, posting a $483.38 million net outflow as red dominated across nearly every fund. Grayscale’s GBTC and Fidelity’s FBTC absorbed the heaviest pressure, shedding $160.84 million and $152.13 million, respectively.

Blackrock’s IBIT, typically a stabilizing force, wasn’t spared this time, recording $56.87 million in outflows. ARKB and BITB followed with exits of $46.37 million and $40.38 million, while smaller losses filtered through HODL, EZBC, and BRRR. Trading activity surged to $5.27 billion, but assets slid to $116.73 billion, reflecting decisive de-risking.

Choppy trading conditions still persist for BTC ETFs with a mix of inflows and outflows.

Ether ETFs fared little better, logging a $229.95 million net outflow as selling spread across all six products. Blackrock’s ETHA led the decline with a $92.30 million exit, followed by Fidelity’s FETH at $51.54 million. Grayscale’s ETHE and Ether Mini Trust together lost nearly $50 million, while Bitwise’s ETHW and Vaneck’s ETHV added further pressure. Trading volume reached $2.23 billion, with net assets easing to $18.41 billion.

XRP ETFs saw one of their sharpest pullbacks yet, posting a $53.32 million net outflow. Grayscale’s GXRP drove the move with a $55.39 million exit, only marginally offset by a $2.07 million inflow into Franklin’s XRPZ. Total value traded came in at $34.74 million, with assets holding at $1.34 billion.

Read more: Bitcoin and Ether ETFs Post $1.9 Billion Weekly Inflow Despite Late Pullback

Solana ETFs stood alone in the green. A $3.08 million net inflow was powered by $2.25 million into Fidelity’s FSOL and $1.09 million into Franklin’s SOEZ, narrowly offsetting a small TSOL outflow. Trading volume reached $46.41 million, with assets closing at $1.07 billion.

In summary, the first session after the holiday delivered a sharp reset. Bitcoin and ether bore the brunt of profit-taking and risk reduction, XRP followed suit, and only solana showed resilience, highlighting a market still searching for conviction after an intense start to the year.

- What happened to crypto ETFs after markets reopened?

Crypto ETFs saw aggressive selling, with bitcoin and ether leading widespread outflows as risk appetite faded. - How severe were bitcoin and ether ETF outflows?

Bitcoin ETFs lost about $483 million and ether ETFs shed roughly $230 million in a single session. - Which crypto ETF showed resilience during the selloff?

Solana ETFs were the only category to post inflows, narrowly avoiding losses. - What does this mean for short-term crypto market sentiment?

The sharp outflows signal near-term caution as investors de-risk after a volatile start to the year.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。