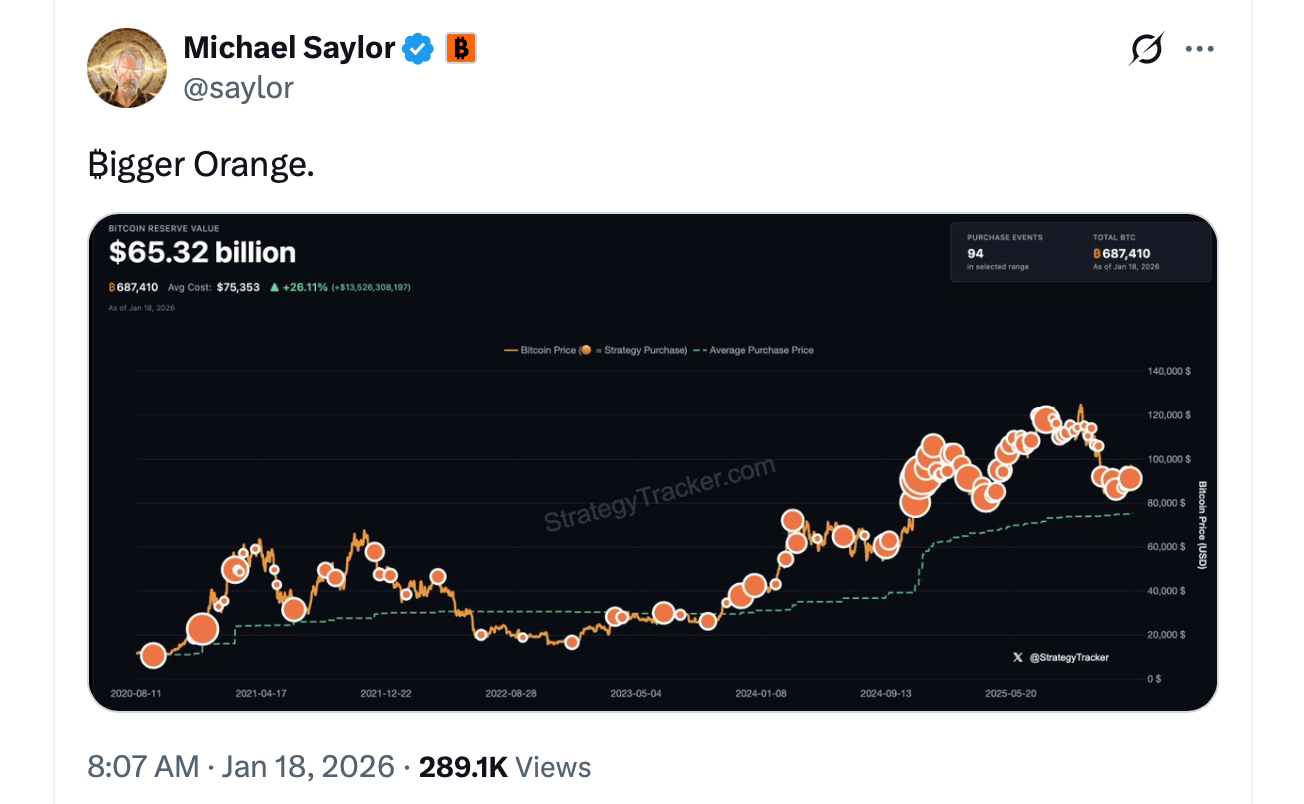

Just seven days earlier, on Sunday, Strategy’s Michael Saylor hopped onto X to share a similar tracker image, this time captioned “₿ig Orange.” The very next day, the publicly listed firm confirmed the acquisition of 13,627 BTC on X. With that pattern in mind, Sunday’s cryptic tease appears to point toward an even heftier bitcoin buy, set to be revealed at 8 a.m. Eastern on Monday morning.

Saylor explained last Monday, on Jan. 12, that Strategy snapped up 13,627 BTC for $1.25 billion, paying an average of $91,519 per bitcoin. While the billion-dollar buy barely nudged prices at the time, BTC has since climbed past $97,000 but is now lower, circling the $94,800 to $95,200 range as of Jan. 18. At present, the company holds 687,410 BTC, valued at a touch north of $65 billion.

Saylor’s ‘Bigger Orange’ hint shared on X.

That figure still tops the $51.80 billion spent since the firm’s first purchase, translating to a dollar-cost average of $75,353 per bitcoin. According to company data, Strategy’s market Net Asset Value, or mNAV, sits at 1.07. In simple terms, the figure measures the ratio between the firm’s enterprise value — its fully diluted market capitalization adjusted for debt and cash — and the current market value of its total bitcoin holdings.

Also read: Report: Anchorage Digital Seeks $200M–$400M Ahead of Potential IPO

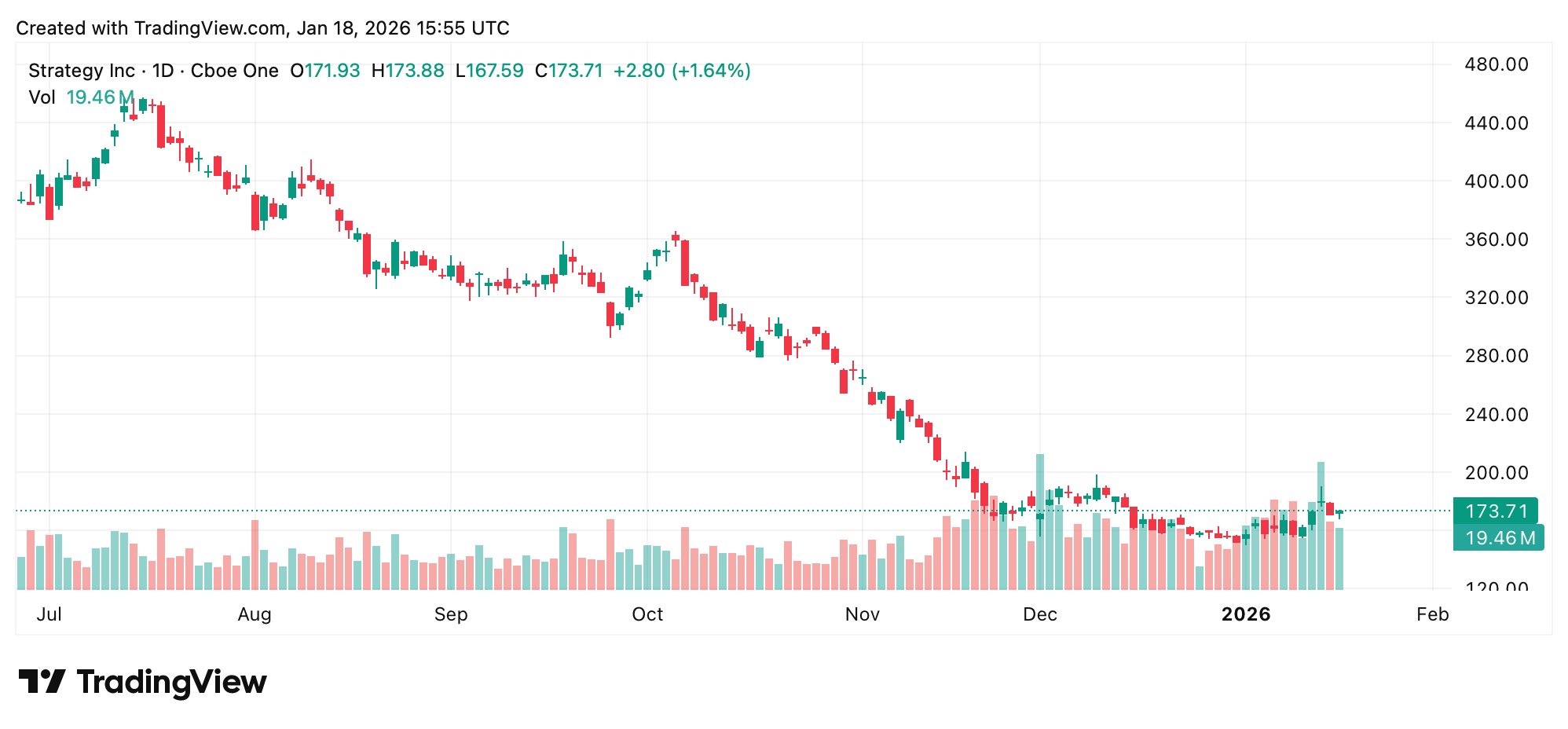

With the metric at 1.07, the company’s fully diluted market capitalization is trading at a modest premium to the real-time value of its bitcoin treasury. As for stock performance, the Nasdaq-listed MSTR has had a solid start to 2026, posting a year-to-date gain of 12.37%. Zooming out, the picture looks rougher, with MSTR down 61% over the past six months, though recent price action shows it clawing its way back. Over the past month, shares have been up 3.5%, gained 4% last week, and finished Friday with a 1.6% lift.

MSTR stock.

If history is any guide, Saylor’s color-coded breadcrumbs rarely lead nowhere. With Strategy’s bitcoin hoard already towering over peers and its balance sheet pricing in a mild premium, the market now waits for Monday morning to see whether “₿igger Orange” signals another heavyweight addition. At present, Strategy’s bitcoin stash sits just 12,590 BTC shy of the 700,000 milestone. If “₿igger Orange” lives up to its name and tops the 13,627 BTC haul tied to “₿ig Orange,” the company would cruise past the 700,000 mark with room to spare.

- What does “₿igger Orange” mean? It’s Michael Saylor’s cryptic signal that Strategy may be preparing another sizable bitcoin purchase.

- How close is Strategy to 700,000 BTC? The company is just 12,590 BTC away from reaching the 700,000 bitcoin milestone.

- When could a new Strategy bitcoin buy be announced? Based on past patterns, an update will likely arrive at 8 a.m. Eastern on Monday.

- Why does Strategy’s bitcoin strategy matter to markets? The firm’s large-scale purchases often shape investor sentiment around corporate bitcoin treasuries.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。