Mike McGlone, senior commodity strategist at Bloomberg Intelligence, shared on social media platform X on Jan. 17 observations on silver’s position within long-term market cycles after reviewing a long-term silver price chart highlighting historical extremes.

He stated:

“Silver may set a multiyear high in 2026, if history is a guide.”

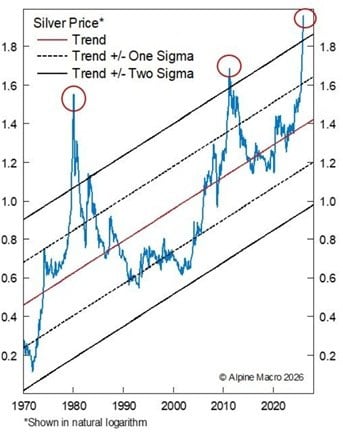

McGlone’s comment responded directly to a silver price chart showing the metal’s movement within a rising multi-decade trend channel, with several prior peaks marked near the upper statistical bands. The chart illustrated how previous instances of similar price extensions were followed by extended periods of consolidation or reversal, reinforcing the idea that extreme deviations from trend have historically signaled major inflection points. Another market observer described silver as “The three-sigma asset,” reinforcing the view that the metal has reached statistically extreme levels relative to its historical distribution.

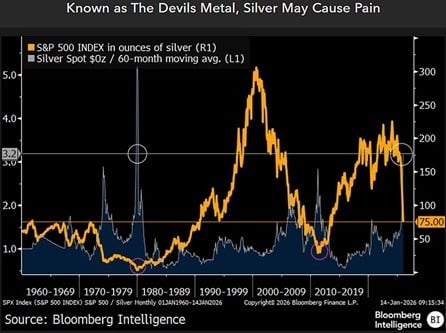

Earlier, on Jan. 15, McGlone shared a separate post accompanied by a second chart comparing silver’s value with the S&P 500 measured in ounces of silver and its premium to a 60-month moving average. That comparison emphasized how relative valuation, rather than nominal price alone, can highlight periods of stress or opportunity across asset classes, particularly during transitions between equity leadership and hard assets.

Read more: Robert Kiyosaki Predicts $107 Silver on Monday as Market Faces Sudden Supply Shock

In that Jan. 15 post, McGlone detailed more extreme metrics pointing to silver’s stretched positioning versus historical norms. He explained:

“Silver may see $100 and set a peak for years – About 75 ounces of silver equal to the S&P 500 on Jan. 14 is the lowest since 2013, and the metal’s 3.2x premium to its 60-month moving average is the highest since the Hunt brothers tried to corner the market in 1979.”

That comparison underscored how far silver has moved above its long-term trend, a degree previously observed only during past speculative peaks, framing the metal as an asset approaching a potentially decisive phase.

- Why does Mike McGlone believe silver could reach a multiyear high in 2026?

McGlone notes that silver’s current price behavior mirrors past statistical extremes within a long-term rising trend, which historically preceded major peaks and multi-year turning points. - What does the term “three-sigma asset” imply for silver investors?

It suggests silver has moved to statistically rare levels relative to its historical distribution, a condition that has often aligned with speculative excess and elevated reversal risk. - How does silver’s valuation versus the S&P 500 affect investment outlook?

Measured in ounces of silver, the S&P 500 ratio is at its lowest since 2013, signaling silver’s relative outperformance and a possible shift away from equity dominance. - Why is silver’s premium to its 60-month moving average significant?

At over three times its long-term average—levels last seen during the 1979 Hunt brothers episode—the premium indicates silver may be nearing a historically decisive peak for long-term investors.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。