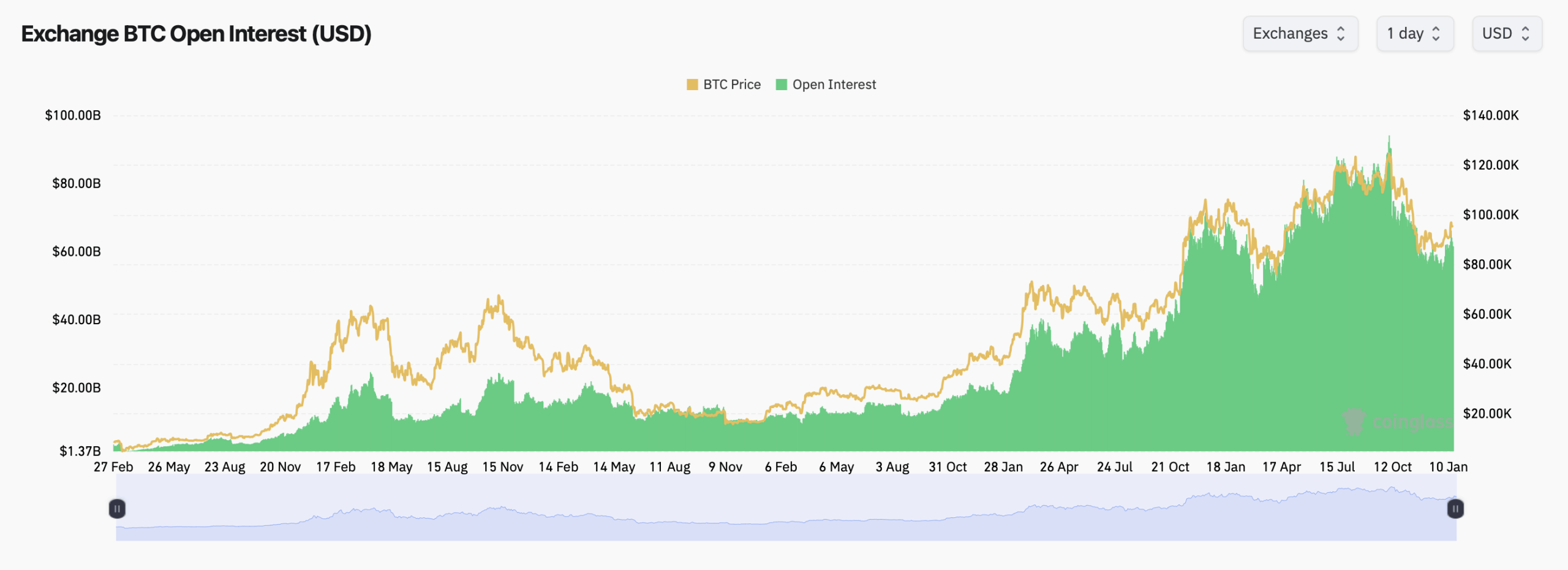

Aggregate bitcoin futures open interest currently sits at roughly 646,850 BTC, translating to about $61.48 billion in notional value, according to coinglass.com stats. While total open interest ticked slightly higher over the past hour and four-hour window, the 24-hour reading slipped by nearly 2%, hinting at selective trimming rather than a broad exit from leverage.

Among futures venues, Binance leads the pack this weekend with approximately 129,540 BTC in open interest, accounting for just over 20% of the global total. CME follows closely with 122,640 BTC, reinforcing its role as a preferred venue for institutional positioning. OKX, Bybit, Gate, and MEXC round out the upper tier, each carrying meaningful exposure despite mixed short-term changes in positioning.

Futures open interest on Jan. 18, 2026, via coinglass.com stats.

Market action across exchanges paints a split picture. Binance and OKX posted modest gains in open interest over the past day, while CME and Bybit saw mild contractions. The churn suggests traders are rotating exposure rather than abandoning bets outright, keeping leverage elevated as price coils near familiar territory.

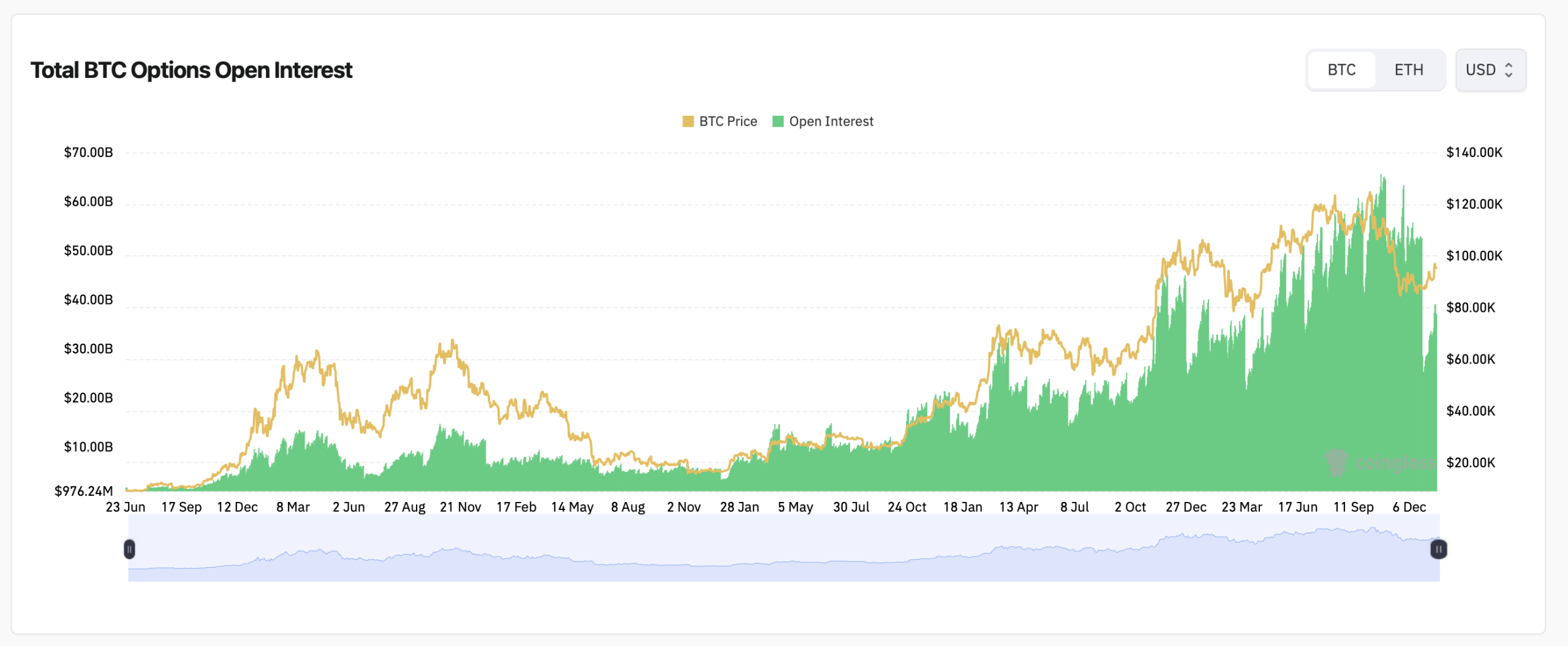

Bitcoin options markets, meanwhile, continue to balloon. Total options open interest now approaches $36.88 billion, tracking closely with price as traders load contracts across multiple expiries. Deribit remains the undisputed heavyweight, hosting the largest share of contracts and the most actively traded strikes.

Options open interest on Jan. 18, 2026, via coinglass.com stats.

Calls still dominate the options landscape by a noticeable margin. Roughly 57% of total options open interest is tied to call contracts, representing more than 209,000 BTC, while puts account for about 43%, or roughly 157,000 BTC. The skew suggests traders are still leaning bullish over the longer term, even if near-term caution lingers.

Short-term volume tells a different story. Over the past 24 hours, put options slightly outpaced calls, capturing more than 55% of daily options volume. That imbalance hints at tactical hedging and downside insurance as traders brace for potential turbulence around upcoming expiries.

Max pain levels offer another layer of insight. On Deribit, the largest concentration of notional value clusters near the $90,000 to $93,000 range for late January expirations, with additional pressure zones emerging around $95,000. These levels often act as magnets as expiry approaches, much to the frustration of overly confident speculators.

Also read: Battle at $95K: Can Bitcoin Bulls Hold the Line?

Binance’s options market shows a different flavor. Max pain there sits closer to $100,000, with significant notional value stacked at strikes between $95,000 and $105,000. The setup suggests traders on Binance are positioning for broader price swings rather than tight consolidation.

Max pain positioning on OKX leans slightly lower, with max pain drifting toward the low-$90,000 region across several expiries. Combined with rising notional value at select strikes, the data points to cautious optimism wrapped in a thick layer of hedging.

Taken together, bitcoin’s derivatives markets reflect conviction without complacency. Futures traders remain engaged, options players are actively sculpting risk, and price continues to orbit a zone where leverage, psychology, and patience collide.

- What does high bitcoin futures open interest indicate?

It signals strong trader participation and elevated leverage across derivatives markets. - Why are calls dominating bitcoin options open interest?

Call-heavy positioning suggests traders expect higher prices over longer time horizons. - What is max pain in bitcoin options?

Max pain is the price level where the most options expire worthless, often acting as a short-term gravitational zone. - Which exchanges dominate bitcoin derivatives trading?

Binance, CME, OKX, Bybit, and Deribit account for a large bulk of futures and options activity.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。