This report is authored by Tiger Research and presents our market outlook for Bitcoin in the first quarter of 2026, setting a target price of $185,500.

Key Points

- Macroeconomic Stability, Slowing Momentum: The Federal Reserve's interest rate cut cycle and M2 money supply growth remain on track. Nevertheless, the outflow of $4.57 billion from ETFs has impacted short-term trends. The advancement of the "CLARITY Act" may become a key factor in attracting large banks to enter the market.

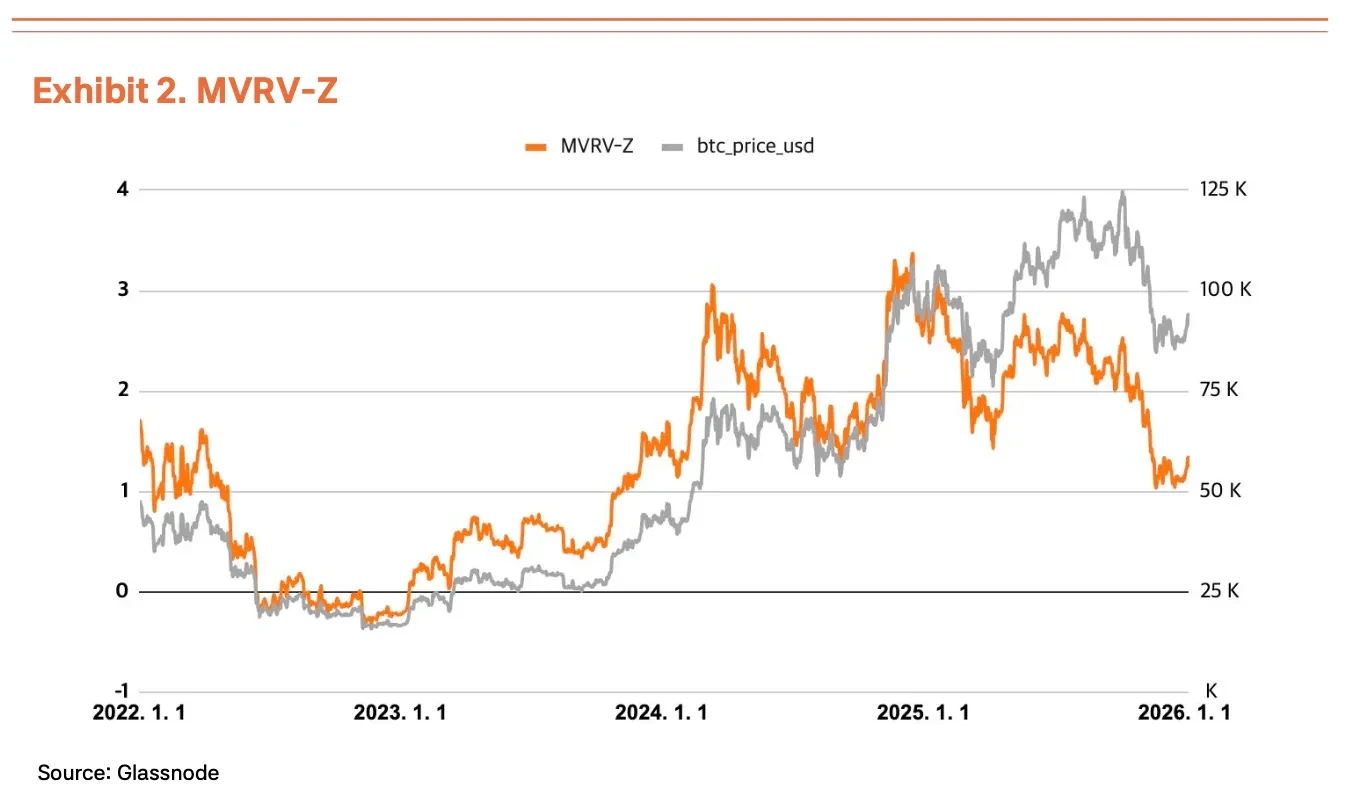

- On-chain Indicators Shift to Neutral: Buy-side demand around $84,000 has formed a solid bottom support; while $98,000, as the cost line for short-term holders, currently constitutes a major resistance level. Key indicators like MVRV-Z show that the market is currently at a fair value state.

- Target Price of $185,500, Maintaining Bullish View: Based on a baseline valuation of $145,000 and a +25% macro factor adjustment, we set the target price at $185,500. This implies approximately 100% upside potential from the current price.

Macroeconomic Easing Maintained, Growth Momentum Weakens

Bitcoin is currently trading around $96,000. Since we released our previous report on October 23, 2025, the price has dropped by 12%. Despite recent pullbacks, the macro backdrop supporting Bitcoin remains solid.

Federal Reserve Path Maintains Dovish Stance

Source: Tiger Research

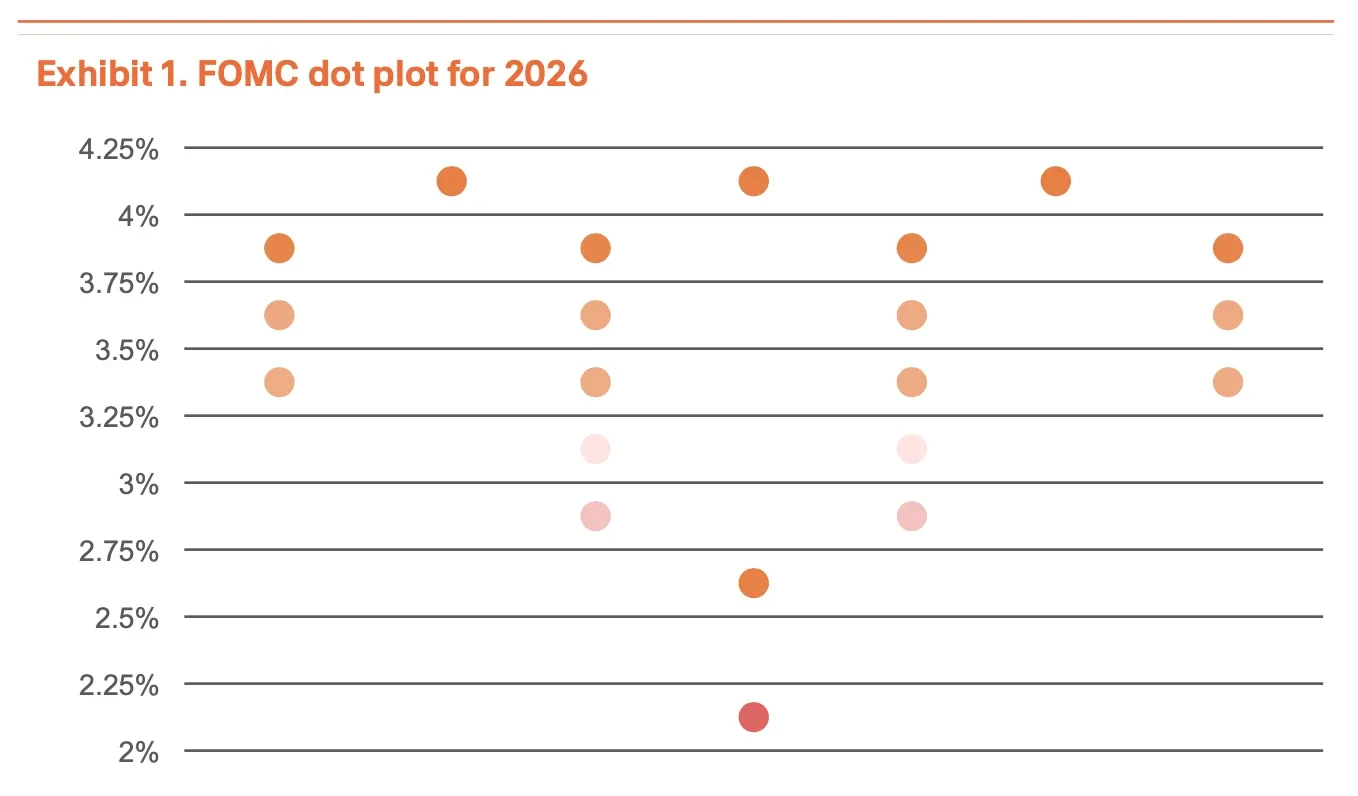

The Federal Reserve cut interest rates three times from September to December 2025, totaling a reduction of 75 basis points, with the current rate in the 3.50%—3.75% range. The December dot plot projects that rates will drop to 3.4% by the end of 2026. While a 50 basis point or larger single cut is unlikely this year, the potential appointment of a more dovish successor to Powell, whose term ends in May, could ensure the continuation of monetary easing trends.

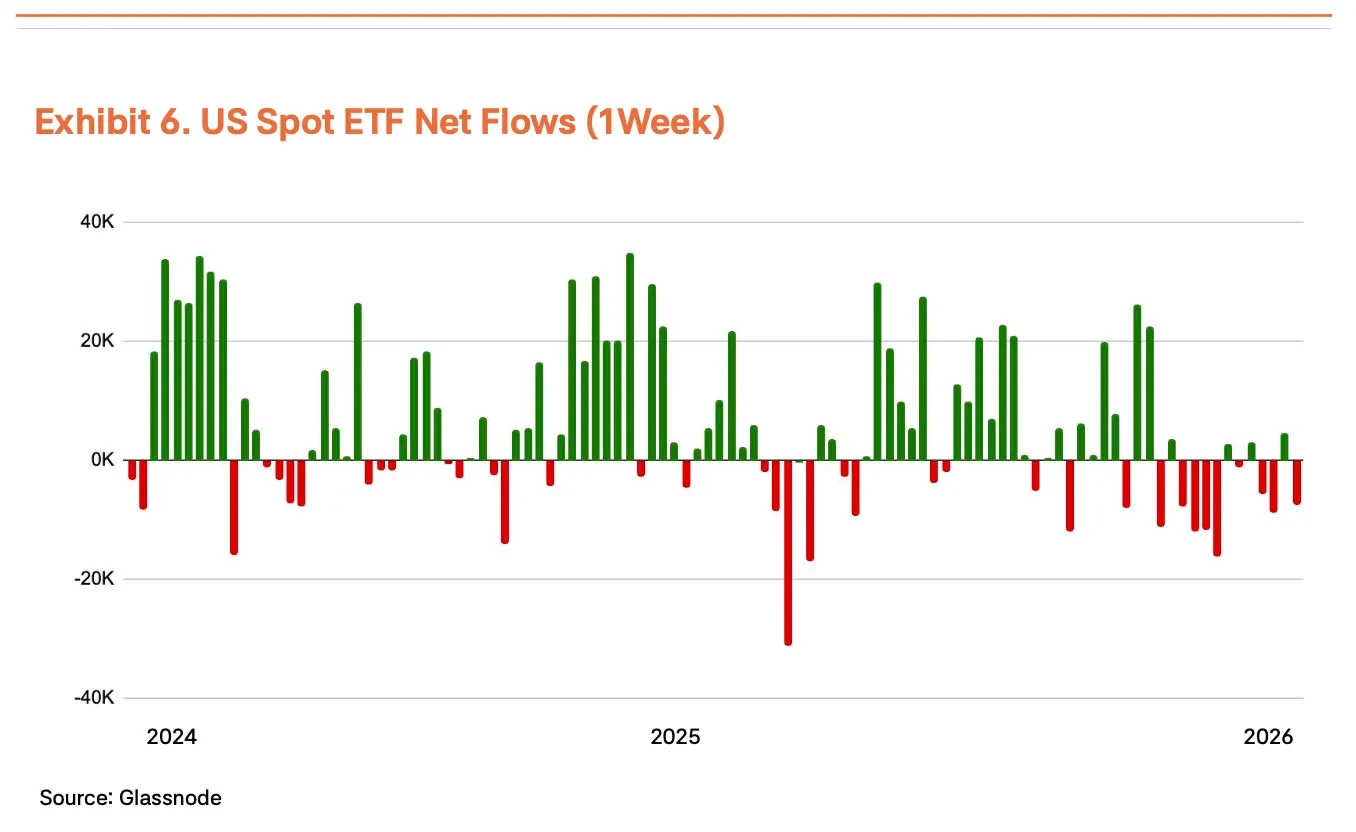

Institutional Outflows and Continued Corporate Buying

Despite a favorable macro environment, institutional demand has recently been lackluster. Spot ETFs recorded an outflow of $4.57 billion during November and December, marking the largest outflow since the product's launch. The annual net inflow was $21.4 billion, down 39% from last year's $35.2 billion. Although January's asset rebalancing brought some inflows, the sustainability of the rebound remains to be seen. Meanwhile, companies like MicroStrategy (holding 673,783 BTC, about 3.2% of total supply), Metaplanet, and Mara continue to increase their holdings.

The "CLARITY Act" as a Policy Catalyst

Against the backdrop of stagnant institutional demand, regulatory progress is becoming a potential driving force. The "CLARITY Act," passed by the House of Representatives, clarifies the jurisdictional boundaries between the SEC and the CFTC and allows banks to provide digital asset custody and staking services. Additionally, the act grants the CFTC regulatory authority over the digital commodity spot market, providing a clear legal framework for exchanges and brokers. The Senate Banking Committee is scheduled to review it on January 15, and if passed, it could prompt traditional financial institutions that have been waiting on the sidelines to formally enter the market.

Ample Liquidity, Bitcoin Underperformance

Liquidity is another key variable aside from regulation. The global M2 supply reached a historical high in the fourth quarter of 2024 and continues to grow. Historically, Bitcoin tends to lead liquidity cycles, usually rising before M2 peaks and entering consolidation during peak phases. Current signs indicate that liquidity will further expand, suggesting that Bitcoin still has upside potential. If stock market valuations appear too high, funds are likely to rotate into Bitcoin.

Macro Factor Adjusted to +25%, Outlook Remains Robust

Overall, the macro direction of interest rate cuts and liquidity expansion remains unchanged. However, considering the slowdown in institutional inflows, uncertainties surrounding the Federal Reserve leadership transition, and rising geopolitical risks, we have adjusted the macro adjustment factor from +35% to +25%. Despite this adjustment, the weight remains in a positive range, and we believe that regulatory progress and continued M2 expansion will provide core support for medium to long-term increases.

$84,000 Support and $98,000 Resistance

On-chain indicators provide auxiliary signals for macro analysis. During the adjustment period in November 2025, buy-side funds concentrated around $84,000, forming a clear support zone. Bitcoin has now broken through this range. The $98,000 level corresponds to the average cost for short-term holders, constituting recent psychological and technical resistance.

On-chain data shows that market sentiment is shifting from short-term panic to neutral. Key indicators such as MVRV-Z (1.25), NUPL (0.39), and aSOPR (1.00) have all moved out of the undervalued zone and into a balanced range. This means that while the likelihood of a panic-driven explosive rise has decreased, the market structure remains healthy. Combined with the macro and regulatory backdrop, there is still ample statistical basis for a medium to long-term price increase.

It is worth noting that the current market structure is significantly different from previous cycles. The increase in institutional and long-term capital proportions has reduced the probability of panic selling driven by retail investors. Recent pullbacks have manifested more as gradual rebalancing. While short-term volatility is inevitable, the overall upward structure remains intact.

Target Price Adjusted to $185,500, Bullish Outlook Firm

Applying the TVM valuation framework, we derive a neutral baseline valuation of $145,000 for the first quarter of 2026 (slightly lower than the $154,000 in the previous report). Combining a 0% fundamental adjustment and a +25% macro adjustment, we set the revised target price at $185,500.

We have adjusted the fundamental adjustment factor from -2% to 0%. Although there has been little change in network activity, the market's renewed focus on the BTCFi ecosystem has effectively offset some bearish signals. At the same time, due to the aforementioned slowdown in institutional inflows and geopolitical factors, we have lowered the macro adjustment factor from +35% to +25%.

This target price adjustment should not be seen as a bearish signal. Even after the adjustment, the model still indicates that the market has approximately 100% potential upside. The lower baseline price primarily reflects recent volatility, while Bitcoin's intrinsic value will continue to rise in the medium to long term. We believe that the recent pullback is part of a healthy rebalancing process, and the medium to long-term bullish outlook remains unchanged.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。