Market attention is shifting toward forward-looking drivers in crypto. Asset manager Grayscale shared on social media platform X on Jan. 13 that it no longer views post-Oct. 10 deleveraging as a meaningful factor for valuations in recent weeks, pointing instead to stabilization and emerging fundamentals.

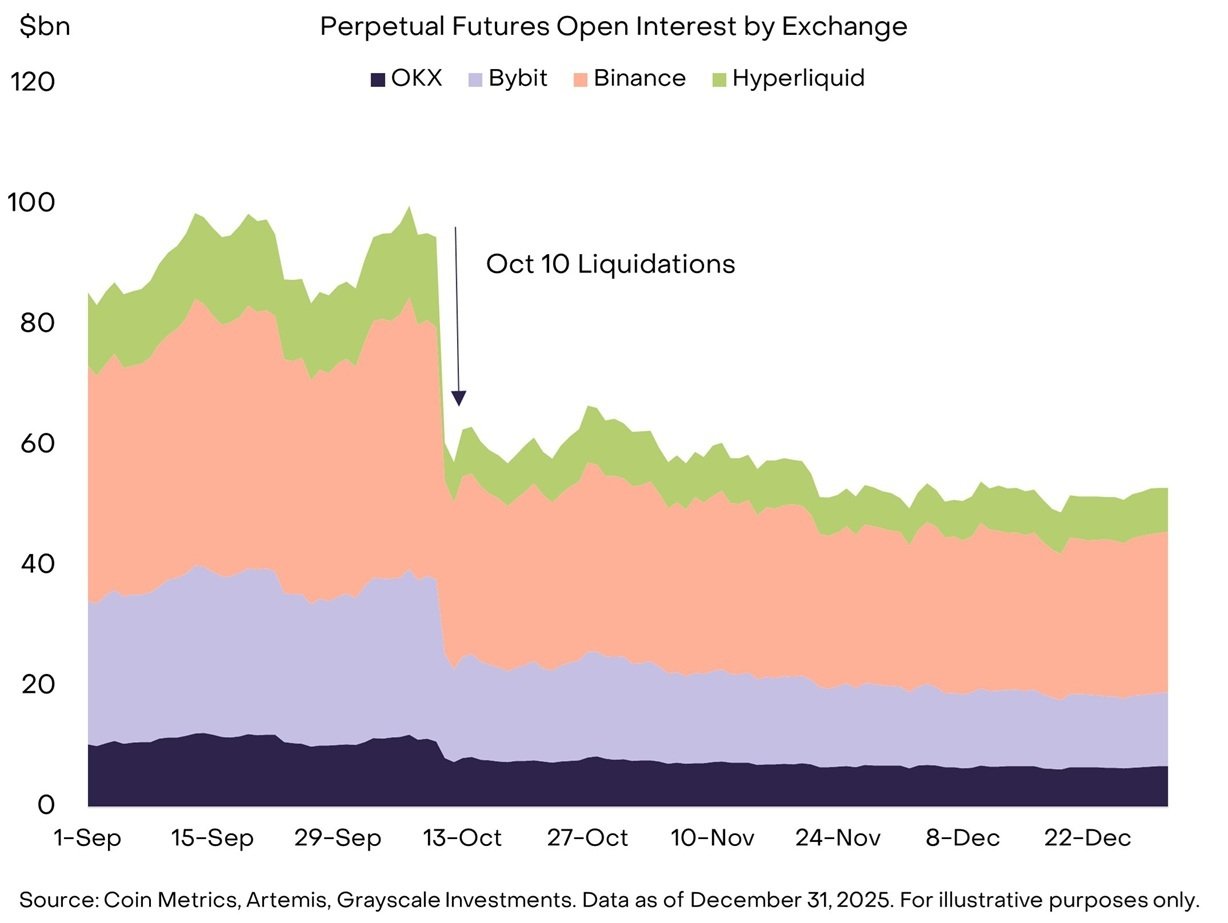

Crypto derivatives markets underwent a sharp reset in October after large-scale liquidations swept through perpetual futures. Open interest across OKX, Bybit, Binance, and Hyperliquid fell abruptly from roughly $90 billion–$100 billion in late September to near $55 billion following the Oct. 10 event, according to data included in Grayscale’s research. After that decline, aggregate open interest moved sideways through November and December, holding close to $50 billion rather than continuing to unwind, with Binance and Bybit accounting for the largest shares and OKX and Hyperliquid maintaining smaller but steady portions.

Against that backdrop, the firm wrote:

“As a result, we no longer believe that post-October 10 deleveraging has been a meaningful driver of valuations in recent weeks.”

It affirmed: “ Crypto futures markets across OKX, Bybit, Binance, and Hyperliquid experienced a sharp deleveraging event on October 10, 2025, but open interest stabilized in December.”

Read more: Grayscale Predicts 10 Crypto Investing Themes Fueling Upside Across 6 Crypto Sectors

That stabilization shaped Grayscale’s broader assessment of December market conditions. Futures open interest increased marginally during the month, while options open interest declined largely because of concentrated expirations, reinforcing the view that leverage was steady but not rebuilding aggressively. The relatively flat trajectories across the four exchanges suggested traders maintained exposure after the October reset rather than exiting derivatives markets altogether. Combined with narrow bitcoin price ranges, subdued volatility, and lighter spot volumes, the derivatives data supported the interpretation of December as a consolidation phase.

Grayscale also highlighted the absence of meaningful selling by long-term bitcoin holders, easing concerns about structural supply pressure. With tax-driven flows fading, regulatory milestones approaching, and institutional tokenization and protocol development accelerating, the firm emphasized that future crypto valuations are increasingly likely to be shaped by fundamentals and policy clarity rather than residual effects from October’s deleveraging.

- What happened to crypto futures markets in October 2025?

Major exchanges saw a sharp deleveraging event that significantly reduced open interest. - Which exchanges were most affected by the deleveraging?

Binance and Bybit held the largest shares of futures open interest before and after the drawdown. - Why does Grayscale say leverage is no longer driving valuations?

Futures open interest stabilized into December instead of continuing to unwind. - What does the stabilization suggest about late-2025 market conditions?

It points to consolidation and a reset rather than ongoing stress in crypto markets.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。