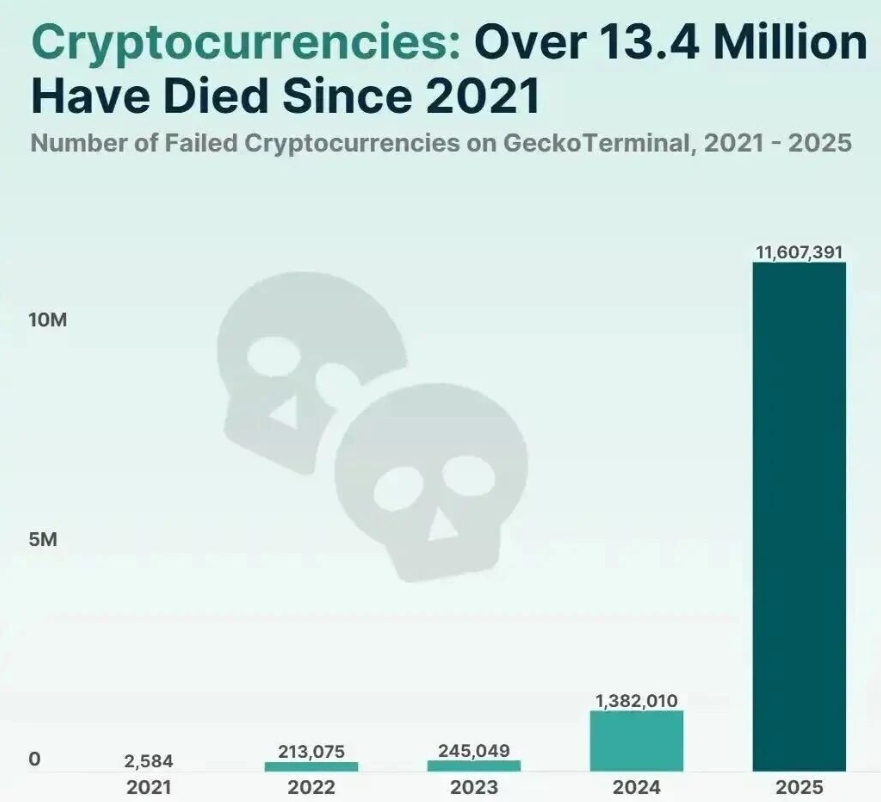

A set of cold data reveals a harsh reality: more than half of cryptocurrencies have gone to zero, with 11.6 million tokens disappearing from the market in 2025 alone. In the fourth quarter of 2025, as many as 7.7 million tokens vanished from the market, accounting for 66.4% of the total tokens that went to zero that year.

Data shows that the total number of cryptocurrency projects skyrocketed from 428,000 in 2021 to nearly 20.2 million in 2025, a 47-fold increase over five years. These figures not only document the bursting of the market bubble but also signal a historic turning point the crypto industry is experiencing.

1. Data Warning

● Data from the GeckoTerminal platform reveals the harsh reality of the cryptocurrency market. By the end of 2025, more than half (53.2%) of cryptocurrencies have completely gone to zero, a shocking figure.

● Even more concerning is the time distribution— the vast majority of zero events occurred in 2025. In that year alone, approximately 11.6 million tokens lost all value, accounting for 86.3% of all tokens that went to zero from 2021 to 2025.

● The fourth quarter became a concentrated outbreak period for token failures, with 7.7 million tokens collapsing in a single quarter, representing 34.9% of all recorded project failures. In contrast, the number of tokens that went to zero in 2024 was only close to 1.4 million, starkly contrasting with the data from 2025.

2. Fundamental Reasons

● The sharp decline in the threshold for token issuance is a direct cause of the market oversaturation. Due to the ease of launching tokens on issuance platforms, a large number of low-cost "meme coins" and projects flooded the market.

● The total number of cryptocurrency projects surged from 428,000 in 2021 to nearly 20.2 million in 2025, an increase of nearly 47 times over five years. This explosive growth reflects the disappearance of market entry barriers, allowing anyone to create and issue tokens at almost no cost.

● Analysis indicates that the sharp decline in token survival rates is closely related to the market turmoil throughout the year, with the meme token sector being particularly hard hit. Most of these tokens lack real use cases and sustainable business models, relying entirely on market speculation and community enthusiasm to maintain value.

3. Historical Background

● In March 2025, a historic event brought fundamental changes to the cryptocurrency market. President Trump signed an executive order to establish a strategic Bitcoin reserve for the U.S. government, officially designating Bitcoin and several other cryptocurrencies held by the government as reserve assets.

● This policy shift marks a recognition of cryptocurrencies in the mainstream. They are no longer seen merely as high-risk speculative tools but are officially recognized by the U.S. government as a means of value storage.

● A series of policy positions from the Trump administration, including multiple public endorsements of cryptocurrencies, accepting crypto donations on campaign websites, and criticizing the regulatory approach of the U.S. Securities and Exchange Commission (SEC), are seen as clear signals of support for the crypto industry. While it is difficult to quantify the specific impact of these statements on the market, they undoubtedly injected optimism into the market.

4. Market Turning Point

● Behind the large number of tokens going to zero is a profound structural change the cryptocurrency market is undergoing. As Chris Kuiper, Vice President of Research at Fidelity Digital Assets, pointed out: “The structure and categories of investors are undergoing a complete transformation.”

● This transformation means that funds are no longer blindly chasing every new project but are more rationally flowing towards assets with real value and clear use cases. The market is transitioning from a "casino narrative" to a "utility narrative."

● The traditional four-year cycle of Bitcoin may be changing. Some investors believe that with the involvement of sovereign nations and institutional funds, the traditional four-year cycle of cryptocurrencies may have come to an end, and the market may be entering a super cycle where bull markets last for years.

5. Token Classification

In the wave of tokens going to zero, different categories of projects exhibit significant survival differences. According to market analysis, cryptocurrency projects can be classified into several categories:

● Meme coins and speculative tokens have become the hardest hit by the wave of zeroes. These tokens typically have no real use and rely entirely on community speculation and market sentiment, quickly going to zero when the hype fades.

● Public chains and Layer 2 projects lacking innovation also face severe challenges. Over 50 other L2 projects experienced a 61% decline in users in 2025, becoming "zombie chains."

● In contrast, projects with actual cash flow and utility show stronger survival capabilities. The market valuation logic is returning to revenue-based metrics, with those directly owning users and generating cash flow—wallets, front-end applications, and super applications—expected to have valuations that surpass underlying infrastructure.

6. Future of the Industry

● The crypto industry stands at a critical juncture, transitioning from "speculation-driven" to "systematic value integration." Multiple institutions predict that 2026 will be a key turning point for the crypto industry, shifting from retail speculation to institutional dominance.

● Bitcoin's position will be further solidified, potentially breaking the traditional four-year cycle model. Funds from institutional giants like BlackRock and Fidelity will operate through compliant DeFi channels, introducing trillions in liquidity to the on-chain world.

● Market differentiation will become more pronounced. Chris Kuiper, Vice President of Research at Fidelity Digital Assets, stated: “Traditional fund managers and investors have begun purchasing Bitcoin and other digital assets, but in terms of the scale of funds they may bring into this space, we have only scratched the surface.”

● For most ordinary investors, this means that investment strategies need to be adjusted. Institutions recommend adopting a dollar-cost averaging strategy to allocate Bitcoin alongside mainstream assets, focusing on DeFi protocols and stablecoin applications with actual revenue, and avoiding chasing high FDV projects with no returns.

The explosive growth of cryptocurrency projects from 428,000 to nearly 20.2 million is rapidly contracting. More than half of the tokens have gone to zero, with an astonishing 11.6 million occurring in 2025 alone.

The market landscape is undergoing fundamental changes driven by policy recognition and institutional funds. These digital assets, once only in the sights of tech geeks and speculators, are being redefined as tools for value storage and financial infrastructure.

As market participants in 2026 review their portfolios, a harsh and clear screening criterion has emerged: tokens without actual utility and cash flow are likely to become the next digital tombstones on the list of those that went to zero.

Join our community to discuss and grow stronger together!

Official Telegram community: https://t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

OKX benefits group: https://aicoin.com/link/chat?cid=l61eM4owQ

Binance benefits group: https://aicoin.com/link/chat?cid=ynr7d1P6Z

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。