Author: Viee I Biteye Content Team

Recently, Twitter has sparked discussions about the integration of trading features, leading to a new round of narrative discussions about entry points. In the context of increasingly fierce competition for traffic entry, BNB Chain has quietly taken another path and will continue to make strides in 2026.

Looking back over the past few years, BNB Chain has been a popular battleground for retail trading. With low fees, fast speeds, and a smooth trading experience, combined with the user traffic naturally brought by Binance, it has become the starting point for countless users entering the crypto market. In 2025, the meme coin market on BSC heated up again, and after the noise, BNB Chain did not enter a cooling period; instead, it attracted more traditional institutions to enter. BlackRock, Franklin Templeton, CMB International, Circle, and others have successively deployed assets to BNB Chain, forming a new pattern of coexistence among institutions, retail investors, and projects within the same ecosystem.

Next, we will restore this process from multiple dimensions and deconstruct how BNB Chain has become an important platform for the coexistence of TradFi and crypto.

1. In 2025, BNB Chain is no longer just a paradise for crypto retail investors

If we only look at the data, BNB Chain delivered a comprehensive growth report in 2025:

- Total independent addresses exceeded 700 million, with daily active users surpassing 4 million

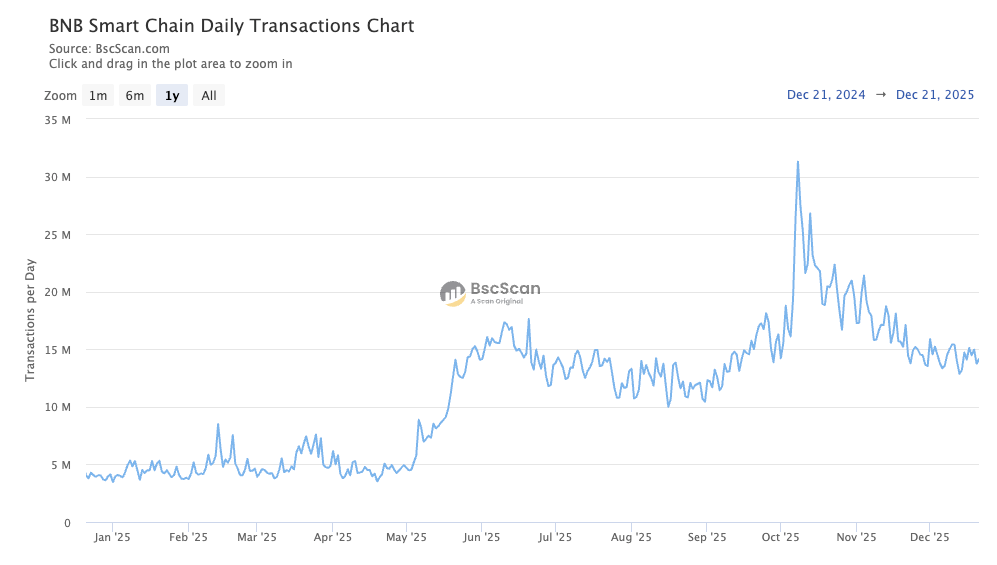

- Daily average transaction volume peaked at 31 million transactions in October

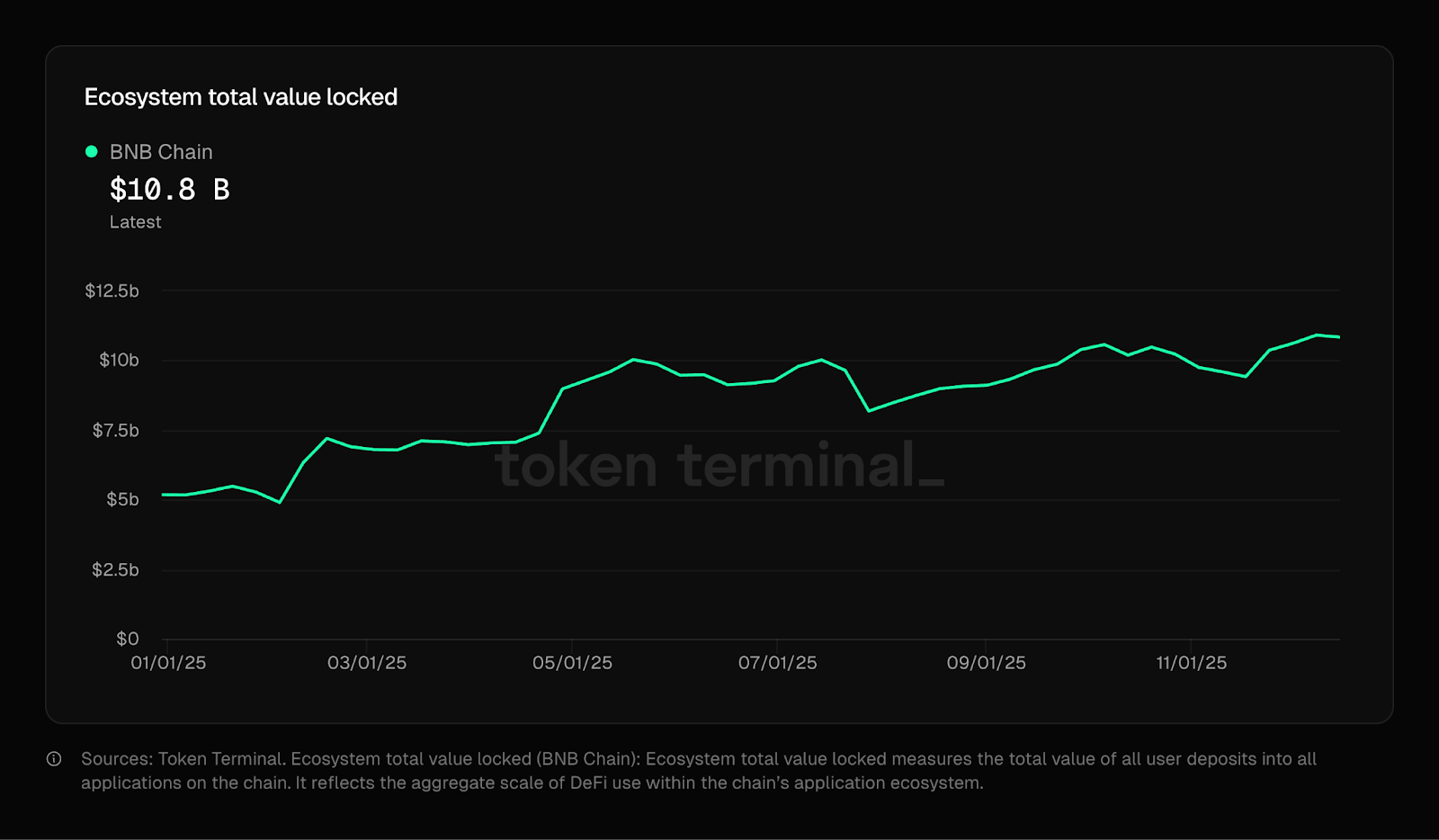

- TVL increased by 40.5% year-on-year

- Total market capitalization of stablecoins doubled to $14 billion

- On-chain compliant RWA assets reached $1.8 billion

Figure: BNB Chain daily average transaction volume

Figure: BNB Chain TVL (Total Value Locked)

These numbers indicate that BNB Chain has withstood the long-term test of real use cases in multiple directions, including stablecoin trading, asset circulation, and high-frequency interactions.

Compared to the data itself, what is more easily perceived by users is the active atmosphere on the chain. In the first half of 2025, under the promotion of the @FourFORM platform, multiple rounds of meme coin markets emerged, with meme coins like $FLOKI, $Cheems, and $BROCCOLI rapidly exploding, making BNB Chain once again a hot chain for retail investors. In the second half of the year, a new round of market driven by Chinese meme coins like $Binance Life completely ignited the enthusiasm of the Chinese community.

After the heat returned, although the trading volume of on-chain memes saw a slight decline, the popularity of stablecoins continued to rise. Stablecoins like $USDC, $USDT, $USD1, and $U widely participated in applications in payment, lending, and yield products. At the same time, institutions like Circle and BlackRock brought stablecoins or money market funds on-chain, with BNB Chain becoming one of the first platforms to host them, indicating that assets are gradually settling on-chain and being retained long-term.

In 2025, BNB Chain experienced simultaneous growth in two directions: one was the periodic explosion of meme traffic, and the other was the steady on-chain transition of traditional financial assets, with the usage scope of stablecoins and real yield products continuously expanding. This also means that the BNB Chain ecosystem has begun to undertake long-term capital application scenarios.

2. Why BNB Chain: Three Reasons Traditional Institutions Choose It

In 2025, several heavyweight financial institutions successively established a presence on BNB Chain, covering multiple tracks such as stablecoins, money market funds, and yield-bearing assets:

- BlackRock: The world's largest asset management company, BlackRock, brought its USD cash management fund BUIDL on-chain, completed tokenization through Securitize, and listed it on BNB Chain.

- CMB International (CMBI): Issued a money market fund token CMBMINT with a scale of $3.8 billion, allowing qualified investors to subscribe and redeem on-chain.

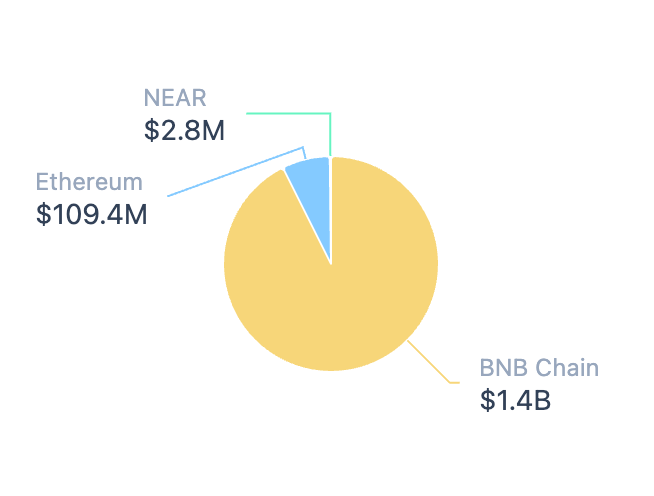

- Circle: Deployed the yield-bearing stablecoin USYC on BNB Chain, with the on-chain total supply of Circle's yield-bearing stablecoin USYC exceeding $1.5 billion, of which over $1.4 billion is deployed on BNB Chain.

Figure: BNB Chain USYC surpasses $1.4 billion

Why do traditional institutions favor BNB Chain? Based on these cases, three main reasons can be summarized:

1. Low Cost, High Performance: BNB Chain is known for its excellent performance and low gas fees, making it very suitable for the needs of high-frequency financial applications. Compared to the high fees and congestion of the Ethereum mainnet, BNB Chain provides a more user-friendly trading environment, allowing institutional products to operate more efficiently on-chain.

2. Large User Base: Relying on Binance's years of accumulation, BNB Chain has the most diverse user base globally, spanning Asia, emerging markets, and more. This means that once institutional assets are deployed, they can reach a higher audience. For example, BUIDL can be used as collateral for trading in the Binance system, opening up a market of tens of millions of CEX users.

3. Complete Infrastructure and Capital Flow Paths: After years of development, BNB Chain's DeFi ecosystem has become increasingly complete, with stablecoins, DEXs, lending, derivatives, and more all available. Therefore, once tokens issued by traditional institutions go live, they can seamlessly connect with various on-chain application scenarios, such as CMBMINT being used as collateral in DeFi protocols like @VenusProtocol and @lista_dao.

It can be said that BNB Chain possesses both technical advantages and ecological foundations, meeting TradFi's requirements for performance and compliance while providing broad user and scenario support, naturally making it the preferred platform for traditional institutions entering blockchain in 2025.

3. BNB Chain's Symbiotic Ecosystem: How Retail Investors, Institutions, and Projects Each Benefit

With the entry of TradFi institutions, the user structure of BNB Chain has also become more complex. In 2025, an interesting phenomenon began to emerge: retail investors, institutions, and project parties operated independently yet simultaneously on the same chain.

Retail Investors: Still Active, Profit Motive Unchanged

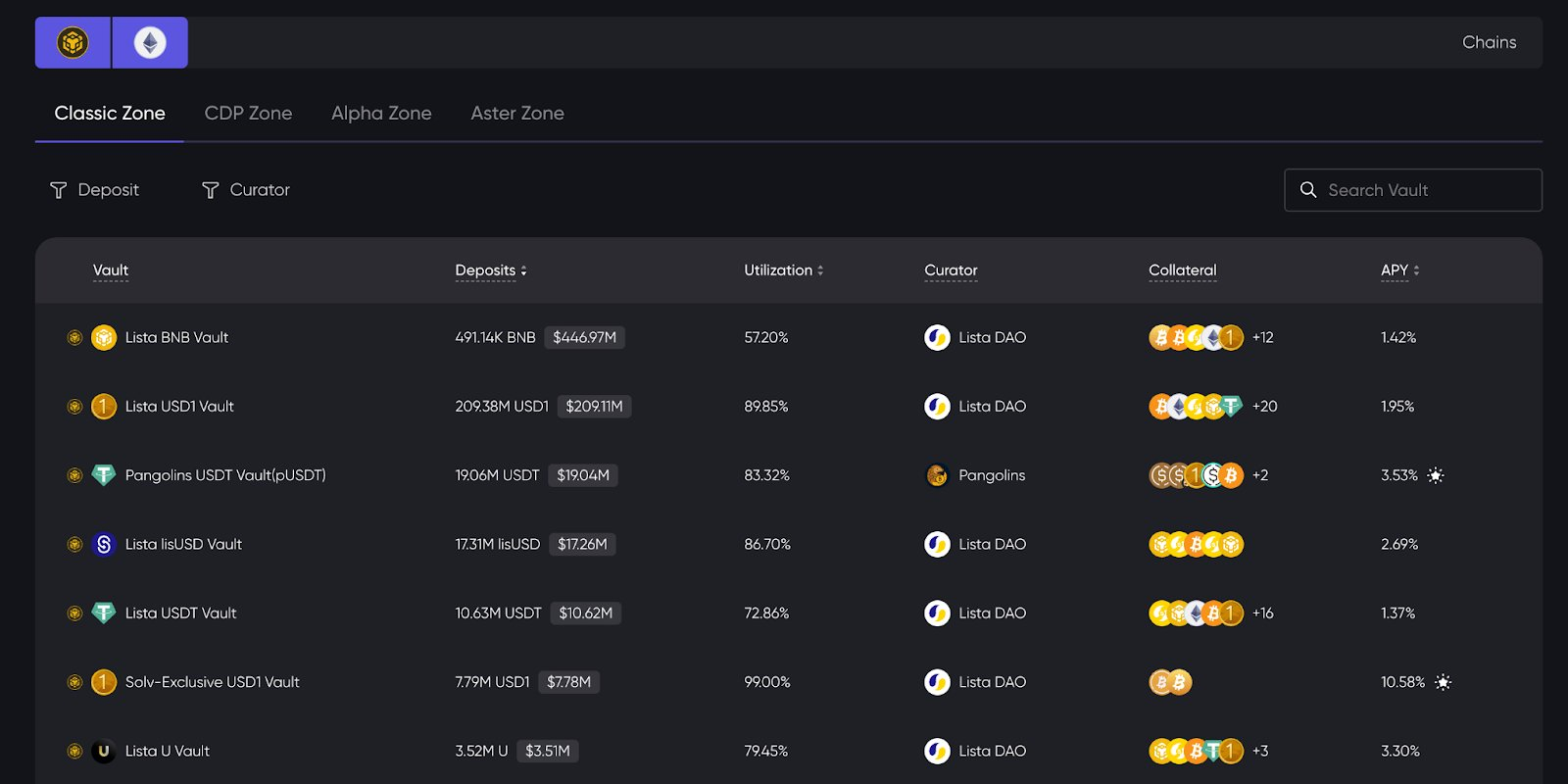

Even with a large influx of institutions, the enthusiasm of retail investors on BNB Chain has not diminished at all. In 2025, multiple rounds of meme coin markets concentrated on platforms like Four.meme, boosting on-chain trading volume for BNB and once driving its price to a historic high of nearly $1,300. Additionally, the PerpDex platform Aster also provides high-leverage tools, and the low gas and high TPS environment allows these users to easily execute multiple operations within a day. Beyond trading frequency, retail investors also participate in on-chain vaults and other strategies to earn passive income, such as ListaDAO, which has launched over ten vaults including BNB, USD1, and USDT.

Figure: ListaDAO Vault Interface

The existence of institutional products has not affected the trading experience of retail investors; rather, the richer asset base and deeper liquidity pools have brought more possibilities for combination strategies.

Institutions: Issuing Assets, Anchoring Yields

After TradFi institutions landed on BNB Chain, they primarily played the roles of issuers and capital providers. They brought real-world assets (such as fund shares, bonds, and stablecoins) onto the chain.

On BNB Chain, the flow of institutional funds on-chain is not limited to subscribing to fund products. For example, the Venus protocol supports on-chain lending using RWA and stablecoins as collateral, reducing the idle rate of funds. In this process, on-chain automatic liquidation, real-time settlement, and intermediary-free processes significantly compress the procedures and time costs found in traditional finance.

Projects: Connecting Retail Traffic and Institutional Assets

On one hand, native projects like PancakeSwap, Lista DAO, and Venus continue to serve a large number of retail and crypto investors, providing decentralized trading, lending, yield aggregation, and other functions; on the other hand, these projects are actively connecting with RWA assets and yield-bearing stablecoins issued by institutions, creating a space for traditional assets on-chain. For instance, the aforementioned lending protocol Venus quickly supported the CMBMINT fund token as collateral, and the yield protocol Lista DAO deeply integrated the institutional stablecoin USD1. Interestingly, this integration does not conflict with existing retail investors but rather expands the overall ecosystem.

Overall, BNB Chain is currently one of the few ecosystems that allows retail investors, institutions, and project parties to each get what they need, operate independently, and develop collaboratively on the same chain:

- Retail investors bring trading activity and usage frequency;

- Institutions bring capital volume and asset diversity;

- Project parties design yield structures, connecting the two into a system.

The reason all of this can coexist lies in BNB Chain's commitment to maximum openness and compatibility; it is not a chain for a specific type of user but an open platform that can accommodate different roles.

4. BNB Chain Project Transformation: From Traffic Games to Real Income

After the meme heat subsided, in response to market changes, projects within the BNB Chain ecosystem have also introduced more real income models:

- ListaDAO: Binds stablecoins like USD1 and U to create a collateral-lending-yield funding cycle system, with TVL exceeding $2 billion.

- Aster: Expands from perpetual contracts to on-chain US stock derivatives trading and the issuance of the USDF series of stablecoins. Aster does not solely rely on trading fee income but shifts towards a platform layout of diversified financial product lines.

- PancakeSwap: As the oldest DEX on BNB Chain, PancakeSwap is also quietly transforming. It is reducing CAKE inflation, retiring outdated staking products, launching stock perpetual contracts, and announcing the introduction of AI-driven prediction market Probable.

Behind these transformations, three major signals of ecological reconstruction on BNB Chain are gradually emerging:

1. The Meme Traffic in the Crypto Market Weakens, Users Focus More on Whether the Yield Structure Works

In the past, relying on issuing tokens to generate hype and piling up transaction volume has become increasingly difficult to retain funds. Users are starting to pay attention to whether the yields are real, rather than how appealing the narratives sound.

2. Combining with Real Assets to Build a Robust and Sustainable Product Structure

It can be seen that on-chain products are actively integrating with traditional capital to meet the dual demands of users for stable yields and institutions for compliant assets.

3. Protocols Begin to Collaborate, Moving Towards Organic Symbiosis

A stablecoin can simultaneously participate in lending, mining, and collateralization, with asset paths no longer isolated. This also means that projects on BNB Chain are collaboratively building a strong on-chain network.

5. Outlook for 2026: The Next Phase of BNB Chain's Role Positioning

As 2026 approaches, the environment facing BNB Chain has quietly changed. The decline in meme popularity is just a surface phenomenon; deeper challenges come from the reshaping of the competitive landscape:

New user growth may enter a plateau phase. The past reliance on meme-driven traffic is difficult to replicate, and the yield strategies of newly incoming institutions have not yet fully materialized, which may lead to a slowdown in new user growth.

In this context, the path for BNB Chain in 2026 is becoming increasingly clear:

1. The Preferred Channel for On-Chain Real Assets

BNB Chain has basically validated its capacity to support high-frequency trading and stable assets, providing traditional institutions with a "safe, controllable, and low-friction" channel for asset tokenization.

With the growth of stablecoin market capitalization, the intensive landing of RWA projects, and more countries and financial institutions adopting an open attitude towards on-chain assets, BNB Chain is expected to become one of the preferred infrastructure platforms in various regions across the Asia-Pacific and even globally.

2. A Testing Ground for New Tracks: Prediction Markets and Privacy Modules

In addition to stablecoins and RWAs, BNB Chain is also exploring more future-oriented tracks.

On BNB Chain, prediction markets are experiencing a diversified explosion: @opinionlabsxyz has entered with a macro trading perspective and has risen to become a leading platform; @predictdotfun innovatively uses prediction positions for DeFi operations, enhancing capital efficiency; @0xProbable offers a zero-fee experience, focusing on lightweight and high-frequency events; @42 is turning real events into tradable assets, opening up a new model of "event assets"; and @Bentodotfun is attempting to gamify prediction markets, creating a new interactive form that is combinable and social.

Additionally, in 2025, the overall performance of privacy coins outperformed the mainstream market, and the on-chain usage ratio is steadily increasing. In 2026, BNB Chain is expected to introduce privacy technologies such as zero-knowledge proofs to help financial institutions manage some private data in isolation on-chain.

3. Continuous Optimization of Protocol Layers to Lower Usage Barriers

On the technical side, BNB Chain will continue to upgrade its underlying protocols in 2026. For example:

- Aiming to process 20,000 transactions per second, with confirmation times shortened to the blink of an eye, making gas fees potentially cheaper in the future.

- Privacy Framework: Configurable, compliance-friendly privacy mechanisms that support high-frequency trading and regular transfers while maintaining DeFi composability.

- AI Agent Framework: Providing an AI Agent identity registration system, credit scoring, and more.

When retail funds meet institutional long-term capital, and when on-chain native yields encounter real cash flows from off-chain, what kind of sparks will fly? BNB Chain has provided a positive answer with its performance in 2025.

Moving into 2026, a new chapter unfolds.

Coexistence may become the keyword for the next phase of crypto, and BNB Chain is undoubtedly one of the most notable testing grounds.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。