In recent days, accompanied by the launch effect of Binance, Memes on BSC have once again gained market attention, with a huge wealth effect and traffic refocusing the market on this public chain that has been established for five years. However, upon closer examination, we see a qualitative transformation of the ecosystem.

If the initial BNB Chain in 2020 primarily absorbed the initial users and transaction accumulation formed by the overflow of ETH's high gas fees and low efficiency, then 2025 is a key year for BNB Chain to actively complete its self-transcendence.

Looking back at this year, BNB Chain is no longer just a cheaper alternative but has begun to possess the foundational capabilities to stably support real financial and payment scenarios in the long term.

User numbers, liquidity, and transaction volume have all reached new highs, with TVL growing by 40.5%, the on-chain stablecoin market cap increasing by over 100% to reach $14 billion, and RWA asset scale exceeding $1.8 billion.

From the results, the on-chain activity of BNB Chain is not a temporary explosion but shows a sustained and stable growth trend.

Throughout the year, core scenarios such as trading, stablecoins, payments, and RWA have maintained high-frequency usage, requiring the network to operate continuously under long-term high loads rather than relying on sporadic peaks to prove performance. It is in this real production environment that BNB Chain has withstood the test, maintaining zero downtime throughout the year and ensuring stable operation against a backdrop of high-intensity trading and asset circulation.

The support for these data points does not come from a single technological breakthrough but from a year-long continuous advancement of underlying engineering capabilities. In 2025, BNB Chain underwent deep iterations of its underlying protocol and client, systematically reconstructing block time and throughput capabilities, enabling the chain itself to possess high concurrency, low latency, and long-term scalability in execution. Block time was compressed from the previous 3 seconds to sub-second levels, with finality significantly advanced, and network bandwidth expanded to over 133 million gas/second, allowing the chain to continuously handle daily loads of up to 5 trillion gas in high-concurrency environments. Coupled with the seamless stablecoin payment network and the scaled introduction of compliant RWA assets, BNB Chain achieved a critical leap in technology, assets, and ecosystem.

Multiple factors have propelled BNB Chain to touch the threshold of a billion-level user infrastructure. Moreover, it is no longer just serving crypto-native users but has begun to provide an acceptable and usable blockchain foundation for a broader public and the real financial system.

The significance of 2025 for BNB Chain lies not in any extreme metric but in validating one thing: under real, sustained, and high-intensity usage conditions, public chains can operate as infrastructure rather than remaining at the theoretical performance stage. This experience forms the realistic foundation for the 2026 technology roadmap, which includes higher TPS, lower latency, fairer execution, and more complete middleware and development tools.

Is daily active user count still important in 2025?

In the AMA during BNB Chain's fifth anniversary celebration, CZ stated that attracting more Web3 users requires strong and attractive products for projects.

This statement aptly summarizes the strategic mainline of BNB Chain's development throughout 2025.

Returning to the beginning of 2025, against a backdrop where modularization has significantly reduced costs and L2 solutions are everywhere, the narrative of BNB Chain was not particularly appealing, and its moat was not wide. BNB Chain did not rush to chase trends but focused on underlying technology reconstruction, laying the groundwork for its explosive growth and daily active user peak in the latter half of the year.

Through the Lorentz and Maxwell hard forks, BNB Chain's block time was compressed from 3 seconds to 0.75 seconds, and with the upcoming Fermi, it will reach 0.45 seconds. The network's throughput capacity has increased to the level of 133 million gas/s, with transaction confirmation times entering the sub-2 second range, and MEV sandwich attacks reduced by 95%, while significantly lowering transaction costs in high-concurrency environments.

For some users, these changes may seem like mere "faster" parameters. However, in practice, the reduction in block time has made high-frequency interactive applications usable for the first time. The increase in throughput capacity means the chain is no longer limited during sudden traffic spikes. The decrease in confirmation time and fees directly alters ordinary users' psychological expectations regarding the worthiness of on-chain operations.

In other words, the work done in the first half of the year resolved a core contradiction for BNB Chain: how to achieve performance comparable to centralized servers without sacrificing decentralization.

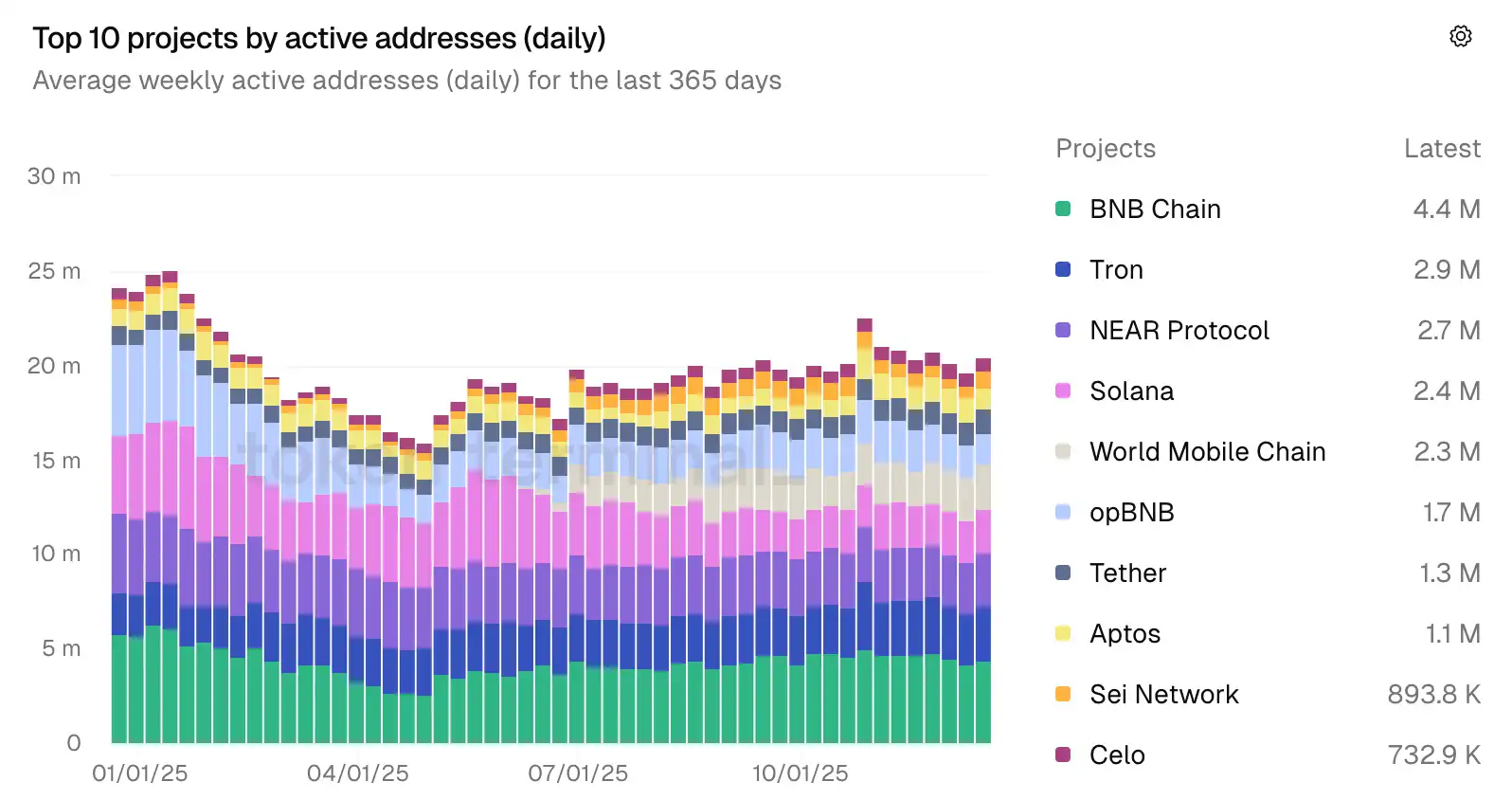

The effects are evident, with rapid growth in high-frequency activities such as stablecoin trading, DEX interactions, and on-chain transfers, making BNB Chain one of the public chains with the highest number of daily active addresses across multiple time windows. The latest data from Token Terminal shows that BNB Chain's daily active users reached 4.4 million, ranking it at the top of the blockchain list. In 2025, the average daily transaction count on-chain stabilized at the tens of millions, setting a historical high of 31 million transactions in a single day in October, with a peak year-on-year growth of 150%. Meanwhile, TVL grew by 40.5% year-on-year, and the market cap of stablecoins on-chain doubled, peaking at $14 billion.

Image source: Token Terminal

Entering the second half of 2025, BNB Chain quickly switched modes from engineer to product manager, successfully accommodating massive stablecoin payment and RWA demands based on the solid foundation laid in the first half of the year.

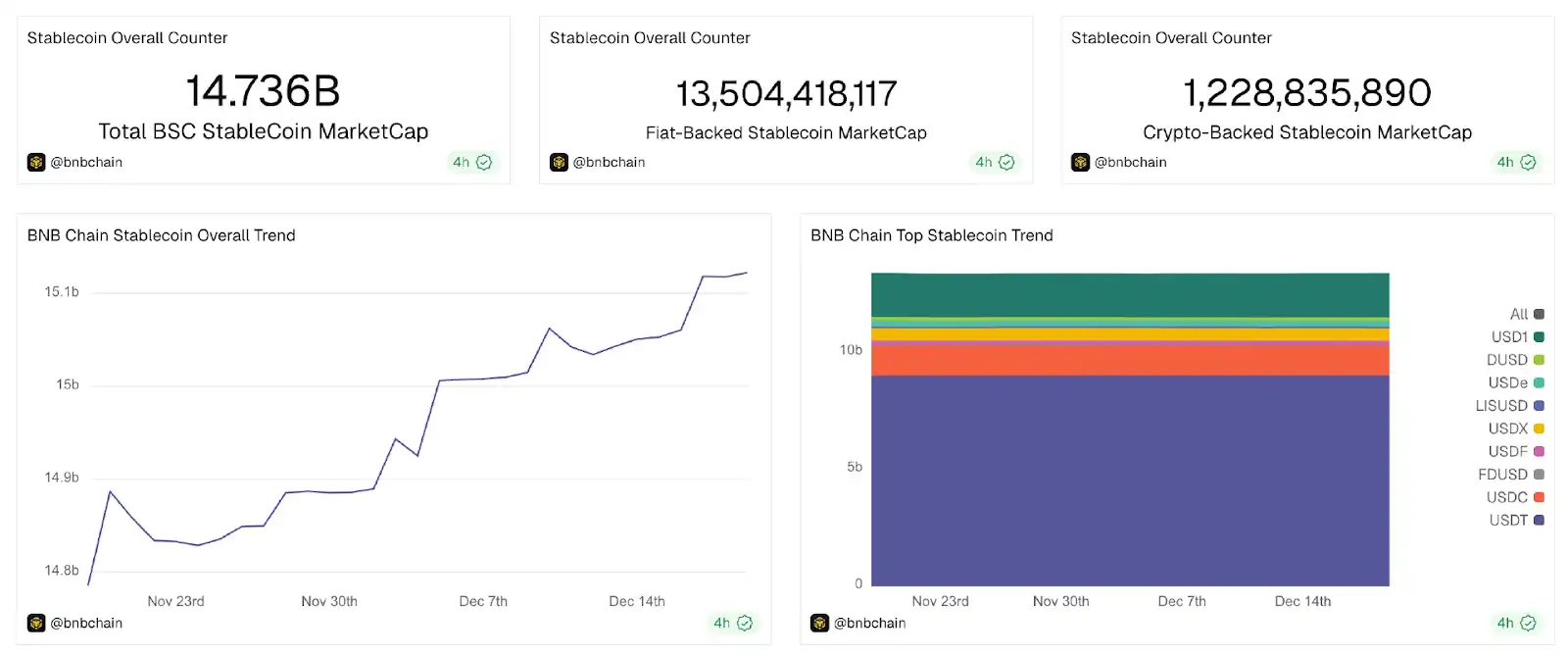

$14.7 billion in stablecoins and 4 million daily active users

If the crypto market before 2024 was driven by speculation, then 2025 has transformed into an era dominated by utility-focused stablecoins. In this year, stablecoin issuer Circle went public, and Franklin Templeton launched JUSD, managing a scale of $1.6 trillion.

Stablecoins are evolving from mere trading mediums to channels connecting traditional finance and the Web3 world. They are no longer just tools for DeFi but are beginning to take on roles closer to real payments and capital turnover.

In this transformation, BNB Chain has become the fastest-growing platform with its 2-second settlement and transaction fees as low as $0.005. The latest data shows that the value of stablecoins on the BNB Chain network has exceeded $14.7 billion, serving over 4 million daily active users on BSC and opBNB.

Image source: Dune

The popularity of stablecoins depends not only on the assets themselves but also on their operating environment. If stablecoins are to serve a billion-level user base, the chain itself must possess characteristics such as being cheap, fast, and seamless. The upgrades of BNB Chain in the first half of the year laid the foundation for the widespread adoption of stablecoins.

Through gas-free transactions and opBNB expansion solutions, the cost of stablecoin transfers has been compressed to nearly zero, significantly lowering the barrier to using stablecoins for payments. On BSC and opBNB, stablecoin transfers are almost completed in real-time, providing a Web2-like experience for on-chain payments, salary disbursements, and merchant settlements.

The supply of stablecoins on BNB Chain has doubled to approximately $14 billion, making it one of the most active stablecoin networks globally. Against this backdrop, the stablecoin ecosystem itself has begun to change. United Stables chose to natively issue the stablecoin U on BNB Chain. Unlike traditional stablecoins that rely on a single collateral asset, U adopts a multi-stablecoin reserve model, allowing mainstream dollar-pegged stablecoins, including USDT, USDC, and USD1, to be directly used as collateral for minting U.

From an ecological perspective, the introduction of U is not an isolated event but a natural result of the maturation of BNB Chain's stablecoin system. As the scale of on-chain stablecoins continues to expand and address activity increases, the demand for unified liquidity and higher capital efficiency also rises. United Stables' multi-collateral model is a response to this demand. It reduces the efficiency loss caused by repeated splitting between different stablecoins, helping to integrate on-chain liquidity and simplify the use of funds in trading, payments, and DeFi applications.

Image source: BNB Chain

A landmark event also occurred in 2025 when Abu Dhabi's MGX invested $2 billion in Binance through the stablecoin USD1. USD1 is a dollar-pegged stablecoin launched by World Liberty Financial, supported by high liquidity asset reserves, and deployed on mainstream blockchains such as BNB Chain and ETH.

This investment sends a clear signal that stablecoins are no longer limited to the crypto industry but have become tools connecting traditional capital with on-chain finance. BNB Chain is a crucial network for this channel.

Additionally, BNB Chain, in collaboration with YZi Labs, launched a Builder Fund of up to $1 billion to accelerate the development of existing and future developers on BNB Chain, especially those applications that can truly make stablecoins flow. This fund not only provides capital but also offers technical incubation and compliance consulting.

According to the development blueprint disclosed by BNB Chain, areas such as on-chain payroll systems, programmable vaults, native stablecoin credit cards, invoice tokenization, CBDC bridging and custody, green finance, and supply chain automation are set to explode. These upcoming tracks share common characteristics of efficiency, automation, and global reach, rather than focusing on crypto attributes. The positioning of stablecoins within this context is closer to a universal unit of the digital economy, while BNB Chain aims to become the underlying operating system that supports these functions.

It is worth noting that the growth of the stablecoin ecosystem on the BNB Chain is not a single-point explosion but is deeply intertwined with RWA.

BNB Chain and RWA Achieve Mutual Success

This year, we are no longer discussing the feasibility of asset tokenization; traditional financial giants such as BlackRock, China Merchants International, VanEck, and Franklin Templeton are transferring hundreds of billions of dollars in assets on-chain. In this on-chain movement, BNB Chain, with its large user base and ecological strategy, has become one of the largest infrastructures for carrying RWA funds.

BlackRock, with the technical support of Securitize and Wormhole, has deployed its dollar institutional digital liquidity fund, BUIDL Fund, to the BNB Chain. This fund can also be used as collateral on the Binance trading platform. This means that on-chain funds are no longer obscure financial products but have become a liquidity layer in the crypto market.

China Merchants International has brought its dollar money market fund, managing over $3.8 billion in assets, onto the BNB Chain. It is reported that this fund ranks first among similar funds in the Asia-Pacific region according to Bloomberg, allowing investors to subscribe for shares using stablecoins on the BNB Chain.

Image source: BNB Chain

The deployment of numerous RWA assets on the BNB Chain is not a one-way benefit but a deeper two-way promotion relationship. RWA and BNB Chain are forming a mutually reinforcing positive feedback loop.

Tokenizing assets is just the first step; without sufficient trading depth and turnover, these tokens are merely digital certificates on the chain and cannot release real financial value. Liquidity exhaustion is the biggest pain point hindering the large-scale explosion of RWA.

As a mature ecosystem, BNB Chain provides three key elements for RWA assets: high throughput, low fees, and a large user base. Compared to other expensive public chains, BNB Chain's low gas fees and high TPS make high-frequency trading and instant settlement possible, significantly lowering the barrier for users to participate in RWA investments. Additionally, BNB Chain users are among the most active groups in Web3, meaning that once RWA assets are launched, they can directly reach a vast pool of potential investors.

In fact, CZ had already revealed in the AMA for BNB Chain's 5th anniversary that the key to RWA's prosperity on BNB Chain is that without users, there are no transactions, and without transactions, there is no liquidity.

When Ondo Global Markets announced the introduction of over 100 US stocks and ETFs to the BNB Chain, deeply integrating them into the Binance Wallet, the market experienced a dramatic chemical reaction. Thanks to BNB Chain's large daily active user base, Ondo's tokenized stock trading volume skyrocketed from a previous daily peak of $84 million to $170 million.

Image source: rwa.xyz

As we stand at the beginning of 2026, looking back at the entire year of 2025, it was a milestone year for BNB Chain, transitioning from competing in public chains based on performance and cost to aligning with the scale of real usage, stable operational capabilities, and compliant accessibility, benchmarking against global traditional finance and internet payment systems. Over the past year, the zero downtime operation under sustained high load, the scaled growth of stablecoins and RWA, and the systematic optimization of underlying performance and cost structure collectively prove that BNB Chain is no longer at the stage of technical feasibility.

Looking to the future, BNB Chain's development focus will no longer just be on chasing higher metrics but on further enhancing execution quality and user experience on the existing scale, with faster confirmation speeds, lower usage costs, a fairer trading environment, and a more user-friendly middleware and tool system for complex scenarios such as stablecoins, RWA, payments, and AI.

In 2026, BNB Chain aims to embed sub-second performance, global payment capabilities, and compliant asset support as a default capability, allowing developers to build applications that offer a Web2-like experience on top of it, enabling ordinary users to use blockchain services without perceiving the underlying complexities. When blockchain is no longer seen as a new technology but is naturally integrated into daily economic activities like networks or payment systems, the large-scale adoption of Web3 will truly arrive. And 2025 was a decisive step for BNB Chain in this direction.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。