Investigator: Joe Zhou, Foresight News

"30 days, 5 cities, 106 scans." A stablecoin experiment that took place in Vietnam has just concluded.

The purpose of this experiment was to validate a proposition that has been mentioned countless times: Can stablecoins truly bridge the "last mile" of payments, replace national-level products like Alipay, and evolve into a genuinely global mainstream payment method?

Without investigation, there is no right to speak. Whether stablecoins can truly be integrated into people's lives and replace the existing fiat currency system requires more real-world cases to support or refute.

To this end, I conducted a thirty-day field study in Vietnamese society in December 2025. During this research, I deliberately avoided traditional fiat currency tools like cash and credit cards at the payment end, relying entirely on stablecoins like USDT for daily consumption (Note: Merchants and other receiving ends still settled in Vietnamese Dong). My research spanned five cities: Hanoi, Nha Trang, Da Lat, Ho Chi Minh City, and others.

The facts and conclusions of the investigation are detailed as follows.

106 Tests: Stablecoins Have Covered 97.17% of Daily Consumption in Vietnam

After 30 days, 5 cities, and 106 real consumption scenarios of extreme stress testing, the investigation's conclusion became increasingly clear—stablecoins (USDT, USDC, etc.) have moved beyond cryptocurrency exchanges and the on-chain world, becoming a payment method that covers 97.17% of daily life scenarios in Vietnam.

To recreate the most authentic payment environment, I set nearly harsh "extreme stress testing" standards: refusing to select scenarios and avoiding difficulties.

Whether facing different types of QR codes, being in mountainous areas with weak network signals, or in urgent moments with low phone battery, as well as dealing with elderly individuals, young children, or even the typical cross-border social payment issue of "AA transfers" among Vietnamese friends… I recorded all payment needs encountered in daily life and included all extreme variables in the statistical sample.

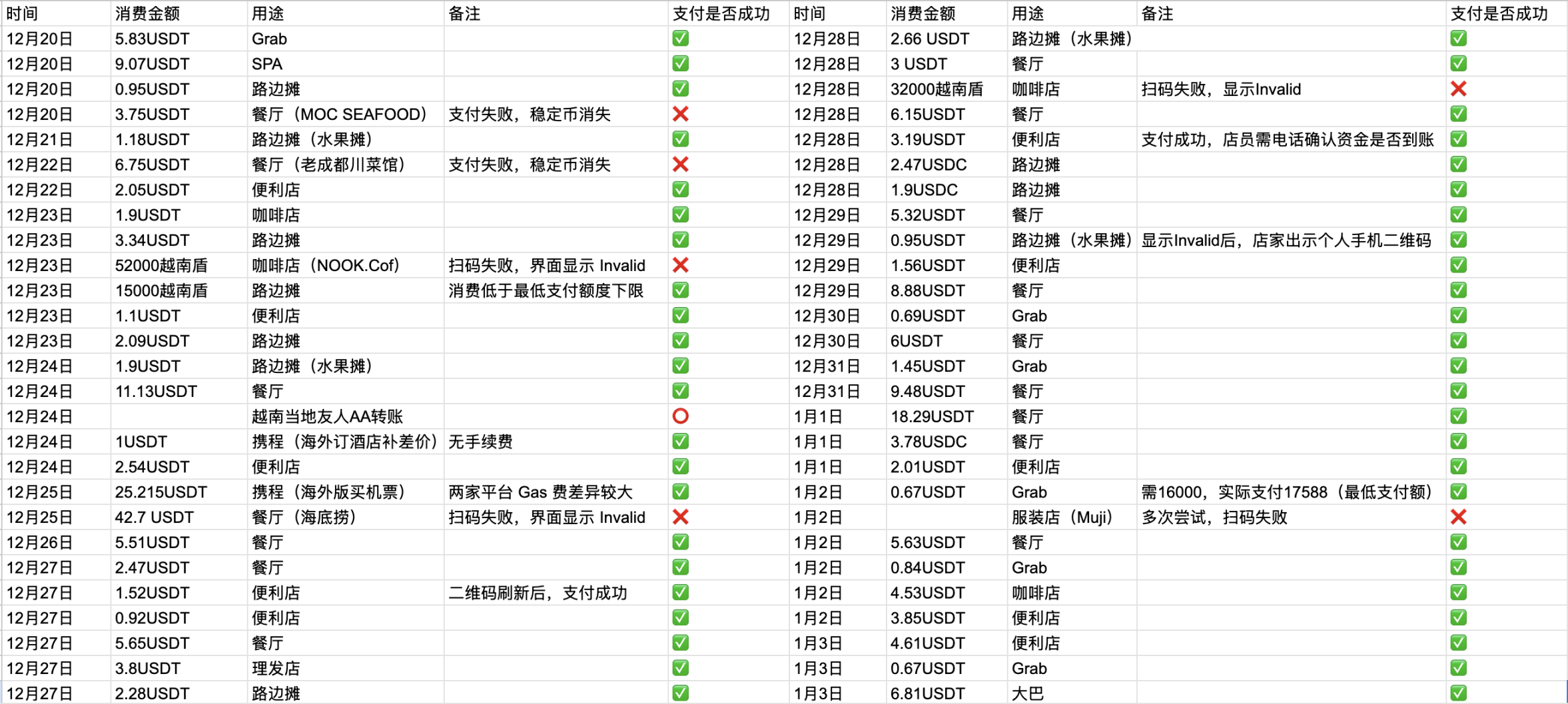

The final result: In 106 challenges, relying solely on cryptocurrency wallet QR code payments, there were 95 successful transactions, resulting in a success rate of 89.6%.

This is limited to the "stablecoin QR code payment" function; if we include U Card (stablecoin credit card) payments, the successful payment count reaches 103, with a success rate of 97.17%.

This means that with just a smartphone (equipped with a Web3 wallet), people can almost navigate Vietnam without obstacles.

Image: Statistics of stablecoin payment test data in Vietnam

The 106 samples collected in this research spanned both online and offline, covering chain giants and street vendors, and included a diverse group from senior citizens to Generation Z… striving to achieve a panoramic scan of Vietnam's consumption ecosystem.

The coverage of this research included mainstream OTA platforms like Trip.com (the overseas version of Ctrip) and Vexere (the Vietnamese version of 12306) online; offline, it delved into stations, tourist attractions, Grab ride-hailing, and street vendors. Additionally, in high-frequency life scenarios such as dining, entertainment, and retail (like convenience stores), stablecoin QR code payments almost achieved seamless transactions.

The underlying logic of this phenomenon lies in the "leapfrog development" of Vietnam's financial system: propelled by rapid economic growth, the entire country has completed a historic transformation at an astonishing speed—directly skipping the lengthy credit card era and stepping into the maturity phase of mobile payments.

Image: A restaurant staff member in Vietnam presenting a VietQR QR code

I found that Vietnam has an extremely high penetration rate of mobile payments; VietQR (Vietnam's national universal QR code) is almost a standard for every citizen, whether in shopping malls or street stalls, among elderly individuals or preschool children—a smartphone and a QR code are the most mainstream financial terminals.

With the help of VietQR, a national-level infrastructure, cryptocurrency wallets like Bitget Wallet have integrated underlying payment protocols like Aeon, breaking down the barriers between "on-chain" and "off-chain": users pay with stablecoins, merchants receive Vietnamese Dong, and both parties complete value exchange within their familiar comfort zones.

Vietnam's Second Financial System: Three Breakthroughs of Stablecoins

"It’s surprising that this explosive growth of the payment ecosystem has only happened in the past year. In 2024, the stablecoin QR code and U Card payment market in Vietnam was almost a barren land," a cryptocurrency payment entrepreneur told me.

Interviews with several local Vietnamese individuals corroborated this timeline: the real turning point appeared in the second half of 2025. Before this, stablecoins were more of a trading target in exchanges; afterward, they began to penetrate the city's capillaries through specific individuals.

This change was first reflected in Jessica, a Chinese entrepreneur residing in Ho Chi Minh City. She candidly told me that her main transaction methods in Vietnam have completely switched to U Card and stablecoin QR code payments, describing this payment combination as "very convenient, covering almost all daily life scenarios."

Jing, a restaurant owner in Nha Trang, confirmed this trend from the merchant's perspective. He revealed to me that since November 2025, customers attempting to pay with stablecoin QR codes have started to appear in his restaurant. "Many have come in one after another; you are definitely not the first."

When discussing the rise of this trend, Jing casually pointed out, "If you want to exchange your stablecoins for Vietnamese Dong cash, just turn left and walk 1 kilometer to a Chinese convenience store." In Vietnam, convenience stores often serve as the most discreet exchanges.

Image: A regular supermarket in Vietnam

As the most basic "exchange nodes" in the ecosystem, Scarlett and Lin, who run a currency exchange shop, demonstrated to me the astonishing maturity and openness of exchange channels in some Vietnamese cities. "Want to exchange stablecoins for Vietnamese Dong? Just come to our shop anytime," they confidently quoted, "Exchange rate 26,000, transfer via TRON chain, single transaction fee 2 USDT."

Of course, this "openness" is not a consensus across all of Vietnam. During my research, I discovered a significant cultural difference in business practices between the North and South of Vietnam: what is commonplace in southern cities like Ho Chi Minh City becomes taboo in the capital, Hanoi. When I inquired about the same issue with local exchange merchants in Hanoi, they appeared reticent and outright refused to discuss stablecoin exchanges.

After in-depth conversations with locals from different social strata in Hanoi (from students to small shop owners), I noticed a clear regional temperature difference: compared to the openness in the South, residents in Northern Vietnam generally hold a cautious, even instinctive, wariness towards stablecoins.

"However, regardless, a new payment paradigm has been established."

Stablecoins have completed a comprehensive penetration of Vietnam's payment terminals. Whether through cash (Cash), stablecoin credit cards (Card), or QR code payments (Scan), these three modes of payment are running in parallel, indicating that Vietnam has effectively opened up all pathways for foreigners to use stablecoins for consumption locally.

A financial closed loop parallel to the fiat currency system has begun to operate independently.

Singularity Moment: A Two-Way "Domestication" of People and Technology

The stablecoin market in Vietnam is currently at a critical tipping point.

By importing the research data into Manus for multidimensional modeling analysis, we found that the payment success rate is not a single technical indicator but is significantly influenced by two latent variables: "user adaptability" and "scale of use."

Both data and real-world cases are revealing this.

From a macro perspective: Manus's analysis divides the 30 days of research data into three clear stages: transitioning from the first week's "exploration phase" (low consumption, high failure rate) to the second week's "adaptation phase," and finally entering the "maturity phase" in the third week—my payment success rate also drew a beautiful upward curve, rising from below 80% in the early stages to over 95% in the last two weeks.

This leap in data has specific explanations on a micro level. For example, in the nine instances during the research where the "QR code displayed Invalid": in the early stages of the experiment, I often passively deemed it a "failure"; however, as I became familiar with the tools and scenarios, I learned to actively intervene—requesting the staff to refresh the screen or change the QR code, thus successfully salvaging the payment. This "human correction" signifies that as "operational proficiency" improves, users have developed the subjective initiative to assess situations and troubleshoot, which significantly boosts the final payment success rate.

Image: A Grab driver presenting VietQR

This trend indicates that there is a dynamic "interaction and domestication" occurring between consumers and payment tools. People are adapting to the tools, and the tools are becoming more user-friendly through human use.

"Users are adapting to the tools, and merchants are also actively adapting to users."

I observed that local merchants in Vietnam, individuals consciously connecting with international standards, and even Grab drivers are transitioning from "bystanders" to "active adapters."

Whether actively switching to the standard VietQR to match Web3 wallets or skillfully using stablecoins to accommodate international partners, these behaviors point to the same logic: embracing technology for business. This pragmatic business culture rooted in Vietnamese society is the key driving force behind stablecoins' ability to cross technological barriers and achieve rapid adoption.

The Long 20 Seconds: The "Last Mile" of Stablecoin Payments

A 97.17% payment success rate is sufficient to prove that stablecoins have the technical foundation for mass adoption; however, those 11 glaring failures serve as a wake-up call, constantly reminding us: the seemingly short "last mile" to true "global usability" is, in fact, still a formidable chasm to cross.

This research left behind cold data: 13 successful transactions at convenience stores; 25 Grab rides resulted in 23 successes; 41 restaurant transactions resulted in 35 successes; and 5 hotel bus transactions were all successful. Behind these numbers, I dissected those 11 failures into three major obstacles on the path to widespread adoption.

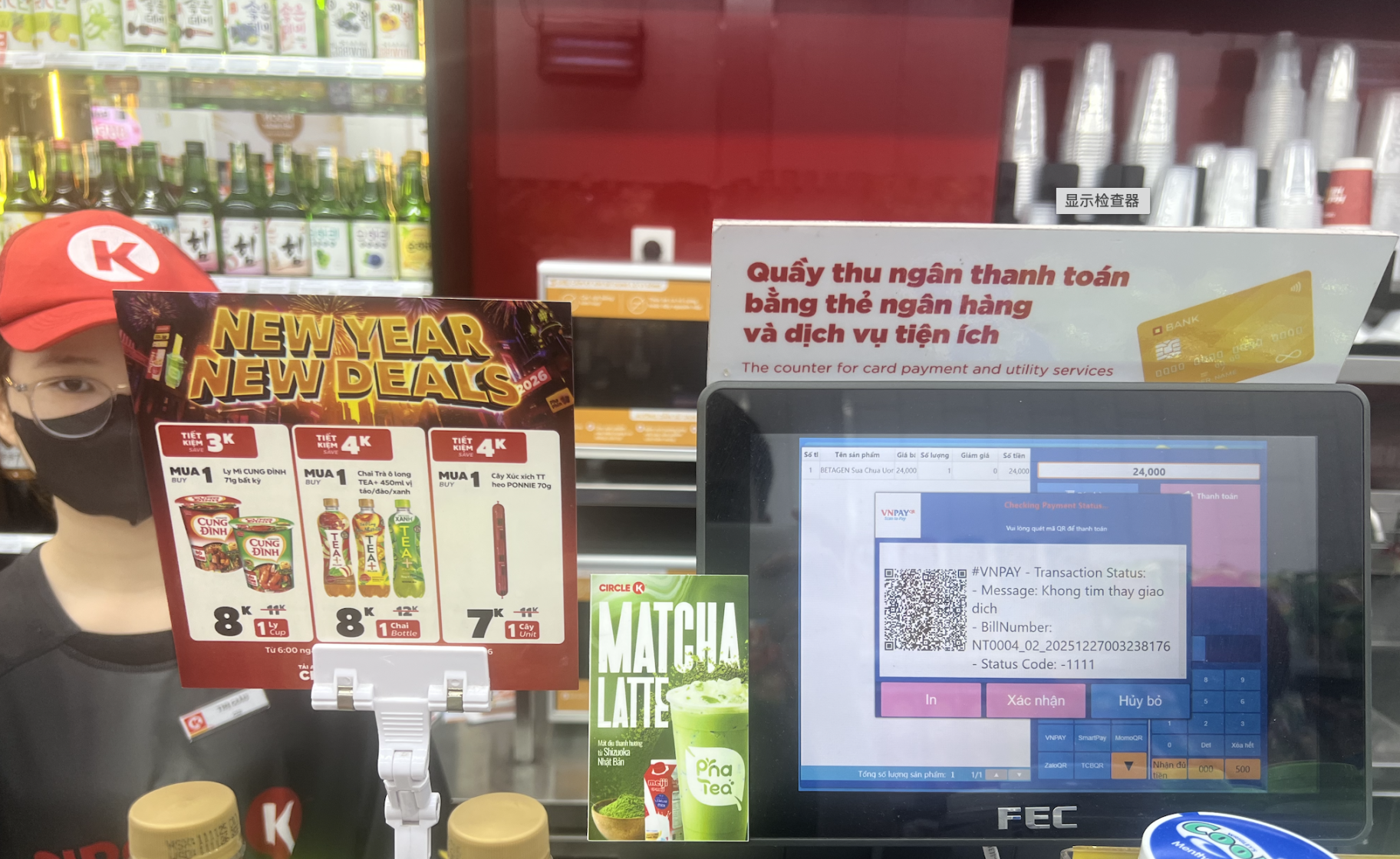

The first mountain is the "instant collapse of trust." This was the most shocking moment during the entire investigation—"the money was deducted, but the other party didn't receive it." This scenario occurred three times: on December 20, 2025, at MOC SEAFOOD restaurant, resulting in a loss of 3.75 USDT; on December 22, at Lao Chengdu Sichuan Restaurant in Nha Trang, resulting in a loss of 6.75 USDT; and on January 5, 2026, at Liên Hoa Bakery, resulting in a loss of 2.26 USDT.

For a tech professional accustomed to tolerating bugs, this might just be "loss"; but for an ordinary user, it is a disaster. You cannot prove your innocence to the merchant like you would with a bank transfer record, because the hash value on the blockchain is just gibberish to the cashier. Standing at the checkout counter, facing the merchant's suspicious gaze, the trust established by technology resets to zero at that moment. This awkwardness is enough to deter any non-geek user.

The second mountain is "social embarrassment," which is that "long 20 seconds." Every on-chain transaction requires waiting for confirmation. It can take as little as 20 seconds or as long as 30 seconds. While this time may represent a significant technological advancement, in the busy checkout line of a convenience store, these 30 seconds feel like an eternity. The anxious gazes of the people waiting behind you make those few seconds feel like a thorn in your back. Compared to Alipay's "millisecond" response, this 20-second "time lag" creates a significant psychological barrier. If this 20 seconds of social pressure is not resolved, Web3 payments will forever remain a toy for geeks and will not become a part of everyday life for ordinary people.

Image: A MUJI staff member in Ho Chi Minh City is demonstrating a QR code

The third mountain is the "walls of giants" and the "micro-payment threshold." Even though VietQR is a national standard, Muji, Haidilao, and some large popular stores still attempt to establish their own "walls," preferring to use self-built aggregation codes, which led to multiple instances of "Invalid" when I scanned. Although this can usually be covered by a Visa card, it undoubtedly results in cold rejections. Additionally, "micro-payments" are also an invisible pain point. The current payment system has a mandatory starting price of around 17,000 Vietnamese Dong (approximately 5 RMB). When you just want to buy a bottle of water or take a very short Grab ride, the system still deducts about 5 RMB worth of Vietnamese Dong. This is an economic loophole that must be fixed for high-frequency daily scenarios.

These 11 failures reveal that the distance from 97% to 100% is not a simple linear increase but a qualitative leap. Only when users no longer worry about their money disappearing, no longer feel ashamed of waiting, and are not "rounded down" due to small amounts will the payment revolution of stablecoins truly have crossed the chasm known as the "last mile."

Echoes of History: From China to Vietnam

History repeatedly proves that a new model of economic growth inevitably calls for a new financial system to support it.

Twenty years ago, China bypassed the credit card system through Alipay and WeChat Pay, using mobile payments to support the rise of internet e-commerce and the digital economy; today, Vietnam is constructing a unique "dual-track finance"—popularizing mobile payments domestically while embracing stablecoins externally, attempting to achieve the same daring leap.

China did this, and so is Vietnam.

The difference is that this time, Vietnam has defaulted to a more decentralized and globally liquid path, which is not coincidental but continues the region's consistent "pragmatism."

Although the "long 20 seconds" still exists and the trust mechanism still needs repair, the wheels cannot be turned back. In this land that firmly believes in pragmatism, a financial artery parallel to traditional banks is carrying the aspirations of countless individuals, roaring into the future alongside the sounds of the times.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。