Original Title: "Price Crash, Project Layoffs, Developer Exodus, Is Berachain Doomed to Fail as a Public Chain?"

Original Author: Ma He, Foresight News

On January 14, BERA briefly surged, skyrocketing from $0.5 to $0.9, which is rare given the previous 12 consecutive weekly declines. On the same day, the Berachain Foundation released its year-end summary for 2025, highlighting ecological expansion, technical optimization, and community engagement following the mainnet launch, while also admitting to various pressures brought on by market volatility.

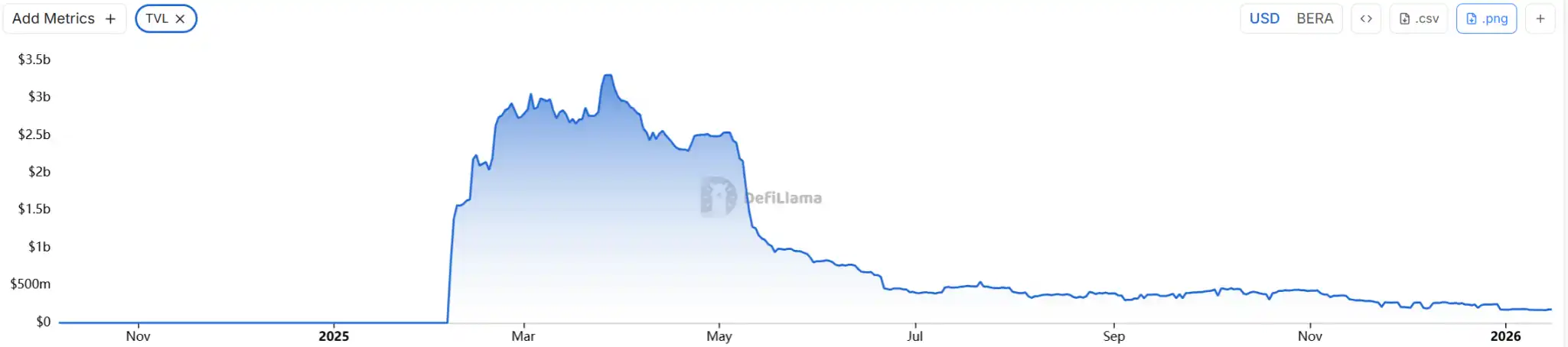

Since the launch of the Berachain mainnet, both TVL and token prices have experienced severe fluctuations. Perhaps this is not only due to market cycles but also a comprehensive result of internal strategies and external pressures.

TVL Drops from $3 Billion to $180 Million, Chain Revenue at $84 in 24 Hours

In February 2025, Berachain officially launched its mainnet, introducing an innovative PoL consensus mechanism designed to incentivize application and user participation through liquidity proof rather than the traditional Proof of Stake. This made Berachain a Layer 1 chain specifically designed for DeFi applications, aimed at enhancing capital efficiency and user adoption. In the early stages, the ecosystem rapidly expanded, attracting hundreds of dApps, including DEXs like BEX, lending protocols, and NFT markets.

TVL once soared to $3.3 billion, with over 140,000 active addresses and transaction volumes reaching 9.59 million. The foundation also supported multiple ecological projects through RFA (Request for Application) and RFC (Request for Comment) programs and collaborated with institutions like BitGo to provide custody services, enhancing the project's professionalism. Additionally, Berachain's community building and marketing strategies performed excellently in the early stages. The bear-themed NFT series (such as Bong Bears) attracted a large number of users, and airdrops and incentive programs further stimulated participation. These initiatives helped Berachain become a hotspot in the DeFi space in the first half of 2025, ranking as the sixth-largest DeFi chain.

However, as token prices continued to decline, according to DefiLlama data, its TVL has dropped to $180 million, with 24-hour chain revenue at $84, and the total amount of on-chain stablecoins at $153.5 million.

Retail Investor Priority? Most Token Shares Belong to VCs, Large Unlocking in February

In its year-end update, the Berachain Foundation admitted that the overall effect of the "retail investor priority" strategy in the crypto market has been poor, leading to a reallocation of resources. This directly triggered a series of issues. The first was layoffs and team changes. As part of a strategic adjustment, the Berachain Foundation cut most of its retail marketing team, shifting focus to core development. Berachain's chief developer, Alberto, is also leaving to co-found a Web2 company with former banking colleagues.

The foundation emphasized that the departures were amicable, but this undoubtedly weakened the project's core technical strength. Within the community, some developers have turned to other chains like Monad, further exacerbating talent loss.

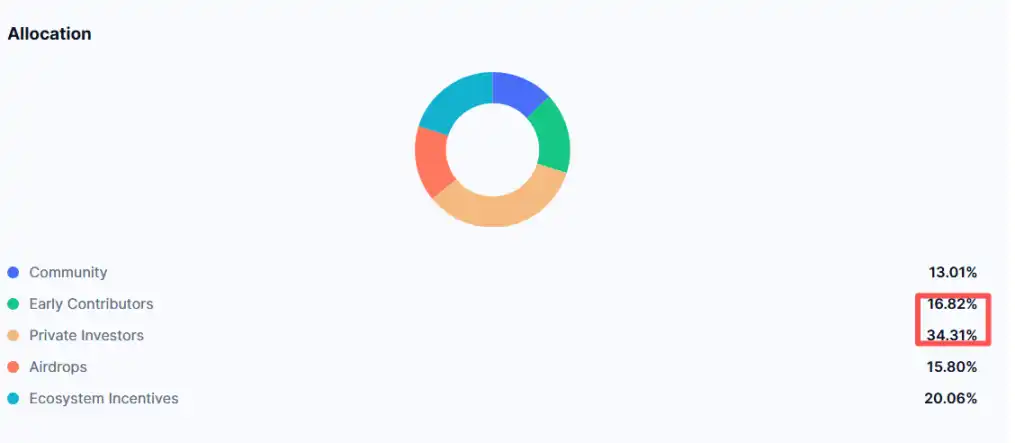

Perhaps the "retail investor priority" strategy promoted by the Berachain Foundation was never truly implemented.

The project initially emphasized community-driven initiatives, but in practice, the incentive mechanisms failed to continuously attract users, and token distribution left retail investors sidelined.

While the PoL mechanism is innovative, its complexity (such as the multi-token model, including BERA and BGT) has deterred users, leading to a sharp decline in network activity. In November 2025, the project paused its network due to a vulnerability in the Balancer protocol, fortunately without affecting user fund security.

The price of BERA has fallen from a high of $9 to the current $0.7, with the so-called king public chain token dropping more than tenfold in just one year.

This crash stems from a model of low circulation and high FDV, leading to artificially inflated prices that quickly collapsed, with the root of these issues lying in Berachain's token distribution mechanism. Early contributors received 16.82% of the total supply, while private investors obtained an astonishing 34.31% of the token share, typical of VC tokens. Additionally, NFT holders could receive tens of millions of dollars in tokens, while testnet users only received $60 in airdrops, sparking controversy over the "wealth gap," with some loyal users marginalized.

This is contrary to the "retail investor priority" slogan; the project is essentially a VC-led model of low circulation and high FDV: early investors entered at $0.82, achieving returns of 10-15 times, while retail investors bore the brunt of the crash. Foundation founder Smokey admitted that if given another chance, he would not sell so many tokens to VCs and has repurchased some to reduce dilution. In October 2025, the Berachain Foundation partnered with Greenlane Holdings to launch BeraStrategy, but using BERA as a reserve asset has not helped reverse the decline in token price.

Moreover, VCs like Brevan Howard's Nova fund hold refund rights, allowing them to request a full refund of $25 million before February 2026, further highlighting Berachain's tilt towards VCs.

Community dissatisfaction is running high, with many users labeling it as "the ultimate fraud L1."

On February 6 of this year, Berachain will unlock 63.75 million BERA, accounting for approximately 12.16% of the current circulation, with private investors unlocking 28.58 million tokens. Starting in March this year, the monthly unlocking share of BERA will be 2.53% of the total supply. Considering the current liquidity exhaustion, continued large unlocks this year may trigger significant selling pressure.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。