Author: Deng Tong, Golden Finance

Overnight, the cryptocurrency market has shown signs of returning to a bull market, with BTC and ETH breaking through $96,000 and $3,300, respectively. In addition, precious metals, U.S. stocks, and A-shares continue to sustain the previous "bull market" trend. What is driving the investment market to continue rising? How will the future of the cryptocurrency market develop?

1. Positive Trends in Precious Metals, Stock Markets, and Cryptocurrency Markets

1. Gold

On January 14, spot gold rose more than $50 in a single day, reaching a record high of $4,639.11 per ounce, an increase of 1.12%. On January 13, a strategist from State Street Global Advisors pointed out in a report that based on recent price momentum and geopolitical dynamics, the probability of spot gold breaking $5,000 per ounce this year has now exceeded 30%. By 2026, gold will be in a favorable position, supported by factors including a surge in global debt burdens, the direction of Federal Reserve policy, and potential volatility shocks. The strategist believes that the correlation between U.S. stocks and bonds may remain positive in 2026, which increases the space for gold allocation in investment portfolios, as investors may seek liquidity alternatives. Meanwhile, demand for gold purchases by central banks is expected to support physical demand, providing a stable anchor for the precious metals market.

2. Silver

On January 14, some trading platforms showed that spot silver first crossed the $90 per ounce mark, setting a new high with an increase of nearly 26% since the beginning of the year. The market value of silver surpassed $50 trillion, making it the second-largest asset globally, with spot gold in the top position and Nvidia in third.

3. U.S. Stocks

The U.S. stock market closed at a historic high on January 12. According to Dow Jones market data, both the S&P 500 index and the Dow Jones Industrial Average rose by 0.2%, closing at record highs of 6,977.32 points and 49,590.20 points, respectively. The tech-heavy Nasdaq Composite Index rose by 0.3%, just 0.9% below the closing record set at the end of October last year.

Trump stated on social media: "Under my leadership, the U.S. economy is thriving! The revival of manufacturing and significant growth in household income are driving GDP to unprecedented increases. We are experiencing an inflation-free economic boom." Driven by unprecedented, possibly historically high levels of corporate investment, the private sector growth rate exceeds 5%, and inflation trends look quite good. All smart money knows that the "hottest" economy in the world is the United States.

Andrew Slimmon, Senior Portfolio Manager at Morgan Stanley Investment Management, stated that for investors, the optimistic expectation of further interest rate cuts under the leadership of the Federal Reserve Chairman appointed by Trump has been an important theme this year, with many expecting looser monetary policy to support the U.S. economy. Slimmon believes that the rise in the U.S. stock market is driven by fundamentals and that it will be a healthy component of a sustained bull market not only this year but also through 2026—even if it appears to be in a late-stage phase.

4. A-shares

In the first week of trading in 2026, the A-share market continued to rise, with the Shanghai Composite Index, Shenzhen Component Index, and ChiNext Index accumulating increases of 3.82%, 4.40%, and 3.89%, respectively.

Regarding the reasons for the continuous rise of the A-share market since the beginning of 2026, Fang Lei, Deputy General Manager and Chief Strategy Investment Officer at Xing Shi Investment, believes that the market's strong performance is mainly due to the accumulation of positive factors, high capital sentiment, and sensitivity to favorable factors. Liquidity factors and policy expectations have also supported stock market performance, indicating that this round of market rise is not driven by a single factor. Additionally, the continuous appreciation of the renminbi at the end of the year and the beginning of the year, with the U.S. dollar breaking the key level of 7 against the offshore renminbi, has also supported the rise in market sentiment.

5. Cryptocurrency Market

This morning, BTC broke through $96,000, reporting $95,020 at the time of writing, with a 24-hour increase of 3.6%. ETH surpassed $3,350, reporting $3,329.89 at the time of writing, with a 24-hour increase of 6.3%. XRP had a 24-hour increase of 4.3%; BNB increased by 3.6%; SOL rose by 3.7%; DOGE increased by 6.5%; ADA also rose by 6.5%.

The latest market analysis from New Fire Research Institute indicates that the directional breakthrough in the cryptocurrency market has arrived as expected, fully validating the previous accurate prediction of the market "building a bottom." The industry is entering a new round of accelerated upward momentum. Ding Yuan, the director of New Fire Research Institute, analyzed that this market breakthrough is a precise realization of the institute's earlier judgment. Last week, Bitcoin's 30-day implied volatility dropped to a yearly low of 40%, which is the "calm before the storm" that the New Fire Research Institute highlighted as a signal for a trend change. With the market explosion early this morning, Bitcoin broke through the $96,000 mark in one go, with a 24-hour increase of 4.4%; Ethereum also rose to $3,300, with a 24-hour increase of 7.4%, marking the official end of the market's consolidation pattern and the establishment of an accelerated upward channel. Ding Yuan believes that the logic behind this round of increase is solid: the macro environment in January-February remains stable, combined with the resonance of multiple heavyweight positive factors such as a16z's $15 billion new fund heavily investing in the cryptocurrency field and South Korea's complete lifting of the ban on cryptocurrency investments, market liquidity is returning at an unexpected speed. The institute maintains its core judgment—Bitcoin is expected to challenge the $100,000 mark in the short term, and it is firmly optimistic about Ethereum's "revenge" rebound after the overselling.

2. What is Driving the Surge in Various Investment Products?

1. Expectations of Interest Rate Cuts

The U.S. Consumer Price Index (CPI) for December increased by 2.7% year-on-year, matching expectations and unchanged from the previous value. Following the CPI release, the probability of the Federal Reserve cutting interest rates in April rose to 42%, up from 38% before the data was released.

Trump stated: "When the market is rising, the Federal Reserve should lower interest rates. In the past, interest rates would drop when the economy was doing well. There is a real blockhead in the Federal Reserve. The Fed Chairman has stifled every economic rebound. Powell is 'about to leave soon.' The U.S. inflation data for December is very low! This means Jerome 'too late' Powell should cut rates significantly! If he doesn't cut rates, he will just continue to be 'too late'! Moreover, U.S. economic growth data is also very good. Thanks to Mr. Tariff!"

Rick Rieder, Chief Investment Officer of Global Fixed Income at BlackRock and a potential successor to Fed Chairman Powell, is reportedly set to meet with President Trump on Thursday. On this occasion, Rieder reiterated his support for lowering the U.S. benchmark interest rate to 3%, which would set a record low not seen in over three years. In a CNBC interview aired on Monday, Rieder stated that he has been repeatedly mentioning the desire for rates to drop to 3% for months. He reiterated his support for this move on Monday, which would reduce borrowing costs by at least 50 basis points (0.5 percentage points) from current levels. After the Federal Reserve cut rates by 25 basis points in December, the current target range for the federal funds rate is 3.5% to 3.75%. "I believe the Federal Reserve does have some policy maneuvering space," Rieder said. "My stance has been very clear for many months. The Federal Reserve must lower interest rates, and I don't think it needs to lower them too much; ultimately, it should settle at 3%—a level closer to the neutral rate." The neutral rate is a theoretical level of borrowing costs that is neither stimulative nor restrictive, capable of maintaining stable U.S. economic operations.

2. Midterm Elections

The 2026 U.S. midterm elections are scheduled for November 3, during which all 435 seats in the House of Representatives, 35 Senate seats, and some governorships and local officials will be up for election. The midterm elections significantly influence policy expectations, liquidity environment, and market risk appetite, making them an important driving factor for the current positive trends in investment products.

Currently, Trump's situation is clearly not optimistic.

Trump has urged Republicans to reverse the political downturn before the midterm elections in November, warning that if Democrats regain control of Congress, he will face impeachment for a third time. "You must win the midterm elections. They will find a reason to impeach me. I will be impeached," Trump predicted that the Republican Party would achieve an "epic" victory, reversing the previous trend. However, polls show that the American public is dissatisfied with his leadership and the state of the economy, which is an ominous sign for the Republican Party's ability to maintain control of Congress.

Under election pressure, the ruling party typically tends to favor loose policies to secure votes. In 2026, the Trump administration will push for fiscal stimulus and the Federal Reserve to cut rates more than expected to provide liquidity and profit support for assets like stocks and gold.

On January 8, he was "instructing my representatives" to purchase $200 billion in mortgage-backed securities, claiming this would lower interest rates and monthly payments. Two government-sponsored mortgage agencies—Fannie Mae and Freddie Mac—currently have ample funds. "Right now, I am particularly focused on the housing market." This move by Trump is the latest effort to lower housing costs ahead of the midterm elections in November.

Additionally, media reports indicate that the White House is drafting an executive order aimed at broadly addressing Americans' dissatisfaction with the cost of living, including promoting the use of retirement funds and college savings accounts for down payments on homes.

3. The Upcoming "Cryptocurrency Market Structure Act"

For the cryptocurrency market, the most significant direct influencing factor recently may be the impending release of the "Cryptocurrency Market Structure Act."

On January 13, cryptocurrency journalist Eleanor Terrett disclosed an incomplete draft of the Senate Banking Committee's market structure bill. This draft includes two small ethical code provisions under the jurisdiction of the Banking Committee—unlike most ethical code-related provisions (which are typically drafted by other committees and will not appear in this draft or the version of the bill to be released within an hour). Notably, page 72 of the draft addresses felony convictions, while page 270 contains provisions related to insider trading. It seems that a compromise has been reached between the DeFi and traditional finance (TradFi) sectors, reflected in the protection of software developers in section 601. According to industry insiders close to the negotiations, both sides finalized the outcome this week after tense closed-door meetings last week. A major concern for traditional financial practitioners has been that decentralized financial protocols could be used for regulatory arbitrage, a point emphasized by associations like the Securities Industry and Financial Markets Association (SIFMA).

The U.S. Senate Agriculture Committee plans to release its cryptocurrency market structure bill on January 21 and hold a key hearing on the bill text on January 27.

The hearing on this bill is a crucial step in advancing the legislative process, allowing lawmakers to debate amendments and vote on whether to incorporate them into the original bill text, followed by a vote on whether to submit the complete bill for full Senate consideration.

The U.S. Senate Banking Committee will hold a hearing on its version of the bill this Thursday. The draft of the Banking Committee's version of the bill was released around midnight on Monday, but it is expected that lawmakers will submit amendments before the hearing. Senator John Boozman, chairman of the Senate Committee, stated in a statement that the revised "timeline ensures transparency and allows the committee to conduct a thorough review in advancing legislation, thereby providing clarity and certainty for the cryptocurrency market."

Galaxy Research issued a warning: The draft of the "Cryptocurrency Market Structure Act" currently under review by the Senate Banking Committee will significantly expand the financial monitoring powers of the U.S. Treasury. The draft includes provisions for freezing transactions without a court order, as well as extended "special measures" authority targeting the front end of decentralized finance. Alex Thorn, Head of Research at Galaxy Digital, stated that if these measures become law, it would represent the largest single expansion of financial monitoring powers since the U.S. Patriot Act in 2001.

SEC Chairman Paul Atkins revealed: The U.S. Congress passed and the President signed the landmark "Genius Act" at the end of last year, marking the first time the U.S. government has formally recognized cryptocurrency assets through regulation, providing a clear regulatory framework for stablecoins. Congress is actively advancing legislation on cryptocurrency market structure to enhance market certainty, aligning with Trump's goal of creating the "world's cryptocurrency capital." He expressed optimism that the relevant bills would be passed and signed this year, believing this would significantly promote the development of the cryptocurrency market and strengthen investor protection.

Bitwise Chief Investment Officer Matt Hougan stated in a post that the "CLARITY Act" is like "Punxsutawney Phil" in this round of cryptocurrency winter. If it only pokes its head out but fails to pass in Congress, the "winter" may continue; however, if it passes smoothly and is signed into law, the cryptocurrency market is likely to reach historical highs.

3. Cryptocurrency Market Price Predictions

Bitwise Chief Information Officer Matt Hougan stated on the X platform that if ETF demand continues long-term, the price of BTC will enter a parabolic growth phase. Hougan pointed to the 65% increase in gold prices in 2025 as an example, noting that both gold and BTC prices are determined by supply and demand. After the U.S. confiscated Russian bond deposits in 2022, central banks' annual purchases of gold increased from about 500 tons to around 1,000 tons and have remained stable. This demand changed the supply-demand balance but did not immediately reflect in prices. Gold prices rose 2% in 2022, 13% in 2023, and 27% in 2024, only showing parabolic growth in 2025. This is because the demand in previous years was met by holders willing to sell gold, and when selling pressure from sellers is exhausted and demand continues, prices rise significantly. Currently, BTC is in a similar situation with ETFs. Since the ETF debuted in January 2024, its purchase volume has exceeded 100% of the new BTC supply. Due to existing holders willing to sell, prices have not yet entered the parabolic phase. If ETF demand continues, the selling pressure from existing sellers will eventually be exhausted.

Data shows that the 52-week correlation between Bitcoin and gold has dropped to zero, the first time since mid-2022, and may turn negative by the end of January. Historically, in similar situations, Bitcoin typically averages a 56% increase within about two months, corresponding to a price range of approximately $144,000 to $150,000. Analysts point out that the divergence between Bitcoin and gold often signals that BTC will enter a strong market. The current macro environment is also viewed as favorable, including a rebound in global liquidity (M2 growth) and the nearing end of the Federal Reserve's quantitative tightening (QT).

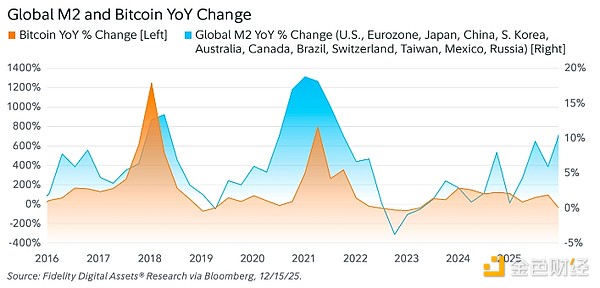

Matt Hougan stated, "Historically, Bitcoin bull markets often coincide with periods of increased global liquidity. With the start of a new round of monetary easing globally and the end of the Federal Reserve's quantitative tightening plan, we are likely to see this growth rate continue to rise in 2026, which is a positive catalyst for Bitcoin prices."

Global M2 and Bitcoin year-on-year percentage change. Data source: Fidelity Investments

In the same macroeconomic environment, gold prices soared 65% in 2025, while Bitcoin's returns were nearly flat. However, according to Hougan's forecast, Bitcoin will surpass gold in 2026.

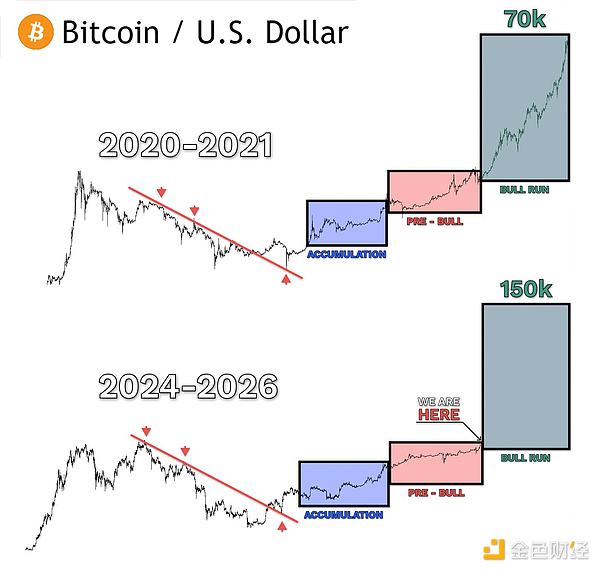

Cryptocurrency analyst Midas shared a long-term fractal chart that also presents a similar bullish view, comparing Bitcoin's current structure to its cycle from 2020-2021. If the historical fractal continues, BTC's target price this round may point to around $150,000.

Bitfinex Alpha stated that although the mid-2026 outlook remains optimistic in the context of expected global liquidity improvement, recent price movements are still constrained by geopolitical uncertainties, fluctuations in ETF fund flows, and the market's need for a clear breakthrough of the resistance band to drive decisive upward movement in market structure. Open interest in options significantly declined at the end of the year, clearing historical positions and making the derivatives market landscape clearer, reflecting a cautiously optimistic sentiment: long-term bullish positions coexist with recent bearish hedges, and while implied volatility remains low, it is gradually strengthening.

Meanwhile, Bitcoin is entering a dense supply zone defined by recent high buyers, with a cost price range roughly between $92,100 and $117,400. As prices return to this area, holders who have experienced declines may increase their breakeven selling pressure to exit without losses. This creates significant overhead resistance, meaning further increases will require time and sustained spot demand to absorb the selling pressure. Before this supply is digested, the market may maintain range-bound fluctuations, with risk appetite gradually recovering rather than immediately transitioning into a new strong upward trend.

LiquidCapital (formerly LDCapital) founder Yi Lihua stated on social media: The U.S., China, and South Korea are the three main markets in the cryptocurrency industry, and coincidentally, all three stock markets are in a bull market. Currently, large funds are mainly in the stock market and even in precious metals (gold, silver, rare earths, etc.), combined with the impact of the interest rate hike cycle and the blockchain technology's impact on reality being less than expected, leading to a four-year period since Bitcoin reached $69,000 in 2021, where BTC has only slightly appreciated, and ETH is even far below its four-year high. This should be considered a disappointing four years for cryptocurrency investors. However, bull markets often emerge in periods of despair, especially with the arrival of the interest rate cut cycle, the globalization of stablecoins, cryptocurrency-friendly policies, and financial on-chain applications. In both macroeconomic conditions and technical indicator analysis, we are currently at the dawn before a major cryptocurrency bull market. One should be greedy when others are fearful; although the bull market may be slow, it will be more exciting when it arrives. I also strongly agree with CZ that a cryptocurrency super cycle is about to come, with industry leaders like BMNR, Strategy, Tether, Binance, and USD 1 continuously buying.

Standard Chartered Bank has issued positive signals regarding Ethereum's prospects. The bank's Global Head of Digital Asset Research, Geoffrey Kendrick, stated that although they have lowered recent price forecasts in the context of overall weakness in the cryptocurrency market, he expects Ethereum to outperform other cryptocurrencies in 2026. The report noted that Bitcoin's continued dominance in the field has weakened the appreciation prospects of digital assets relative to the dollar. Standard Chartered expects the ETH/BTC exchange rate to gradually return to the 2021 high of about 0.08, thanks to Ethereum's structural advantages that other cryptocurrencies lack, including dominance in stablecoins, real-world assets, and decentralized finance, as well as ongoing network expansion efforts. The bank currently expects Ethereum to reach $7,500 by the end of 2026, down from a previous forecast of $12,000; the targets for 2027 and 2028 have been adjusted to $15,000 and $22,000, respectively, both lower than earlier expectations. However, Standard Chartered has raised its long-term outlook, increasing the 2029 end-of-year forecast to $30,000 and adding a new target of $40,000 by the end of 2030.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。