Original Title: Frowny Cloud

Original Author: Arthur Hayes, Co-founder of BitMEX

Original Compilation: BitpushNews

(Disclaimer: All views expressed in this article represent the author's personal stance and should not be used as a basis for investment decisions, nor should they be considered as advice for participating in investment trading.)

The deities I believe in have all transformed into adorable plush toys.

During the peak ski season in Hokkaido in January and February, I pray to the "Little God of Snow" – (Frowny Cloud) who governs snowfall. The local climate patterns dictate that during the best times of the snow season, snowflakes fall almost continuously day and night, and you can hardly see the sun. Fortunately, I also pray to the God of Vitamins – a soft and cute little pony plush – who grants me vitamin D3 tablets and various other blessings.

While I love snow, not all snow is of high quality and safe. The carefree and exhilarating skiing experience I enjoy requires a specific type of snow: low wind speeds at night and temperatures between -5 to -10 degrees Celsius. Under these conditions, new snow can effectively bond with old snow, creating bottomless powder. During the day, Frowny Cloud blocks specific wavelengths of sunlight, preventing south-facing slopes from becoming "sun-baked," which could lead to potential avalanches.

Sometimes, Frowny Cloud abandons us fearless skiers at night. Cold, clear nights can cause the snowpack to develop "layer fractures" after experiencing warming and cooling, creating persistent weak layers. This phenomenon can remain in the snowpack for a long time, and once energy transfer triggered by a skier's weight causes a collapse, it can lead to deadly avalanches.

As always, the only way to understand what kind of snowpack Frowny Cloud has created is to study history. On the slopes, we conduct research by digging large pits and analyzing the different types of snow that have fallen over time. But since this is not an article about avalanche theory, our approach in the market is to study charts and the interactions between historical events and price fluctuations.

In this article, I hope to explore the relationship between Bitcoin, gold, stocks (especially the American tech giants in the Nasdaq 100 index), and dollar liquidity.

Those who are gold bugs or members of the financial establishment dressed in Hermès scarves and red-soled shoes (who firmly believe in "buy and hold stocks" – I didn't have a high enough GPA at Wharton to get into Professor Siegel's class) are ecstatic about Bitcoin becoming the worst-performing mainstream asset in 2025.

These gold bugs mock Bitcoin enthusiasts: if Bitcoin is touted as a ballot against the existing order, why hasn't its performance matched or exceeded that of gold? Those dirty fiat currency stock salespeople scoff: Bitcoin is merely a "high beta" (high-risk) toy of the Nasdaq, but in 2025 it didn't even keep up, so why should cryptocurrency be considered in that asset allocation?

This article will present a series of exquisite charts, accompanied by my commentary, to clarify the interconnections between these assets.

I believe Bitcoin's performance is entirely in line with expectations.

It flows down with the tide of fiat currency liquidity – particularly dollar liquidity, as the credit pulse of "Pax Americana" is the most significant force in 2025.

The surge in gold prices is due to price-insensitive sovereign nations hoarding it madly, fearing that wealth will be plundered by the U.S. if left in U.S. Treasuries (as Russia experienced in 2022).

Recent actions by the U.S. against Venezuela will only further strengthen the desire of countries to hold gold rather than U.S. Treasuries. Ultimately, the AI bubble and its related industries will not disappear. In fact, Trump must double down on national support for AI, as it is the largest contributor to GDP growth for the empire. This means that even if the pace of dollar creation slows, the Nasdaq can continue to rise because Trump has effectively "nationalized" it.

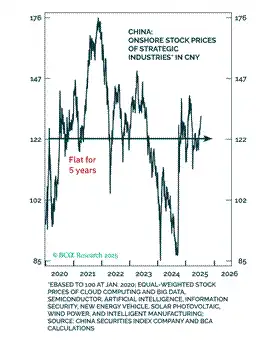

If you have studied China's capital markets, you will know that stocks perform very well in the early stages of nationalization, but then significantly underperform as political goals take precedence over capitalists' returns.

If the price trends of Bitcoin, gold, and the stock market in 2025 validate my market framework, then I can continue to focus on the fluctuations of dollar liquidity.

To remind readers, my prediction is: Trump will frantically inject credit, making the economy "run hot to the point of explosion." A thriving economy will help the Republican Party win in the elections this November. With the central bank's balance sheet expanding, commercial banks increasing loans to "strategic industries," and mortgage rates declining due to money printing, dollar credit will expand significantly.

In summary, does this mean I can continue to "surf" carefree – that is, aggressively deploy the fiat currency I've earned and maintain maximum risk exposure? I leave it to the readers to judge.

A Chart That Governs the Whole Picture

First, let’s compare the returns of Bitcoin, gold, and the Nasdaq in the first year of Trump's second term. How do these assets perform compared to changes in dollar liquidity?

I will elaborate later, but the basic assumption is: if dollar liquidity decreases, these assets should also decline. However, gold and the stock market have risen. Bitcoin has performed as expected: it’s as bad as dog poop. Next, I will explain why gold and the stock market can rise against the trend despite a decrease in dollar liquidity.

[Chart: Comparison of Bitcoin (red), gold (gold), Nasdaq 100 (green), and dollar liquidity (purple)]

Not Everything That Glitters Is Gold, But Gold Is Indeed Shining

My cryptocurrency journey began with gold. In 2010 and 2011, as the Federal Reserve ramped up quantitative easing (QE), I started buying physical gold in Hong Kong. Although the absolute amount was pitifully small, it constituted a remarkably high proportion of my net worth at the time.

Ultimately, I learned a painful lesson about position management, as I had to sell gold at a loss to buy Bitcoin for arbitrage in 2013. Fortunately, the outcome was relatively satisfactory. Even so, I still hold a significant amount of physical gold coins and bars in vaults around the world, and my stock investment portfolio is primarily composed of gold and silver mining stocks. Readers may wonder: since I am a devoted follower of Satoshi Nakamoto, why do I still hold gold?

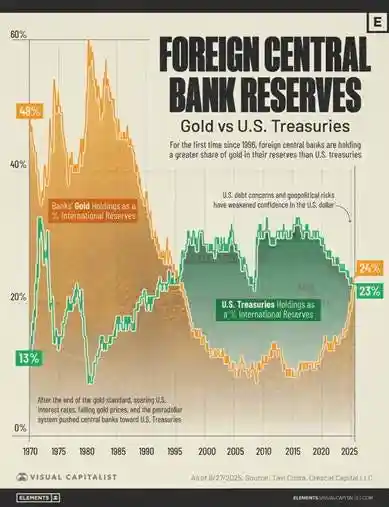

I hold gold because we are in the early stages of global central banks selling U.S. Treasuries and buying gold. Additionally, countries are increasingly using gold to settle trade deficits, even when analyzing the U.S. trade deficit.

In short, I buy gold because central banks are buying. Gold, as the true currency of civilization, has a history of 10,000 years. Therefore, no significant central bank reserve manager would store Bitcoin when they distrust the current dollar-dominated financial system; they are and will be buying gold. If gold's share of total reserves held by global central banks returns to the levels of the 1980s, the price of gold will rise to $12,000. Before you think I am being fanciful, let me prove it to you in an intuitive way.

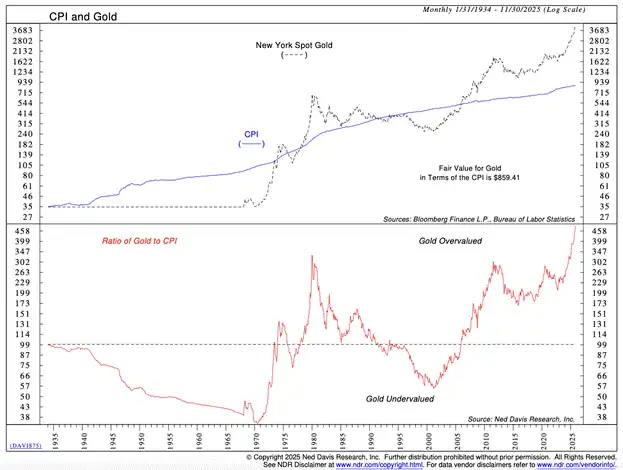

In the fiat currency system, the traditional view of gold is as an anti-inflation tool. Therefore, it should roughly track the CPI index manipulated by the empire. The above chart shows that since the 1930s, gold has roughly tracked that index. However, since 2008 and accelerating after 2022, the rate of increase in gold prices has far outpaced inflation. So, is there a bubble in gold, ready to harvest gamblers like me?

[Chart: Gold Price vs. U.S. CPI]

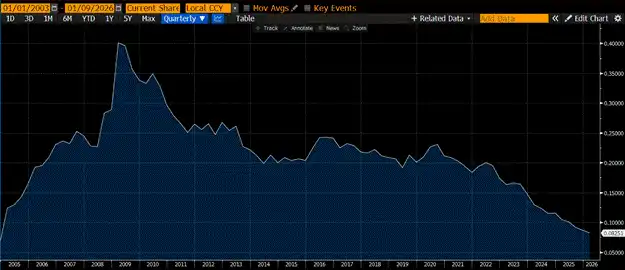

If gold is in a bubble, retail investors should be flocking in. The most popular way to trade gold is through ETFs, with GLD being the largest. When retail investors buy gold frantically, the circulating shares of GLD increase. To compare across different periods and gold price systems, we must divide the circulating shares of GLD by the physical gold price. The chart below shows that this ratio is declining rather than rising, indicating that a true gold speculation frenzy has not yet arrived.

[Chart: Circulating Shares of GLD Divided by Spot Gold Price]

If retail investors are not pushing up gold prices, who are those price-insensitive buyers? They are the central bank governors around the world. Over the past two decades, there have been two key moments that made these individuals realize: U.S. currency is only fit for wiping bottoms.

In 2008, American financial titans created a global deflationary financial crisis. Unlike the unmediated situation of the Federal Reserve in 1929, this time the Fed violated its obligation to maintain the dollar's purchasing power, printing money madly to "save" specific large financial players. This marked a watershed moment in the ratio of sovereign nations holding U.S. Treasuries to gold.

In 2022, President Biden shocked the world by freezing the bond holdings of a country with a massive nuclear arsenal and the world's largest commodity exporter (Russia). If the U.S. is willing to abolish Russia's property rights, then it can do the same to any weaker or less resource-rich country. Unsurprisingly, other countries can no longer comfortably increase their exposure to U.S. Treasuries that face the risk of confiscation. They began to accelerate their purchases of gold. Central banks are price-insensitive buyers. If the U.S. president steals your money, your assets instantly go to zero. Since buying gold can eliminate counterparty risk, what does it matter if the price is a bit high?

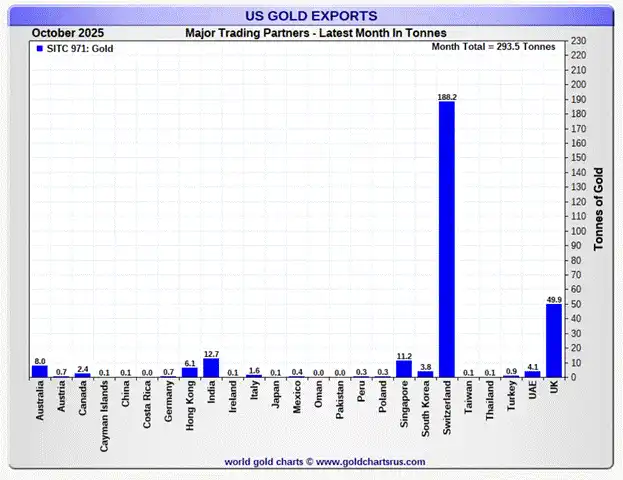

The fundamental reason sovereign nations have an insatiable appetite for this "barbarous relic" is that net trade settlements are increasingly conducted in gold. The record shrinkage of the U.S. trade deficit in December 2025 is evidence of gold re-establishing its status as a global reserve currency. In the changes of the U.S. net trade balance, over 100% is attributed to gold exports.

"According to data released by the U.S. Department of Commerce on Thursday, the goods trade gap fell 11% from the previous month to $52.8 billion. This brought the deficit down to its lowest level since June 2020… Exports in August rose 3% to $289.3 billion, primarily driven by non-monetary gold." – Source: Financial Times

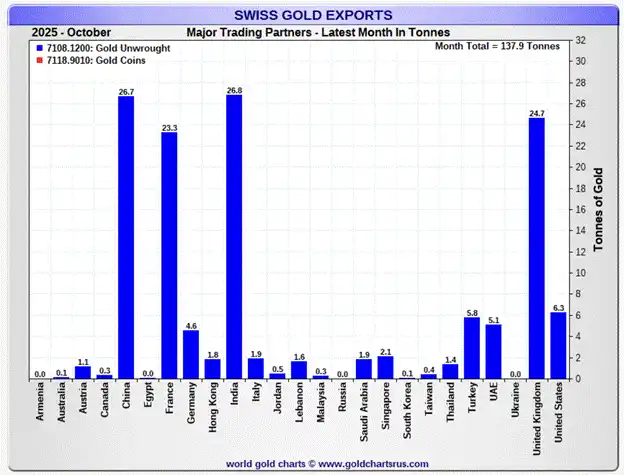

The flow path of gold is: the U.S. exports gold to Switzerland, where it is refined and recast, and then sent to other countries. The chart below shows that primarily China, India, and other emerging economies that manufacture physical goods or export commodities are purchasing this gold. This physical gold ultimately flows back to the U.S., while the gold moves to more productive regions of the world.

What I mean by "productivity" is not that these places are better at writing nonsense reports or annotating complex email signatures, but that they export energy and other key industrial goods, and their people manufacture steel and refine rare earths. The fact that gold continues to rise despite declining dollar liquidity is because sovereign nations are accelerating the restoration of the global gold standard.

[Chart: Gold Import/Export Flow by Country]

Long-Term Investors Love Liquidity

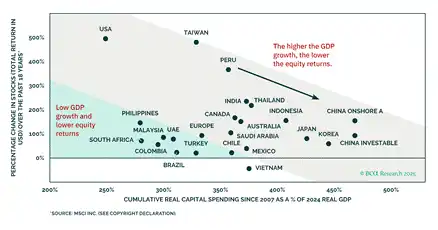

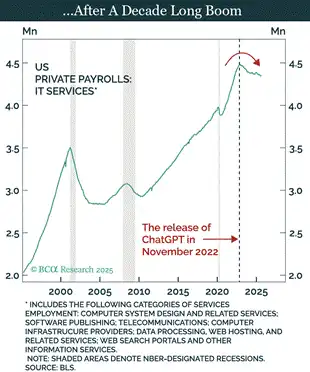

Every era has its soaring tech stocks. In the roaring 1920s bull market in the U.S., radio manufacturer RCA was the darling of technology; in the 1960s and 1970s, IBM, which manufactured new large computers, became the market focus; today, AI mega-service providers and chip manufacturers are all the rage.

Humans are inherently optimistic. We love to predict a glorious future: every penny spent by tech companies today will lead to a societal utopia in the future. To realize this vision in the minds of investors, companies burn cash and take on debt. When liquidity is cheap, betting on the future becomes easy. Thus, investors are eager to splurge on tech stocks with cheap cash today in exchange for the opportunity of massive cash flows in the future, driving up price-to-earnings ratios. Therefore, during periods of excess liquidity, tech growth stocks soar exponentially.

Bitcoin is a monetary technology. The value of this technology is only relative to the degree of depreciation of fiat currency. The innovation of proof-of-work (PoW) blockchain is great, and it guarantees that Bitcoin's value is greater than zero. However, to bring Bitcoin's value close to $100,000, continuous depreciation of fiat currency is required. The asynchronous growth of Bitcoin is a direct result of the explosive increase in dollar supply after the 2008 global financial crisis.

Therefore, I say: When dollar liquidity expands, Bitcoin and the Nasdaq will rise.

The only contradiction at present is the recent divergence between Bitcoin prices and the Nasdaq.

[Chart: Bitcoin vs. Nasdaq Price Trends]

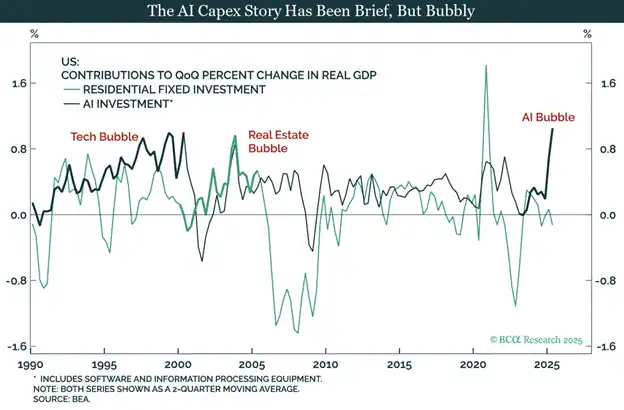

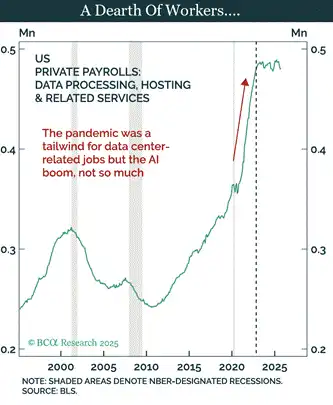

My theory for why the Nasdaq did not pull back in 2025 as dollar liquidity decreased is: AI has been "nationalized" by both the U.S. and China.

AI tech giants have sold the idea to the two world leaders: AI can solve everything. AI can reduce labor costs to zero, cure cancer, increase productivity, and most importantly, it can achieve military dominance globally. Therefore, whichever country "wins" in AI will dominate the world. China has long bought into this, which aligns perfectly with its five-year plan.

In the U.S., this analysis is a novelty, but industrial policy is as deeply rooted as in China, just marketed differently. Trump has drunk the "Kool-Aid" of AI, and "winning the AI competition" has become his economic agenda. The U.S. government has effectively nationalized any components deemed helpful for "winning." Through executive orders and government investments, Trump is dulling market signals, allowing capital to flood into AI-related fields without regard for returns. This is why the Nasdaq has decoupled from Bitcoin and the decline in dollar liquidity in 2025.

[Chart: Nasdaq vs. Dollar Liquidity Decoupling]

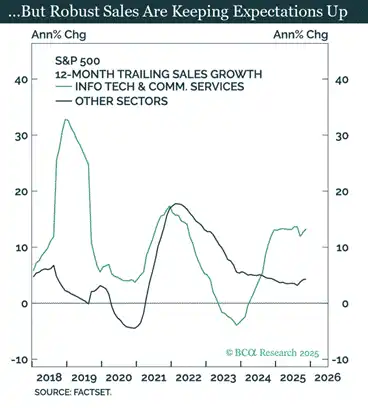

Whether or not there is a bubble, the increased spending to "win" AI is driving the U.S. economy. Trump has promised to keep the economy running hot; he cannot simply stop because the returns on these expenditures may be lower than the cost of capital a few years down the line.

U.S. tech investors should proceed with caution. The industrial policy aimed at "winning AI" is a great way to burn cash. Trump's (or his successor's) political goals will diverge from the interests of shareholders in strategic enterprises. This is a lesson that Chinese stock investors have learned the hard way. As Confucius said, "Learn from the past to know the future." Clearly, given the Nasdaq's outstanding performance, this lesson has not yet been absorbed by U.S. investors.

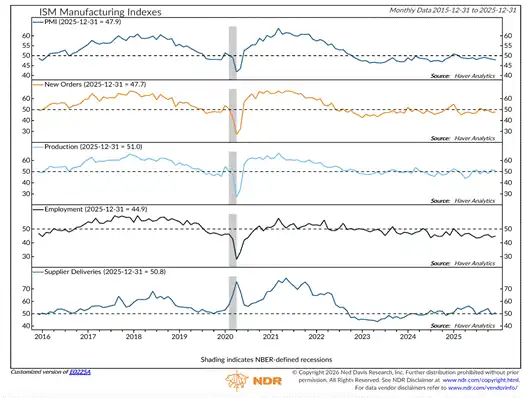

[Chart: U.S. PMI vs. Economic Growth Data]

A PMI reading below 50 indicates contraction. All the GDP growth has not led to a revival in manufacturing. I thought Trump was for the white working class? No, buddy, Clinton sold your jobs to China, and Trump brought the factories back, but now the factory floors are filled with AI robotic arms owned by Musk. Sorry, you’ve been played again! However, U.S. Immigration and Customs Enforcement (ICE) is hiring (hell of a joke)!

These charts clearly show that the rise of the Nasdaq is supported by the U.S. government. Therefore, even if overall dollar credit growth is weak, the AI industry will receive all the capital it needs to "win." The Nasdaq has thus decoupled and outperformed Bitcoin. I do not believe the AI bubble is ready to burst. This extraordinary performance will continue to characterize global capital markets until it no longer does, or most likely until the red team loses the House in 2026 (as predicted by Polymarket). If the Republican Party is "The Jetsons" (the tech faction), then the Democratic Party is "The Flintstones" (the retro faction).

If both gold and the Nasdaq have momentum, how can Bitcoin regroup? Dollar liquidity must expand. Clearly, I believe this will happen in 2026, so let’s explore how to achieve it.

Make the Economy Run Hot to the Point of Explosion

At the beginning, I mentioned that there are three pillars supporting the surge in dollar liquidity this year:

· The Federal Reserve's balance sheet will expand due to money printing.

· Commercial banks will lend to strategic industries.

· Mortgage rates will decline due to money printing.

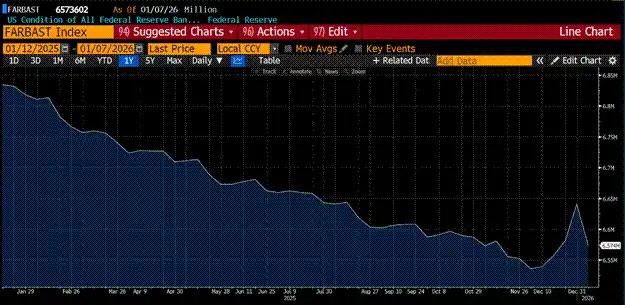

[Chart: Federal Reserve Balance Sheet Size]

The Federal Reserve's balance sheet decreased in 2025 due to quantitative tightening (QT). QT ended in December and launched a new money printing program called "Reserve Management Purchases" (RMP) at that month's meeting. I have discussed this in depth in previous articles. The chart clearly shows that the balance sheet bottomed out in December. RMP will inject at least $40 billion per month, and its scale will expand as funding needs for the U.S. government increase.

[Chart: U.S. Banking Loan Growth (ODL)]

The above chart shows the banking loan growth indicator (ODL) released by the Federal Reserve. Starting in the fourth quarter of 2025, banks have issued more loans. When banks issue loans, they create deposits out of thin air, thus creating money. Banks like JPMorgan are very willing to lend to government-backed enterprises. JPMorgan has launched a $1.5 trillion loan program for this purpose. The process is as follows: the government invests in a company, and the bank sees that the government backing reduces default risk, so it is happy to create money to fund that strategic industry. This is exactly what China has been doing. Credit creation has shifted from the central bank to the commercial banking system, resulting in a higher initial money multiplier, thus creating super-trend nominal GDP growth.

The U.S. will continue to display its might, and producing weapons of mass destruction requires financing from the commercial banking system. This is why bank credit growth will experience a structural rise in 2026.

Trump is a real estate businessman; he knows how to finance properties. His new order is to have Fannie Mae and Freddie Mac ("the GSEs") use the capital on their balance sheets to purchase $200 billion in mortgage-backed securities (MBS). This is a net increase in dollar liquidity. If successful, Trump will not stop there. By lowering mortgage rates to boost the housing market, Americans will be able to take out home equity loans. This wealth effect will put voters in a good mood on election day, turning them to support the Republican Party. More importantly, this creates more credit to purchase financial assets.

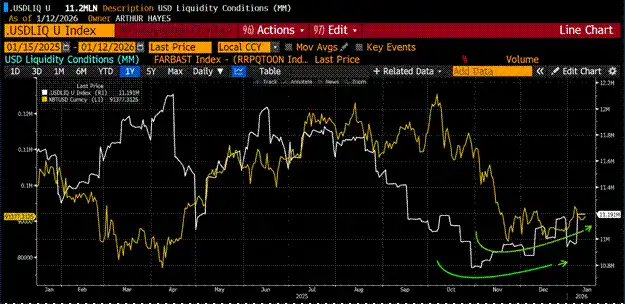

[Chart: Bitcoin and Dollar Liquidity Bottoming Out Together]

Bitcoin and dollar liquidity nearly bottomed out simultaneously. As dollar liquidity rapidly increases for the reasons mentioned above, Bitcoin will take off accordingly. Forget about the performance in 2025; that was due to insufficient liquidity.

Trading Strategy

I am an aggressive speculator. Although my fund Maelstrom is nearly fully invested, I still want to increase my risk exposure because I am extremely optimistic about the growth of dollar liquidity. Therefore, I am gaining leveraged exposure to Bitcoin by going long on MicroStrategy (MSTR) and Metaplanet (3350 JT), without trading complex options or perpetual contracts.

[Chart: Price Ratio of MSTR and Metaplanet Relative to Bitcoin]

I divide the stock prices of these two companies by the price of Bitcoin, and they are currently at the bottom of their volatility range over the past two years.

If Bitcoin can regain $110,000, investors will feel the urge to go long on Bitcoin through these tools. Given the leverage embedded in these companies' balance sheets, their performance will far exceed that of Bitcoin when they rise.

Additionally, we continue to increase our holdings in Zcash (ZEC). The departure of ECC developers is not a negative; I believe they can deliver more impactful products within their own profitable entity. I am grateful for the opportunity to buy discounted ZEC from the "weak hands."

Onward, crypto adventurers. The world is fraught with crises, so please stay vigilant. May peace be with you—and pray to the "Little God of Snow."

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。