Original | Odaily Planet Daily (@OdailyChina)

On January 15, Beijing time, the first Senate hearing on the cryptocurrency market structure bill (CLARITY) was suddenly thrown into uncertainty — Eleanor Terrett, a U.S. journalist who has been tracking the cryptocurrency legislative process, reported that due to Coinbase's sudden opposition to CLARITY, the U.S. Senate Banking Committee has canceled the originally scheduled markup hearing for CLARITY at 10:00 AM EST (11:00 PM Beijing time) on January 15, and a new hearing time has yet to be determined.

- Odaily Note: Regarding the hearing of CLARITY, the Senate Agriculture Committee (the main oversight committee for the CFTC) had previously planned to hold a hearing concurrently with the Senate Banking Committee (the main oversight committee for the SEC) on January 15, but the Senate Agriculture Committee has since postponed its hearing to January 27. The Senate Banking Committee was still preparing according to the original schedule, but this morning, just before the hearing, it was suddenly postponed.

Overview of CLARITY (skip if familiar)

Last week, we detailed the content, significance, and progress of CLARITY in our article “The Biggest Variable in the Post-Crypto Market: Can the CLARITY Bill Pass the Senate?.”

In short, CLARITY aims to clearly distinguish the classification of digital assets and delineate the regulatory responsibilities of the U.S. Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC), thereby establishing a clear and functional federal regulatory framework for the U.S. digital asset market to address long-standing issues of regulatory ambiguity and inconsistent enforcement.

For practitioners, the implementation of CLARITY will mean a substantial shift in the regulatory environment, where there will be a more predictable compliance path in the future. Market participants will be able to clearly know which activities, products, and transactions fall under regulatory oversight, thereby reducing long-term regulatory uncertainty, lowering litigation risks and regulatory friction, and attracting more innovators and traditional financial institutions to enter the market.

For cryptocurrencies themselves, the implementation of CLARITY is expected to promote cryptocurrencies as “an asset class more easily allocated by traditional capital,” by resolving institutional uncertainties and providing compliant entry paths for long-term capital that was previously unable to enter, thus raising the entire market's valuation floor.

Severe Industry Disagreement

Clearly, the cryptocurrency industry has high hopes for the future regulatory environment based on CLARITY, but as the hearing approaches, major representative companies in the industry have expressed starkly different attitudes.

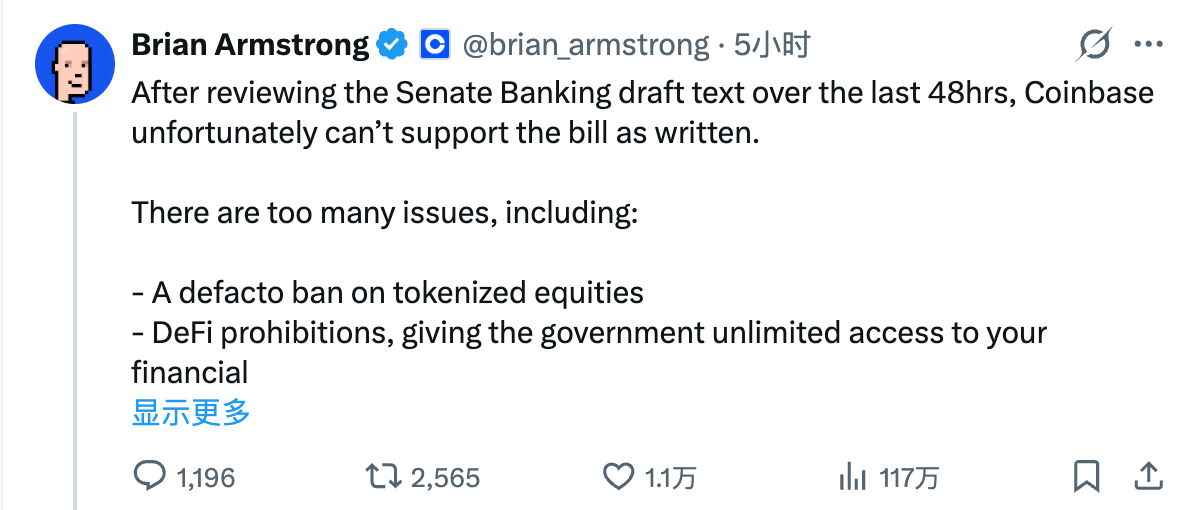

This morning, Coinbase, a significant lobbying force for cryptocurrency legislation, explicitly stated its opposition to the current version of the CLARITY bill.

Coinbase founder Brian Armstrong stated that the bill is worse than the current situation under its current text, and it is better to have no bill than a bad one — “The bill has significant issues regarding DeFi and stablecoin yields, and some provisions may grant the government unlimited access to personal financial records, harming user privacy and potentially stifling stablecoin reward mechanisms.”

At the same time, other industry representative companies such as a16z, Circle, Kraken, and Ripple expressed support for the current version of CLARITY.

Chris Dixon, a star partner at a16z (a major proponent of Web3 narratives), explained: “Cryptocurrency developers need clear rules… Essentially, this bill is designed to achieve that purpose. It is not perfect and needs some modifications before it becomes law, but if we want the U.S. to maintain its best position globally in building the future of cryptocurrency, now is the best time to advance CLARITY.”

Kraken co-CEO Arjun Sethi explained that legislation around market structure is inherently complex, and friction is bound to occur. The existence of legacy issues does not mean that efforts have failed; rather, it means we are working to solve the most challenging tasks… Giving up now will only lock in uncertainty, forcing U.S. companies to operate in a murky environment while the rest of the world continues to move forward.

What are the flaws in the current version of the bill?

From the statements of the parties involved, it is clear that both the firmly opposed Coinbase and the temporarily supportive a16z and Kraken share a common view regarding the current version of CLARITY, which is that they all agree the current version of the bill is not perfect and has certain flaws — the difference lies in Coinbase's more aggressive resistance, directly labeling it as a “bad bill,” while a16z and Kraken have opted for a more conservative approach, using terms like “not perfect” and “legacy issues” that are more tempered.

In fact, disagreements surrounding CLARITY have long existed — after the bill passed the House on July 17 last year, it was originally scheduled for Senate review in mid-last year, but was subsequently pushed to October, then to the end of last year, and then postponed to 2026, and it seems it will continue to be delayed…

In our previous article, we mentioned that the disagreements surrounding CLARITY mainly focus on issues of DeFi regulation, stablecoin yields, and the ethical standards of the Trump family.

Regarding the ethical standards of the Trump family, one of the most active lawyers in the industry, Jake Chervinsky, explained that while many Democrats have stated they would vote against CLARITY if restrictions are not imposed, the ethical issues do not fall under the jurisdiction of the Senate Banking Committee, so the hearing cannot discuss this issue, making this disagreement not the current focus of contention.

- Odaily Note: In future full Senate reviews, this issue will certainly be a focal point of attack for Democratic lawmakers.

As for other core disagreements, Jake Chervinsky broke them down into five more detailed points, as follows.

Point One: Stablecoin Yield Issues

The GENIUS bill passed last year prohibited interest-bearing stablecoins as a compromise to gain support from the banking industry, at the cost of stifling an entire category of innovative products.

However, the banking industry remains dissatisfied with this provision and is trying to overturn it in CLARITY. This is because while GENIUS stipulates that stablecoin issuers cannot pay “any form of interest or yield” to holders, it does not restrict third parties from providing yields or rewards, whereas the current CLARITY Section 404 prohibits third-party yield provision as well. If the current version of the bill passes, holders of stablecoins will not be able to receive any yields or rewards, only incentives through payments and other actions.

Jake Chervinsky criticized that restricting the yields or rewards of stablecoins lacks reasonable policy justification and will only harm the interests of U.S. consumers, the international status of the dollar, and U.S. national security. The reason banks are strongly demanding this change is that large banks can earn over $36 billion annually from payment and deposit businesses, and interest-bearing stablecoins would directly threaten these profits.

Point Two: Security Tokenization

Last year, SEC Chairman Paul Atkins launched the Project Crypto initiative, aimed at upgrading the financial system by migrating it on-chain, but CLARITY Section 505 seems to prevent this goal by stripping the authority to treat crypto assets fairly.

Paul Atkins emphasized the “innovation exemption,” while Section 505 stipulates that securities issued on-chain cannot be exempted or modified from any securities regulatory requirements, nor can anyone's registration obligations be exempted on this basis.

Point Three: Token Issuance

This may be the most important part of CLARITY, providing builders with a clear path to issue tokens without worrying about being enforced by the SEC for issuing “unregistered securities.”

Title 1 of CLARITY covers this path; it is clear but not simple or cheap. Title 1 requires many projects to disclose information, which theoretically is a good thing, but the problem lies in the details — Title 1 includes extremely burdensome disclosure requirements, close to equity-level, which are not much different from those for publicly listed companies — including audited financial statements, etc. This system is suitable for mature companies but not for startups.

This is just one of many details. Title 1 also requires builders to obtain SEC approval for each token; disclosure obligations must continue long-term after issuance; the public fundraising cap is set at $200 million, etc.

In contrast, creators might as well issue overseas or simply issue stocks.

Point Four: Developer Protection

Non-custodial software developers are not money transmission entities and should not bear user KYC obligations — this should be undisputed.

However, Title 3 of CLARITY repeatedly suggests that regulators may extend their monitoring reach into the DeFi space. These provisions must be removed or amended.

Point Five: Institutional Channels

Regulated financial institutions have always been hesitant to venture into DeFi due to compliance concerns.

Section 308 of CLARITY hoped to address this issue but made a critical mistake — it imposed additional burdens on institutions, making it even easier to scare them away from DeFi than the current situation.

Radicals vs. Conservatives

In summary of Jake Chervinsky's breakdown of the major core issues in the current version of the CLARITY bill, it is easy to understand why Coinbase, a16z, Kraken, and others would all agree — this is not a perfect bill.

Faced with a bill that contains hidden pitfalls, as representatives of the cryptocurrency industry, Coinbase, a16z, and Kraken actually share fundamental interests, but there are differences in the paths they take to pursue those interests.

Coinbase has chosen a more aggressive confrontational stance. Its core logic is that if CLARITY is passed with provisions unfavorable to the industry, even if they are vaguely worded, they could be infinitely amplified in enforcement, leading to long-term suppression of innovation. The subsequent costs of amending the law and political resistance may far exceed the price of continuing to endure the current regulatory uncertainty.

Institutions like a16z, Kraken, and Circle have adopted a more conservative and "realist" strategy. In their view, the biggest problem with the long-standing stagnation of U.S. cryptocurrency regulation is not that "the rules are not good enough," but rather that there are fundamentally no rules. Even though CLARITY has flaws, it at least provides a legislative starting point that can be amended, negotiated, and gradually improved. Once CLARITY is officially implemented, the U.S. cryptocurrency industry will have a unified federal framework for the first time, allowing for more operational space to address specific provisions later.

There is no simple right or wrong here; the core of the conflict between the two sides actually lies in whether to continue pushing the bill under the current version and how much compromise cost should be paid for it. There is also no "industry consensus" here; both sides share the common demand to make CLARITY better, but they have chosen different strategies for negotiation.

As Jake Chervinsky said: “Regardless of whether it is good or bad, this text will undergo significant changes before it officially becomes law. I hope it evolves in a better direction.”

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。