Original Title: "Countdown to Fogo Launch on Binance: Is It a Profit Opportunity?"

Original Author: Ma He, Foresight News

On January 12, the Fogo public chain launched its token sale through the Pre-TGE Prime Sale on Binance Wallet, marking the project's transition from the testing phase to the mainnet and TGE, making it the third Pre-TGE Prime Sale project on Binance.

Binance Prime Sale is a pre-TGE token sale mechanism launched by Wallet, with Fogo's FOGO token sale amounting to 200 million FOGO, accounting for 2% of the total supply, priced in BNB, raising approximately $7 million. The sale price is fixed at $0.035 per FOGO (based on the current BNB exchange rate), with a sale FDV of $350 million.

Previously, on January 10, Binance announced the launch of FOGO pre-market perpetual contracts. As of the time of writing, the token is quoted at 0.056 USDT, with an FDV of $560 million. Based on the current FDV estimate, the profit margin for this Binance Pre-TGE Prime Sale is approximately 60% (return rate).

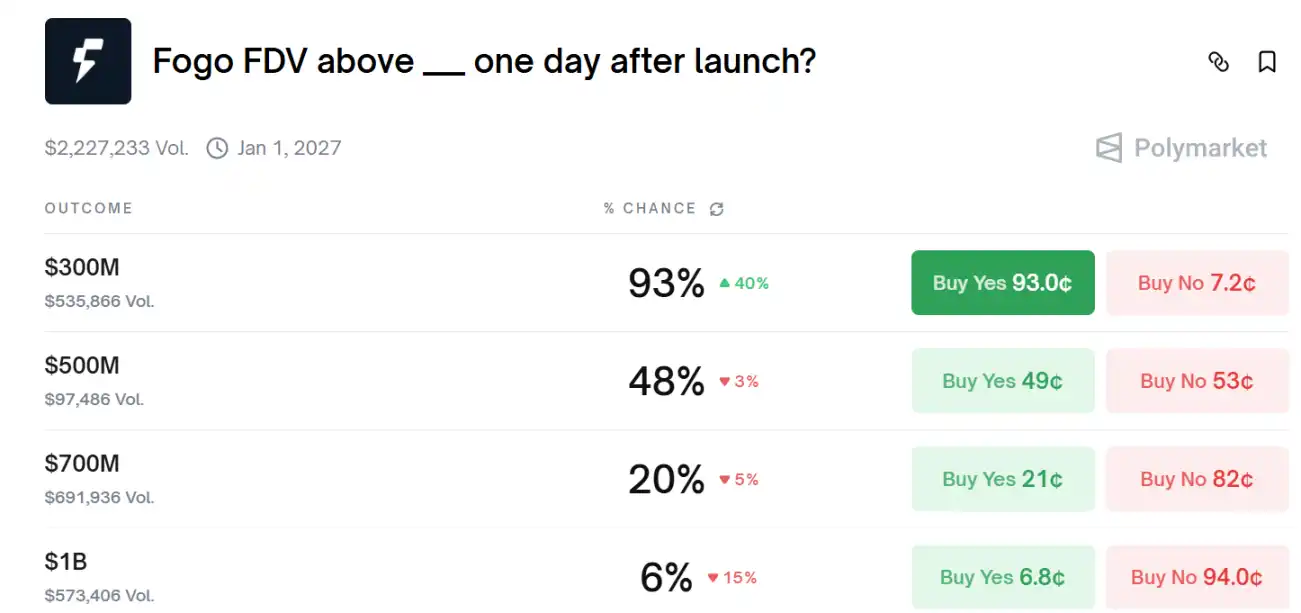

Currently, Polymarket data shows that the market bets on the probability of Fogo's token having an FDV exceeding $300 million on the day after its launch has risen to 93%.

The subscription time for this project is from 16:00 to 18:00 Beijing time on January 13, and participating users must have at least 200 Alpha points. Each Binance Wallet user can submit a maximum of 6 BNB. Binance will distribute based on the proportion submitted by users, and if total subscriptions exceed the limit, they will be proportionally reduced.

Compared to other Prime Sale projects (like the first two), Fogo's sale places more emphasis on community access, eliminating early presales and instead filtering active users through Alpha points.

Historical data shows that the average oversubscription rate for the first two Prime Sales reached 150%, resulting in an actual allocation shrinkage of 20%-30%. Currently, both Binance and Bybit have announced the launch of FOGO spot trading.

High-Performance L1

Fogo is a high-performance SVM Layer 1 public chain, with the core goal of achieving a "real-time experience," optimized for trading, DeFi, and social payments, rather than general computing. Unlike Solana's distributed architecture, Fogo adopts a centralized optimization strategy to ensure low latency and high throughput. According to its official introduction, its block time is 40ms, far lower than Solana's 400ms, supporting high-frequency trading such as perpetual contracts (perps) and arbitrage. Fogo focuses more on performance benchmarking, having proven a 1.3s confirmation rate on its testnet.

Doug Colkitt

The two founders of the Fogo team have a strong industry background. Co-founder Doug Colkitt is also the founder of Ambient Finance, with a solid background in quantitative trading, having previously worked as a quantitative researcher at Citadel Securities, focusing on high-frequency trading and arbitrage strategies. The other co-founder, Robert Sagurton, previously held an executive position at Jump Crypto and has worked at institutions such as JPMorgan, Morgan Stanley, and R3, focusing on banking and trading exchange systems.

Robert Sagurton

In December 2024, Fogo completed a seed round financing of $5.5 million, led by Distributed Global. In January 2025, Fogo completed another $8 million community round financing, led by Echo (associated with Cobie), with a valuation of $100 million.

Total Supply of 10 Billion Tokens, Community Allocation Accounts for 16.68%

Fogo's token is FOFO, which has two main utilities: one is to serve as transaction gas fees, and the other allows participation in staking rewards, where token holders and validators earn native rewards by securing the network.

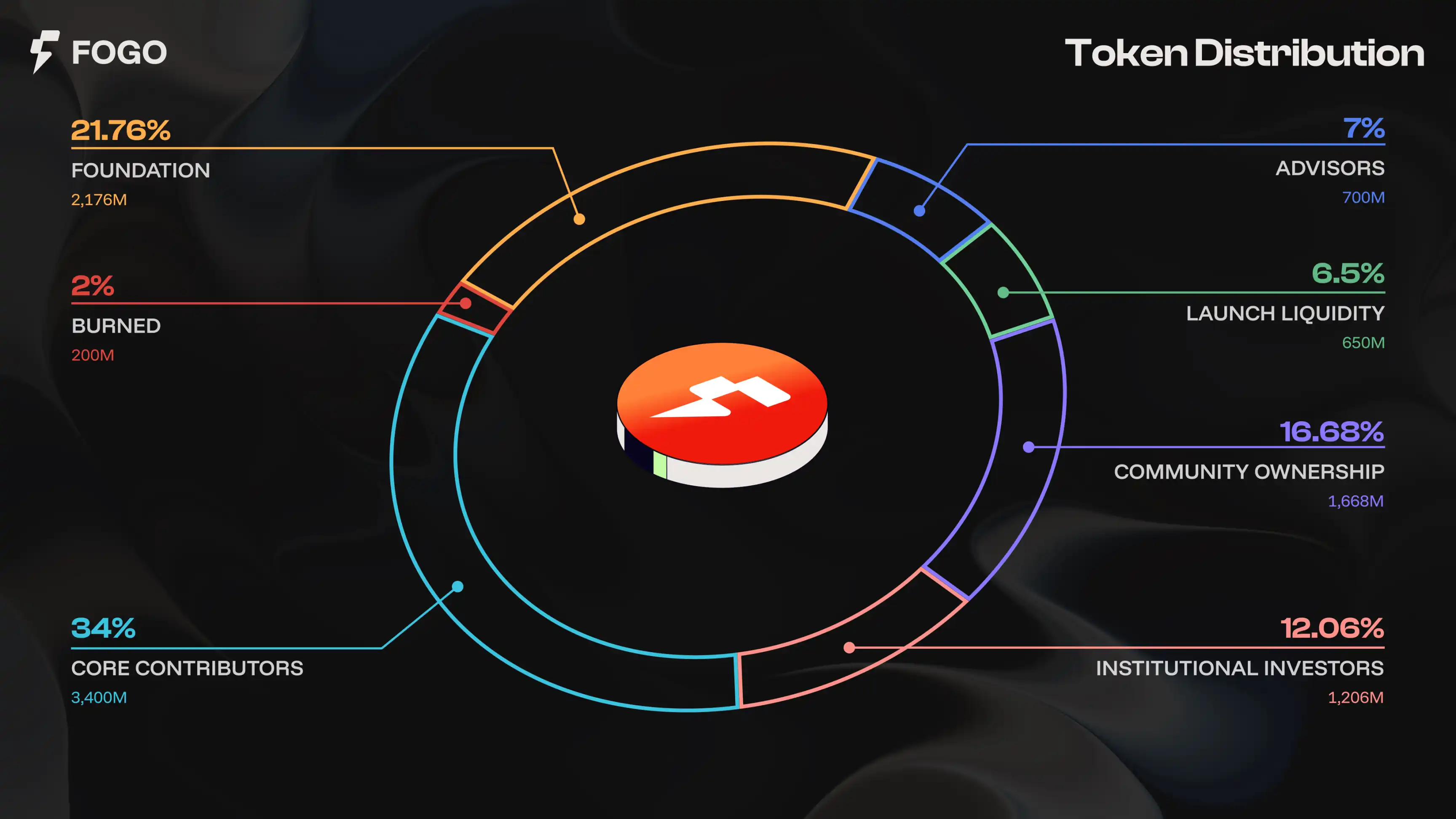

On January 13, Fogo updated its tokenomics, with a total supply of 10 billion tokens.

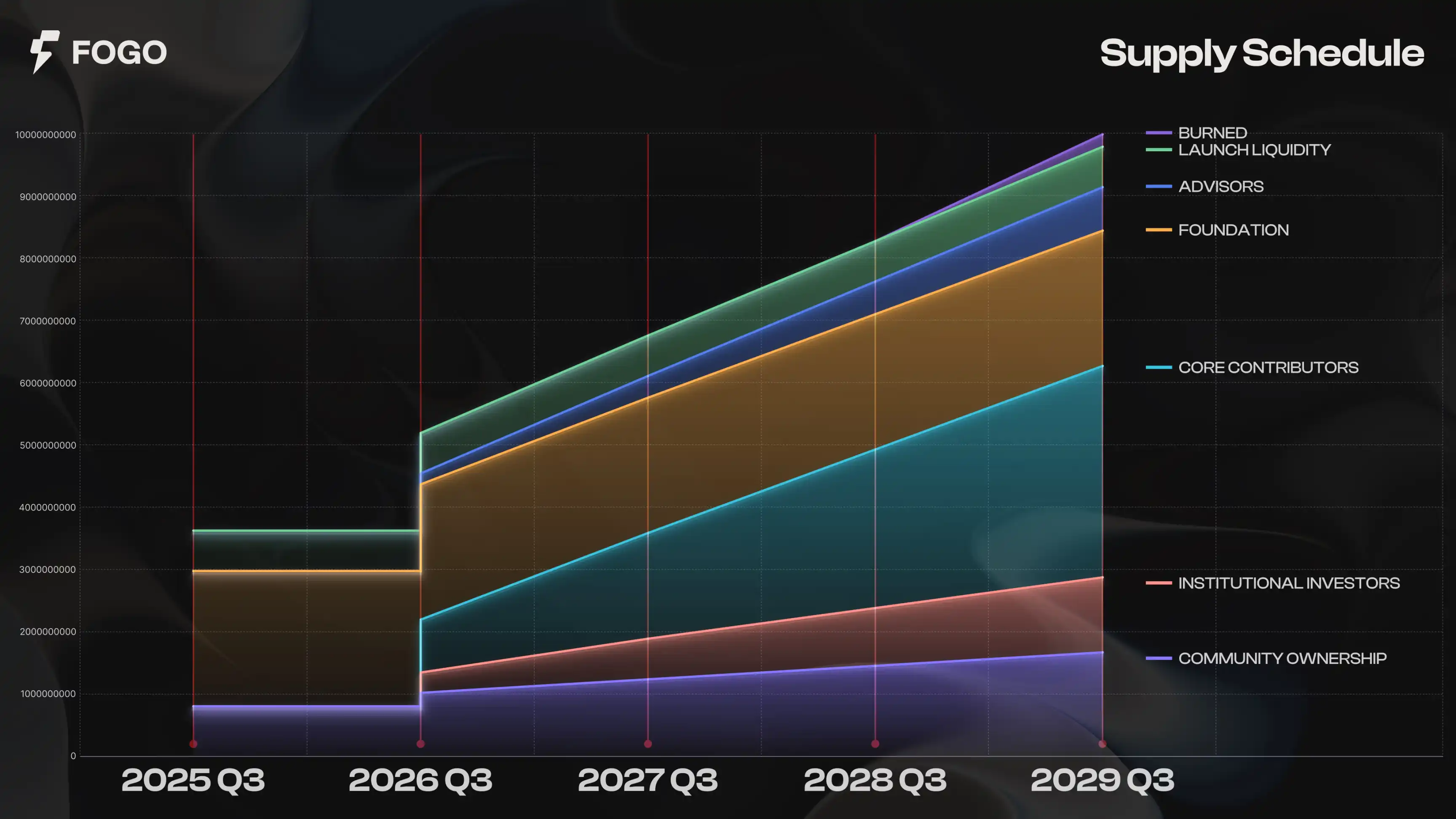

Among them, the total community allocation accounts for 16.68%, including Echo fundraising, Binance priority purchase, and airdrop activities, all categorized under community ownership. Previously, Fogo completed two rounds of fundraising on the Echo platform: the first round raised $8 million with an FDV of $100 million, and the second round raised $1.25 million with an FDV of $200 million, with approximately 3,200 participants. The tokens from the Echo fundraising share (8.68%) will be fully locked at TGE. Starting from September 26, 2025, the Echo share will unlock over four years, with a 12-month lock-up period. The Binance priority purchase share (2%) will have all tokens unlocked. The community airdrop share (6%) will have all tokens unlocked. 6% of the genesis supply is allocated for airdrop activities.

· January 15 allocation share (1.5%): At the mainnet launch, 1.5% of the share will be allocated to reward early community members and initial network participants. Future reward shares (4.5%) are reserved for ongoing promotional activities.

· Institutional investor share (12.06%): All tokens are locked. The institutional investor share will start unlocking on September 26, 2026.

· Core contributor share (34%): Core contributors hold 34% of the supply. All tokens are locked. Starting from September 26, 2025, the core contributor share will unlock over four years, with a 12-month lock-up period.

· Foundation share (21.76%): This allocation is used to fund grants, incentives, and ecosystem projects. All these tokens are unlocked.

· Advisor share (7%): All tokens are locked. The advisor share will unlock over four years starting from September 26, 2025, with a 12-month lock-up period. This is used to reward strategic support and ongoing contributions.

· Launch liquidity share (6.5%) (formerly known as "Airdrop and Launch"): All tokens are unlocked to support liquidity provided by third parties at launch.

· Burned share (2%): The number of tokens that have been burned to date.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。