Written by: Yokiiiya

The story of Circle is essentially a history of entrepreneurial struggles regarding the evolution of internet architecture, the geopolitical game of financial sovereignty, and the digital reformation of the ancient concept of "currency." From the initial idealistic attempts to package Bitcoin as a consumer-level payment tool, to the cultural and regulatory Waterloo encountered during the costly acquisition of the Poloniex exchange, and finally establishing a "compliance-first" strategic moat and successfully issuing USDC, every transformation of Circle has precisely aligned with pivotal moments in the history of the crypto economy.

Jeremy Allaire, an internet veteran who defined early web development standards, along with his co-founder Sean Neville, has undergone a decade-long cognitive iteration. Their story is filled with dramatic twists: how did they envision the future of finance in a warehouse in Boston? Why did they choose the most difficult compliance path during the peak of the ICO frenzy? What led to the historic alliance with Wall Street giant BlackRock?

Today, we will attempt to comprehensively deconstruct Circle's transformation from an insightful perspective, analyzing why USDC was able to break free from the shadow of Tether (USDT) and become a key bridge connecting traditional finance and the crypto economy.

This article is approximately 6,000 words long.

1. The Last Startup of an Internet Architect

To understand Circle's DNA, we must first trace back to Jeremy Allaire's early life. Unlike many founders from the crypto-native generation who emerged from cypherpunk mailing lists or gaming forums, Allaire is a "regular army" of internet infrastructure development.

In the 1990s, Allaire founded Allaire Corporation and invented ColdFusion, a revolutionary middleware that allowed web pages to connect directly to databases for the first time, transforming the static internet into a dynamic application platform. Subsequently, as the Chief Technology Officer of Macromedia (later acquired by Adobe), he led the evolution of the Flash platform, focusing on solving one of the internet's most challenging problems: how to transmit video and interactive content over extremely limited bandwidth.

This experience endowed Allaire with a unique "protocol thinking." In his view, the world is built layer by layer with protocols. HTTP solved the transmission of information, SMTP solved the transmission of communication, but he keenly observed that the most critical layer—value transfer protocol—was missing from the internet's architecture.

In 2012, when Bitcoin was still viewed by mainstream media as the poison of the dark web, Allaire read Satoshi Nakamoto's white paper. For this technical expert, who had spent his career solving "how to distribute data on an open network," it was not just a reading but an epiphany. He did not see "decentralization" or "anti-censorship" first like libertarians; instead, he saw "the HTTP protocol of currency."

He realized that blockchain is essentially a distributed ledger technology that allows value to flow globally at an instantaneous speed and with extremely low marginal costs, just like email. This understanding formed the underlying philosophy of Circle: not to destroy the existing financial system but to upgrade its tech stack.

In 2013, Jeremy Allaire co-founded Circle with his old partner from Adobe, Sean Neville. Neville is a highly skilled architect who previously served as a senior architect and chief scientist at Brightcove and Adobe. His dedication to building high-concurrency, enterprise-level systems injected the initial engineering DNA into Circle.

In the early days of Circle, to obtain compliance for operations, Allaire did not choose the "cutting corners" approach like other crypto companies; instead, he spent a significant amount of time shuttling between Washington and New York. His testimony at the Senate hearing in 2013 was one of the earliest attempts by the cryptocurrency industry to engage in rational dialogue with regulators. This "good student" posture was scoffed at by many crypto anarchists at the time, but it laid the groundwork for Circle's survival a decade later.

2. Circle Pay: The Practice of Bitcoin as "Invisible Rails"

Circle's first flagship product was Circle Pay. The design concept of this product was extremely forward-thinking: to create a global version of Venmo or WeChat Pay, but without relying on the banking clearing system, instead using the Bitcoin blockchain.

On the user interface, Circle Pay made every effort to hide the traces of Bitcoin. Users saw balances in dollars, pounds, or euros. When User A sent $100 to User B, Circle would convert A's fiat currency into Bitcoin in the background, send it to B via the blockchain, and then instantly convert it back to fiat currency.

To attract users, Circle promised "instant and free" transactions. However, this business model encountered structural flaws in the market environment from 2013 to 2016.

Volatility Trap: The extreme volatility of Bitcoin prices meant that Circle had to bear exchange rate risks. In the minutes or even seconds of a transfer, fluctuations in Bitcoin prices could completely erode profits or even lead to losses.

Hostility from Banks: Despite Circle's efforts to comply, at that time, the banking channels connecting the fiat world and the crypto world were extremely fragile. To maintain fiat currency inflows and outflows, Circle had to pay high banking fees, which the company absorbed internally to maintain a "free" user experience.

Misalignment of User Perception: Most users did not care about the underlying "decentralized rails"; they only cared about the convenience of transfers. By 2015, Venmo and Cash App were already performing well enough through traditional banking channels. The "blockchain advantage" of Circle Pay was not apparent on the user experience side, but it brought significant operational costs on the backend.

Thus, by the end of 2016, Allaire and Neville painfully realized: Bitcoin was too unstable as an asset and too congested as a payment network. If they wanted to realize the vision of "internet currency," merely using Bitcoin as a backend channel was not feasible. The world needed a native, stable digital currency.

This led to Circle's first major transformation in history: in December 2016, Circle announced it would stop directly buying and selling Bitcoin on its app and instead focus on building a more fundamental payment protocol. This decision was interpreted by the outside world as Circle "abandoning Bitcoin," sparking widespread skepticism in the community, but it was actually the beginning of Allaire's strategic focus.

3. A Gamble in the Right Direction and the Nightmare of Poloniex

In 2017, the ICO (Initial Coin Offering) frenzy triggered by Ethereum swept the globe. The focus of the cryptocurrency market shifted from simple Bitcoin trading to speculative trading of thousands of tokens. For Circle, this was a huge temptation. Although their long-term vision was to build a stable payment network, the hot money in the current market surged in the exchange business.

To quickly enter this market, Circle made a decision that would later prove to be an "expensive lesson": in February 2018, they acquired Poloniex, then one of the largest altcoin exchanges in the world, for approximately $400 million.

Allaire had a clear plan. He hoped to transform Poloniex from a retail speculation casino into a regulated, institutional-grade digital asset exchange. He envisioned that not only would cryptocurrencies be traded on Poloniex, but in the future, tokenized stocks, bonds, and real estate could also be traded. This was referred to as the "Tokenization of Everything."

Yes, this is the same intention as today's RWA.

However, the process of integrating Poloniex turned out to be a corporate culture disaster.

Circle: Headquartered in Boston, filled with former Wall Street executives, lawyers, and compliance officers. The culture is rigorous, hierarchical, and emphasizes processes and regulations.

Poloniex: The team is scattered globally, with many employees being anonymous, accustomed to a "Wild West" style of freedom. The user base primarily traded obscure coins that were not listed elsewhere and was extremely resistant to KYC verification.

At the same time, after Circle's compliance team took over Poloniex, they immediately launched a large-scale "cleaning" operation:

Mandatory KYC: Circle required all Poloniex users to upload identification. This led to a massive loss of core users, who quickly migrated to offshore exchanges like Binance, which had looser regulations at the time.

Large-scale Delisting: To avoid the risk of the SEC classifying tokens as securities, Circle delisted many of the most popular but questionable tokens on Poloniex. This directly severed the exchange's revenue source.

According to former employees' revelations on Reddit and Glassdoor, the internal chaos during this period was referred to as a "nightmare."

The original codebase of Poloniex was described as "a mess," filled with technical debt. Circle's engineers spent a lot of time patching security vulnerabilities instead of developing new features. Meanwhile, facing complaints from users about their assets being frozen due to delisting, the customer service team was on the brink of collapse. This "shock therapy" not only destroyed Poloniex's market share but also plummeted the morale of Circle's employees.

In addition to the business-level collapse, Poloniex also brought a huge legal black hole to Circle. Before Circle's acquisition, Poloniex had provided services to users in sanctioned regions (such as Crimea) and acted as an unregistered securities exchange. Although these actions occurred before the acquisition, as the new owner, Circle had to bear the consequences.

Ultimately, Circle agreed to pay over $10 million in fines to the SEC and pay penalties to OFAC (Office of Foreign Assets Control) to settle these historical issues.

By the end of 2019, the situation had become very clear: trying to operate an exchange primarily profiting from "long-tail altcoins" within a compliance framework was a paradox. Allaire demonstrated decisiveness as CEO. In October 2019, Circle announced the spin-off and sale of Poloniex to a consortium composed of Asian investment groups (reportedly backed by Justin Sun).

According to subsequent disclosures in SPAC documents, Circle confirmed a loss of approximately $156 million from this transaction.

This failed acquisition instead became Circle's "rite of passage." It bought a profound lesson for $150 million: Circle's DNA lies not in speculative trading but in infrastructure. This divestiture was essentially a "detox," allowing Circle to lighten its load and fully bet on the newly born USDC.

4. The Birth of USDC—The Awakening of Minting Rights

Amid the chaos of Poloniex, an internal R&D project at Circle was quietly changing the company's fate. Allaire and Neville returned to their original intention from 2013: if the internet needed a currency, it must possess the stability of the dollar and the programmability of cryptocurrencies.

At that time, Tether (USDT) was already on the market, but Tether was like an "offshore casino chip" in the crypto world—opaque, with mysterious banking relationships and missing audit reports. Allaire saw a significant market gap: a "clean" Tether. A digital dollar fully backed by reserves held within the U.S. regulatory framework, regularly audited, and legally redeemable.

Circle understood that to establish a universal currency standard, going it alone was not enough. Currency needs network effects. In 2018, Circle formed a strategic alliance with Coinbase, the largest compliant exchange in the U.S., to jointly establish the CENTRE Consortium.

This was a stroke of genius.

Role of Coinbase: As the largest fiat on-ramp, Coinbase promised that USDC could be seamlessly exchanged 1:1 with dollars on its platform. This meant that millions of retail users instantly became potential holders of USDC.

Role of Circle: As the issuer, responsible for underlying reserve management, compliance interfaces, and connections with banks.

Sean Neville led the team in designing the smart contract architecture for USDC. Unlike the closed Circle Pay, USDC was built on the Ethereum ERC-20 standard. This is an open protocol, meaning any wallet, exchange, or decentralized application (dApp) can integrate USDC without permission. This "open garden" strategy allowed USDC to rapidly permeate the capillaries of the crypto ecosystem.

In the summer of 2020, decentralized finance (DeFi) exploded. This was the true takeoff moment for USDC. Protocols like Uniswap, Compound, and Aave needed an asset that was extremely stable on-chain and could be automatically processed by smart contracts as collateral or trading pairs:

Disadvantages of USDT: While it had good liquidity, its opacity made risk-averse DeFi developers uneasy.

Advantages of USDC: Transparent, compliant, and redeemable.

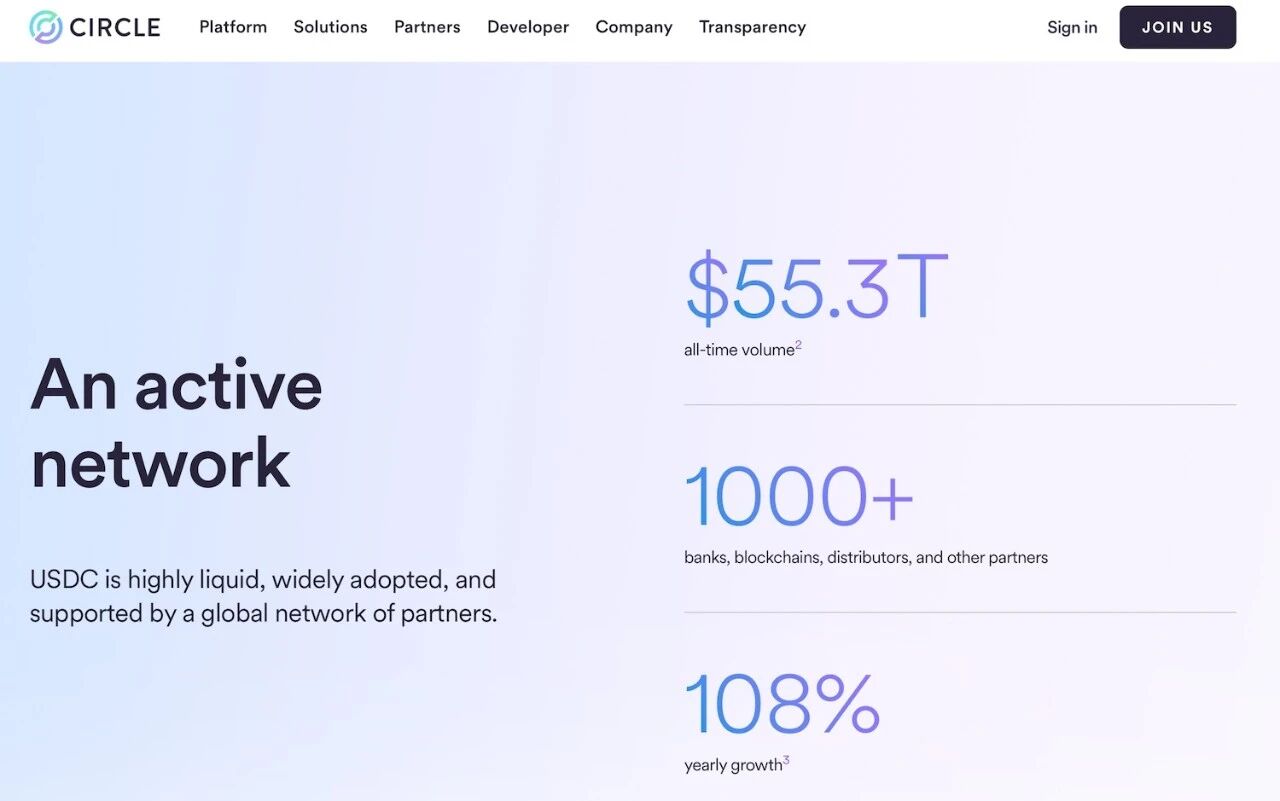

At this stage, Allaire's frequently mentioned vision of "programmable money" became a reality. Billions of USDC began to be lent, accrued, and settled globally through smart contracts without any human intervention. The market capitalization of USDC skyrocketed from less than $500 million at the beginning of 2020 to over $10 billion in just over a year.

5. The Awakening of Traditional Finance and Wall Street's Embrace

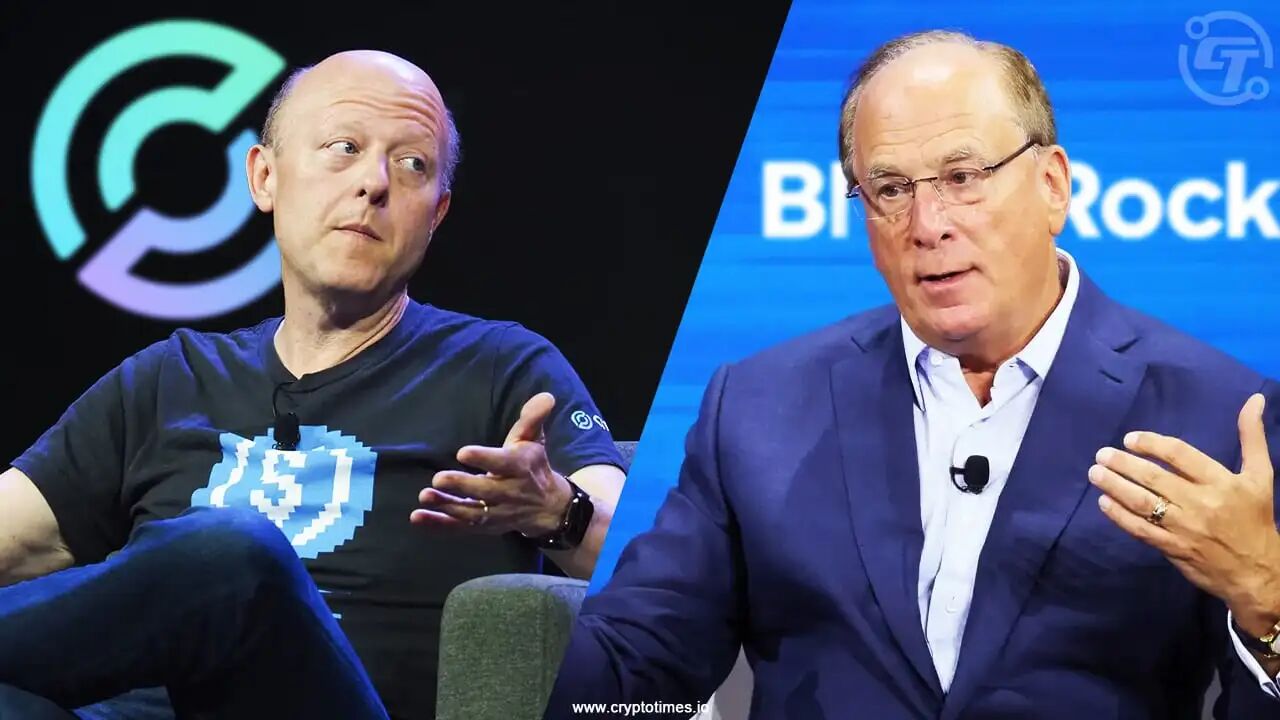

As the size of USDC grew, it was no longer just a tool in the crypto world but began to attract the attention of Wall Street giants. A key figure in this turning point was Larry Fink, CEO of BlackRock.

Early on, Larry Fink was skeptical of Bitcoin, calling it a "money laundering index." However, as client demand for digital assets increased and his understanding of blockchain technology deepened, Fink's attitude underwent a 180-degree turn. He began to realize that asset tokenization would be the next generation of technology in financial markets.

In April 2022, Circle announced a $400 million funding round led by BlackRock. This was not just an injection of capital but also a vote of confidence. More strategically, BlackRock became the primary manager of USDC's cash reserves.

To thoroughly address external concerns about the safety of stablecoin reserves (especially after the panic triggered by the Terra/Luna collapse), Circle collaborated with BlackRock to establish a Circle Reserve Fund registered with the SEC (a Rule 2a-7 government money market fund).

Mechanism: The reserves of USDC were no longer casually stored on the balance sheets of certain banks but were primarily invested in short-term U.S. Treasury securities and custodied by BNY Mellon.

Significance: This effectively turned USDC into a "tokenized U.S. Treasury." Even if Circle the company went bankrupt, the assets custodied at BNY Mellon would be bankruptcy-remote, allowing holders to still redeem them.

This initiative was the pinnacle of Circle's "compliance moat." It upgraded USDC from a "privately issued token" to a kind of "public-private partnership digital dollar."

In March 2023, Silicon Valley Bank (SVB) collapsed. Circle had about $3.3 billion in cash reserves stored at SVB. After the news broke, USDC briefly lost its peg, with the price dropping to $0.88. This was the most dangerous 48 hours in Circle's history.

However, it also became a moment to validate Circle's strategic resilience. Since most reserves had already been transferred to the Treasury fund managed by BlackRock, and Allaire quickly and transparently disclosed the risk exposure while promising to cover the gap with company assets, market confidence rapidly restored.

This crisis proved the transparency and risk resilience of Circle's reserve structure; in contrast, if the same situation had occurred with opaque competitors, the consequences could have been dire.

6. IPO: Capitalizing on "Compliance First"

Circle's journey to going public is itself a microcosm of the capitalization process in the crypto industry. From early attempts at SPAC mergers failing to ultimately choosing the traditional IPO route to list on the New York Stock Exchange, this process not only validated regulatory agencies' initial recognition of compliant stablecoin business models but also established a paradigm for the subsequent public offerings of crypto companies.

On June 5, 2025, Circle officially began trading at an issuance price of $31.00 per share, raising over $1 billion. The market performance on the first day of trading was phenomenal, with the stock price soaring to $83.23, a single-day increase of 168%, and the market capitalization instantly surpassing $16 billion. This irrational market frenzy was deeply rooted in the extreme lack of quality compliant crypto asset targets in the secondary market.

Notably, after the IPO, Circle continued to push for deeper "financial system embedding," including media reports of applying to U.S. regulators to establish a national trust bank, which was seen as part of an industry trend. This was not about retail banking but about embedding reserve management and institutional custody capabilities into a higher-level regulatory shell.

The narrative here is very consistent: Circle is not satisfied with merely being a "regulated stablecoin issuer"; it wants to become a "regulated internet financial infrastructure company," and the identity of a public company and the path to a banking license are fundamentally about reinforcing this positioning.

7. The Inevitability of USDC's Emergence

The reason USDC was able to stand out in the fierce stablecoin war is not coincidental but rather the inevitable result of Circle's evolution path of "ideal-frustration-epiphany-rebirth":

Tether won in "breadth" and "speed," occupying offshore markets and payment channels in developing countries; while Circle won in "depth" and "credibility," occupying the entry point for Wall Street institutions into the crypto world.

The so-called inevitability does not mean that Circle was destined to succeed, but rather that in the category of stablecoins, as competition progressed, the decisive factor would shift from "growth" to "trust structure." Circle's transformation happened to place organizational capability on the "trust structure":

- Cutting off C-end applications (Circle Pay) and high-risk entry points (exchanges) to focus on the main line;

- Transforming the reserve system into standard financial components through institutional-level asset management and custody;

- Turning "trust" from narrative into evidence through continuous disclosure and auditing.

This is a very counterintuitive path: no one wants to hear it in a bull market, but it is known to save lives in a bear market.

Looking at Jeremy Allaire's Twitter, blogs, and interviews, one can also clearly see the trajectory of a heartfelt journey:

Idealist (2013): Believing that Bitcoin could directly change the world, trying to use technology to mask the complexities of finance.

Frustrated Reformer (2016): Realizing that the resistance of the "old world" (banks, regulators) could not be bypassed, bridges must be built rather than walls destroyed.

Pragmatic Architect (2018): Understanding through the lessons of Poloniex that "compliance" itself is a product feature, not a burden.

Politically Astute Leader (2022+): Shaking hands with regulators and allying with BlackRock. Allaire understands that to make USDC a trillion-dollar asset, it must gain the tacit approval of sovereign nations.

He often mentions in interviews that this is not just about technology, but about "the reconstruction of trust." In a world where algorithms can be malicious and code can have vulnerabilities, the trust that Circle attempts to provide is a trinity of "code + law + audit."

8. In Conclusion

Circle's success stems from its choice to take the most challenging compliance path during the "wild west era" of cryptocurrency, successfully evolving from a "startup trying to disrupt banks" into "builders of the infrastructure for the internet financial system." By combining the stability of the dollar with the programmability of the internet through USDC, it has become an indispensable value transfer protocol connecting the old financial world with the new digital economy.

In fact, the most dangerous misunderstanding of Circle is to view it merely as proof that "stablecoins = low risk"; Circle's advantages come from a long-term accumulation of licenses, banking relationships, and disclosure systems—capabilities that ordinary teams cannot replicate through technology and enthusiasm alone.

Shutting down Circle Pay and divesting Poloniex, actions that may seem like strategic contraction, are essentially about reallocating resources from bustling but unsustainable businesses back to the foundational infrastructure that can solidify institutional trust.

Circle's transformation is not about changing tracks but acknowledging that "the foundation of the payment experience must be stable," thus shifting from the Bitcoin narrative to compliant dollar on-chain; what seems like boring compliance and transparency has, in times of crisis and regulation, become the strongest starting point for network effects.

The greatest insight Circle offers to entrepreneurs is that the path to success is often not linear. It requires a constant dynamic balance between idealism (the vision of changing the world) and realism (compliance, banking relationships, business models). When you find that a path is blocked, do not patch it; instead, have the courage to forge a new path—even if that path seems harder, slower, and more "boring."

Appendix:

1. Circle Q3 2025 Earnings Call Transcript (PDF)

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。