In January 2024, the Bitcoin spot ETF was officially approved.

For the cryptocurrency industry, this is a milestone moment that has been over a decade in the making, and the news quickly captured the attention of global financial markets.

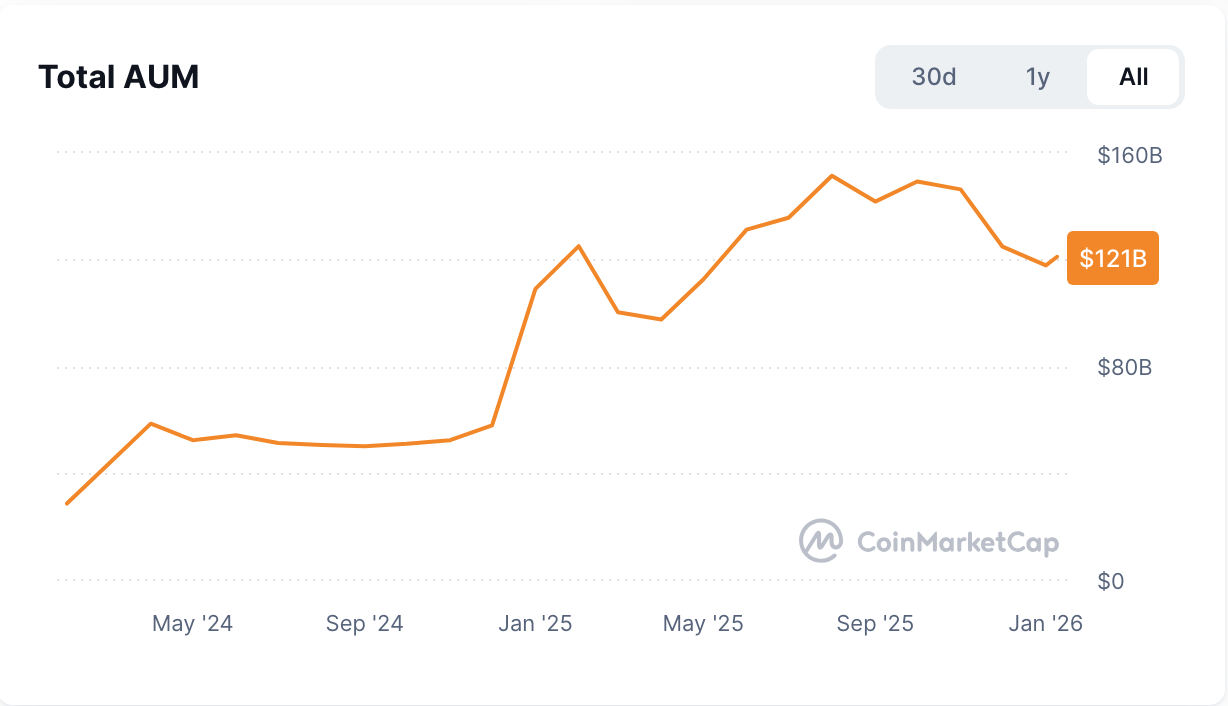

Two years have passed, and the Bitcoin spot ETF is no longer a fresh topic. A set of solid data is quietly reshaping the market's perception of this asset class.

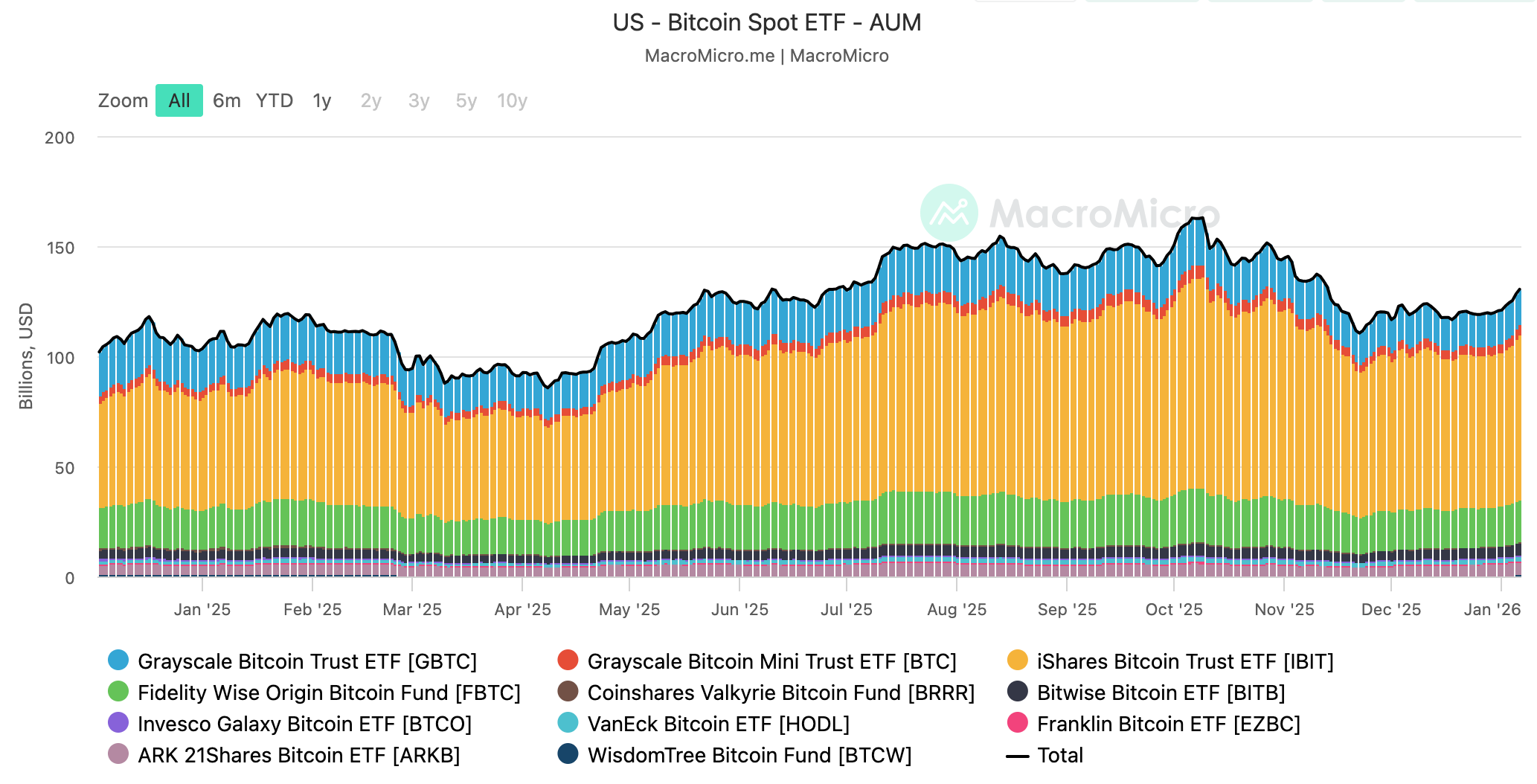

As of now, the total assets under management (AUM) of Bitcoin ETFs have climbed to $124.85 billion. The head effect is particularly significant: the five leading products—IBIT ($74.11 billion), GBTC ($16.4 billion), FBTC ($18.89 billion), ARKB ($5.81 billion), and BITB ($5.35 billion)—collectively manage assets totaling $120.56 billion, accounting for 96.6% of the overall market, clearly outlining an institution-led market structure.

The trading activity has also exceeded expectations. According to data from The Block, the cumulative trading volume of U.S. spot cryptocurrency ETFs officially surpassed $2 trillion on January 2. Looking back at this process: it took 16 months to first reach $1 trillion on May 6, 2025; however, it took only 8 months to go from $1 trillion to $2 trillion, with the growth rate doubling. Among them, BlackRock's IBIT still holds the top position, with a trading volume share of 70%.

The divergence in capital flows is also very clear. In 2025, U.S. spot Bitcoin ETFs accounted for the majority of net inflows in the cryptocurrency ETF market, significantly outperforming Ethereum ETFs, further solidifying Bitcoin's dominant position in the crypto ETF space.

If the approval of the Bitcoin ETF symbolizes Bitcoin's formal entry into the mainstream financial system, then these data now prove that it has become a structurally significant asset in institutional portfolios. Behind these numbers lies not only a leap in scale but also institutional recognition: Bitcoin is integrating into the regular operational framework of the global financial system at an unprecedented speed.

The History of Bitcoin ETFs: A Breakthrough Not by Chance

The launch of the Bitcoin spot ETF was not a sudden act of institutional goodwill but rather the result of a long-term game.

Before 2024, the core concerns of regulators regarding Bitcoin ETF applications and denials focused on three points: whether the underlying market is mature, whether it can effectively prevent manipulation; whether the asset custody, clearing, and auditing mechanisms are reliable; and whether the investor protection system is complete. These issues are not related to the value judgment of Bitcoin itself but are institutional thresholds that any asset must cross to be included in the formal financial product system.

Tracing the timeline, the demand for Bitcoin ETFs can be traced back to 2013. At that time, Bitcoin prices began to enter the public eye, and some investors and brokers found it difficult for ordinary investors to directly access this emerging asset within a compliant framework, leading to the earliest concepts of Bitcoin ETFs. However, for many years afterward, the U.S. Securities and Exchange Commission (SEC) consistently rejected related proposals, with reasons repeatedly revolving around market manipulation risks, custody security, and information transparency.

It wasn't until October 2021 that the SEC first relented, approving the ProShares Bitcoin Strategy ETF (BITO), a Bitcoin-related ETF product. However, this product is linked to futures contracts rather than being a true spot ETF, resembling more of a regulatory trial.

The real turning point occurred on January 10, 2024. The SEC approved 10 Bitcoin spot ETFs in one go, including those from BlackRock, Fidelity, Grayscale, Ark Invest, and Invesco. This decision marked the official entry of U.S. crypto asset investment into the spot ETF era and became the most significant institutional connection between traditional financial systems and crypto assets.

The arrival of this moment was not accidental. By 2024, the infrastructure surrounding Bitcoin, including trading systems, custody mechanisms, compliance frameworks, and information disclosure standards, had developed to a stage acceptable to regulators. The emergence of ETFs is essentially a recognition and response from the financial system to the maturity of this market.

From a longer-term perspective, this is not the end of Bitcoin's financialization but rather a clearly visible, formally recognized milestone in its financialization process.

Beyond Gold: Bitcoin ETFs Press the "Fast Forward" Button

In 2004, the SPDR Gold Trust ETF (GLD) was approved, becoming the first spot gold ETF in history. At that time, the global market value of gold was approximately $1 trillion to $2 trillion. Subsequently, driven by ETFs and related financial instruments, the financialization process of gold began to accelerate. By 2025, the global gold ETF AUM had risen to $55.9 billion, while the average daily trading volume in the gold market reached about $361 billion, both hitting historical highs.

With this history in mind, when the Bitcoin spot ETF was approved in 2024, many market participants naturally compared the two. Everyone had a similar question in mind: Could the ETF once again play the role of a "catalyst," injecting unprecedented liquidity and vitality into the Bitcoin market?

Now, two years later, the Bitcoin ETF has provided a clear answer.

According to data from Chainalysis, the capital flow pace of Bitcoin ETFs has already surpassed the early-stage inflow speed of the first net gold ETF launched in 2005 (adjusted for inflation).

After the launch of the gold spot ETF, not only did its own scale rise rapidly, but it also invigorated the entire gold ecosystem: trading volumes in spot, futures, options, and various derivatives markets achieved exponential growth in the following years.

This journey provides a vivid reference for understanding the potential impact of Bitcoin ETFs. It confirms that ETFs, as a financial medium, inherently possess a certain "leverage effect," capable of rapidly enhancing asset liquidity and attracting a broader range of market participants.

Therefore, Bitcoin ETFs are not simply retracing the old path of gold. They have demonstrated a faster market acceptance speed in a shorter time and received a more enthusiastic capital response.

The Significance of ETFs: Accelerators of the Financialization Process

From the development over the past two years, spot Bitcoin ETFs have promoted the financialization process of Bitcoin on multiple levels.

First, participation methods have been institutionalized.

Spot Bitcoin ETFs provide investors with a regulated, standardized participation path, significantly lowering technical and operational barriers. Investors can participate in price fluctuations without directly holding, storing, or managing Bitcoin, making Bitcoin investment more aligned with mainstream financial market practices.

Second, the investment process has been greatly simplified.

Investors can buy and sell Bitcoin ETF shares through market orders or limit orders, just like trading stocks or other ETFs, enhancing both convenience and security, thus making it easier for Bitcoin to be included in conventional investment portfolios.

Third, the mainstream acceptance of Bitcoin as an asset class continues to rise.

Spot Bitcoin ETFs have significantly enhanced market recognition of Bitcoin as an independent asset class, gradually moving it from discussions within the crypto market to mainstream asset allocation and wealth management frameworks, and beginning to appear in some long-term investment and retirement planning scenarios.

Fourth, institutional capital and global market participation have been systematically opened.

The participation of top global asset management institutions, including BlackRock and Fidelity, has transformed Bitcoin ETFs from symbolic compliance products into important gateways for institutional funds entering the crypto market. At the same time, markets in the U.S., Hong Kong, and others have successively promoted spot Bitcoin ETFs, indicating that this financialization process is showing a trend of global diffusion.

Structural Challenges and Diverse Participation Paths Under Accelerated Financialization

The rapid development of Bitcoin ETFs has significantly accelerated the financialization process of Bitcoin, but it has also amplified some long-standing structural challenges.

First, from a market perspective, spot Bitcoin ETFs remain directly exposed to the high volatility of Bitcoin itself, and rapid price changes can lead to short-term valuation fluctuations; at the same time, the management fees and operating costs of ETFs can also affect the investment return structure in the long run.

More importantly, the high degree of financialization represented by ETFs is a double-edged sword. On one hand, it significantly amplifies Bitcoin's market liquidity and participation scale; on the other hand, it can lead to a greater focus on the price performance of financial products, thereby neglecting the fact that the Bitcoin network still requires continuous computational power investment and infrastructure development to maintain its long-term security and stability.

From the investor's perspective, participation in Bitcoin is not limited to trading and holding at the price level. In addition to obtaining price returns through spot, spot ETFs, or trading strategies, cloud computing power offers another approach: participating in Bitcoin through locked costs and stable outputs.

Through cloud mining, investors can lock in computational power and costs in advance, obtaining relatively stable Bitcoin output over a certain period. This model essentially amounts to locking in the future Bitcoin acquisition costs for a period, allowing investors to establish a more controllable cost structure and return expectations in a market with significant price fluctuations, also providing another possible path to outperform spot prices during cycles.

At the same time, this method allows individual funds to continue participating in the computational power system of the Bitcoin network, rather than being limited to financial transactions at the price level. Cloud computing power is both a way to acquire Bitcoin and a means of ongoing support for network infrastructure. In the context of deepening financialization, it preserves a richer and more diverse participation structure for the market.

As Bitcoin continues to integrate into the global financial system, different levels and forms of participation will collectively form an important foundation for its long-term operation and development.

Conclusion

Two years is enough for a new financial product to undergo a complete market test. The journey of the Bitcoin spot ETF clearly tells us that Bitcoin's speed of entering the mainstream financial track is much faster than most people initially imagined.

But this is clearly not the end. The ETF is more like a lit beacon, clarifying the financialization path of Bitcoin and indicating that more institutional forms will emerge in the future.

In the future, Bitcoin will continue to evolve between financial markets, technological systems, and infrastructure. Different forms of participation will collectively shape its long-term position in the global financial system.

Two years is just the prologue. This journey is still unfolding, and the truly noteworthy new chapters may have just begun.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。