Russia has registered yet another crypto milestone, one that might push the use of these digital assets as a reserve currency for institutions.

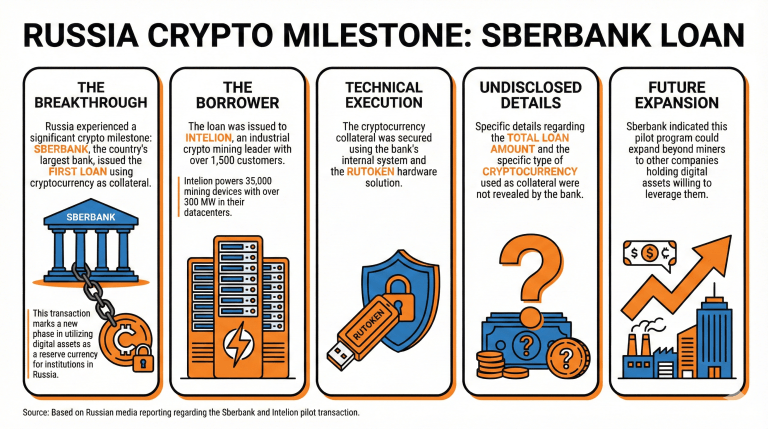

Sberbank, the country’s largest bank, issued a loan to an institution using cryptocurrency as collateral. According to Russian media, while the transaction was part of a company pilot, it marks the first time that such an arrangement has happened in the country, marking a new phase in the utilization of digital assets in Russia.

While the details of the transaction, including the loan amount and the cryptocurrency that served as collateral, were not revealed, the bank disclosed that the digital collateral was received within the bank’s own system and the Rutoken hardware solution.

The loan was issued to Intelion, a company that describes itself as a “leader of industrial crypto mining” and boasts having over 1,500 customers, with over 300 MW powering 35,000 devices in its datacenters.

Sberbank detailed that this kind of operation will be relevant not only for mining companies, but also for other companies that hold digital assets and want to leverage them similarly. This means that the bank might expand this pilot program to more companies in the future.

Sberbank’s crypto loan might mark an acceleration of cryptocurrency usage as a reserve asset for companies, which could now leverage it as collateral for loans without selling it.

Intelion CEO Tiomofey Semenov referred to the deal as an “important practical case for the industry,” stating that this elevated the crypto market to a new level.

“If the effectiveness is confirmed, this format can be scaled up and used in the Russian mining industry,” he stressed.

Russia is poised to open more of its financial system to crypto assets, as the Bank of Russia recently proposed a new framework that would allow non-qualified investors to invest in crypto assets, expanding the reach of these as investment tools.

Read more: Bank of Russia Proposes New Crypto‑Market Regulation Framework

- What significant milestone has Russia achieved in cryptocurrency use?

Sberbank issued the first loan backed by cryptocurrency collateral, indicating a shift in institutional adoption. - Who was the loan issued to, and what is their focus?

The loan went to Intelion, a leader in industrial crypto mining, with over 1,500 customers and extensive data center operations. - What does this development mean for companies holding cryptocurrencies?

This milestone allows companies to leverage digital assets as collateral, potentially increasing their utility and paving the way for more widespread adoption. - How is Russia’s financial system evolving regarding cryptocurrency?

The Bank of Russia is proposing a new framework to allow non-qualified investors to invest in crypto assets, broadening access to these digital currencies.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。