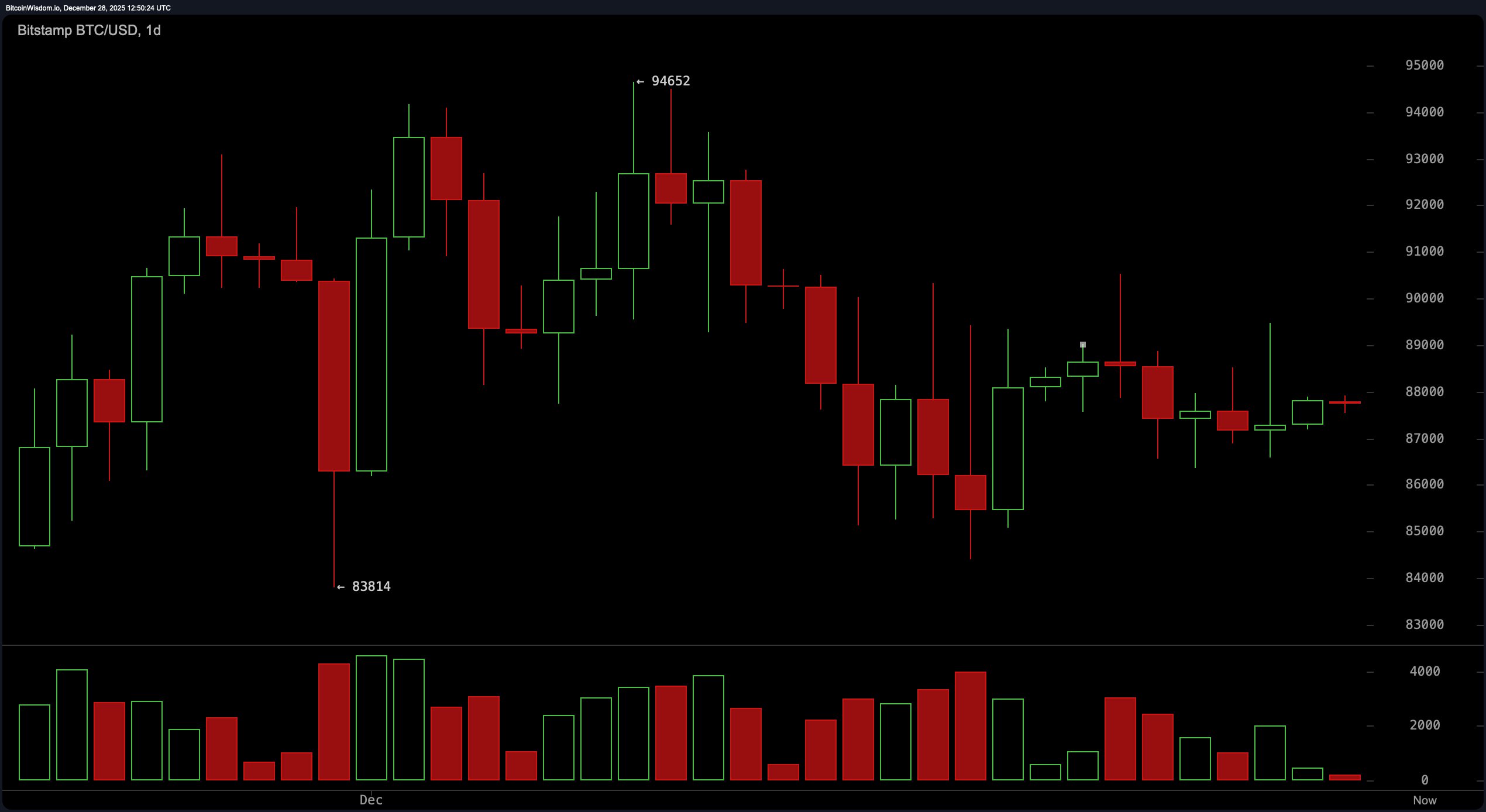

The daily chart paints a picture of consolidation purgatory. Following a dip from recent highs, bitcoin is grinding sideways between support at approximately $83,800—already tested twice—and resistance flirting with $94,600. Volume tells a tale of distribution, with red candles drawing the lion’s share of participation, signaling that bears still have a seat at the table.

The momentum indicator posted a reading of 2,295, paired with a moving average convergence divergence ( MACD) level at -1,148—both leaning into a bullish posture, albeit with a raised eyebrow. If bitcoin retests the $83,800 level and posts a bullish reversal candlestick, the market might get its next catalyst.

BTC/USD 1-day chart via Bitstamp on Dec. 28, 2025.

On the 4-hour chart, price recently bounced from roughly $86,363 after an uninspired breakdown from $90,070. What we have now is a classic case of sideways shuffle between $86,300 and $88,000, complete with dwindling volume—a cocktail for indecision. Traders eying that $88,000 breakout should watch for strong candle formations and volume expansion before jumping in. The short-term exit zone sits between $88,500 and $90,000, assuming bitcoin musters enough courage to test higher grounds again.

BTC/USD 4-hour chart via Bitstamp on Dec. 28, 2025.

Zooming in further, the 1-hour chart is no place for weak nerves. It’s a tight squeeze between $87,272 and $87,920 with volume tapering off, signaling a lack of conviction among participants. A breakout above $87,920 with solid volume could unlock a run toward $88,500, but failure to hold above $87,200 might invite a quick slide down to $86,500. It’s a mean-reversion playground at the moment—dip buyers near $87,300 and nimble scalpers at the upper bounds, proceed with precision.

BTC/USD 1-hour chart via Bitstamp on Dec. 28, 2025.

Looking at the oscillators, we find the relative strength index ( RSI) at a neutral 45, the Stochastic oscillator at 52, and the commodity channel index (CCI) clocking in at -41—all signs of a market in no rush to pick a side. The average directional index (ADX) sits at 19, confirming the lack of a strong trend. The Awesome oscillator logs a mild -1,693, continuing the neutral chorus, while MACD and momentum wave tiny bullish flags amid the inertia.

And now, the parade of moving averages (MAs)—and none of them are doing bitcoin any favors. Every single short-, mid-, and long-term moving average, from the 10-period exponential moving average (EMA) at $87,784 to the towering 200-period simple moving average (SMA) at $107,278, signals bearishness. It’s like a symphony of trend-followers playing a minor key. This dissonance points to the fact that while price may flirt with recovery, the overarching trend remains downward until proven otherwise.

Bull Verdict:

If bitcoin can hold above the $86,500–$87,000 zone and reclaim $88,000 with volume, the setup favors an upside continuation toward $89,000 and possibly $94,000. Momentum indicators are beginning to stir, and a breakout from this tight consolidation range could mark the next leg up in this slow-burning recovery.

Bear Verdict:

With price stuck below every major moving average and volume bleeding from the charts, the downside remains a real threat. A breakdown below $87,200, followed by a trip under $86,500, could accelerate bearish momentum and drag bitcoin toward the $83,800 support—or worse, snap it altogether and send the market into retreat.

- What is the current bitcoin price?

Bitcoin is trading at $87,752 as of December 28, 2025. - Is bitcoin trending up or down today?

Bitcoin is consolidating with weak momentum and no clear trend direction. - What are key support and resistance levels for bitcoin now?

Support is near $83,800 and resistance ranges from $88,000 to $94,600. - What’s the short-term outlook for bitcoin?

A breakout above $88,000 or a drop below $87,200 could signal the next move.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。