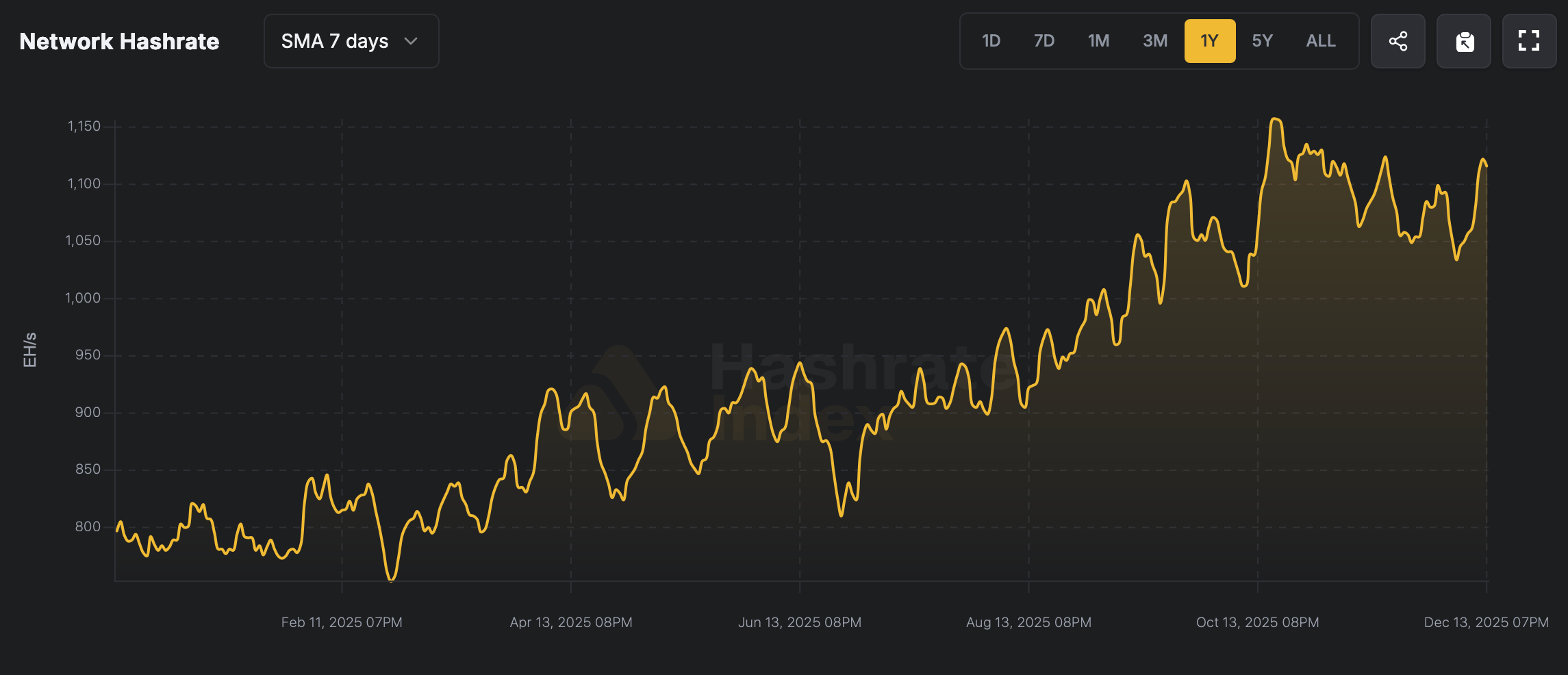

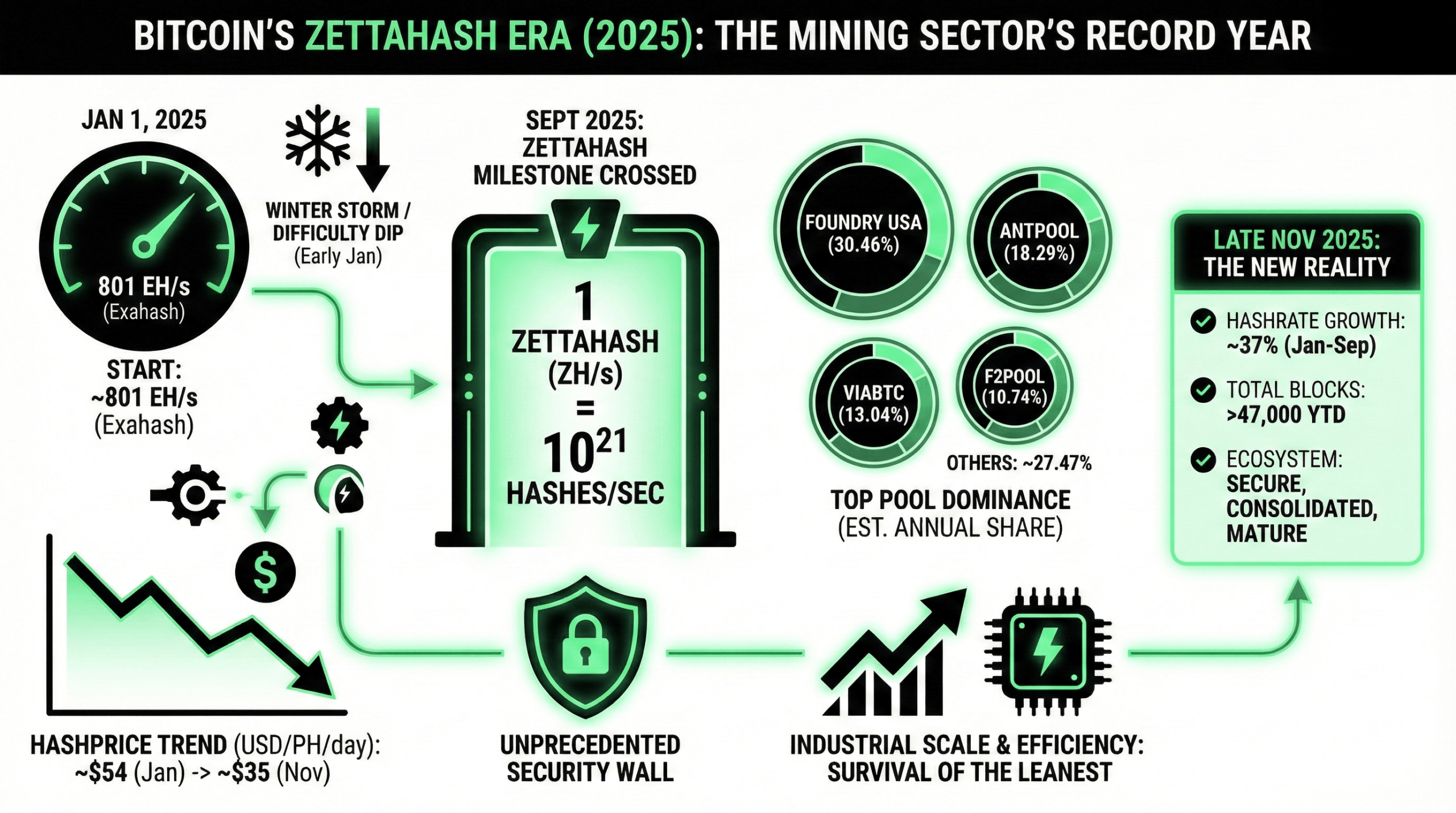

Bitcoin’s 2025 mining story begins with a number so large it barely fits in the mind: roughly 801 exahash per second (EH/s) on Jan. 1. That figure alone reflects a network humming at a scale unmatched in the digital world, performing 801 quintillion SHA256 computations every second. It was an early marker for what would become one of the most transformative years in the history of proof-of-work ( PoW) security.

January didn’t exactly roll out the red carpet for miners. A harsh winter storm cut power to a number of operations, prompting the first difficulty decrease since the fall of 2024. Network difficulty entered the year at about 109.78 trillion before edging lower after a late-January adjustment. Transaction fees, meanwhile, fell to their lowest point since 2012 — not exactly the revenue environment miners like to see. Yet even with weather-forced downtime and thin fees, the network’s computing power held firm and continued inching upward through the opening weeks of the year.

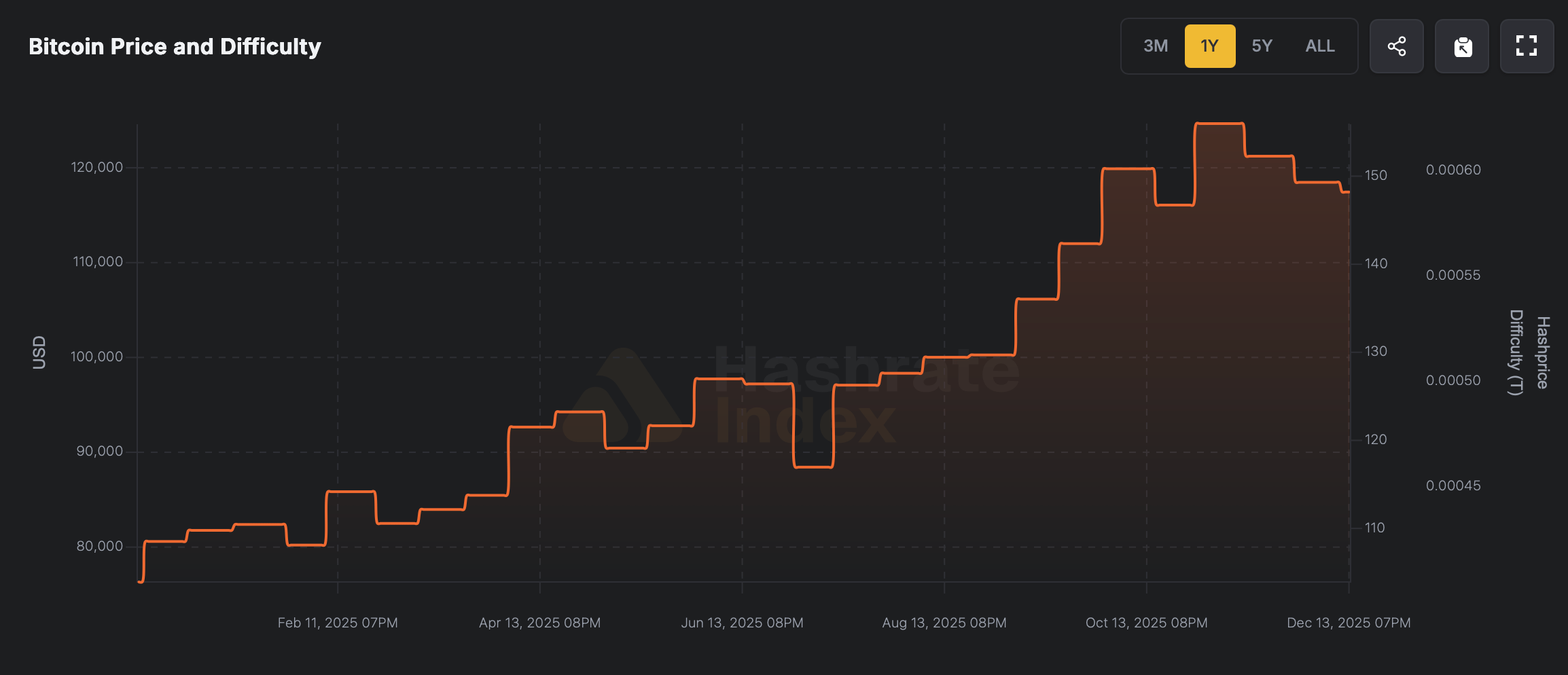

Bitcoin’s difficulty has witnessed a continuous climb this year.

But the real fireworks didn’t arrive until September, when the seven-day simple moving average (SMA) broke through one of Bitcoin’s most symbolic milestones: one full zettahash per second (ZH/s). Crossing the zettahash mark meant the network was performing on the order of 10²¹ SHA-256 calculations every second. In plain English, miners added three additional orders of magnitude of compute power compared to the one-exahash threshold crossed in 2016. The achievement served as a blunt reminder of how fast industrial-scale mining has matured in less than a decade.

Bitcoin’s total hashrate in 2025.

The zettahash milestone carried serious implications beyond bragging rights. Nothing strengthens Bitcoin’s security more directly than raw hashrate, and controlling more than half of 1 zettahash would require hardware and energy investments reaching into the tens of billions of dollars. In a year defined by thin margins and aggressive competition, miners still managed to anchor the network at unprecedented levels of protection. The result was an ecosystem more resistant to attacks than ever before, even as the economics of mining tightened significantly over the year.

Mining economics in 2025 told a story all their own. On Jan. 1, BTC-denominated hashprice sat around 0.00058 bitcoin per petahash per day — about 58 satoshis per terahash per day when broken down to the smallest unit. In U.S. dollar terms, hashprice hovered at roughly $54.45 per petahash per day, rising modestly during January before settling back into the $50–$60 range through the quarter. This was the baseline revenue miners worked with before accounting for fees, overhead, or the creeping difficulty adjustments that continued to squeeze profitability as the network grew.

Also read: Google Trends Data Shows Bitcoin Quietly Holding Its Place as the Year Comes to a Close

As 2025 unfolded, that squeeze only intensified. Hashprice trended downward across the year, sliding to roughly the mid-$30s per PH/day by November and just under $40 in December. The combination of minimal transaction fees, higher global competition, and relentless investment in next-generation ASIC hardware weighed heavily on less efficient miners. Some operators were sidelined entirely, while others merged or shifted strategy as the market rewarded only the leanest and most energy-efficient setups. By contrast, large-scale operations with access to inexpensive power and cutting-edge hardware strengthened their footing, mirroring the broader industrial consolidation shaping the sector.

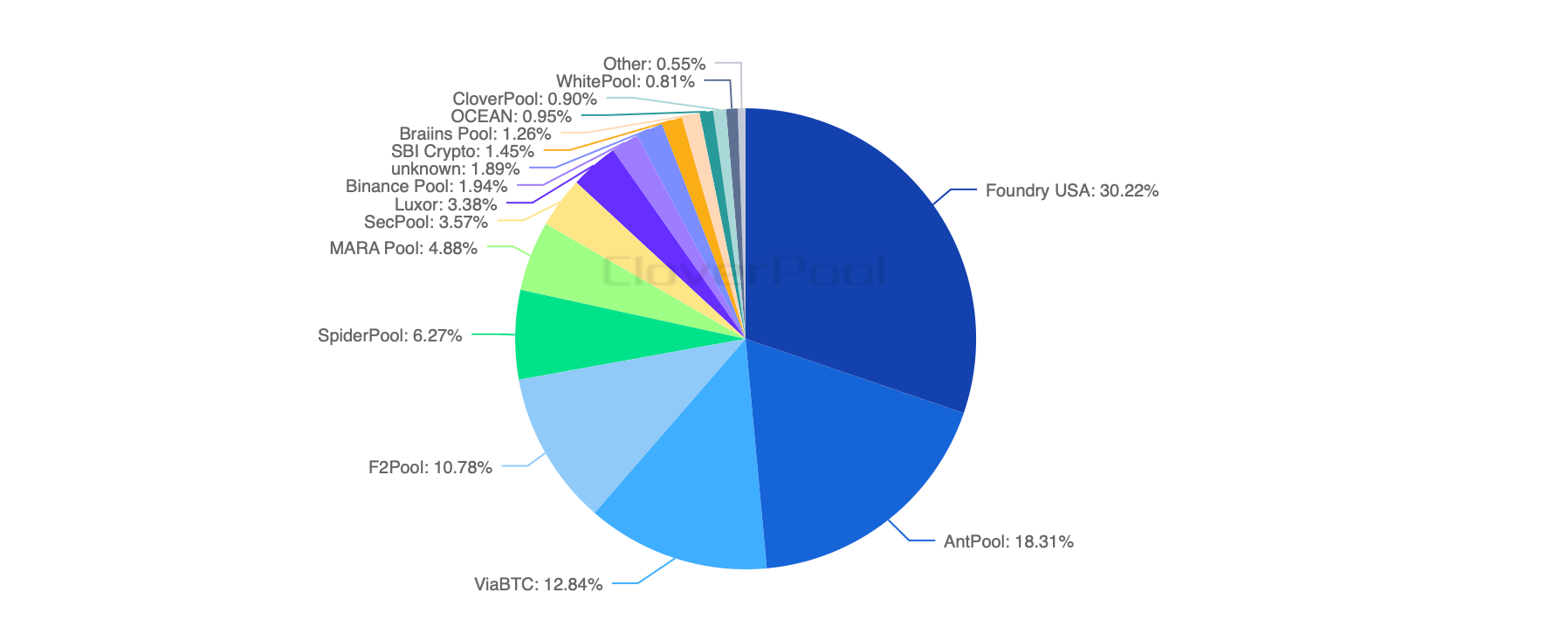

While hashrate and hashprice illustrate the economic reality, the mining-pool breakdown reveals how block production actually shook out year-to-date. Using the 335 days between Jan. 1 and Dec. 1 as the measurement window, the network produced an estimated 47,664 blocks. Each pool’s annual share offers a reliable proxy for determining who mined what during the year. By that measure, Foundry USA dominated 2025, capturing 30.46% of all blocks — approximately 14,518 blocks year-to-date. That lead represents not only hashing power but the operational scale needed to maintain such a footprint in a year defined by fierce competition.

12-month hashrate distribution via cloverpool.com.

Antpool followed as the second-largest contributor with an estimated 8,718 blocks, holding an 18.29% share for the period. ViaBTC ranked third at 13.04% of block production, translating to around 6,215 blocks. F2pool landed close behind with a 10.74% share, or roughly 5,119 blocks. These four pools alone controlled about two-thirds of all blocks mined in 2025, reflecting the increasingly industrialized nature of the sector. In a high-difficulty, low-margin environment, scale mattered more than ever.

Below the big four, Spiderpool carved out a meaningful slice with an estimated 2,850 blocks, or 5.98% of total production. MARA Pool contributed roughly 2,340 blocks at a 4.91% share, while Secpool added about 1,702 blocks at 3.57%. Another notable contributor was Luxor at a 3.30% share, or approximately 1,573 blocks year-to-date. Collectively, these mid-tier pools accounted for a substantial portion of the remaining hashrate, offering a glimpse into the competition happening just outside the top tier.

The long tail of the mining landscape included Binance Pool with an estimated 910 blocks (1.91%), as well as an “Unknown” category representing independent miners who collectively mined around 882 blocks (1.85%). Smaller pools such as SBI Crypto, Brains Pool, Ocean, Cloverpool itself, Whitepool, Ultimus Pool, Poolin, Bitfufupool, Solo CK, 1Thash, and Kanopool captured the remaining blocks in varying proportions. While these operators together represent only a modest fraction of total block production, their participation underscores the network’s decentralization and the persistence of smaller, niche-focused miners who continue to contribute despite rising competitive pressures.

By December, the picture was clear: 2025 was the year Bitcoin leveled up. Hashrate grew roughly 37% from early January to the start of September, culminating in a sustained seven-day average above one full zettahash per second. Even as hashprice slid and operating costs remained stubbornly high, miners kept pushing the upper limit of what the hardware — and the human appetite for risk — could support. The network secured more than 47,000 blocks year-to-date, and despite tighter economics, the competition never slowed.

The year closed with a mining sector both battle-tested and undeniably stronger. High-efficiency operations proved they could weather an unforgiving revenue environment, while less efficient setups were forced to upgrade, consolidate, or shut down entirely. Yet the numbers tell a simple story: Bitcoin’s security reached its highest level ever in 2025, backed by an unprecedented wall of computational power. The zettahash era didn’t just arrive — it settled in, parked its boots, and made itself at home.

FAQ ⛏️

- How much did Bitcoin’s hashrate grow in 2025?

It climbed from about 801 EH/s at the start of the year to more than 1 ZH/s by early September. So around 200 EH/s over the course of the year. - What was hashprice for miners on Jan. 1, 2025?

Miners earned about 0.00058 bitcoin per PH/day, or roughly $54.45 per PH/day in dollar terms. - How many blocks were mined year-to-date through Dec. 1?

The network produced an estimated 47,664 blocks during the first 331 days of the year. - Which mining pools led block production in 2025?

Foundry USA, Antpool, ViaBTC, and F2pool dominated with roughly two-thirds of all blocks mined.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。