A quiet holiday backdrop did little to steady crypto exchange-traded fund (ETF) flows, as investors continued trimming exposure to bitcoin and ether while maintaining smaller allocations to XRP and solana funds.

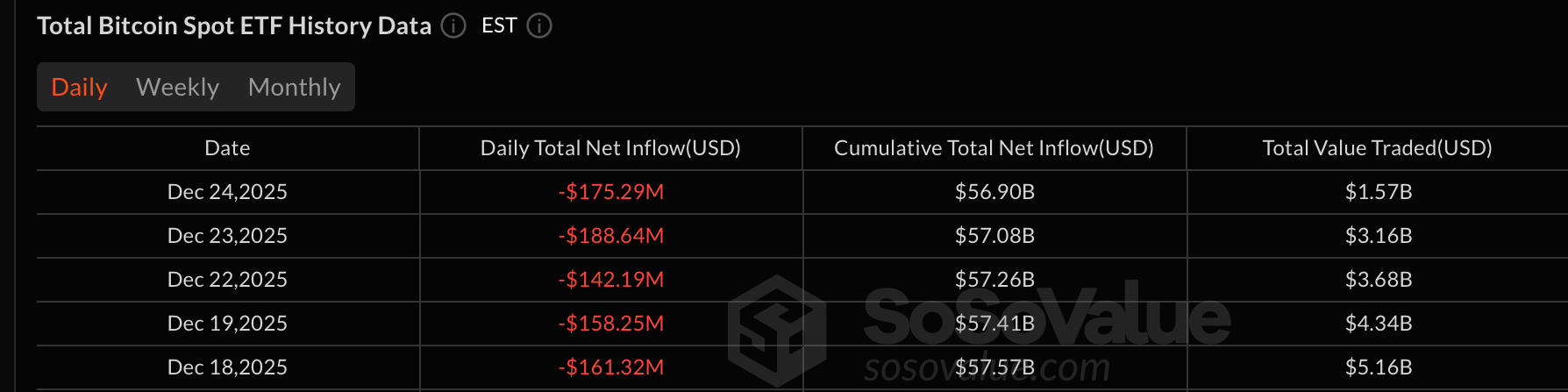

Bitcoin spot ETFs saw a net outflow of $175.29 million, extending their streak of daily exits to five sessions. The selling pressure was broad-based, spanning eight different funds. Blackrock’s IBIT once again absorbed the largest share, shedding $91.37 million. Grayscale’s GBTC followed with a $24.62 million outflow, while Fidelity’s FBTC lost $17.17 million.

Additional exits were spread across Bitwise’s BITB at $13.32 million, Ark & 21Shares’ ARKB at $9.88 million, and Vaneck’s HODL at $8.05 million. Smaller outflows were also recorded by Grayscale’s Bitcoin Mini Trust with $5.81 million and Franklin’s EZBC with $5.06 million. Despite the heavy exits, trading activity remained elevated at $31.57 billion, while total net assets edged slightly lower to $113.83 billion.

Five days of successive outflows for bitcoin ETFs

Ether ETFs also closed the day in the red, posting a net outflow of $52.70 million. Grayscale’s ETHE led the declines with a $33.78 million exit, followed by Blackrock’s ETHA, which saw $22.25 million leave the fund. The only offset came from Grayscale’s Ether Mini Trust, which attracted a modest $3.33 million inflow. Trading volumes cooled to $689.44 million, and net assets held steady at $17.86 billion.

XRP ETFs continued their steady run of inflows, adding $11.93 million on the day. Franklin’s XRPZ accounted for nearly all of the activity with an $11.14 million inflow, while Canary’s XRPC contributed a smaller $794K addition. Total value traded came in at $10.84 million, with net assets unchanged at $1.25 billion.

Read more: Bitcoin Logs 4th Straight Outflow Day With $189 Million Exit

Solana ETFs also remained in positive territory, albeit with modest gains. The group recorded a $1.48 million inflow, driven by a $1.08 million addition to Fidelity’s FSOL and a $399K inflow into Vaneck’s VSOL. Trading volume reached $15.77 million, and total net assets stood at $930.59 million.

Overall, Christmas Eve’s trading reflected a cautious market tone. Bitcoin and ether ETFs continued to see consistent outflows, while XRP and solana maintained small but persistent inflows, as the markets go off for the holidays.

- Why are bitcoin ETFs seeing five straight days of outflows?

Holiday-thinned liquidity and risk reduction have led investors to trim bitcoin exposure. - What’s driving continued weakness in ether ETFs?

Persistent redemptions from major funds signal cautious positioning despite stable assets. - Why are XRP ETFs still attracting inflows?

Investors are selectively maintaining XRP exposure due to steady demand and regulatory clarity. - How are solana ETFs performing during the holiday period?

Solana ETFs remain modestly positive, reflecting small but consistent capital rotation.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。