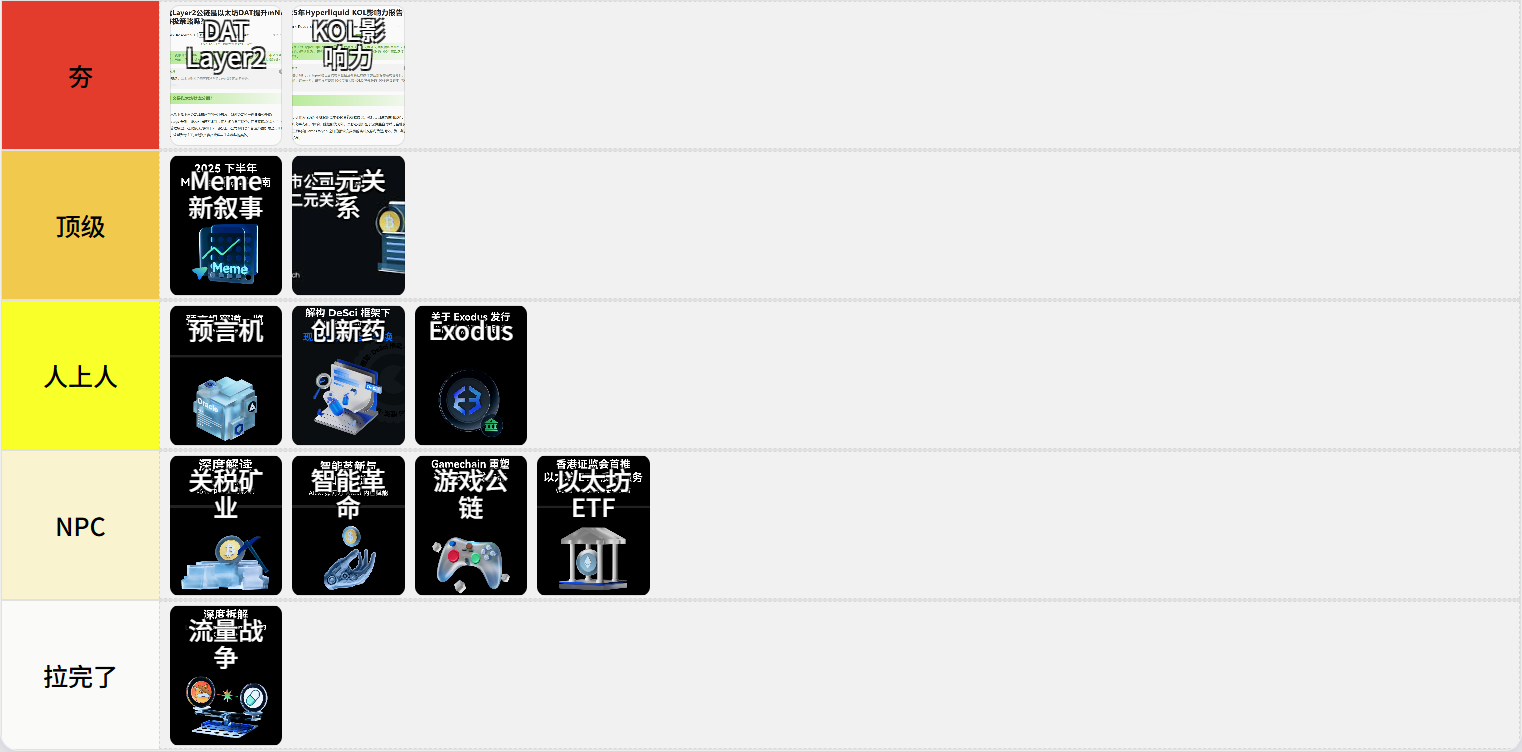

Recently, it has become popular online to rank everything from "from rough to fine," as if everything can be ranked in this way. As a practitioner in the Web3 industry, my perception of 2025 can be summed up in two words: "Acceleration." After experiencing major global events like "Trump's cryptocurrency," "tariff wars," "the genius bill," and "1011," it feels like the entire capital market and the crypto world have been pressed on the acceleration button since Trump took office. The events that will occur in 2025 will equal the total of what has happened in the past 2-3 years. Meanwhile, as a content creator, I have consistently produced one in-depth piece of content every month. However, in these final days of 2025, I reread these pieces and found that while some were quite good, others were less satisfactory. So, at the end of 2025, I will use the "from rough to fine" framework to rank my own articles.

1. Deconstructing the Real Dilemmas and Paradigm Shifts in the Narrative of "Innovative Drugs" under the DeSci Framework

Author's Note

The DeSci narrative gained traction in the fourth quarter of 2024, and I personally believe it is a "pseudo-narrative." Although CZ and Vitalik have endorsed several Biotech projects, they are not actually experts in the topic of life sciences. As someone who has worked as an investment manager in Biotech VC for two years, I may have a better understanding of innovative drugs than most crypto bigwigs. For example, when an innovative drug team discovers a macromolecule, it must go through a 10-year cycle of Phase I, Phase II, and Phase III clinical trials, which is completely misaligned with the investment rhythm of the crypto world. Therefore, I believe this narrative will ultimately fall flat, becoming yet another narrative that ends without results in the crypto space. After multiple discussions with former colleagues about the title, we ultimately settled on this relatively mild one.

Article Highlights

"I believe that the high proportion of life sciences in the DeSci industry is mainly due to the fact that opinion leaders in the crypto industry, after accumulating enough wealth, have satisfied all five levels of Maslow's hierarchy of needs and are starting to pay more attention to issues related to the continuation of life. From a fundamental perspective, the DeSci in the crypto field is misaligned with the resource, cycle, and operation aspects of innovative drug development in the real world."

Article Review

Content Innovation: Four Stars

Content Dissemination: Three Stars

Content Revaluation: No Change

Overall Rating: Above Average

2. Smart Innovation × Crypto Wave — How AIGC Empowers Web3 Content

Author's Note

This article is on a topic I really wanted to write about, inspired by a project I saw while working in VC. It was July 2024, during the peak of Memecoin popularity, when Pump.fun lowered the threshold for issuing coins, leading many entrepreneurial projects to revolve around memes. One project that caught my attention was a platform that collected trending meme images through web scraping from social media platforms like X, then crowdfunded to issue Memecoins. Its advantages lay in its data scraping speed and the platform's ability to predict the trends of meme images after issuance. This made me think of Memecoin issuance as a factory assembly line, with upstream being meme collection, midstream being the launch platform, and downstream being retail investors and market makers.

Later, coinciding with the surge of DeepSeek in early 2025, I began to think about how AI and Memecoins could be combined. As a cultural symbol, Memecoins still require content support. Thus, I realized that AI empowering memes and memes empowering AI is a bidirectional relationship. It's somewhat like what the well-known blogger Zhang Zhala said about "content productization" and "product contentization." Using Nano Banana and GPT to generate content for PEPE is content productization; while some entertainment AI agents like Luna represent product contentization. However, none of these can generate economic benefits for authors or developers without a public chain like Story to distribute economic returns. Upon rereading this article, I feel that many of my ideas were still too idealistic, and the overall effect was somewhat lacking.

Article Highlights

"AIGC can not only provide content for existing meme images, but AIGC technology can also use agents as carriers to offer users richer services. If the AIGC empowerment of Memecoins is the "old memes told anew" of Web3 content, then AI agents represent a paradigm shift in AIGC technology from content production to service interaction."

Article Review

Content Innovation: Four Stars

Content Dissemination: Three Stars

Content Revaluation: Minus One Star

Overall Rating: NPC

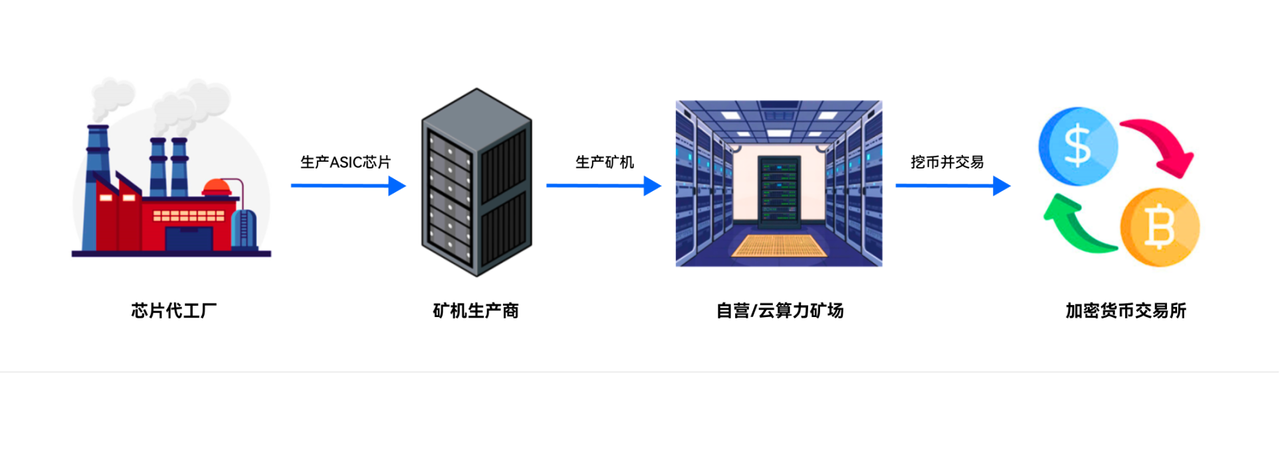

3. In-Depth Analysis of the Impact of Tariff Policies on Bitcoin Mining

Author's Note

This article was a prompt given to us by my previous company, set against the backdrop of Trump's "crazy" tariff policies that left the global capital market in turmoil. In this context, we were asked to analyze the impact of tariffs on the industry. It is well known that the mining industry is closely linked to the crypto industry and the real economy, and the implementation of tariff policies has a significant impact on overseas mining operations in countries like Iran, Uzbekistan, and Ethiopia. The results showed that the most affected by the tariffs were mining machines, followed by mining farms, and finally cloud computing platforms. Of course, Trump eventually retracted most of the tariff policies, leaving the capital market in a false alarm.

At that time, my previous company also assigned me a small team of three, with two very good and hardworking colleagues. If this configuration had been maintained, we would have produced a lot of quality content. However, this prompt had a strong time sensitivity, and after the tariff policies were implemented, rereading this article yielded little new insight.

Article Highlights

After Trump announced the tariff policies, companies related to Bitcoin mining experienced varying degrees of decline, and the stock performance of various sub-sectors also showed a certain degree of differentiation. The decline in mining machine manufacturers was the most pronounced over the past month, primarily due to the impact of tariff policies on both the supply and demand sides of mining machine manufacturing. Self-operated mining farms were mainly affected on the supply side, as the process of selling Bitcoin to cryptocurrency exchanges was less impacted by tariff policies. The leasing business model of cloud computing mining farms naturally has a risk buffer mechanism—essentially transferring the cost of purchasing mining machines to customers through computing service fees, and some customers directly share hardware investments through mining machine hosting agreements, making the erosion of mining machine premiums on platform profits significantly less than traditional mining models.

Article Review

Content Innovation: Two Stars

Content Dissemination: Three Stars

Content Revaluation: Minus One Star

Overall Rating: NPC

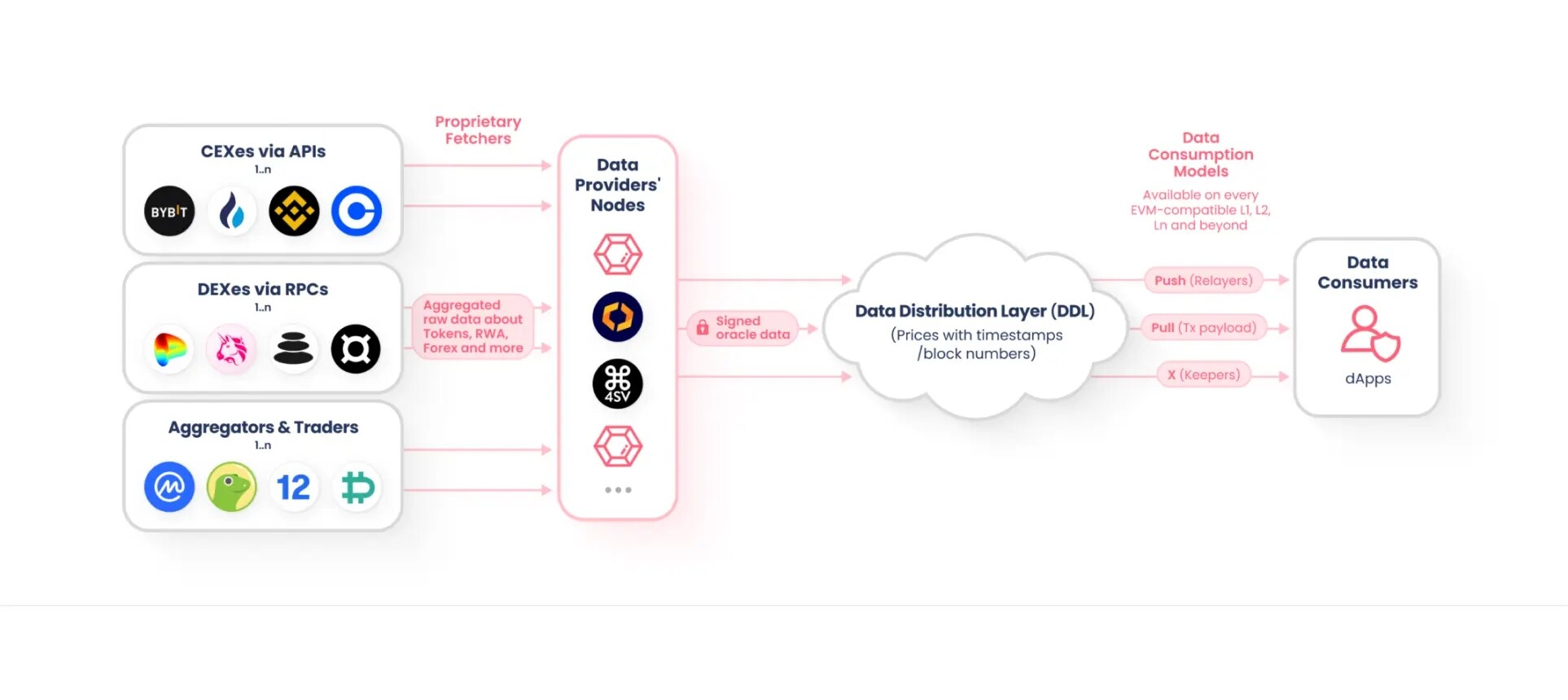

4. The Underrated High-Growth Track: Seeking the Second Growth Curve for Oracles

Author's Note

This article was selected from the topic pool, as my previous company required each researcher to produce two articles per month. The topic of oracles is quite interesting; when I first entered the industry, I didn't understand many concepts, and oracles were one of them. Because I had to write on this topic, I researched a lot of materials. In the field of "price feeding," Chainlink has already established a deep moat, making it difficult for latecomers like Pyth, Redstone, and API3 to shake it. I still believe that future opportunities in the oracle industry lie in handling complex, non-standardized data, such as clinical data, industrial data, and code data, rather than traditional financial data, which seems to have little chance of challenging Chainlink. After reading this, I still feel it lacks depth, and I personally didn't like it much.

Article Highlights

Non-financial assets refer to assets that cannot reflect prices in real-time and need to be represented at a certain point in time through mathematical modeling and other methods. Examples include real estate, charging piles, photovoltaic components, and artworks. Taking charging piles and photovoltaic panels as examples, users invest in tokenized assets through on-chain funds, but these cash flow assets are significantly affected by weather, environment, and equipment management, which may impact their future cash flow distribution. For these non-financial assets, oracles need to provide more complex services, such as accessing data sources that can reflect asset status and influencing factors (like weather data, equipment operation data, etc.), and combining this information with mathematical models to convert it into reliable on-chain prices or risk assessments, thereby supporting the valuation and management of non-financial RWA tokens.

Article Review

Content Innovation: Three Stars

Content Dissemination: Four Stars

Content Revaluation: Minus One Star

Overall Rating: Above Average

5. From General to Specialized: How Game Chain Reshapes the Web3 Gaming Ecosystem

Author's Note

This was also a topic selected from the topic pool. I have always been personally interested in the gaming sector, and during my time in Web3 VC, I have looked at many gaming projects. This article mainly analyzes some gaming-specific public chains, such as WAX, ImmutableX, and Ronin, examining their gaming ecosystems and resource endowments. However, what I completely did not expect was that the entire GameFi sector, from games to public chains, would be quite cold in 2025. The price of IMX dropped by 82%, RON by 92%, and SAND by 79%, all of which exceeded the declines of mainstream altcoins. That said, Web2 games this year haven't been great either, with no globally popular blockbusters released. It's no wonder that Dembélé won this year's Ballon d'Or. The decline of the blockchain gaming sector this year raises the question of whether the crypto market is dragging down gaming or if gaming is dragging down blockchain.

Article Highlights

Gaming is a relatively emerging industry, with Web2 online games having only about 50 years of history. Looking at the development of Web2 games, high-quality game studios have the opportunity to grow into monopolistic oligarchs (like Blizzard Entertainment and Game Science), while internet companies with strong financial power will also expand their businesses into the gaming sector, becoming leaders in the industry (like Tencent and NetEase). A similar situation exists in the Web3 field, where Sky Mavis, with its hit game Axie Infinity, has gradually evolved from a game studio into a giant in the Ronin gaming ecosystem; meanwhile, general-purpose public chains like Polygon and OpBNB, backed by strong financial resources, have also released several influential games.

Article Review

Content Innovation: Two Stars

Content Dissemination: Three Stars

Content Revaluation: Minus One Star

Overall Rating: NPC

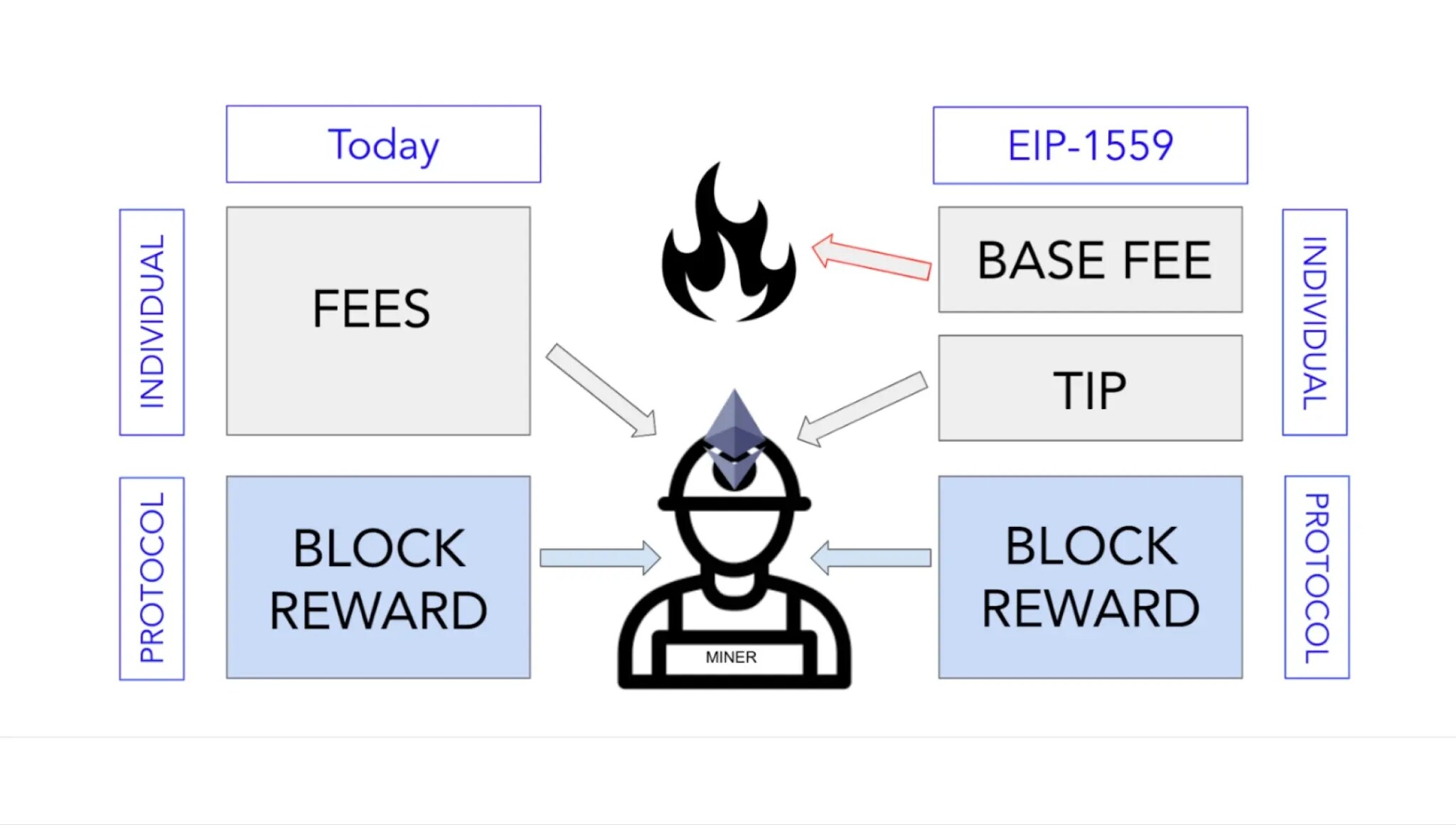

6. Hong Kong Securities and Futures Commission Launches Ethereum Spot ETF Staking Service, Marking a Historic Breakthrough for the Web3 Industry

Author's Note

This article is closely related to policy, as Hong Kong's Ethereum ETF has launched a staking service, theoretically making it more competitive than the US Ethereum ETFs that do not offer staking services. However, in reality, after this policy was introduced, there was not much net inflow of funds into the several ETFs launched in Hong Kong, and liquidity still lags far behind that of the US. This article serves as a short report, essentially introducing the benefits of Ethereum staking to readers. Looking back at this article, perhaps the biggest takeaway was gaining a deeper understanding of the EIP-1559 proposal during my research, realizing that node earnings and transaction volume are not a completely linear relationship.

Article Highlights

We should ask another question: why has the yield on ETH staking continued to decline, significantly lagging behind SOL? I believe that the passage of EIP-1559 is a very important reason. The purpose of this proposal is to reduce the inflation rate of ETH, thereby further optimizing Ethereum's economic model. Before the passage of EIP-1559, nodes received the base fee + tips from traders for on-chain transactions. After the passage of EIP-1559, nodes only receive the tips paid by traders, while the base gas fee is directly burned to ensure a stable deflationary mechanism in the ETH economic model. Ethereum nodes and ETH stakers have lost an important source of income.

Article Review

Content Innovation: One Star

Content Dissemination: Three Stars

Content Revaluation: No Change

Overall Rating: NPC

7. In-Depth Analysis of the Traffic War Between Letsbonk.fun and Pump.fun

Author's Note

I consider this to be one of my poorer writings, as there were relatively few new narratives in July of this year, so there weren't many topics to write about. Letsbonk.fun was another challenger to Pump.fun at the time, but the platform incubated by Bonk was overall quite immature, with a simple UI and product structure, making it difficult to compare with the complex product that is Pump.fun. The reason for comparing the two is that Letsbonk.fun had also produced some "golden dogs," allowing its Memecoin issuance to surpass Pump.fun in just a few weeks.

Article Highlights

As a latecomer in the one-click coin issuance field, the core difference between Letsbonk.fun and Pump.fun lies in their driving mechanisms. The initiator of Letsbonk.fun, Tom, is also the initiator of the Bonk token, and he has mastered the community-driven growth strategy for Memecoins. Pump.fun, as the pioneer of one-click coin issuance, primarily relies on code technology to make coin issuance a convenient tool. The on-chain address of Pump.fun has repeatedly transferred SOL to the centralized exchange Kraken, facing backlash from the community. From the outset, Letsbonk.fun announced an incentive plan for Memecoin project parties, sharing the profits of coin issuance with community users.

Article Review

Content Innovation: Two Stars

Content Dissemination: One Star

Content Revaluation: Minus One Star

Overall Rating: Below Average

8. 2025 Second Half Meme New Narrative Guide

Author's Note

This is an article I had high hopes for. In my previous company, I wrote a total of 12 long articles, four of which were related to Memecoins. In reality, many readers also want to discover the next PEPE or the next BOME. Of course, we all know that the probability of this is very low, akin to winning the lottery. In 2024 and 2025, many cultural symbols and AI symbols have also become popular Memes, such as Wukong, Nezha, Grok, etc. Therefore, this article attempts to establish a methodology to inform readers of potential hot events in advance, so that if a "golden dog" appears, there is a greater chance of not missing it. However, in retrospect, no domain-type Memes that have increased more than tenfold have appeared on chain scanning tools like GMGN, which indirectly reflects that altcoins have been relatively cold in the second half of the year.

Article Highlights

For retail investors, the first wave of KOL-driven Memecoins is extremely difficult to capture, while another type of Meme presents market opportunities that are easier to predict. This type of Meme is the on-chain manifestation of concepts that have exploded in the real world. Since the IP itself is not a physical asset, it cannot be mapped on-chain through RWA methods, so it can only bring its popularity to the chain in the form of Memecoins. Representative examples include Memecoins related to the game "Black Myth: Wukong," the movie "Nezha," the large model "DeepSeek," and "Grok."

Article Review

Content Innovation: Five Stars

Content Dissemination: Three Stars

Content Revaluation: No Change

Overall Rating: Top Tier

9. Analyzing the Binary Relationship Between Public Companies and Cryptocurrencies

Author's Note

The background for writing this content is that the topic of DAT (financial treasury companies) surged in popularity in the second half of the year, with many public companies imitating MSTR's methods to establish DATs based on BNB, ETH, SOL, and HYPE as underlying assets. Some friends from my previous private equity investment days also consulted me about what this is all about. This article was originally intended to be a guide for public companies on how to buy coins, for example, some companies with poor main businesses wanting to rely on convertible bonds to finance their transformation into DATs. It would be best for them to accumulate SOL or ETH, as staking yields could cover financing costs. Other companies with stable cash inflows, like insurance companies, could accumulate BTC or LTC, as mining coins are similar to gold and silver, serving as reserve assets. On the other hand, the Solana Foundation is also looking for the most suitable public company to act as MSTR for the SOL token. Therefore, token project parties also have demands for public companies to accumulate coins. Ultimately, the title evolved into a binary relationship between the two. From the final presentation, I am quite satisfied with this article.

Article Highlights

The staking yield can be likened to the dividend yield of stocks. From the perspective of public companies' needs, the demand to become PoS token hoarders mainly falls into three categories: (1) obtaining high staking yields to cover financing costs while generating positive cash flow. (2) Achieving high asset appreciation to drive stock price growth. (3) Occupying a core position in the ecosystem and strategically positioning around the public chain ecosystem. Pursuing high staking yields: SOL has a high staking yield and stable public chain transaction volume; pursuing value growth: HYPE has a transaction fee buyback mechanism, and its token price has achieved a tenfold increase; pursuing ecological layout: ETH has a high degree of decentralization, and Layer 2 development is relatively easy.

Article Review

Content Innovation: Three Stars

Content Dissemination: Four Stars

Content Revaluation: Plus Half Star

Overall Rating: Top Tier

10. Thoughts on Exodus Issuing Tokenized Stocks On-Chain

Author's Note

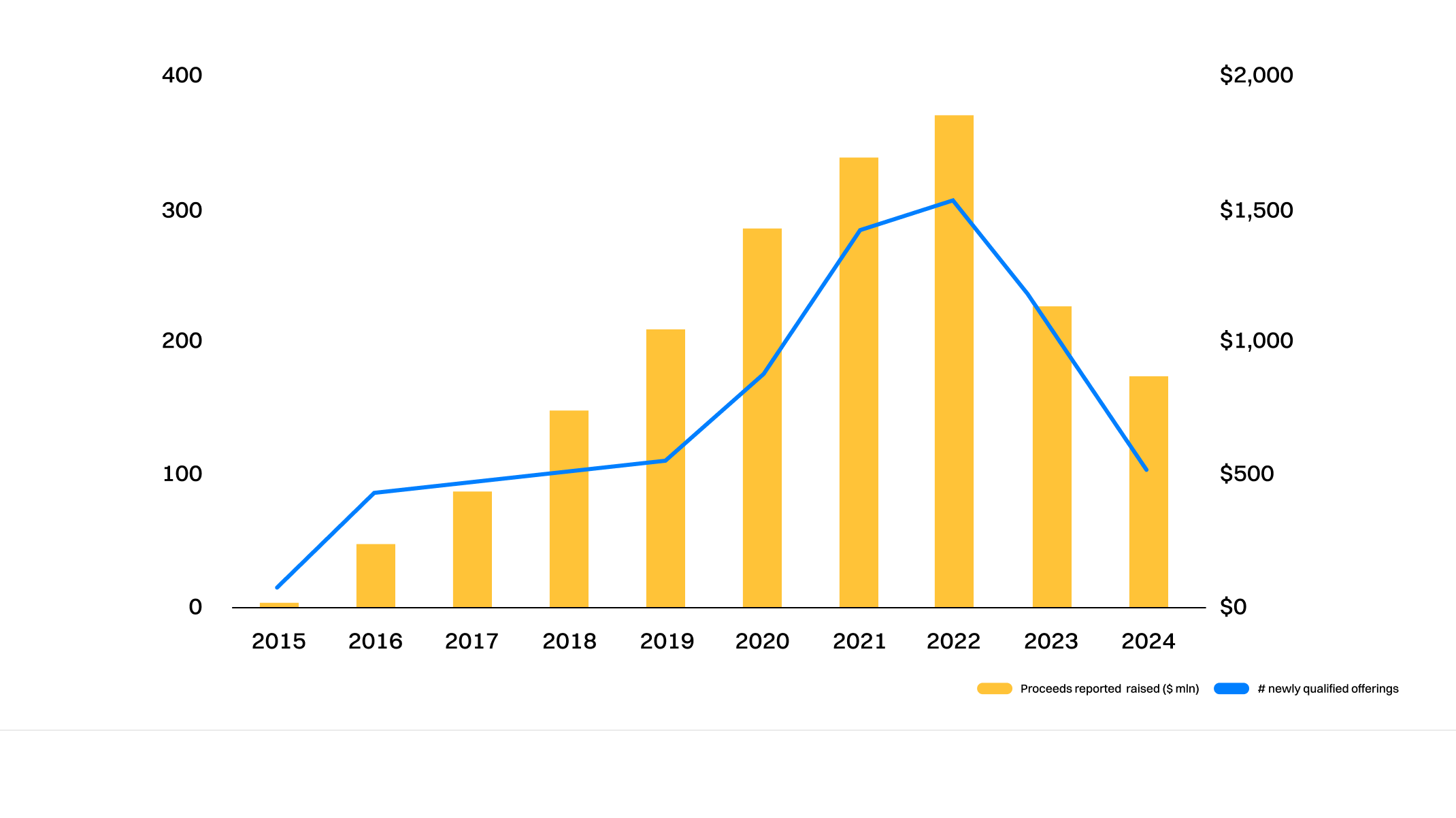

The impetus for writing this piece was the hot narrative around stock tokenization that emerged in July, with xstocks and Robinhood launching stock tokenization products and ramping up market promotion. Looking at the data from RWA.xyz, it turns out that well-known companies like Tesla, Nvidia, Oracle, Apple, and Google are not the largest by scale. The largest is actually the stock of Exodus, which has passed the SEC's Regulation A, financing its IPO directly through token issuance to access on-chain liquidity rather than traditional cornerstone and anchoring methods. This sparked a lot of thoughts for me. In the four methods of Pre-IPO, IPO, targeted issuance, and direct tokenization of large company stocks, there are different demands from companies, platforms, and users.

Article Highlights

Public companies, especially those listed in the US related to cryptocurrencies (such as Circle, Coinbase, Marathon), can supplement liquidity through on-chain stock token issuance financing, allowing for business expansion or investment mergers; for investors, this provides an opportunity to acquire stocks at lower prices than in the secondary market, as well as the chance to earn interest on-chain. I believe this area will be a key development direction for the future of stock tokenization.

Article Review

Content Innovation: Four Stars

Content Dissemination: Two Stars

Content Revaluation: No Change

Overall Rating: Above Average

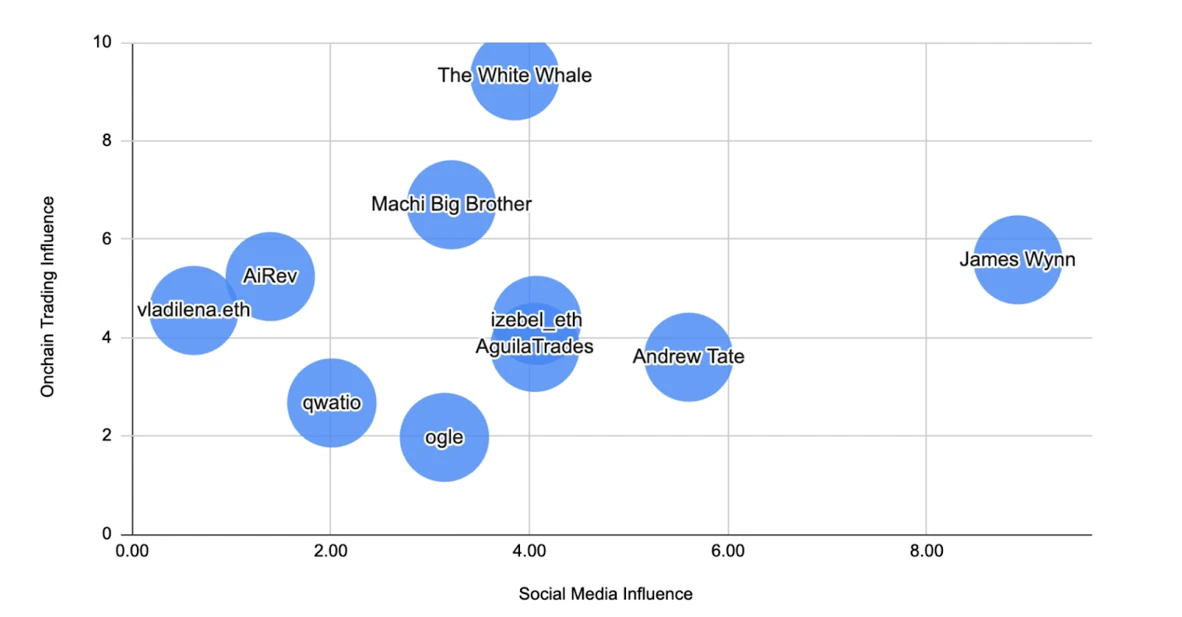

11. 2025 Hyperliquid KOL Influence Report

Author's Note

I consider this to be a very good article, and I put a lot of effort into it. Hyperliquid and Pump.fun are the two biggest narrative highlights of 2024, and both projects have effectively combined social media and trading, with the former using X and the latter incorporating a live streaming section within the platform. Hyperliquid has many trader KOLs, so which traders have higher win rates? I gathered data from the Hyperdash website and compiled the publicly available wallet addresses of these individuals. This article is also my first piece as an independent researcher, actually completed during my time at my previous company.

Article Highlights

Focusing on KOLs with personal IPs, two typical persona strategies can be observed: "loss-making whales" and "high-win-rate smart money." The former attracts market attention by shaping narratives around "massive wealth fluctuations" and leveraging dramatic events; the latter focuses on verifiable high win rates to attract investors to follow their trades in hopes of replicating their excess returns. It is worth emphasizing that The White Whale has successfully broken through the common "scale curse" in asset management, combining top-tier asset scale with high win rates, thus becoming a benchmark IP in the Hyperliquid ecosystem that possesses both influence and profitability.

Article Review

Content Innovation: Four Stars

Content Dissemination: Three Stars

Content Revaluation: Plus One Star

Overall Rating: Strong

12. Is Building a Layer 2 Public Chain the Ultimate Strategy for Ethereum DAT to Enhance mNAV?

Author's Note

This is also a topic I have reserved for a long time. In fact, the discussion of ETH in the article "Analyzing the Binary Relationship Between Public Companies and Cryptocurrencies" already hinted at this. For this wave of DAT, many companies have not clearly thought through which tokens to hoard to achieve which strategic goals. Hoarding ETH has the highest ceiling because establishing a Layer 2 is already quite easy. If a public company has accumulated many C-end users, it can completely convert some of these users into users of its own public chain. Of course, this is just theoretical; to truly achieve conversion, many user incentive activities would need to be pushed to attract users to the chain. Ultimately, this article was also turned into a video by a friend from Bilibili, and it was shared in Binance Square and Bitget Square, far exceeding my expectations in terms of dissemination. The host of the "Web3 101" podcast also mentioned the possibility of Ethereum DAT building its own Layer 2 in subsequent episodes.

Article Highlights

Staking is currently the most commonly used asset appreciation method for cryptocurrency treasury companies, and this method has gained widespread market recognition. However, for Ethereum treasury companies holding ETH, merely using third-party platforms for staking and lending ETH limits it to a financial asset, missing out on the strategic opportunities provided by Ethereum's mainnet's high scalability. Building their own Ethereum Layer 2 network represents a fundamental strategic leap for treasury companies. Although building Layer 2 will incur higher capital expenditures for treasury companies, the core value of this decision lies in transforming the company from a passive "holder" of crypto assets to an active "builder" of the blockchain ecosystem.

Article Review

Content Innovation: Four Stars

Content Dissemination: Five Stars

Content Revaluation: Plus Half Star

Overall Rating: Strong Impact

Epilogue

2025 is almost over, and this year I have written various articles, including daily, weekly, monthly, and annual reports on the blockchain industry during my time at my previous company. After the restructuring of my previous company, I also wrote quite a few PR materials. For me, transitioning from Web3 VC to a creator, I may not have written this much content in the previous five years of work. This is my 13th creation of 2025 and serves as a personal annual reflection for the year. If I were to rank this piece in the "from strong to weak" category, I would give it a "top tier" rating. I can learn more new things next year and produce even better content. Although next year may be the worst year in the four-year cycle, creators will continue to evolve with AI, undoubtedly forming their own brand and moat.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。