The original text is from Eli5DeFi

Translation|Odaily Planet Daily Golem (@web 3_golem )

As 2025 comes to a close, major cryptocurrency research institutions are releasing reports and making predictions about industry trends for the coming year, forming a new consensus: the pure speculation cycle is fading, replaced by structural maturity, driven not by short-term profit motives, but by liquidity convergence, infrastructure development, and integration.

Odaily Planet Daily has summarized the core predictions for 2026 from five research institutions—Coinbase, A16Z Crypto, Four Pillars, Messari, and Delphi Digital:

- End of the four-year cycle: Research institutions unanimously agree that the speculative halving cycle occurring every four years is fading. Instead, structural maturity will prevail, with value flowing towards "ownership tokens" that have revenue-sharing models and projects with real application value, rather than being driven by short-term profits.

- Rise of the agent economy: Major research institutions (Delphi Digital, a16z, Coinbase) predict that AI agents will become major economic participants. Market focus may shift to KYA (Know Your Agent) identity protocols and machine-native settlement layers.

- Super APP: With the clarification of U.S. regulatory policies (Four Pillars, Messari), the complex cryptocurrency experience will be simplified into user-friendly "super apps" and privacy-focused blockchains, abstracting technology for mass adoption.

Delphi Digital 2026 Outlook

Delphi Digital is based on the macro assumption of "global convergence." They predict that by 2026, the divergence in global central bank policies will end, moving towards a unified cycle of interest rate cuts and liquidity injections. As the Federal Reserve ends quantitative tightening (QT) and global liquidity improves, the market environment will favor hard assets like gold and Bitcoin.

Agent Economy

A significant expansion of infrastructure is the rise of the "agent economy." AI agents will no longer be mere chatbots but will actively manage funds, execute complex DeFi strategies, and optimize on-chain yields without human intervention.

Social Trading and "Pump" Economy

In consumer applications, Delphi emphasizes the user stickiness of platforms like pump.fun and predicts that "social trading" will mature. This trend will evolve from simple meme coin gambling to complex copy trading, with strategy sharing becoming a tokenized product.

Institutional Liquidity

Market structure will change as the prevalence of ETFs deepens, with traditional financial liquidity flowing into the cryptocurrency market, not only as a hedging tool but also as a standard investment portfolio allocation driven by macro liquidity easing.

Full report link: https://members.delphidigital.io/reports/the-year-ahead-for-infra-2026

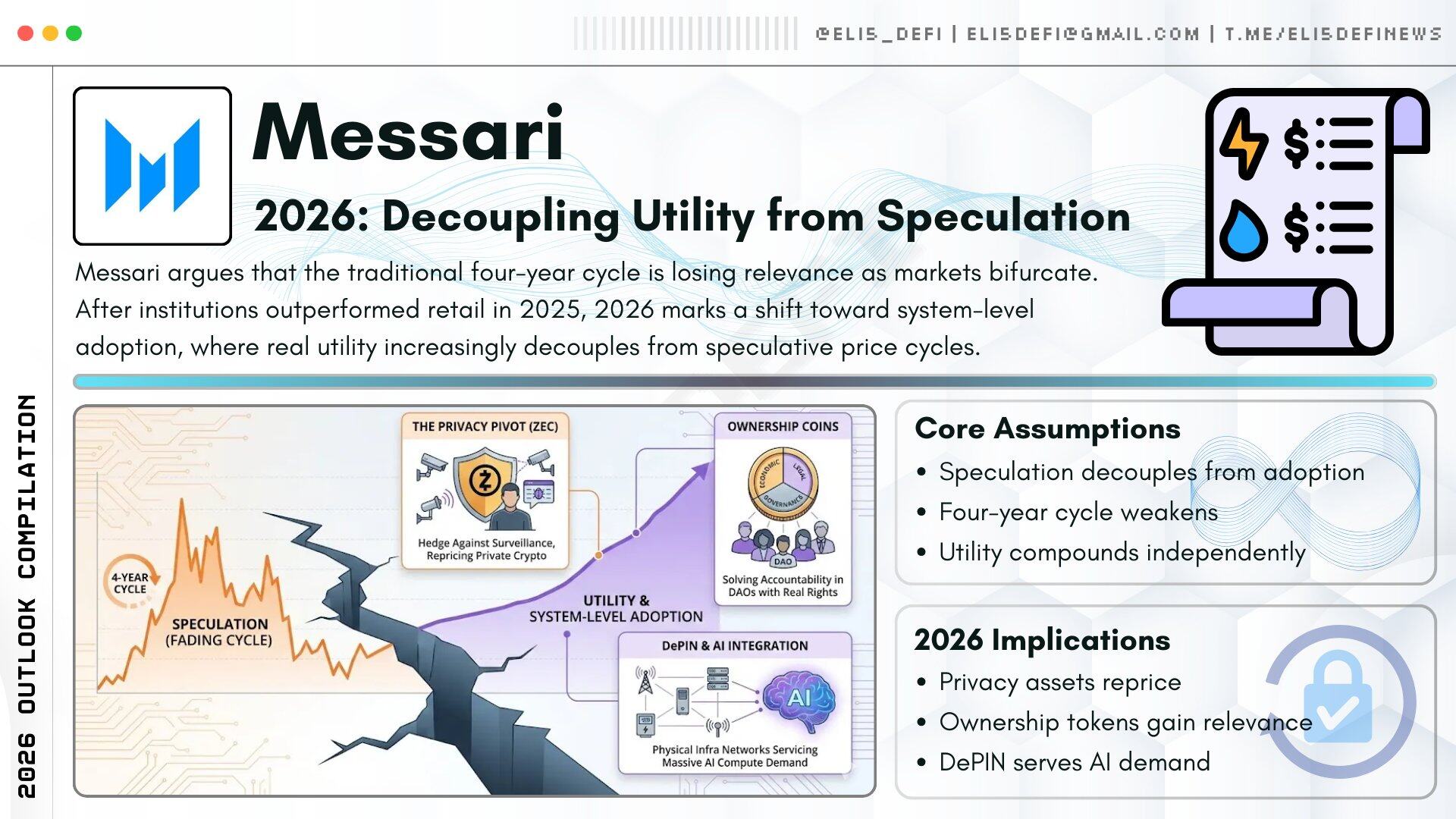

Messari 2026 Outlook

Messari's core argument is the "decoupling of utility and speculation." They believe that as the market differentiates, the relevance of the "four-year cycle" model is declining. They hypothesize that 2025 will be a year where institutional investors win while retail investors struggle, laying the groundwork for "system-level adoption" rather than mere asset price speculation in 2026.

Rise of Privacy Coins ($ZEC)

The revival of privacy is a trend of reverse expansion. Messari emphasizes that Zcash (ZEC) and similar assets are not just "privacy coins," but necessary hedging tools against increasing surveillance and corporate control, predicting that "private cryptocurrencies" will be repriced.

Ownership Tokens

A new category called "ownership tokens" will emerge in 2026, combining economic, legal, and governance rights. Messari believes that ownership tokens can address accountability crises in DAOs and may give rise to the first projects in this specific field with a market value of over a billion dollars.

DePIN and AI Integration

This theory focuses on DePIN (Decentralized Physical Infrastructure Networks), anticipating that these protocols will find actual product-market fit by meeting the massive computational and data needs of the AI field.

Full report link: https://messari.io/report/the-crypto-theses-2026

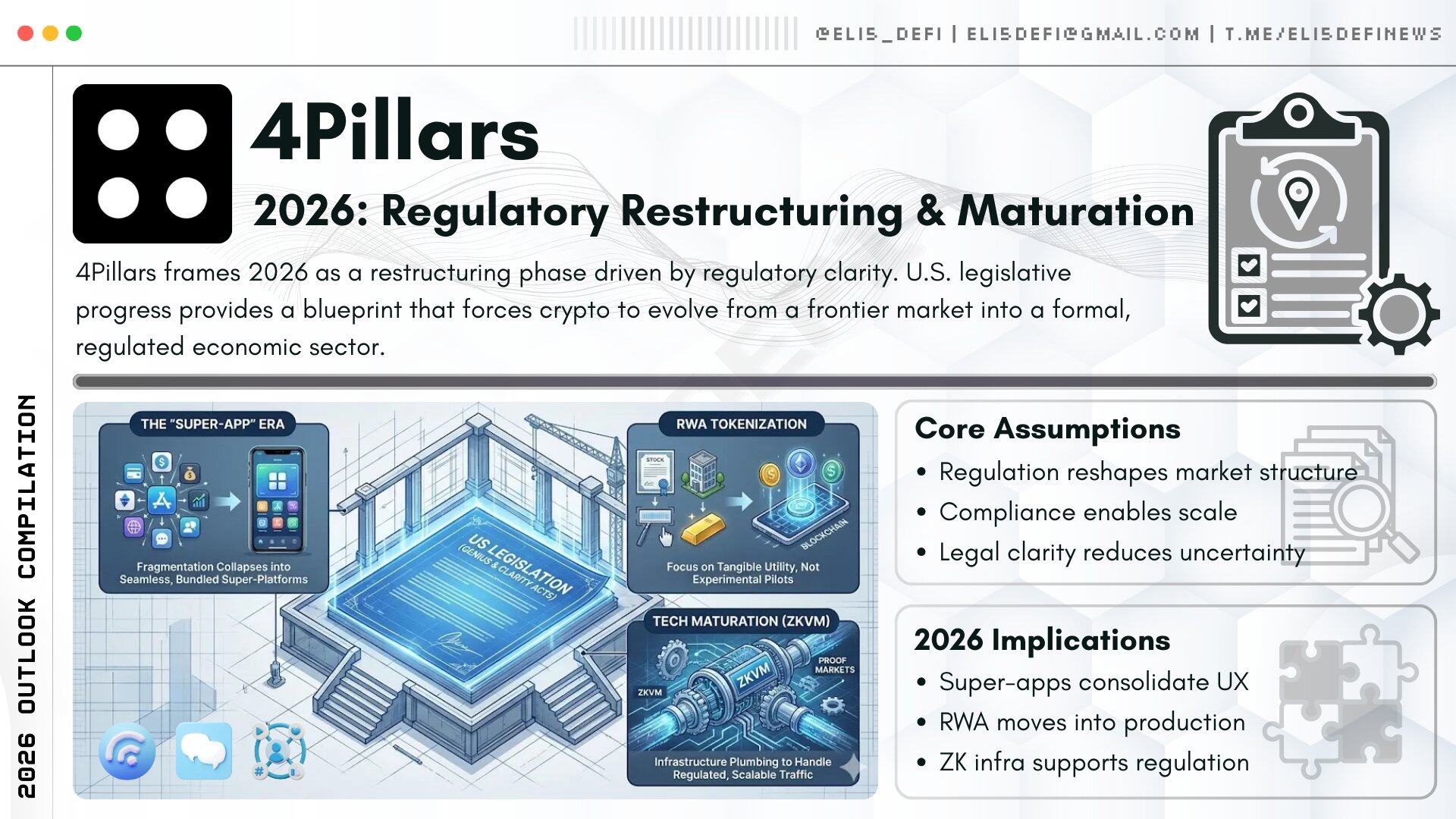

Four Pillars 2026 Outlook

Four Pillars' outlook centers on "regulatory restructuring." Their core assumption is that U.S. legislative initiatives (specifically mentioning the GENIUS Act and the CLARITY Act in their predictions) will provide a blueprint for comprehensive market reform.

This regulatory clarity will act as a catalyst for restructuring the market from a "Wild West" environment into a formal economic sector.

Era of "Super APP"

Four Pillars predicts that the fragmentation of crypto applications will ultimately merge into "super apps"—platforms driven by stablecoins that seamlessly integrate payment, investment, and lending functions. The complexity of blockchain will be completely eliminated.

RWA Tokenization

Restructuring will drive the tokenization of stocks and traditional assets, focusing on actual utility rather than experimental pilot projects.

Maturity of Crypto Technology

On the technology front, they delve into the role of zero-knowledge virtual machines (ZKVM) on Ethereum and the proof market, viewing them as necessary infrastructure to handle the scale of this new, regulated institutional flow.

Full report link: https://4pillars.io/en/articles/2026-outlook-restructuring-100ys-perspective

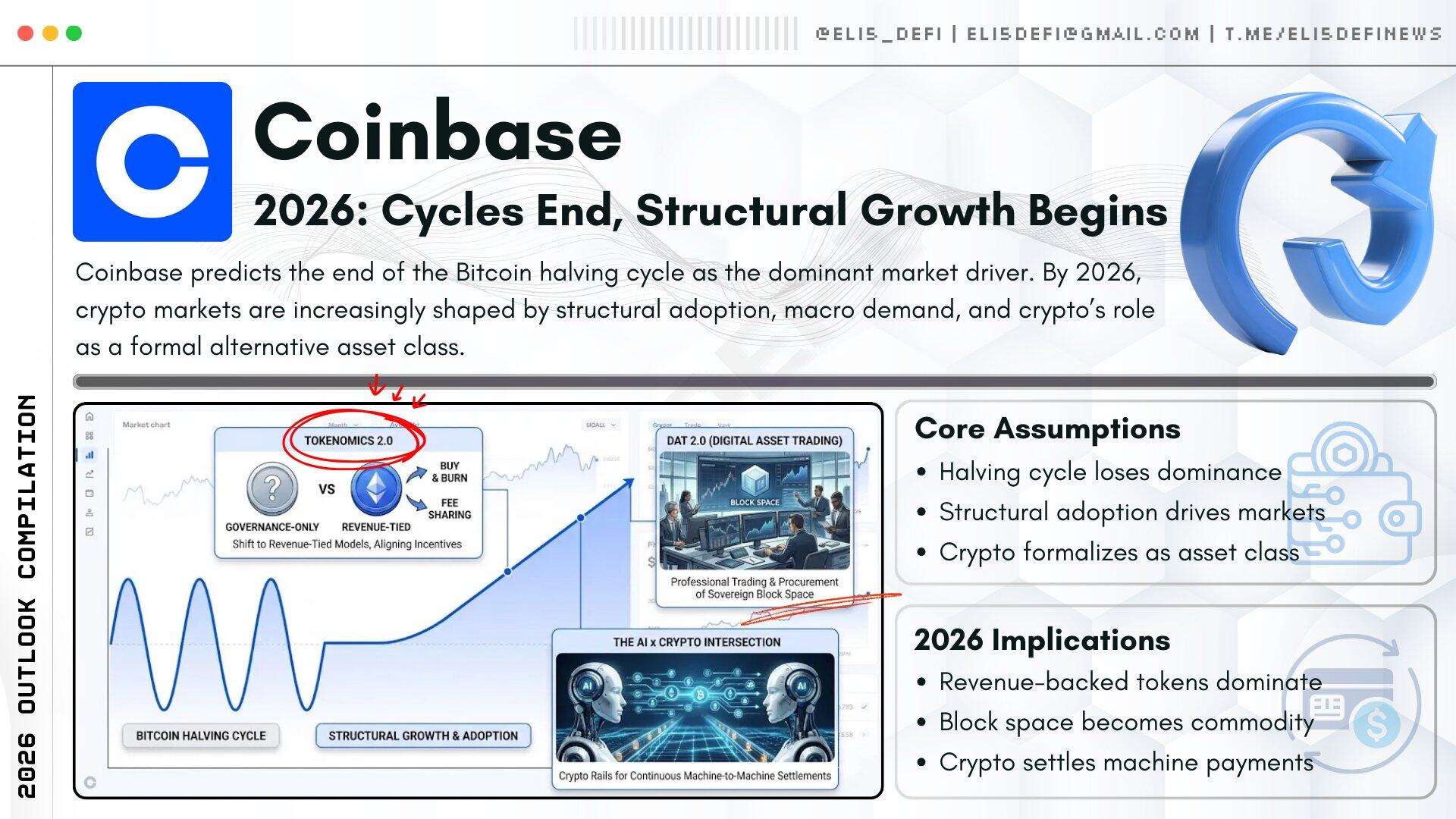

Coinbase 2026 Outlook

Coinbase's report predicts the "end of the four-year cycle." They clearly state that 2026 will mark the end of the traditional Bitcoin halving cycle theory. Instead, the market will be driven by structural factors, macro demand for alternative stores of value, and the formalization of cryptocurrency as a medium-sized alternative asset class.

Token Economics 2.0

Shifting from "governance-only" tokens to a model "linked to revenue." Protocols will increasingly implement buyback-and-burn or fee-sharing mechanisms (in line with new regulations) to align the incentives of token holders with the success of the platform.

DAT 2.0 (Digital Asset Trading)

Moving towards specialized trading and "sovereign block space" procurement, viewing block space as a key commodity in the digital economy.

Intersection of AI and Crypto

Coinbase anticipates a significant increase in AI agents using cryptocurrency payment rails. They predict that the market will require a "cryptocurrency-native settlement layer" capable of handling continuous microtransactions between machines, which traditional payment rails cannot support.

Full report link: https://www.coinbase.com/en-sg/institutional/research-insights/research/market-intelligence/2026-crypto-market-outlook

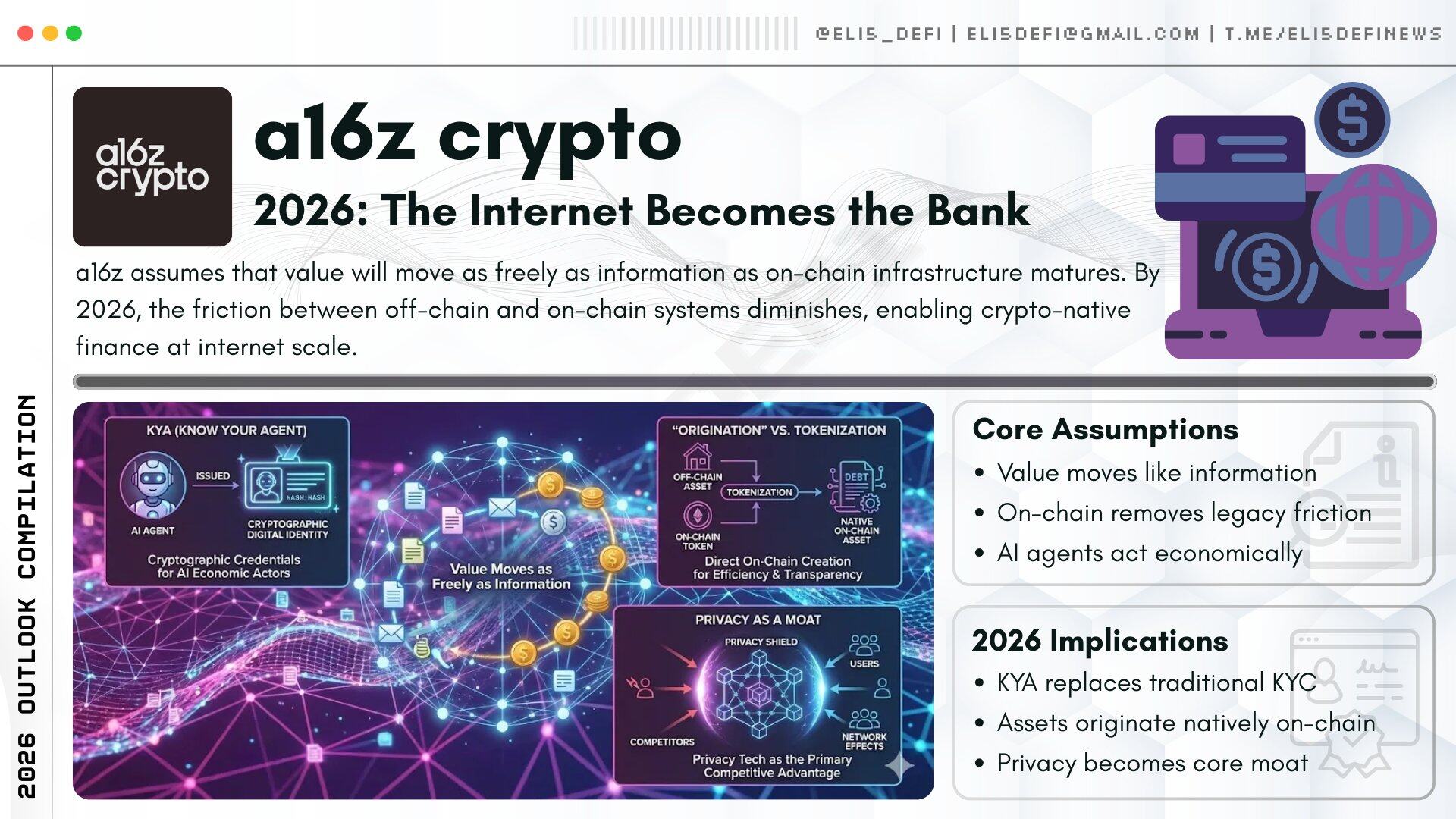

a16z Crypto 2026 Outlook

a16z crypto's outlook is that "the internet will become banking." Their fundamental belief is that value is beginning to flow as freely as information. They believe that the friction between the "off-chain" and "on-chain" worlds is the main bottleneck, which will be eliminated by more robust infrastructure in 2026.

KYA (Know Your Agent)

A key expansion is the shift from KYC (Know Your Customer) to KYA. As AI agents become major economic participants, they will require cryptographic signatures as credentials to transact, creating a new layer of identity infrastructure.

"Native Bonds" vs Tokenization

a16z predicts that in the future, assets will no longer be tokenized off-chain (e.g., purchasing treasury bonds and putting them on-chain), but rather debt and assets will be initiated directly on-chain to reduce service costs and increase transparency.

Privacy Technology Moat

They believe that in the era of open-source code, privacy technology (and the ability to protect state privacy) will become the most important competitive moat for blockchains, creating strong network effects for blockchains that support privacy features.

Universal Wealth Management

The combination of AI and cryptocurrency infrastructure will make complex wealth management (such as asset rebalancing and tax-loss harvesting) accessible to the general public, which was previously only available to high-net-worth individuals.

Full report link: https://a16zcrypto.com/posts/article/big-ideas-things-excited-about-crypto-2026/

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。