As gold hits a historic high of $4500 per ounce, don't forget history! 🧐

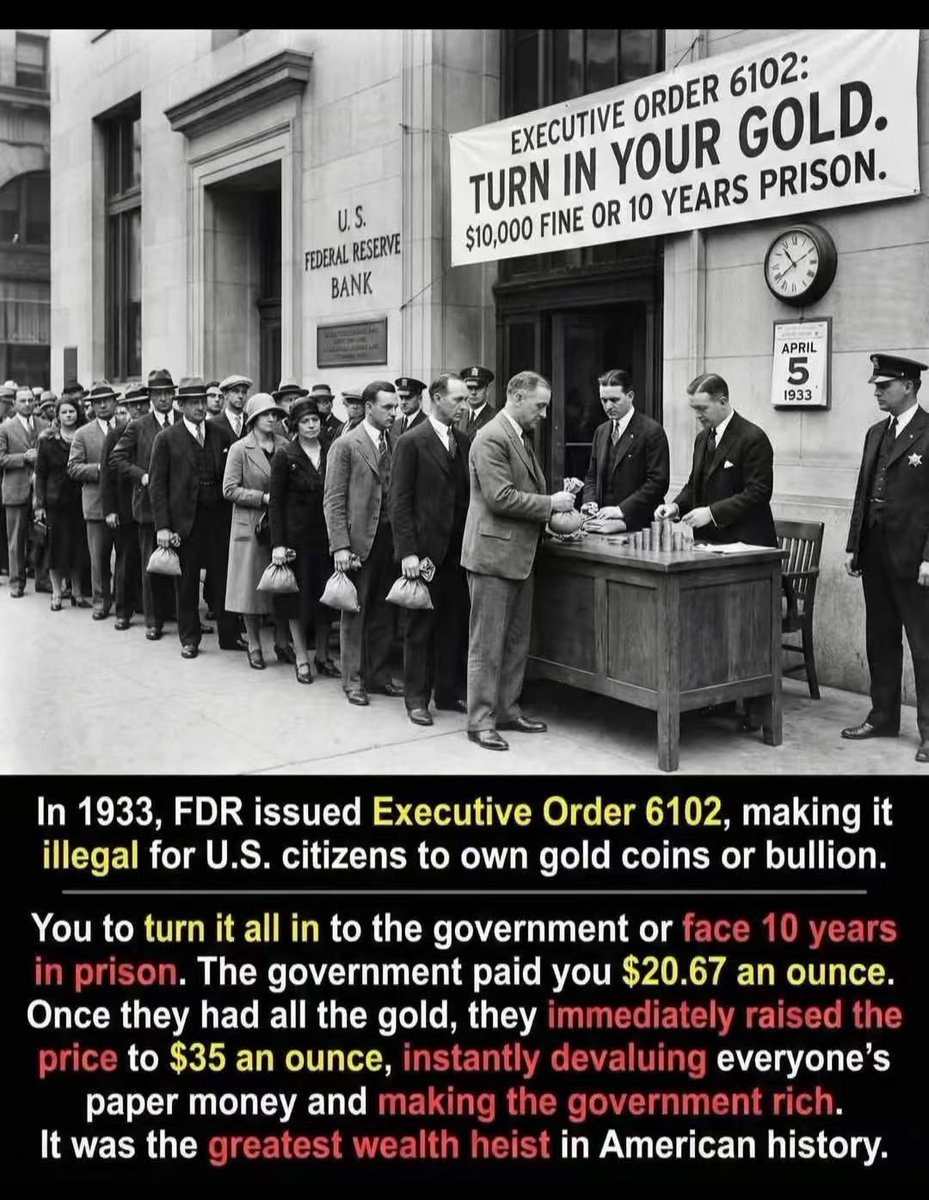

On April 5, 1933, Roosevelt signed Executive Order 6102 - "Surrender Your Gold." That day, the gold coins and bars in the hands of American citizens were no longer symbols of wealth but became evidence of illegality. The government "acquired" the gold from the people at $20.67 per ounce, only to raise the official gold price to $35 per ounce, diluting your purchasing power overnight while filling the treasury. This was not an economic policy; it was a carefully orchestrated wealth redistribution, and ordinary people were merely the targets of the harvest. This is a true historical event!

Today, on December 24, 2025, Christmas Eve, I sit in front of the screen, watching the #BTC price fluctuate around $87,000, and I feel a chill in my heart. Not because of the volatility, but because history always rhymes.

I once thought #BTC was the "non-sovereign gold" of the digital age - decentralized, censorship-resistant, with a fixed total supply of 21 million coins, the last bastion for ordinary people against currency overissuance. It does not rely on any government credit and is not controlled by any central bank. However, with the approval of Bitcoin ETFs, Wall Street fully entering the scene, and even sovereign nations beginning to discuss "strategic reserve Bitcoin," I gradually realized: Are we not handing digital gold over to the eve of a new "Executive Order 6102"?

Today, many of us no longer control our private keys. Storing #BTC in Coinbase, Grayscale, or BlackRock's ETFs, these "custodial digital gold" assets are essentially no different from the gold coins in bank vaults in 1933. Once policies shift, these assets can be frozen, tracked, and "legally" requisitioned. The true spirit of decentralization is quietly being eroded by convenience and compliance.

What alarms me the most is that the government no longer needs to "confiscate" Bitcoin. It only needs to promote "compliance" - through tax tracking, KYC/AML rules, and on-chain monitoring, taming free crypto assets into regulated financial instruments. When 90% of BTC circulation relies on centralized entry points, and "non-custodial" becomes a minority behavior for geeks, Bitcoin is no longer a force resisting the system but has become part of the system.

So, I remind myself every day: do not repeat the mistakes of 1933. My #BTC only exists in the cold wallet that I control. I do not believe that "custody equals safety," because historically, safety has never come from systems but from sovereignty, from absolute sovereignty over one's assets.

People in the Roosevelt era surrendered their gold for paper money and inflation. Will our generation one day surrender our private keys in exchange for a "compliant yet completely unfree" digital financial cage? It is worth reflecting on! 🧐

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。