Written by: ChandlerZ, Foresight News

On December 22, Coinbase announced that it has reached an agreement to acquire The Clearing Company, with the transaction expected to be completed in January. The team from The Clearing Company will join Coinbase to help expand its product offerings. A spokesperson declined to disclose the transaction amount, stating it was "insignificant," and confirmed that the deal includes a combination of cash and Coinbase stock.

Although the specific financial terms of the acquisition have not been disclosed, it marks a shift for Coinbase in the increasingly growing prediction market sector, moving from simple distribution partnerships to a deep integration of technology and talent.

Just a week before the announcement of this deal, Coinbase had launched a partnership with the CFTC-regulated prediction platform Kalshi, allowing its users to access Kalshi's markets through the Coinbase interface. The acquisition of The Clearing Company is seen by the market as a further move by Coinbase to seek ownership of the underlying technology stack and strengthen its internal product development capabilities.

Polymarket and Kalshi's "Hybrid Gene"

In August 2025, The Clearing Company completed a $15 million seed round financing, led by Union Square Ventures, with participation from Haun Ventures, Variant, Coinbase Ventures, Compound, Rubik, Earl Grey, Cursor Capital, and Asylum. The company has not yet announced a timeline for its platform launch but emphasizes a focus on designing products that balance ease of use and compliance.

Although it is an early-stage startup, its team composition has significant background advantages in the prediction market field.

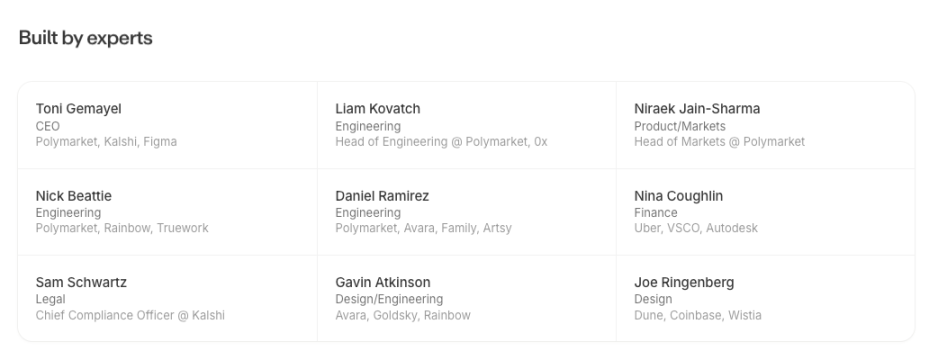

According to information on its official website, The Clearing Company's core team consists of several former executives and technical backbones from Polymarket and Kalshi. The company's founder and CEO, Toni Gemayel, is a seasoned operator in the prediction market space. His resume shows that he has previously served as the head of growth at both Polymarket and Kalshi. Additionally, he has a background in designing the unicorn Figma.

Furthermore, The Clearing Company's core engineering team is primarily composed of early employees from Polymarket, while also incorporating some operational personnel from Kalshi.

- Liam Kovatch (Engineering): Former Head of Engineering at Polymarket;

- Niraek Jain-Sharma (Product/Markets): Former Market Lead at Polymarket;

- Sam Schwartz: Former Chief Compliance Officer at Kalshi;

- Nick Beattie and Daniel Ramirez: Both engineers also come from the Polymarket team and have experience in development at Raibow and Avara.

A Coinbase spokesperson told The Block that the startup has about 10 employees, and nearly all team members will join Coinbase as part of the transaction.

In contrast, although The Clearing Company is a latecomer, its initial capital thickness far exceeds that of Polymarket and Kalshi in their early days. Comparing the seed round financing data of the three companies clearly shows the leap in valuation systems in the prediction market track over the past five years.

The Clearing Company completed a $15 million seed round financing led by Union Square Ventures even before its product was launched. This amount is nearly four times that of Polymarket's seed round back in the day. This indicates that even before Coinbase's acquisition, the primary market had already placed a very high expectation label on this hybrid gene team.

Coinbase Launches Stock Trading and Prediction Market Services

On December 18, Coinbase announced a significant expansion of its platform's trading asset range during its System Update release, including stock trading, prediction markets, new cryptocurrencies, and perpetual futures, aiming to solidify its market position as a "one-stop exchange."

Coinbase will initially launch stock trading services for hundreds of stocks based on market capitalization and trading volume, with plans to add thousands of stocks and ETFs in the coming months. Users can enjoy zero-commission trading, unrestricted by traditional market hours, available five days a week, 24 hours a day. Additionally, Coinbase has partnered with the $11 billion prediction market provider Kalshi, allowing users to trade on the outcomes of real-world events such as elections, sports, collectibles, and economic indicators.

At the same time, Coinbase has launched the AI-driven wealth management tool Coinbase Advisor and the Coinbase Business service for startups, further expanding its business scope. Company executives stated that these new features will be supported by the Coinbase Tokenize platform, which is designed as an end-to-end institutional-grade platform for tokenizing real-world assets.

Recently, Coinbase, Kalshi, Crypto.com, Robinhood, and Underdog jointly established the Coalition for Prediction Markets. This national organization is dedicated to maintaining a safe, transparent, and federally regulated access environment for prediction markets.

Coinbase is gradually downplaying its label as merely a cryptocurrency exchange. As Robinhood and Interactive Brokers venture into prediction markets, Coinbase must defend its territory. Having native prediction products will enhance its product matrix of spot, futures, and prediction markets, allowing users to complete a full range of operations from purchasing Bitcoin to hedging macroeconomic risks within a single account.

The Next Stage of Competition in Prediction Markets

The acquisition of The Clearing Company is Coinbase's tenth acquisition announced in 2025. Earlier transactions completed this year include Roam, Spindl, Iron Fish, Deribit, Opyn Markets, Liquifi, Sensible, Echo, and Vector.fun.

From the distribution partnership with Kalshi to acquiring The Clearing Company's team and technology, Coinbase's path in the prediction market has become clear. First, it validates demand and product form through collaboration, then internalizes key capabilities through acquisitions, ultimately forming a scalable long-term business line.

The competition in prediction markets is shifting from who launches first to who can operate in a compliant manner over the long term. Coinbase's choice to integrate people and technology into its system is clearly positioning itself for the next stage of licensing and institutional competition.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。