The majority of financial institutions are still hesitant to approach crypto despite the change in sentiment and regulation.

The main barrier is the mismatch between public, pseudonymous ledgers and regulatory requirements like KYC and private transfers.

For example, the Bank Secrecy Act requires institutions to know the sender, the recipient, and the purpose of every transfer. They must maintain the ability to audit records that tie every transaction to a verified customer or legal entity.

Financial institutions also require private payments. Banks cannot send client flows where counterparties and random observers can analyze every activity on a public ledger.

What's required is private flows and public accounts.

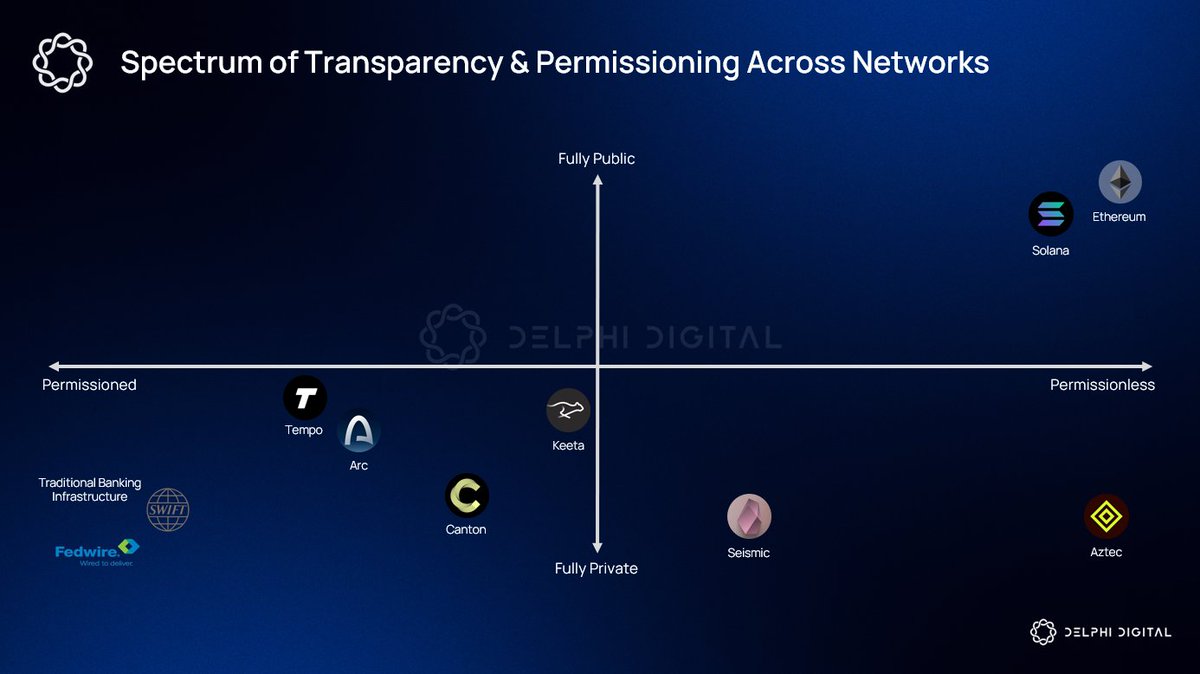

As it stands today, most existing chains are not an option with public flows and anonymous accounts.

An institutional blockchain would need to fall somewhere in the middle.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。