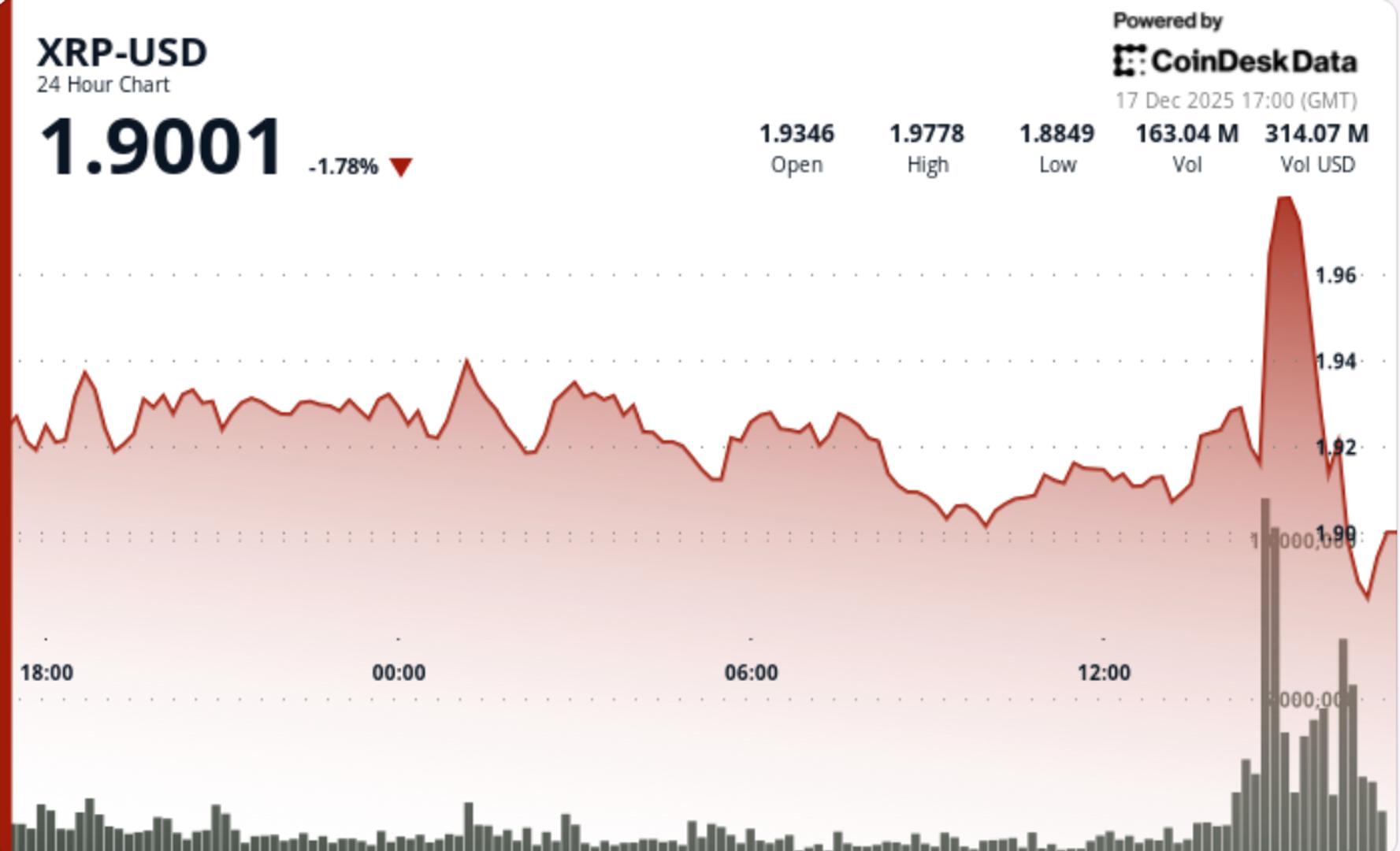

What to know : XRP fell 5.04% as it broke below the $1.92 support zone amid heightened selling pressure and market volatility. The selloff was marked by high trading volume, indicating institutional repositioning rather than retail panic. XRP's price action now faces resistance at the former support levels, with $1.90 as the immediate line of defense.

XRP slid sharply on Wednesday, breaking below the $1.92 support zone as elevated selling pressure collided with violent cross-asset volatility during U.S. trading hours.

The move came amid abrupt reversals in bitcoin, U.S. equities and AI-linked stocks, leaving altcoins exposed as liquidity thinned and derivatives positioning reset.

News Background

- Crypto markets saw violent whipsaw action in early U.S. trade, with bitcoin briefly ripping from $87,000 to above $90,000 before snapping back to the $87,000 area

- The reversal coincided with sharp losses in AI-linked equities, including Nvidia, Broadcom and Oracle falling 3%–6%, dragging the Nasdaq down more than 1%

- Sentiment weakened after reports that Blue Owl Capital pulled out of funding a $10 billion Oracle data-center project, pressuring risk assets tied to AI infrastructure.

- The sudden swings triggered over $190 million in crypto liquidations in four hours, with $72 million in longs and $121 million in shorts flushed out, according to CoinGlass.

- XRP underperformed the broader market slightly as derivatives-driven flows hit mid-beta altcoins harder during the volatility spike.

Technical Analysis

- Support:Immediate: $1.90, now the first line of defenseSecondary: $1.75–$1.64, deeper liquidity zone if $1.90 fails

- Resistance:Near-term: $1.94–$1.99, former support turned supplyPsychological: $2.00, now firmly rejected

- Volume Structure:Rejection near $1.9885 printed the session’s highest volumeElevated activity confirms distribution, not passive sellingNo evidence yet of seller exhaustion

- Trend Structure:Breakdown below key Fibonacci retracement shifts structure bearishLower highs formed before the rejection, signaling momentum decayConsolidation resolved to the downside

- Momentum Check: Failed squeeze above $2.00 acted as a bull trapPrice acceptance below $1.94 keeps downside bias intact.

What Traders Are Watching

- Whether $1.90 holds — a clean break exposes $1.75–$1.64 quickly.

- Reaction if price retests $1.94–$1.99 — rejection there confirms trend continuation.

- Whether macro volatility eases or continues to force cross-asset deleveraging.

- Derivatives positioning after $190 million in liquidations — direction depends on who reloads first.

- XRP’s relative performance vs BTC if bitcoin stabilizes near $87,000

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。