Written by: Prathik Desai

Translated by: Block unicorn

Preface

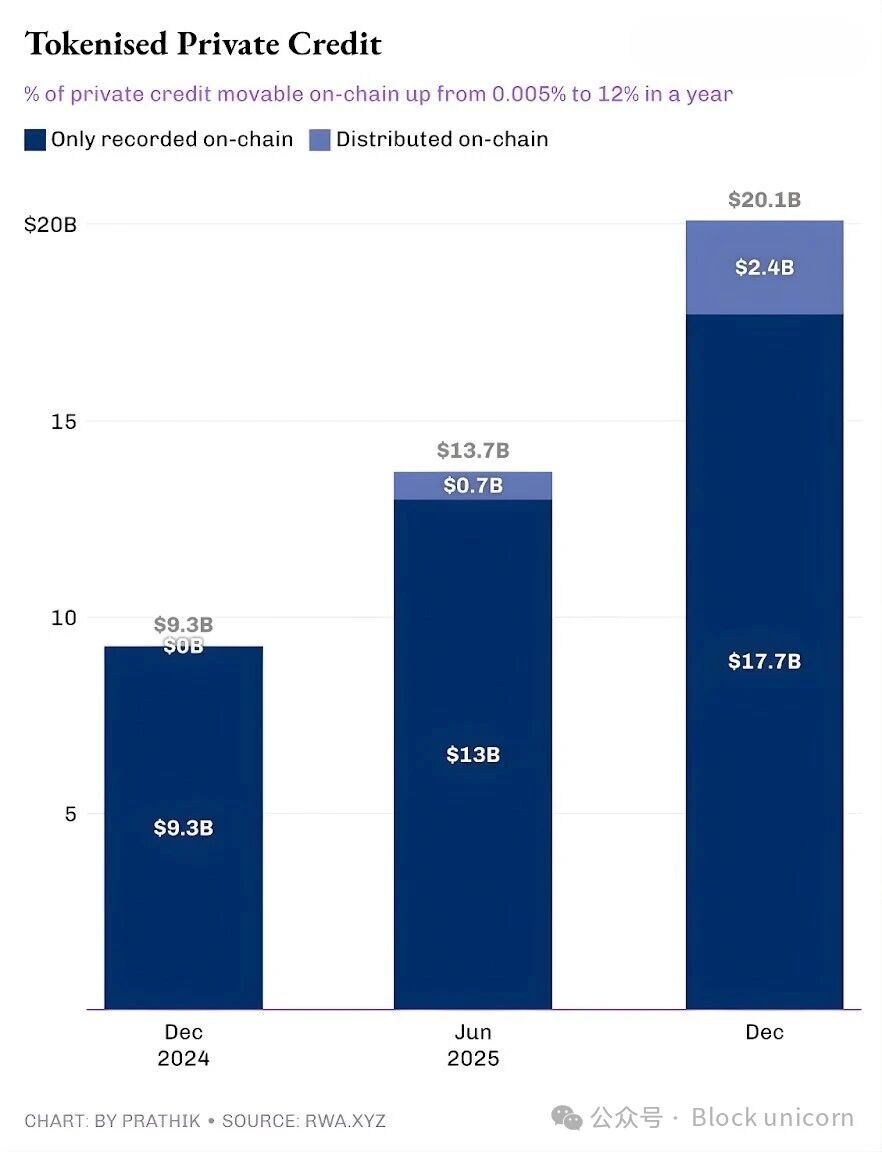

Private credit is at the forefront of tokenizing real-world assets (RWA) platforms. Over the past year, tokenized private credit has been the fastest-growing category, scaling from less than $50,000 to approximately $2.4 billion.

Excluding stablecoins (which cover all on-chain activities), tokenized private credit ranks just behind on-chain commodities. Top tokenized commodities include gold-backed currencies from Tether and Paxos, as well as cotton, soybean oil, and corn-backed tokens from Justoken. This seems to be a serious category, with real borrowers, cash flows, underwriting mechanisms, and yields, and it is less dependent on market cycles compared to commodities.

But the story becomes complex upon deeper exploration.

This $2.4 billion in outstanding tokenized private credit represents only a small fraction of the total outstanding loans. This indicates that only a portion of assets can truly be held and transferred on-chain through tokens.

In today’s article, I will examine the reality behind the numbers of tokenized private credit and what these numbers mean for the future of this category.

Let’s get straight to the point.

The Dual Nature of Tokenized Private Credit

The total active loans on the RWA.xyz platform is slightly over $19.3 billion. However, only about 12% of these assets can be held and transferred in a tokenized form. This reflects the dual nature of tokenized private credit.

On one side is "representative" tokenized private credit, where blockchain merely provides operational upgrades by establishing an on-chain registry of outstanding loans sourced from the traditional private credit market. On the other side is distributed upgrades, where blockchain-driven markets coexist with traditional (or off-chain) private credit markets.

The former is used solely for recording and reconciliation, documented in a public ledger. In contrast, distributed assets can be transferred to wallets for transactions.

Once we understand this classification system, you will no longer ask whether private credit is on-chain. Instead, you will pose a sharper question: How much private credit assets originate from the blockchain? The answer to this question may provide us with some insights.

The development trajectory of tokenized private credit is encouraging.

Until last year, almost all tokenized private credit was merely an operational upgrade. Loans already existed, borrowers were repaying on time, and platforms were functioning normally, with blockchain simply recording these activities. All tokenized private credit was recorded on-chain but could not be transferred as tokens. Within a year, this transferable on-chain share has risen to 12% of the total traceable private credit.

It showcases the growth of tokenized private credit as a distributable on-chain product. This enables investors to hold fund shares, liquidity pool tokens, notes, or structured investment exposures in token form.

If this distributed model continues to expand, private credit will no longer resemble a loan ledger but rather an investable on-chain asset class. This shift will change the returns lenders receive from transactions. Beyond returns, lenders will gain a tool with greater operational transparency, faster settlement speeds, and more flexible custody methods. Borrowers will obtain funding that does not rely on a single distribution channel, which could be beneficial in a risk-averse environment.

But who will drive the growth of the distributable private credit market?

Figure Effect

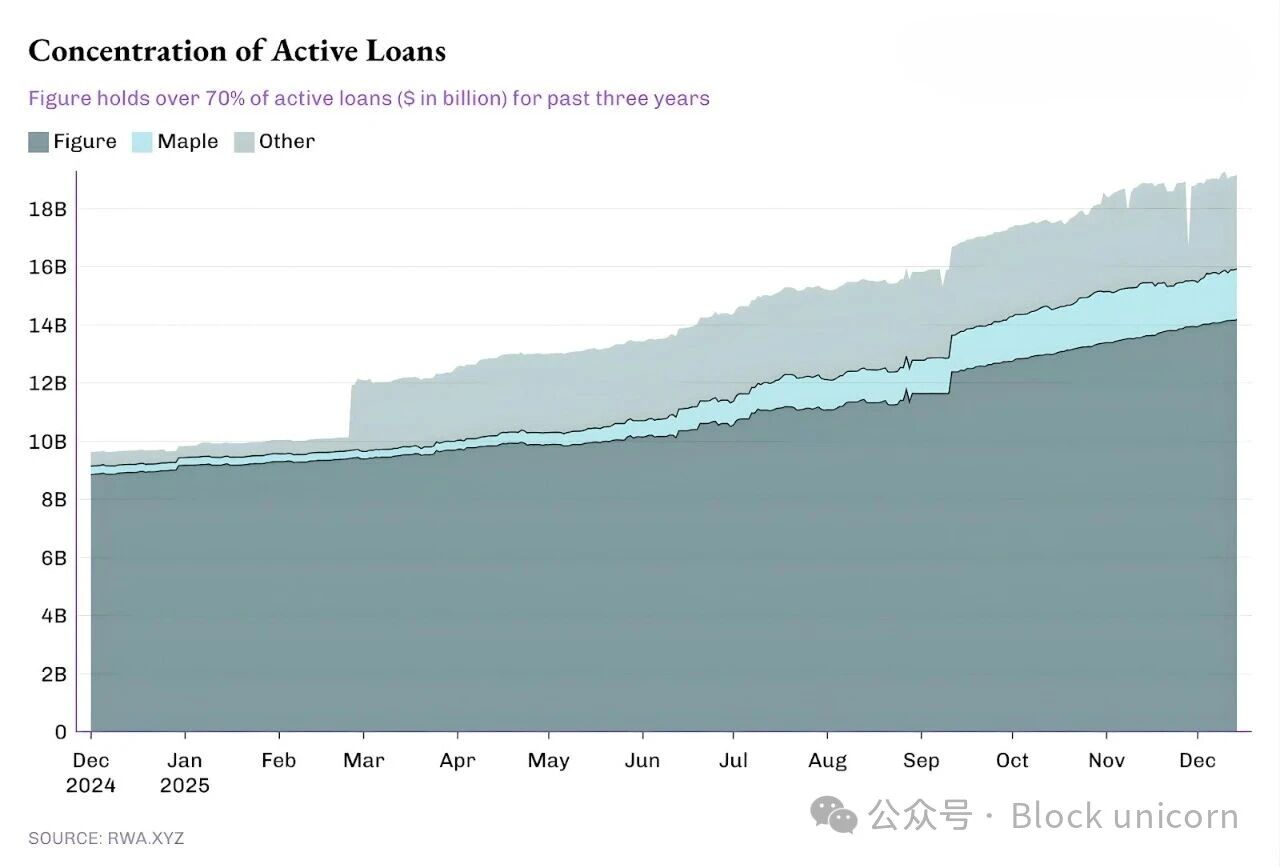

Currently, most outstanding loans come from a single platform, while other parts of the ecosystem constitute a long-tail effect.

Since October 2022, Figure has dominated the tokenized private credit market, but its market share has decreased from over 90% in February to the current 73%.

But what’s more interesting is Figure's private credit model.

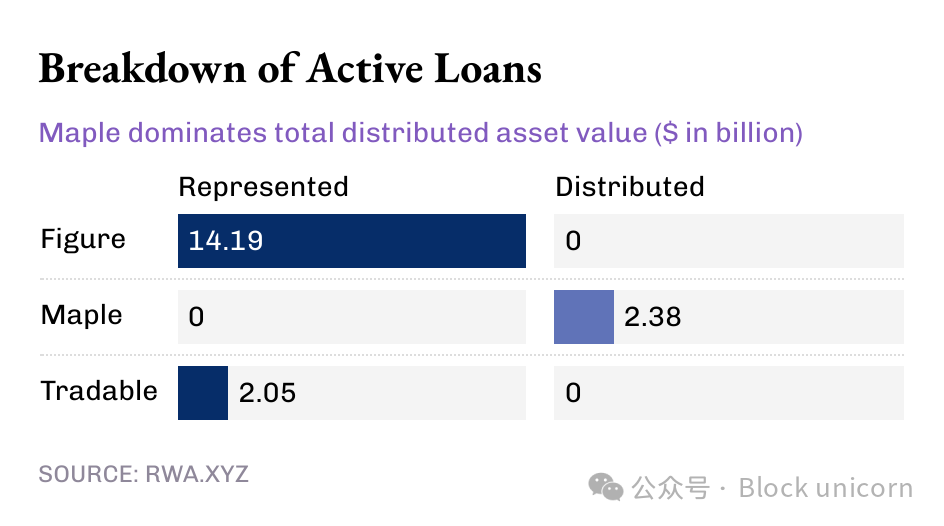

Although the scale of tokenized private credit has now exceeded $14 billion, all the value of this industry leader is reflected in "representative" asset value, while distributed value is zero. This indicates that Figure's model is an operational pipeline that traces loan issuance and ownership records on the Provenance blockchain.

Meanwhile, some smaller participants are driving the distribution of tokenized private credit.

Figure and Tradable hold all their tokenized private credit as representative value, while Maple's value is entirely distributed through the blockchain.

From a macro perspective, the vast majority of the currently active $19 billion in on-chain loans are recorded on the blockchain. However, the trend over the past few months is undeniable: more and more private credit is being distributed through the blockchain. Given the enormous growth potential of tokenized private credit, this trend will only intensify.

Even at a scale of $19 billion, RWA currently accounts for less than 2% of the total $16 trillion private credit market.

But why is "movable, not just recorded" private credit important?

Movable private credit offers more than just liquidity. Gaining private credit exposure off-platform through tokens provides portability, standardization, and faster distribution speeds.

Assets obtained through traditional private credit channels can trap holders within a specific platform's ecosystem. Such ecosystems have limited transfer windows, and secondary market trading processes are cumbersome. Additionally, negotiations in the secondary market progress slowly and are primarily dominated by professionals. This gives the existing market infrastructure far more power than asset holders.

Distributable tokens can reduce these frictions by enabling faster settlements, clearer ownership changes, and simpler custody.

More importantly, "movable" is a prerequisite for achieving large-scale standardized distribution of private credit, which has historically been lacking in private credit. In traditional models, private credit appears in forms such as funds, business development companies (BDC), and collateralized loan obligations (CLO), each adding layers of intermediaries and opaque fees.

On-chain distribution offers a different path: programmable wrappers enforce compliance (whitelisting), cash flow rules, and information disclosure at the tool level, rather than through manual processes.

That’s all for today’s content; see you in the next article.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。