This is an "informal" column from the Odaily editorial team. The author shares immediate thoughts and different perspectives on industry news, data, hot events, and their nuances; explores investment ideas and opportunity hypotheses that are still being validated—these may not necessarily be direct wealth codes, but could simply be the questions themselves; shares observations gained from interactions with industry practitioners; and those materials that have genuinely enhanced our understanding, whether from internal or external sources.

The content of this column is based on the real investment and observation experiences of Odaily editorial team members, and it does not accept any form of commercial advertising, nor does it constitute investment advice (after all, we are equally experienced in losing money). Its purpose is merely to expand perspectives and supplement information sources, rather than to create consensus. You are welcome to join the Odaily community (Telegram group, X official account) to exchange ideas, question, and joke around.

Asher (X: @Asher_0210)

Introduction: Primarily focused on interaction + finance, occasionally buys memes (buys what he doesn't like to sell), inexperienced with contracts but enjoys participating.

Content: Yesterday, the crypto fear index dropped to 11, still believing there will be a rebound, and has started bottom-fishing SOL, ADA, ENA (also opened a small contract position). PIPPIN and BEAT simply feel like they have risen too much, so opened short positions this morning (made a profit to share next time).

For those playing contracts, I recommend trading on-chain top contract platforms for token airdrops. Among them, Lighter is already in the listing plan on Coinbase, and now is the last stage to earn points; StandX has launched mainnet trading, so it can be ramped up; Aster S4 quarter is ongoing.

Recently, the main operation is still interacting with early popular projects. Last week, I wrote a summary and reflection on the 2025 harvesting, recommended reading: “2025 Harvesting Survival Rules: Once a Land of Gold, Now Only Relying on These Two Cards”.

Wenser (X: @wenser2010)

Introduction: Tea server, crypto soy sauce party, media observer.

Sharing:

- Macro: US stocks hit new highs, but crypto concept stocks hit new lows this year, creating asymmetric opportunities under the hot and cold comparison. The crypto native crowd should reverse harvest the stock market through tokenized trading platforms. Altcoins in the circle will continue to bleed, but meme stocks like Gamestop may see a new wave of speculation.

- Investment reference: Cathie Wood's Ark fund is still bottom-fishing, including Coinbase, Circle, Bitmine; I personally think there is still a rebound opportunity.

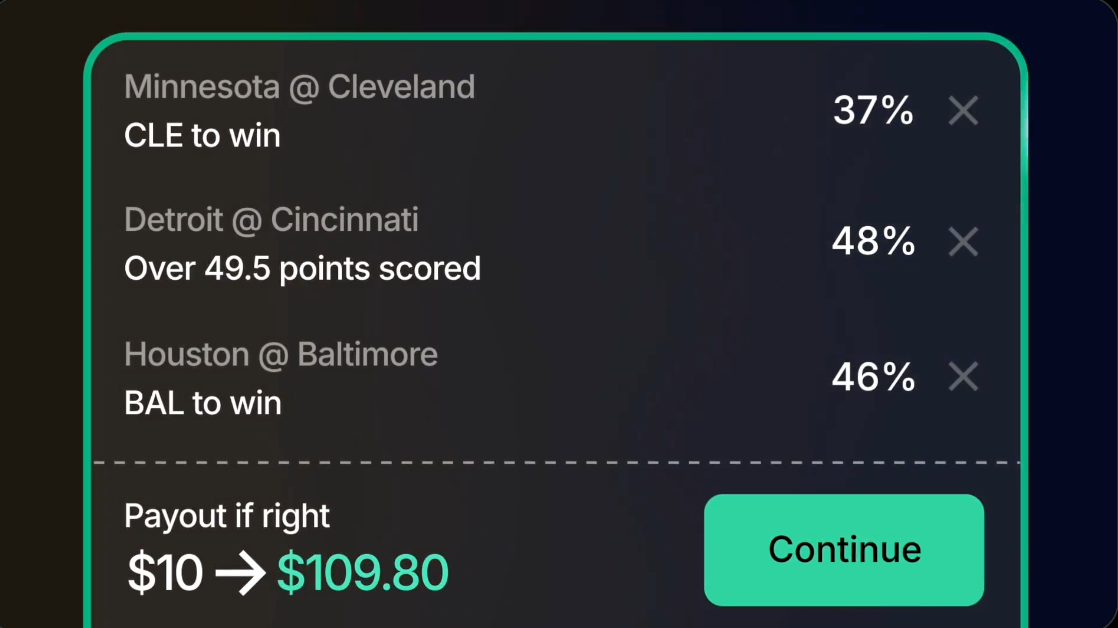

- Prediction market: Kalshi launched the Combo feature, which I think is an important node for the prediction market to grow independently from the crypto native field into an emerging track. This also means: (1) the prediction market supports automated combination operations; (2) the combination of prediction markets and traditional financial market derivatives is becoming closer. Within 5 to 8 years (or even shorter), it will quickly grow into a trillion-dollar track. Most importantly, the development of the prediction market and the updates of the platform are also betting events, so the two have reached a kind of "self-referential state." "Predicting the prediction market platform" may become a separate subdivision, where everything can be predicted and everyone is a product manager converge, which is worth looking forward to. After all, betting implies the bonuses provided by the counterpart.

- New product: "Life K-Line," originally a test product created by @0xsakura666 in the circle, later received good feedback and became a project after systematization (https://www.lifekline.cn/). Many people feedback that the AI fortune-telling results are very close to their reality. I think this is also a major trend, especially after AI combines with stablecoins, x402 protocol, and EIP 8004; stablecoin payments are very promising for next year. Circle is still worth betting on, just like Coinbase back in the day (the two have interests intertwined).

Finally, I recommend an article in the direction of character biography, about an asset manager and the past of the Kondratiev wave: “There is No More Zhou Jintao in the World” by Zhang Jieyu · Yuanchuan.

Nan Zhi (X: @Assassin_Malvo)

Introduction: A meme diamond hand making a fresh start after a heavy blow.

Content: 1. Fully researching Polymarket while part-time brushing Opinion. 2. There are more and more prediction markets, which have exceeded the capacity to track. After talking with a major company, it was revealed that a prediction market aggregation market and full data platform are on the way (Polymarket's official performance is too poor). 3. Created a Human VS AI project, featuring selected followers vs. the latest AI model, which will be launched soon.

Ding Dong (X: @XiaMiPP)

Introduction: Pure "leek."

Content: I personally tend to go long on BTC, ETH or some quality altcoins. Recently, apart from buying ZEC, I haven't dared to touch other altcoins easily. Bitcoin is particularly volatile; the harder I try, the more I lose.

I always feel that the current trend is somewhat like the pullback phase at the top of the 2021 bull market. If it really replicates, then it might be the early stage of a bear market now. On the other hand, we are entering a rate-cutting cycle, and macro-wise, it seems that there is no basis for entering a deep bear market. Moreover, recently, leading DAT companies have been aggressively buying crypto assets. Do they have some significant good news that we are still unaware of or have not seen? In short, this market is too difficult to play; I will still hold onto my chips and be honest.

Ethan (X: @ethanzhang_web3)

Introduction: Rambling.

Content: The only major event last week might be Federal Reserve Chairman Powell announcing a rate cut. I wrote about the market, and the core view of institutions is that short-term market activity will decline, and there may be a sustained "downtrend" at the end of the year, with limited momentum for a bull market restart. Whether to continue cutting rates in the long term still depends on weak wage growth or employment data. If the data remains poor, rate cuts may become more aggressive, but now is not the time to blindly bottom-fish.

Recently, I chatted with people in the industry, and it can be considered a rumor that due to the tightening of policies this year, many agents in Shenzhen that previously provided operational support to exchanges will likely all move overseas before the end of the year. Just watch for fun; there’s no way to verify it.

For those who enjoy memes, you can check out this episode (guests: Cupsey & Jack Duval). I remember Cupsey seems to be on the show for the first time; there are quite a few stories about how they made money.

Golem (X: @web3_golem):

Introduction: Golem's whimsical ideas.

Content: Last week, the news that sei announced pre-installing an app on overseas Xiaomi phones also attracted considerable attention, but after the announcement, sei became nervous, not only clarifying but also contacting major Chinese media to delete related news. Subsequently, we discussed internally at Odaily that exchanges should be the ones to cooperate with phone manufacturers to pre-install crypto applications.

So, I asked a few people from exchanges, and according to insiders, Binance had actually cooperated with overseas Xiaomi before sei, but due to Xiaomi's restrictions, it only exists in certain markets, and it is not something worth marketing. Moreover, this pre-installation does not mean it automatically downloads to the phone upon startup; instead, it will pop up a guiding page, giving users ample choice, similar to a push installation, and the effectiveness can be imagined.

However, everyone's enthusiastic attitude towards pre-installation also indicates that growth remains the biggest issue for Web3. If a project can break the circle, regardless of whether it is directly related to oneself, it will still cause a mental high.

Moni (X: @mich73692)

Introduction: Does not trade altcoins, only looks at Bitcoin.

Content: The market trend over the past week has made me more convinced of one thing: the cryptocurrency market is systematically bidding farewell to the collective upward narrative based on time nodes, known as the "Christmas rally."

Previously, I thought there would be a drop in November, followed by a rebound in December, especially a significant rise in the 1-2 weeks before Christmas, because many US-listed companies have included Bitcoin in their treasury, and behind these listed companies is Wall Street. Considering human nature, Wall Street would definitely want to gamble for year-end bonuses. But soon, reality slapped me in the face; even though Strategy announced the purchase of over 20,000 Bitcoins in the past two weeks, it still couldn't reverse the price decline. Many Wall Street banks previously predicted Bitcoin prices to be basically unreliable, feeling like they were tricking retail investors to enter the market, such as JPMorgan predicting Bitcoin to reach $170,000, Bernstein predicting $200,000, and Standard Chartered predicting $100,000.

Another thing to pay attention to is the yen's interest rate hike on Friday. The yen, as an arbitrage currency, if it raises interest rates, will cause panic among investors who previously borrowed yen at "zero interest." These investors usually borrow yen to purchase other interest-bearing currencies (like the US dollar) and risk assets (like gold and Bitcoin). If interest rates rise, it means increased repayment costs, and investors will choose to sell risk assets, leading to further declines in Bitcoin prices.

Among altcoins, SOL has had many positive news in the past week (possibly due to the Breakpoint conference), such as Visa opening USDC settlement services to banks in the US through Solana, Invesco and Galaxy's collaboration to launch a staking Solana ETP, and Charles Schwab announcing support for Solana and Micro Solana futures products. However, due to the overall poor performance of the market, SOL's price did not see much breakthrough.

Suzz (X: @uu01194636)

Introduction: Adheres to long-termism, shorting air coins.

Content: There are too many projects in the crypto market, with varying quality. My core observation is that a significant portion of new projects aim to dump tokens rather than build long-term. This is an inherent risk under the irrational prosperity of the market, and it is also my opportunity. My idea is to short these overvalued "dump projects" that are destined to retract, thus converting risk into profit. The difficulty of the shorting strategy lies in the extreme volatility of cryptocurrencies; one cannot be "squeezed" or "liquidated" due to a temporary rebound.

Currently exploring execution directions: how to capture the benefits of declines while preventing liquidation from the market's short-term noise or extreme rebounds through strict risk control. I am researching a set of entry and stop-loss mechanisms that do not rely on high leverage, can tolerate certain volatility, and have a very high fault tolerance. I am trying to establish an evaluation system to accurately identify those projects "born to dump" from token economics, unlocking cycles, and capital flows.

Bcxiongdi (X: @bcxiongdi)

Introduction: Primarily focused on on-chain PvP.

Content: The liquidity on-chain is declining rapidly, and PvP has to compete for resources with a smarter and more diligent group of people. At this time, holding back is the best option for most people; otherwise, it is easy to become the exit liquidity for the previous level. The worse the market, the more unfortunate it becomes to keep messing around. If you clearly know you are not a diamond hand, just wait patiently for the market to improve before engaging in PvP.

I am optimistic about the Meme track in the long term. When liquidity is good, there are still great opportunities to make money. It won't die out completely like other tracks. One can observe the operations of skilled addresses that are still making money now, copy them first, and then gradually form one's own style. It is best to watch more and act less.

Azuma (X: @azuma_eth)

Introduction: Inexperienced, learning more.

Content: Sharing some recent content that I find interesting:

- “Go long on the application layer, short on infrastructure.”

Major VCs are gradually releasing year-end reports or expectations for the coming year. Delphi Digital and Moonrock Capital have both provided the logic of “going long on the application layer and short on infrastructure” — “Layer 1 valuation premiums are disappearing, and the market's demand for homogeneous infrastructure is weakening”; “Value will accrue to applications that aggregate large-scale users”; “The ultimate winners will not be those who build the most robust infrastructure, but those who control user identities, user traffic, capital flows, and daily interaction interfaces.”

Full report from Delphi Digital: https://members.delphidigital.io/reports/the-year-ahead-for-apps-2026?utmsource=twitter&utmmedium=social&utm_campaign=Apps#robinhood-ee30

- “Tokens vs. Equity”

After Circle acquired the Axelar team but abandoned the token, the issue of “tokens vs. equity” has sparked renewed discussion. Regarding the positioning, value, and legal rights of tokens in financing structures, this article by Dragonfly may be the most detailed analysis currently available in the market. https://writing.dragonfly.xyz/post/read-the-fine-print-token-compensation

Pantera Capital has launched a new podcast called Stateful. The first episode discusses topics such as “Robinhood vs. Coinbase” and “stablecoin payment chains.” Interested parties can check it out: https://www.youtube.com/watch?v=wIh8KZOHWBw&t=1s

For those interested in quantitative trading, you can check out this podcast featuring quantitative trading expert Annanay Kapila (formerly of Tower Research and Flow Traders). The content includes some advertisements, but there is also a lot of valuable information: https://www.youtube.com/watch?v=aQlR_fxrThM&t=1s

Some good content related to general AI.

A podcast featuring two experts from Anthropic, Barry Zhang and Mahesh Murag, discussing the shift from Agents to Skills: https://www.youtube.com/watch?v=CEvIs9y1Uog

How far has AI impacted programmers' work? An internal survey from Anthropic: https://www.anthropic.com/research/how-ai-is-transforming-work-at-anthropic?utmsource=substack&utmmedium=email

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。