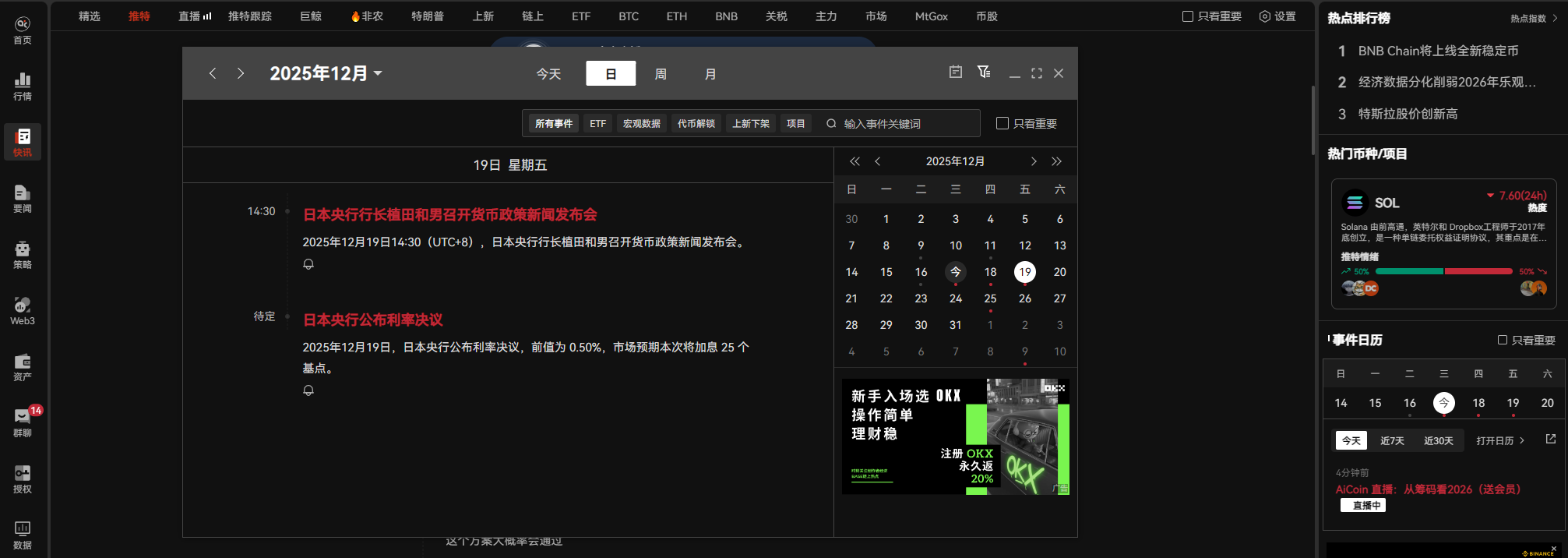

When major global central banks (such as the Bank of England and the Federal Reserve) hesitate or test the waters at the edge of a loosening cycle, the Bank of Japan (BOJ) stands at a historical turning point. The market widely expects that the BOJ will raise the policy interest rate from 0.5% to 0.75% this Friday (December 19), marking the highest level in 30 years. For cryptocurrency investors, this means that the invisible engine driving the bull market—the Yen Carry Trade—is running out of steam. The storm may not form overnight, but the risks are already in sight. How should we respond?

1. Timeline Review: Japan's Rate Hike is Not a Sudden Move

Phase One: The Eve of the End of the Ultra-Loose Era (Early 2024–2025)

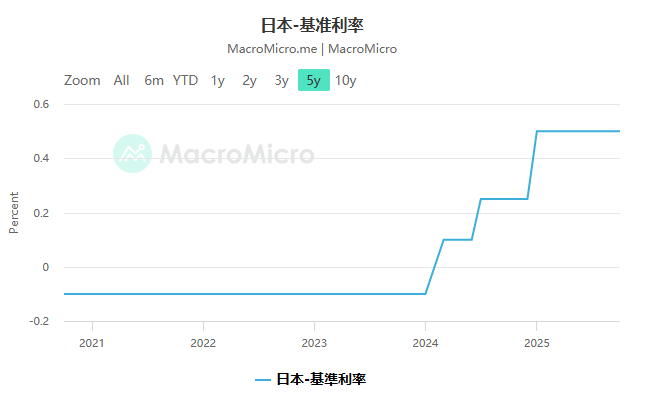

In March 2024, the BOJ officially ended its negative interest rate policy, taking the first step towards normalizing monetary policy.

In January 2025, the policy interest rate was raised to 0.5%, reaching a high level not seen in over a decade. During this phase, the BOJ repeatedly emphasized "gradual exit, avoiding shocks," and the market's pricing of its global spillover effects was relatively limited.

Phase Two: The Tension Between Fiscal and Monetary Policy Emerges (August–November 2025)

In the second half of 2025, Japan's new Prime Minister Sanae Takaichi pushed for a large-scale fiscal stimulus plan (market estimates exceed 17 trillion yen), raising concerns among investors about Japan's fiscal sustainability.

During this period, the rise in Japanese interest rates was more a reflection of passive reactions in the bond market rather than active tightening by the central bank:

- The 10-year JGB yield briefly rose above 1.7%

- The 2-year government bond yield rose to about 1%, a high level since 2008

This phase was referred to by some market commentators as Japan's version of the "Truss Moment":

Fiscal expansion expectations → Pressure on the bond market → Passive rise in interest rates.

Phase Three: The Key Strike Ready to Launch (December 2025)

The market widely expects that the BOJ will raise interest rates by another 25 basis points on December 19, bringing the policy interest rate to 0.75%, close to the highest level in nearly 30 years.

Governor Kazuo Ueda has emphasized in multiple public speeches that if inflation trends and wage growth continue, Japan will continue to advance the normalization of monetary policy. At this point, the market's focus is no longer on "whether to raise rates," but rather:

After the rate hike, which high-leverage funds will be forced to exit?

2. Transmission Mechanism: Why Does a Rate Hike "Affect" the Crypto Market?

The reason Japan's rate hike can shake the globe lies in the marginal reversal of the Yen Carry Trade.

The basic logic is:

Borrowing yen at an extremely low cost in Japan → Converting to dollars → Investing in high-volatility assets such as U.S. stocks, tech stocks, and Bitcoin → Earning interest rate differentials and asset appreciation. The scale of this funding chain is generally estimated by the market to be in the range of $1–3 trillion, making it one of the important sources of liquidity for global risk assets.

When rate hikes coincide with potential appreciation pressure on the yen, the arbitrage model faces threefold pressure:

- Rising borrowing costs

- Increased exchange rate volatility risk

- Compressed leverage profit margins

The result is often the same: some high-leverage positions are forced to close.

There have been many similar historical reactions:

- After the BOJ released hawkish signals in March 2024, BTC experienced a phase retracement of about 23%

- During the rapid rebound of the yen in July 2024, BTC retraced about 30%

- Around the time of the rate hike in January 2025, BTC saw a retracement of over 30%

In the face of liquidity changes, Bitcoin often reacts first, becoming a sort of "electrocardiogram" for global risk appetite.

3. Current Market Situation: Has Bad News Been Priced In?

From recent highs, Bitcoin has retraced over 30%, and some rate hike expectations have been priced in by the market, but risks have not been completely cleared.

The real variables to observe are:

- Whether more continuous hawkish forward guidance is released (e.g., further tightening in 2026)

- Whether the yen shows a trend of appreciation

- Whether the U.S.-Japan interest rate differential continues to narrow rapidly

If all three occur simultaneously, it is possible that BTC could experience another 20–30% liquidity shock, testing lower ranges.

But equally important is:

The global tightening is not synchronized. The Federal Reserve and some developed economies are still in a loosening or near-loosening phase, and Japan's tightening path remains independent and uncertain on a global scale.

From a medium-term perspective, global liquidity remains the core driving factor for the crypto market.

Therefore, when arbitrage funds are forced to contract, short-term volatility rises, and trends accelerate; at the same time, long-term assets that do not rely on sovereign credit—Bitcoin—are also being re-evaluated in their macro positioning.

In the short term, it may be the pressure end of liquidity adjustments;

In the long term, it may still be a beneficiary of changes in the credit cycle.

4. What Can We Do as Investors?

At the macro turning point, judging "direction" is often less important than identifying "funds."

At this time, the true behavior of major funds is more valuable than sentiment.

Taking the recent market as an example, according to AiCoin's "Major Order Tracking" data:

In the BTC/USD trading pair on Coinbase, there are currently about $90 million worth of unfilled large orders in the $75,000 to $85,000 range. Several key points are particularly noteworthy:

- $78,500: About 209 BTC buy orders

- $75,500: About 224 BTC buy orders

Therefore, it is necessary to pay attention to the subsequent situation of these orders in this range, and more importantly, whether these large orders are filled, consumed, or actively canceled. This often determines whether this range is a "short-term bottom" or "the next breakdown point."

In an environment of rate hikes, retreating arbitrage, and deleveraging, seeing who is selling is just as important as seeing who is buying—this is the core value of AiCoin's Major Order Tracking function.

【Special Information | AiCoin Annual Membership Limited-Time Discount】

December 17 – December 23

- Annual membership 32% off

- Quarterly membership 22% off

- Major order tracking / Chip analysis / Full-depth comprehensive unlocking

This is not just a simple purchase, but an opportunity to enhance your ability to "see the funds" before macro volatility intensifies. The cycle will not wait for anyone, but tools can be prepared in advance.

Conclusion

The significance of Japan's rate hike is never just 25 basis points.

What it truly leverages is a low-cost funding chain that has supported global assets for many years. At this critical stage of cycle switching,

understanding the flow of funds is often more important than predicting prices.

Join our community to discuss and grow stronger together!

Official Telegram community: http://t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。