Original Author: By Ben Protess, Andrea Fuller, Sharon LaFraniere, and Seamus Hughes

Original Translation: Luffy, Foresight News

A cryptocurrency company operated by billionaire Winklevoss brothers once faced a severe federal lawsuit, but after Donald Trump returned to the White House, the U.S. Securities and Exchange Commission (SEC) decided to suspend the case. Previously, the SEC had also filed a lawsuit against Binance, the world's largest cryptocurrency exchange, but after the new government took office, that lawsuit was completely withdrawn. Additionally, after years of litigation with Ripple Labs, the new SEC attempted to lessen the penalties imposed on this cryptocurrency company.

An investigation by The New York Times found that the SEC's retreat in these cases reflects a comprehensive shift in the federal government's attitude toward the cryptocurrency industry after Trump began his second term. Never before has a regulatory agency withdrawn multiple lawsuits against the same industry on such a large scale. However, The New York Times discovered that over 60% of the cryptocurrency-related cases the SEC was pursuing when Trump took office saw a relaxation in handling—either the litigation process was paused, penalties were reduced, or cases were directly dismissed.

The investigation also pointed out that the withdrawal of cryptocurrency cases is particularly unusual. During Trump's administration, the proportion of cases related to cryptocurrency companies that the SEC withdrew was significantly higher than that of other industries. Although the specifics of these cryptocurrency lawsuits vary, many of the involved companies share a commonality: they have financial ties to Trump, who calls himself the "crypto president."

As the highest federal agency regulating financial market violations, the SEC is no longer actively pursuing any known companies associated with Trump. For all companies that collaborated with the Trump family's cryptocurrency business or previously funded his political activities, the SEC has withdrawn related lawsuits. Currently, the remaining cryptocurrency-related cases involve defendants that are relatively obscure and have no apparent connection to Trump.

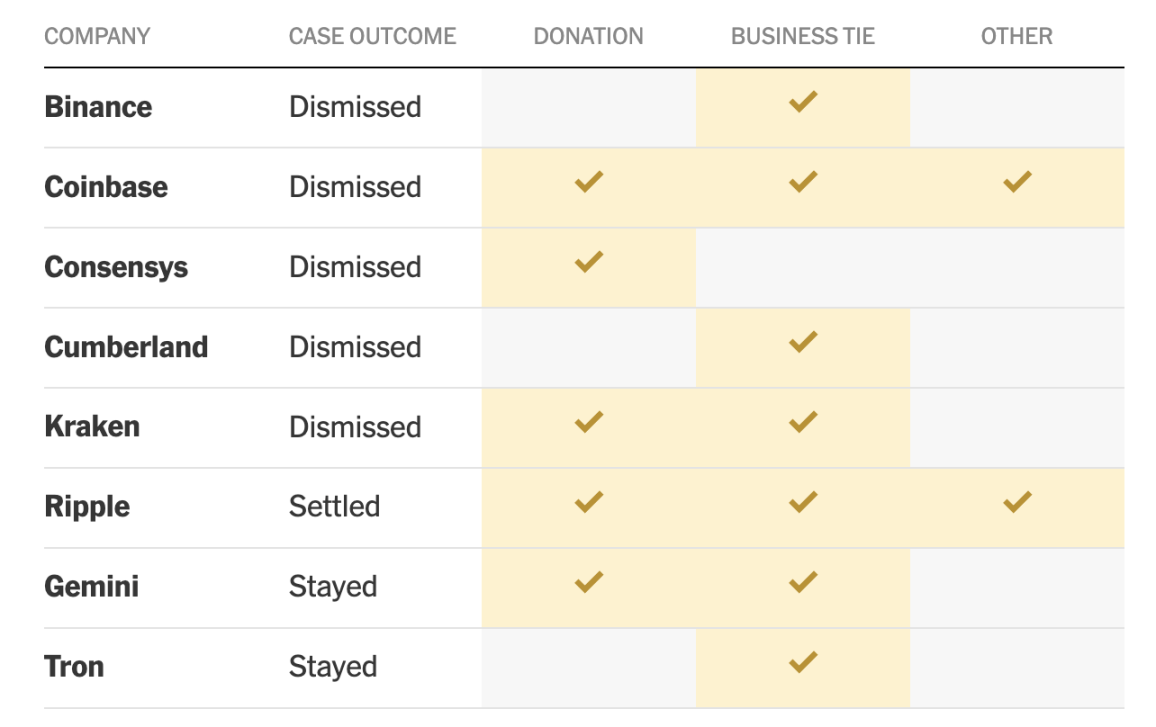

- The SEC has withdrawn 7 cryptocurrency cases, 5 of which involve companies with known ties to Trump;

- An additional 7 cryptocurrency cases have been paused, with favorable settlement proposals or concessions being considered, 3 of which involve companies with known ties to Trump;

- Only 9 cases remain that have not been dismissed, and all of these parties have no known ties to Trump.

The SEC stated in a statement that political bias has never influenced its handling of cryptocurrency enforcement cases, and this adjustment in enforcement direction is based on legal and policy considerations, including doubts about its authority to regulate the cryptocurrency industry. The SEC also noted that long before Trump supported the cryptocurrency industry, current Republican commissioners fundamentally opposed filing most cryptocurrency-related lawsuits, while emphasizing that the SEC "places a high priority on securities fraud issues and effectively protects investor rights."

There is currently no evidence that the president pressured the SEC to go easy on specific cryptocurrency companies. The New York Times also found no indication that these companies influenced the outcome of cases by providing political donations to Trump or engaging in business collaborations; some financial transactions and business collaborations even occurred after the SEC adjusted its case handling.

But the crux of the issue is that Trump is both a participant in the cryptocurrency industry and the highest policymaker in that industry. As president, if the policies he promotes align closely with his own interests, it creates a conflict of interest, and many cryptocurrency companies sued by the SEC are connected to him, highlighting the existence of this conflict.

At the beginning of Trump's second term, the White House publicly declared that the president would "stop the tough enforcement actions and excessive regulatory measures that hinder cryptocurrency innovation." Although the SEC's withdrawal of individual cryptocurrency cases had already drawn public attention, The New York Times found through analyzing thousands of court records and conducting dozens of interviews that this year, the SEC's relaxation of cryptocurrency regulation far exceeds previous levels, and Trump's allies in the cryptocurrency industry have also gained significant benefits, which had not been fully exposed before.

All defendants involved in this investigation deny any wrongdoing, and many defendants claim they are only accused of procedural violations. Additionally, some cases that the SEC has relaxed handling of have no clear connection to the president.

Trump's newly appointed SEC Chairman Paul S. Atkins stated that the cryptocurrency industry will usher in a new chapter, which cryptocurrency companies welcomed.

White House Press Secretary Karoline Leavitt dismissed claims of conflicts of interest involving Trump and his family, stating that the policies Trump promotes "are fulfilling the president's promise to drive innovation, create economic opportunities for all Americans, and help the U.S. become a global cryptocurrency hub."

The Trump administration has fully relaxed regulations on the cryptocurrency industry, and the U.S. Department of Justice even disbanded its cryptocurrency enforcement division. The SEC's policy shift this year is a complete 180-degree turn.

The New York Times' analysis shows that during Biden's administration, the SEC filed an average of more than two cryptocurrency-related cases per month, with case acceptance channels covering federal courts and the agency's internal legal system. Even during Trump's first term, the SEC filed about one cryptocurrency-related case per month, including the high-profile Ripple lawsuit.

In stark contrast, after Trump took office again, the SEC has not filed any cryptocurrency-related cases, while the agency continues to pursue dozens of lawsuits against other industries.

Atkins stated in a statement that the SEC's actions are merely to correct the previous administration's overly aggressive regulatory stance toward the cryptocurrency industry. He claimed that the SEC during the Biden era is using enforcement powers to forcibly implement new policies. He also emphasized, "I have made it clear that we will completely abandon the model of replacing regulation with enforcement."

As cryptocurrency companies celebrate this new era, senior SEC lawyers who previously led related cases are worried about the trend of regulatory relaxation. They fear that this agency, established during the Great Depression and nearly a century old, was originally intended to protect investor interests and maintain market order, and that the relaxation of regulation will embolden the cryptocurrency industry, ultimately harming consumer rights and even posing risks to the entire financial system.

Christopher E. Martin, a former senior litigation attorney at the SEC who led a lawsuit against a cryptocurrency company, chose to retire after the SEC withdrew that case this year. Regarding the SEC's broad relaxation of regulation, he bluntly stated, "This is a complete compromise and retreat, essentially pushing investors into a fire pit."

The End of Regulatory Crackdown

The U.S. Securities and Exchange Commission building in Washington

By the end of last year, regulatory actions against cryptocurrencies had nearly come to a halt at the SEC headquarters in Washington, which features a glass curtain wall design. Gary Gensler, the SEC chairman during Biden's administration, had intended to advance multiple cryptocurrency investigations, but his term was already counting down.

Previously, Trump had just announced the launch of a cryptocurrency project called World Liberty Financial with his family, and shortly thereafter, he successfully secured re-election, having already publicly declared his intention to limit the SEC's power.

In fact, Trump has not always supported the cryptocurrency industry. During his first term, he stated on Twitter that cryptocurrencies are purely speculative and could facilitate illegal activities such as drug trafficking. At that time, the SEC also took a tough regulatory stance, establishing a dedicated department to investigate online violations in the cryptocurrency field and filing dozens of related lawsuits.

During Biden's administration, the SEC's regulatory efforts toward cryptocurrencies further escalated. In 2022, the collapse of the major cryptocurrency exchange FTX led to the SEC's cryptocurrency regulatory division nearly doubling in size, expanding its team of lawyers and industry experts to about 50 people.

Whether during Trump's first term or Biden's administration, the SEC has always believed that since investors may invest their life savings in the cryptocurrency field, they have the right to understand the associated risks. However, a tricky legal question has always troubled the SEC: Does the agency truly have the authority to file related lawsuits against the cryptocurrency industry? The answer to this question depends on whether cryptocurrencies fall under the category of securities, which are modern derivatives of stocks and other financial instruments.

The SEC claims that many cryptocurrencies essentially qualify as securities, and therefore cryptocurrency exchanges and brokers must register with the SEC, disclose detailed information as required, and some institutions must undergo independent reviews. If they fail to fulfill their registration obligations, the SEC can file lawsuits against them under securities law.

The cryptocurrency industry, on the other hand, argues that most cryptocurrencies are not securities but a special type of financial product that should have dedicated regulatory rules, which the SEC has yet to establish. Summer Mersinger, CEO of the Blockchain Association, stated, "We do not seek to escape regulation; we just hope for clear and specific rules to operate under."

In 2024, the situation began to shift, with Trump's attitude changing from skepticism to endorsement of cryptocurrencies. In July of that year, he promised cryptocurrency practitioners during a speech that the "deliberate crackdown" on the industry would soon stop, and he declared, "I will fire Gary Gensler on the first day in office."

In 2024, at a Bitcoin conference in Nashville, Trump made positive remarks about cryptocurrencies, a stark contrast to his previous skeptical attitude.

The SEC, as an independent agency, has 5 commissioners appointed by the president, and the chairman usually aligns with the stance of the government that appointed him. Whether to file, settle, or withdraw cases must be decided by a vote of the commissioners, but the actual investigative work is handled by dedicated enforcement personnel. This mechanism allows for flexible adjustments in regulatory focus while avoiding significant fluctuations in regulatory policy due to political shifts.

However, after Trump's second election victory, the atmosphere at the SEC underwent a significant change. Shortly after the election, Gensler announced his departure. The cryptocurrency regulatory division, which was once a popular position for career advancement, suddenly became viewed as a "hot potato."

According to anonymous sources, during the presidential transition, Sanjay Wadhwa, the enforcement director under Gensler, urged enforcement personnel to "do the job that the American people are paying us to do."

However, some staff members began to back off. Insiders reported that an executive from the cryptocurrency regulatory team took an unauthorized several-week leave and ignored emails related to cases; another executive refused to sign documents related to the few cryptocurrency cases filed by the SEC after the election; and some staff simply stopped processing cryptocurrency cases, which completely hindered Gensler's efforts to advance regulation in the final stages.

Victor Suthammanont, who served at the SEC for ten years and was Gensler's enforcement advisor before leaving, stated that during previous transitions, staff always remained on duty and performed their roles normally. "But this transition was completely different; the atmosphere within the agency changed instantly," Suthammanont said, although he did not discuss specific cases.

Gary Gensler announced he would resign after Trump won re-election.

After Trump was sworn in, the situation became irreversible. He first appointed SEC Republican Commissioner Mark T. Uyeda as acting chairman until his nominee, Paul S. Atkins, was confirmed by the Senate. Uyeda has long opposed the SEC's approach to handling cryptocurrency cases, stating in an interview with The New York Times that many of Gensler's regulatory measures were based on "new theories lacking current legal support."

Gensler had expressed a completely opposite view in a speech in 2022, stating, "Even with new technologies, existing laws do not become obsolete."

In early February 2025, Uyeda reassigned Jorge G. Tenreiro from his position as head of SEC litigation. Tenreiro had previously led the cryptocurrency regulatory division and oversaw many related cases, but was moved to the information technology department, which was seen internally at the SEC as a demotion with a humiliating nature.

After Tenreiro's departure, the SEC began to halt investigations into several cryptocurrency companies that might face lawsuits. Although some investigations are still ongoing, at least 10 companies have publicly announced that they are no longer under SEC investigation, with one company issuing a related announcement just last week.

No Room for Negotiation

Mark T. Uyeda is one of the Republican commissioners at the U.S. Securities and Exchange Commission, serving as acting chairman until Atkins was confirmed by the Senate.

Uyeda soon faced a more challenging dilemma: how to handle the cryptocurrency lawsuits that were still pending from the Biden administration. It is common for the SEC to shelve investigations, but it is extremely rare to withdraw ongoing cases, and such actions must be approved by a vote of the commissioners.

The largest cryptocurrency exchange in the U.S., Coinbase, was sued by the SEC for failing to fulfill its registration obligations, a highly publicized case in the cryptocurrency field. During Biden's administration, Coinbase adopted a strong defense strategy, successfully persuading a judge to allow a higher court to review the case before trial.

Now that the SEC is under the control of the Trump administration, Coinbase became one of the first companies to apply for case dismissal. Typically, the SEC chairman's office does not intervene in negotiations for such cases, which are handled by dedicated enforcement personnel. However, during this negotiation process, staff from Uyeda's office participated in some discussions with Coinbase alongside enforcement lawyers.

Coinbase's Chief Legal Officer Paul Grewal, a former federal judge, stated in an interview, "We always ensured that we kept the previous chairman's office updated on the progress of case negotiations to ensure they were fully informed." Uyeda claimed that his staff's participation in such negotiation meetings was "completely standard."

Initially, the SEC under Uyeda was reluctant to completely withdraw the case. Insiders revealed that the SEC's initial proposal was merely to pause the case proceedings. However, this proposal was rejected by Coinbase.

Subsequently, the SEC made a larger concession, proposing to dismiss the case but retaining the right to reopen it if future leadership changed their minds, yet this proposal was still not accepted by Coinbase. Grewal firmly stated, "Our position is very clear: either they completely withdraw the case, or we will continue to litigate; there is no room for negotiation."

Ultimately, the SEC chose to compromise. At that time, Gensler and two other Democratic commissioners had already left, leaving only two Republican commissioners and one Democratic commissioner on the SEC committee.

While Uyeda did not respond specifically to this decision, he stated, "It is not appropriate to continue pursuing such cases, especially if the SEC may not recognize the legal theories underlying the case in the short term."

The remaining Democratic commissioner at the SEC, Caroline A. Crenshaw, candidly stated in an interview that the SEC's actions have given the cryptocurrency industry an advantage, "They can almost do whatever they want without facing any consequences."

Change in Attitude

Caroline A. Crenshaw is the only Democratic commissioner at the SEC.

After the Coinbase case was dismissed, the cryptocurrency industry viewed it as a signal of the SEC's compromise. Lawyers for other cryptocurrency companies also began to follow suit, seeking similar outcomes for their clients. By the end of May, the SEC had dismissed another six cryptocurrency-related cases.

The New York Times found this phenomenon to be extremely unusual through an analysis of court records. During Biden's administration, the SEC never proactively dismissed any of the cryptocurrency cases left over from Trump's first term. The only cases dismissed during that time were due to the death of a defendant and a judge's unfavorable ruling in another case, which led to the withdrawal of one case and part of the claims in another.

In contrast, after Trump began his second term, 33% of the cryptocurrency cases from the Biden administration were dismissed, while the dismissal rate for cases in other industries was only 4%.

Despite the SEC's repeated promises to continue investigating securities fraud, it still withdrew the lawsuit against Binance. Previously, the SEC accused two affiliated entities of Binance of fraudulent behavior, claiming they misled consumers regarding the prevention of illegal market manipulation.

Additionally, the SEC also requested the court to pause the fraud case against Sun Yuchen and his founded Tron Foundation. There are a total of four cases that have been paused for negotiation and settlement, and the SEC has not yet announced the follow-up handling of this case.

The cryptocurrency cases taken over by the Trump administration totaled 23, of which 21 originated from the Biden administration, and 2 were leftover cases from Trump's first term, with the SEC having relaxed handling on 14 of these cases. Among these 14 cases, 8 involved companies that established connections with Trump and his family both before and after the case handling.

Connections between cryptocurrency companies and Trump or his family businesses.

For example, Sun Yuchen spent $75 million to purchase tokens issued by World Liberty Financial. The Tron Foundation did not respond to multiple requests for comment from reporters, while Sun Yuchen and the Tron Foundation stated in court documents that the SEC not only lacked evidence to prove any fraudulent behavior but also lacked the authority to sue them.

In the weeks leading up to the dismissal of the Binance case, the company participated in a $2 billion business transaction that involved the use of stablecoins issued by World Liberty Financial. This transaction is expected to generate tens of millions of dollars in annual revenue for the Trump family.

A spokesperson for World Liberty Financial stated, "The company has no connection to the U.S. government," and "will not influence the government's policy-making and decision-making processes." Binance stated in a statement that the SEC's lawsuit against it is essentially "a targeted crackdown on the cryptocurrency industry."

In March 2025, the SEC withdrew the case accusing cryptocurrency trader Cumberland of conducting unregistered securities trading. About two months later, Cumberland's parent company, DRW, invested nearly $100 million in a media company owned by the Trump family. DRW executives stated that the company obtained the investment opportunity only after the case was dismissed, and that the SEC's withdrawal was merely because the related accusations lacked factual basis.

Ripple had donated nearly $5 million to Trump's inauguration and was also embroiled in litigation. During Trump's first term, the SEC accused Ripple of failing to disclose key information to investors when issuing its cryptocurrency tokens. Last year, a federal judge dismissed some of the SEC's accusations, but still ruled that Ripple had committed securities violations and ordered it to pay a $125 million fine.

After Trump took office again, the SEC attempted to reduce the fine to $50 million. The judge harshly criticized the SEC for this flip-flopping behavior and rejected the request. Ripple argued to the judge that it deserved a lighter penalty, partly because the SEC had withdrawn subsequent lawsuits against multiple similar cryptocurrency cases. Ultimately, Ripple paid the full fine. In July of this year, a media company owned by the Trump family announced plans to include Ripple's issued cryptocurrency in its publicly offered investment fund.

Hester Peirce is a Republican commissioner at the SEC and also heads the agency's newly established cryptocurrency task force. In an interview, she stated that the withdrawal of numerous cryptocurrency cases is correcting past mistakes, as these cases should never have been filed in the first place.

She said, "I believe the real overreach occurred in the previous years when many cases filed by the SEC had no legal basis." She also added that these lawsuits hindered legitimate innovation in the industry. Peirce emphasized that case handling is based solely on facts and specific circumstances, unrelated to "the connections of the parties involved," and is not influenced by any political or economic considerations.

Financial Strength

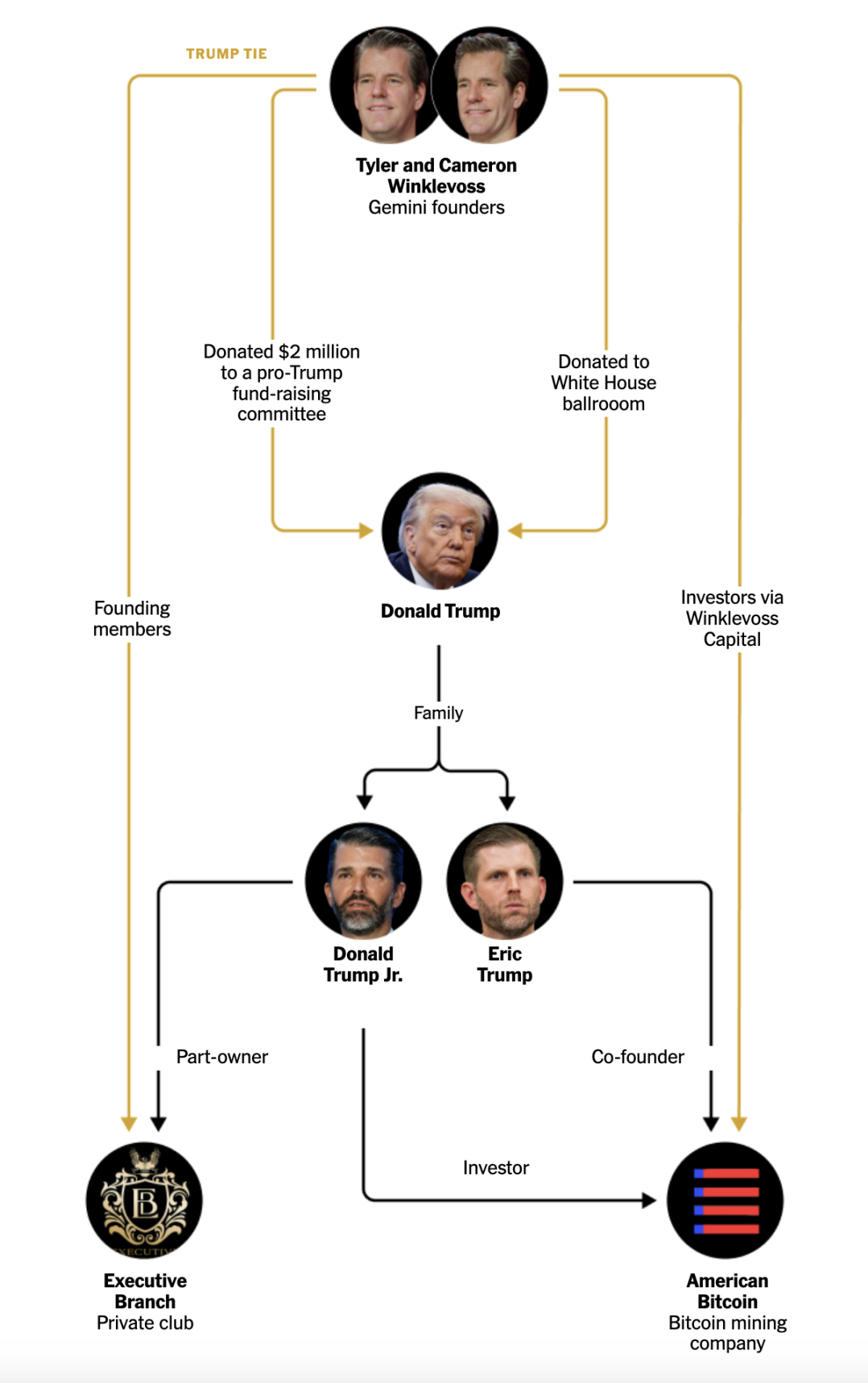

In the cryptocurrency industry, few have a closer relationship with Trump than brothers Tyler Winklevoss and Cameron Winklevoss. The duo founded and operates the cryptocurrency company Gemini Trust. They not only provided financial support to fundraising committees backing Trump's re-election and other Republican-related organizations but also contributed to the renovation project of the White House dining room, which Trump favored. Additionally, they funded a high-end private club in Washington called Executive Branch, of which Trump's eldest son, Donald Trump Jr., is one of the shareholders.

The brothers' investment company recently invested in a new cryptocurrency mining enterprise called American Bitcoin. Trump's second son, Eric Trump, is a co-founder and chief strategy officer of this company, and Donald Trump Jr. is also involved in the investment.

The Winklevoss brothers' connection to the Trump family

Trump has publicly praised the brothers multiple times, calling them "the total package" for their intelligence and looks. At a White House event, he remarked, "They have looks, they have brains, and they have a lot of wealth."

However, Gemini Trust has also been embroiled in legal disputes.

In December 2020, Gemini Trust partnered with another company, Genesis Global Capital, to offer Gemini's customers the service of lending their crypto assets to Genesis, which would then lend those assets to larger institutional investors.

Genesis would pay users interest and promised that users could redeem their assets at any time; Gemini acted as an intermediary, earning a corresponding commission. Gemini had promoted that the project could provide account holders with an annualized return of up to 8%.

Peter Chen, a data scientist from San Diego, stated in an interview that he invested over $70,000 in the project because he trusted Gemini.

"Gemini gave me the impression of being compliant and rule-abiding, one of the most regulated companies in the cryptocurrency field," he recalled.

Peter Chen stated that he invested over $70,000 in Genesis because he trusted Gemini Trust.

However, at the end of 2022, Genesis faced a bankruptcy crisis and froze the accounts of 230,000 customers.

A 73-year-old grandmother pleaded with Gemini to return her life savings of $199,000. According to court documents filed by New York state regulators, she wrote in her plea, "Without this money, I am completely out of options."

In May 2024, Genesis reached a $2 billion settlement with New York state regulators, and customers' funds were ultimately recovered. Gemini also reached a settlement with New York state, promising to pay up to $50 million to cover remaining customer losses if necessary. Gemini insisted it bore no fault, blaming the crisis on Genesis, and emphasized that ultimately no customers suffered losses.

However, the SEC also filed lawsuits against both companies, accusing them of selling crypto assets without registration. Tyler Winklevoss called the lawsuit "a deliberately fabricated charge" on social media.

Genesis chose to settle with the SEC, but Gemini insisted on litigating until April 2025, when the SEC suddenly proposed to pause the case to allow both parties to negotiate a solution. In September of the same year, the SEC revealed that it had reached a settlement agreement with Gemini, which is still pending a vote by the commission members.

The SEC informed the federal judge handling the case that the agreement "will completely resolve this litigation dispute."

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。