Saturday passed so quietly. I was initially a bit worried that the Oracle issue would elevate the pessimistic mood over the weekend, but in reality, even if there was some negativity, it wasn't severe. Bitcoin only maintained a very slight fluctuation, but who knows what will happen next week. There are three important data releases next week. First is Tuesday's non-farm payrolls; everyone knows how crucial labor data is. Powell himself has stated that the main reason for considering a rate cut in December is the poor labor data.

So, non-farm payrolls remain the most important data right now, mainly focusing on the unemployment rate and employment numbers, as well as wage changes. The current market expectation for the unemployment rate is 4.4%. The higher this number, the worse the economic outlook, but it favors rate cuts. Conversely, the higher the employment data, the better the economic resilience, which is unfavorable for rate cuts. A smaller wage increase indicates poor economic development but favors rate cuts. Overall, the non-farm data is a mixed bag.

Then there's the CPI data on Thursday; the lower this number, the better. Following that is Japan's interest rate adjustment on Friday, where a 25 basis point hike seems inevitable. Although this is negative news, the market has already fully anticipated it, so I believe the impact won't be very strong after the announcement. After next week, it will be Christmas, and the holiday season will begin, lasting until after New Year's.

Looking at Bitcoin's data, the trading volume significantly decreased over the weekend, finally reaching a normal level. However, as the workweek starts next week, it may rise again. A higher trading volume indicates that overall investor sentiment is still quite tense, especially among short-term investors. With three major data releases next week, I estimate that volatility will intensify.

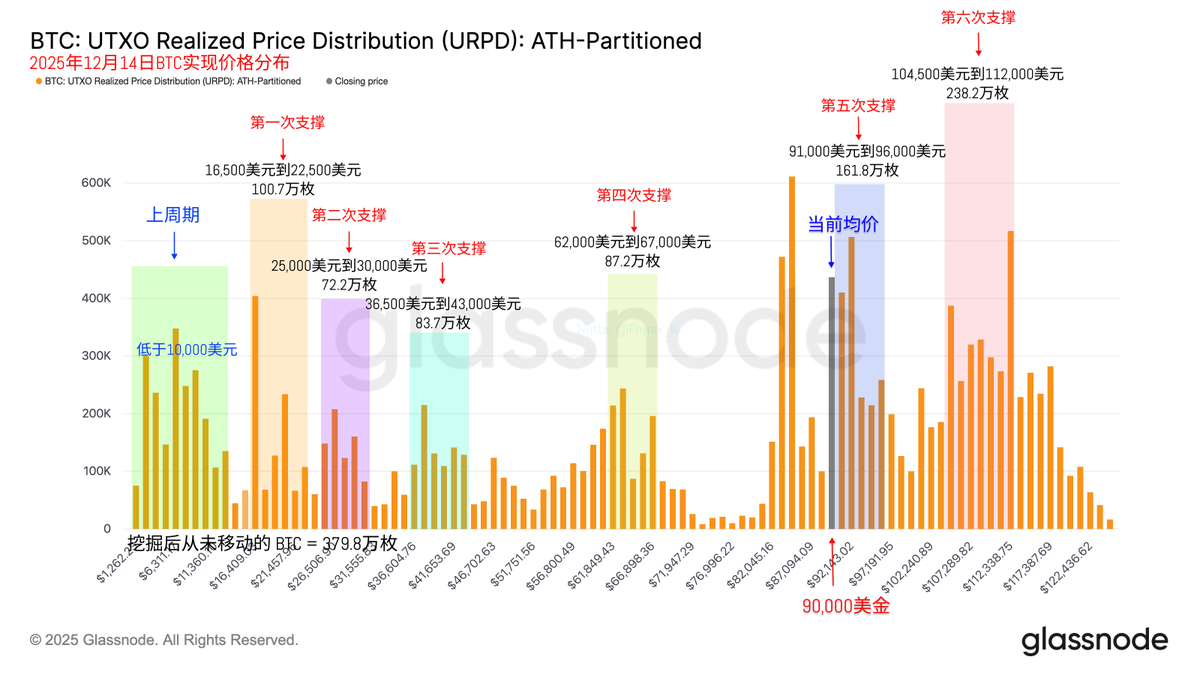

Other than that, there's not much to report. The weekend can be a good time to rest. The chip structure remains stable, and I haven't seen any panic among investors. It feels like we are in the process of stabilizing and building a bottom again, which may take some time.

Bitget VIP, lower fees, better benefits

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。