Some days in the ETF market feel like a reset button has been pressed, and Wednesday, Dec. 3, was one of them. After nearly a week of broad inflows across the crypto landscape, sentiment fractured. Bitcoin’s steady run halted, ether’s momentum exploded, and solana faced a rare stumble after weeks of uninterrupted strength.

Bitcoin ETFs, which had quietly stitched together five consecutive days of inflows, finally broke their streak with a modest $14.90 million outflow. The weakness was driven largely by a sharp $37.09 million exit from ARK & 21Shares’ ARKB, coupled with a $19.64 million pullback from Grayscale’s GBTC and a small $411.53K retreat from the Bitcoin Mini Trust.

Blackrock’s IBIT did its best to counter the pressure with a $42.24 million inflow, but even that wasn’t enough to pull the category back into the green. Trading activity remained healthy at $4.22 billion, while total net assets held steady at $121.96 billion, showing just how resilient the broader market remains.

Ether ETFs came back into the inflows after two days of outflows

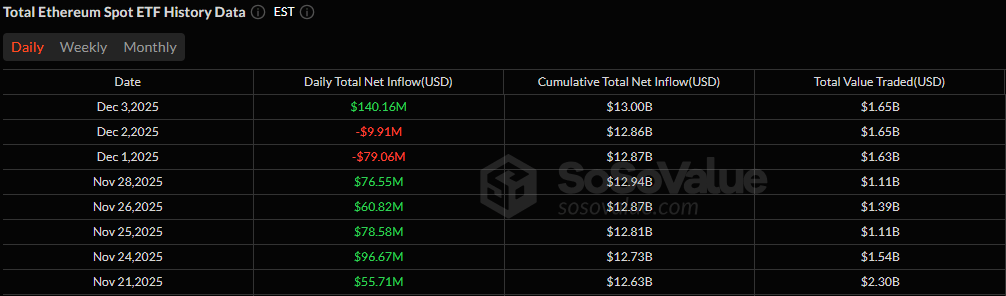

If bitcoin paused, ether leapt forward. The category delivered a forceful $140.16 million inflow, marking a stark reversal and easily ranking among the strongest days of the month. Blackrock’s ETHA led the charge with $53.01 million, closely followed by Fidelity’s FETH at $34.38 million. Grayscale’s flagship ETHE and its Ether Mini Trust added $27.57 million and $20.72 million, while Bitwise’s ETHW chipped in another $4.48 million. With trading volume of $1.65 billion and net assets rising to $19.70 billion, ether was the day’s undisputed bright spot.

Read more: Jobs Down, Bitcoin Up

Solana ETFs, however, saw another setback. What began with meaningful inflows of $5.57 million into Bitwise’s BSOL, $1.66 million into Fidelity’s FSOL, $1.55 million into Grayscale’s GSOL, and an additional $817.92K into Canary’s SOLC was entirely undone by a heavy $41.79 million exodus from 21Shares’ TSOL.

The result was a $32.19 million net outflow, snapping solana’s steady green streak. Even so, trading remained lively at $32.72 million, and total net assets stayed firm at $915.08 million, signaling that investor conviction hasn’t disappeared, only paused.

FAQ📊

- Why did Ether ETFs surge while others fell?

Investors rotated back into ETH, driving one of the strongest inflow days in weeks. - What caused Bitcoin ETFs to slip into outflows?

Large withdrawals from ARKB and GBTC outweighed gains from IBIT, ending BTC’s five-day inflow streak. - Why did Solana ETFs turn negative after weeks of gains?

A sharp exit from TSOL overwhelmed smaller inflows across other SOL funds. - Does this shift signal a change in market sentiment?

Yes, flows show investors temporarily favoring ETH over BTC and SOL as momentum realigns.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。